Looking for a credit card payoff calculator with extra payments? Trying to find a multiple credit card payoff calculator? Trying to calculate the time to payoff credit cards? You came to the right place.

I developed the credit card payoff calculator snowball a few years back and I've just recently refined it to try to help as many people get out of credit card debt as possible!

Credit cards are great if you use them once in a while and earn some rewards points to your benefit, but far too often we get into trouble with credit cards.

And then the interest just sucks the life out of us with that 20%+ rate!

No more.

It's time to get out of credit card debt!

It's time to use the credit card early payoff calculator in this post to outline your debts, set up a plan to pay them off, then ramp up that initial plan, and then kick tail and get out of credit card debt faster than you ever thought possible!!

Are you ready to get started? I hope so! Use the credit payoff calculator (link below) and don't ever look back!

How to Calculate Your Credit Card Payoff in Excel and Google Sheets—A Sneak Peek

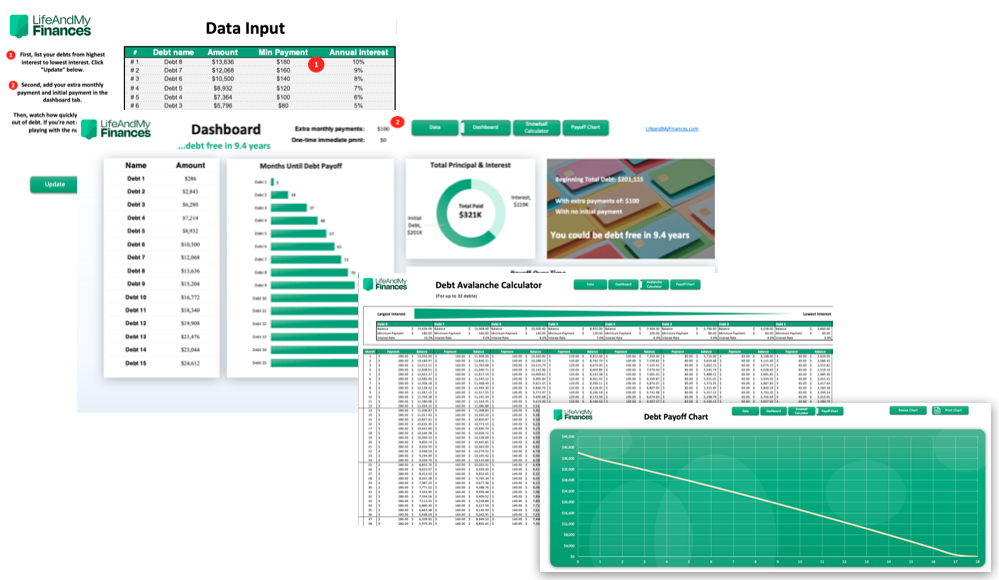

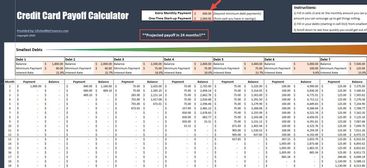

We’ve built one of the best multiple credit card payoff calculators. Here’s a sneak peek of our top-tier tool.

It can handle 32 credit card debts, it's compatible with both Excel and Google Sheets, and you can purchase it from our store for less than $10.

Bebe J recently bought and reviewed this monthly credit card spreadsheet—“Just what I needed!” She gave it 5 out of 5 stars. In short — download the tool, enter your credit card stats—and the template will show you how long it will take to pay off all your debts.

Want to see how the tool works? Here's a video tutorial for you:

Credit Card Payoff Calculator Snowball

There are really two methods to paying off credit card debt.

One option will tell you to first pay off the credit cards with the highest interest

The other will tell you to start with the smallest balance, then the larger balance, and then the larger balance, etc. and ignore the interest entirely

I'm a huge fan of option #2. ..."But won't this cost me more money?" you might ask. After all, it does make sense when you logically think about it. I mean, if you don't tackle the largest interest debt first, it's going to rack up a higher cost than the others, and over time you'll therefore have to pay off more debt and it will take longer. Like I said, seems logical...but it's incorrect.

I'm a big believer in the debt snowball method for paying off credit cards

I freakin' love the debt snowball method. I have personally used it to get out of debt, and it flat out works. And, as it turns out, various case studies agree with me too!

With the debt snowball method, you start paying down the smallest balance while paying the minimum payments on all the other credit card balances.

You pay as much as you can toward that smaller balance until you pay it off.

Then, you start paying down the next largest balance until it's gone

...And so on and so forth until your entire credit card debt is gone!

Credit Card Payoff Calculator Excel Snowball - It's simply the best!

When you use the debt snowball method, you tend to get laser-focused on that one debt that you're trying to pay off. SO focused that you'll seemingly stop at nothing to get it paid off.

You'll spend less, save more, and even do some side gigs to pay it off.

Then, when you pay off that first debt, you're completely ENERGIZED!

You did it! You can't wait to tackle and kill the next one!

If you truly want to get rid of your credit card debt and get rid of it for good, you'll want to use this credit card payoff calculator Excel sheet, which follows the debt snowball principles.

Read more articles on credit cards:

(Want Something More? Check Out Our New Get Out of Debt Course!)

Want to get out of debt even faster?

We recently created a full get-out-of-debt course. This is for those who want more. For those who want to pay off debt fast. For those absolutely hate their debt and want it gone for good.

This course includes the debt snowball spreadsheet, but also includes sooo many more extras!

This course includes...

The debt snowball vs. debt avalanche calculator ($15 value)

The weekly and monthly budget template ($10 value)

An early mortgage payoff calculator ($10 value)

80 minutes of video instruction ($200 value)

A complete slide deck of the video

A full workbook

And a live Q&A session with me in the next few weeks... ($100 value)

That's $335 of value...all for just $79? Yeah, we're doing that! Oh, and if you buy it and you're not satisfied, we'll give you a full refund.

It's a complete steal—we truly want to help as many people as possible.

If you want to get serious about your debt payoff journey, take the course. You won't regret it. I can't wait to meet you and hear your questions in the live Q&A!

Credit Card Payoff Calculator Google Sheets

Our credit card snowball calculator download comes with two files: one for Google Sheets, and one for Excel. If you want the Google Sheets credit card payoff calculator, simply click that link and your tool will instantly open in Sheets.

Here's the link again if you want to check it out for yourself.

Credit Card Payoff Calculator - How to Enter Your Data

If you haven't already, download the multiple credit card payoff calculator Excel here. Open it up (you'll likely see it at the bottom-left of your screen once it downloads), and if you get the message to enable the file at the top of the page, click "Enable File".

(The tool format has recently been updated and is more user-friendly. We plan to update the below instructions shortly.)

Now it's time to enter your data:

Key in the debt balance on each credit card,

the minimum monthly payment,

and, the interest rate on each card.

Once you input all of that data, you'll see how long it will take you to pay off your credit card debt if you only pay the minimum payments. Likely, it's not a very fun story.

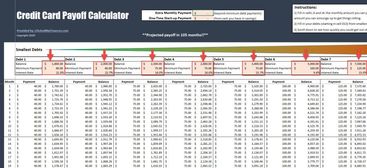

Here's what your credit card payoff calculator should look like:

You've entered in all your debts, the minimum payments, and the interest rate for each credit card (boxed red areas below). Once you enter those in, note your estimated payoff date in the middle of the header.

The example below shows that it will take 105 months to pay off the credit cards debts (by only making the minimum payments). THAT'S NEARLY 11 YEARS!! NO THANK YOU!

With just keeping up with the minimum payments, how long will it take you to pay off your credit card debts?

5 years?

7 years?

10+ years?

It's absolutely insane how long you'll have some of these credit card balances if you try to pay them off with only the minimum payments.

You don't want to wait 10+ years to get out of debt, do you?

I don't think so! It's time to get rid of that balance. It's time to slay this beast once and for all!

Read more:

How Quickly Could You Get Out of Credit Card Debt?

It's time to play with the numbers. Sure, it could take you an eternity to pay off your credit cards if you don't make any extra payments. But, what if you really started to go after it?

What if you start paying an extra $300 a month?

What if you really cut back on your spending and could put $700 a month toward your credit cards?

Heck, what if you went absolutely crazy and got a part-time job on the weekend that allowed you to put $1,500 extra dollars toward your debt each month??

What would happen? How quickly could you get out of debt? This is when looking at your debt finally gets fun. Instead of 10+ years, you might cut your time all the way down to 2 years...of you know what? Maybe even less!!

Setting Your Goals With the Credit Card Payoff Calculator

You were looking for a multiple credit card payoff calculator, and you found it. Now it's time to use it to its fullest!! The above exercise is how you start to set a goal.

Instead of asking yourself, "Based on my current course, how long will I be in debt?" you instead start to make statements like, "I want to be out of debt in 2 years."

And then you start asking questions that will turn that into a reality:

"How much extra do I need to pay per month to get this debt gone in 2 years?"

"What could I do to earn extra money to get that amount per month?"

"What if I sold a few things to get this snowball rolling faster?

In this credit card payoff calculator, you can impact your payoff time frame by doing two things:

Changing cell J3 to a monthly dollar amount you think you can pay toward your credit card debt above and beyond all of the minimum payments

Updating cell J4 with a one-time amount you'll put toward your debts up-front (maybe you had some cash stashed away for something else and you instead decided to use it toward your credit card debt. Either that, of you could sell some stuff!)

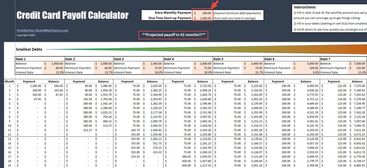

The 105-Month Example

In the first screenshot, we showed you that our 7 credit cards wouldn't all get paid off until month 105 (nearly 11 years!).

What if we could muster up $1,000 to get the debt snowball started? (if you don't have it in savings, I bet you could get there by selling some stuff!)

And, what if we could find an extra $200 a month?

That's not overly radical, right? Guess what that does to our 105 month payoff?

Check it out:

This credit card payoff calculator snowball sheet shows you what's possible, and it should pump you up!

Just those simple moves bring the time frame down from 105 months to just 42 months - that's just 3.5 years instead of 11!!

But maybe you think you can do more.

Perhaps you really DO want to get out of credit card debt in 2 years. And, maybe you could bump up your initial contribution to $2,000! Then how much extra would you have to contribute per month to make this possible?

What if you could contribute $600 a month? Let's try it!

BOOM! That did it! If you can find $2,000 to start and then put an extra $600 toward your credit card debt each week, you could get rid of $25,000 worth of credit card debt in just 2 years!

Wouldn't that be awesome??!! I bet you could do it too!

The Credit Card Payoff Calculator Is Amazing! Will You Use It??

This free credit card payoff calculator Excel sheet is simply amazing! Not only will it show you how long your current track will take to get out of credit card debt.

It will show you what it takes to get out of debt faster so you can sharpen your plan and get out of credit card debt even faster!!

Paying off your credit card debt is a FANTASTIC thing to do.

It'll save you cash in the long run,

it will remove your monthly burdens,

you'll feel less stressed with fewer bills and less outgoing cash

and finally, you'll free up money to start investing and you'll finally be able to start funding retirement!

So what's your goal? How quickly will you pay off this credit card debt? You've got no excuses! You know you want to do it - you've got the tools, and now is the time. You can do this! Download the Credit Card Payoff Calculator here. Get started today!

.jpg)