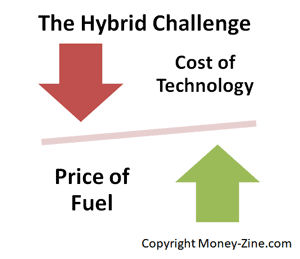

While anything is possible, it looks like the long-term price of gasoline is going to stay below the $3.00 per gallon mark. Given this new price point, the economics of buying a hybrid vehicle are changing, which is good news for "green" consumers. In this article, we're going to discuss how gasoline prices at the pump are changing the economics of driving in America. We're going to evaluate the premiums paid for hybrid cars, and determine if it makes good business sense to buy these vehicles. We're also going to talk about a very important variable that's often overlooked when evaluating the purchase of a hybrid. Finally, we'll provide a link to an online tool, which can help figure out if owning a hybrid makes good economic sense.

Vehicle Demand and Gasoline Prices

According to statistics published by the Department of Energy, during the week ending June 16, 2008, the national average price of regular gasoline hit the $4.00 mark for the first time. In October 2020, the price of regular gasoline averaged $2.19 per gallon across the United States. Car owners that once paid $40.00 to fill up their vehicles are paying $20.00, while SUV owners are paying closer to $30.00. For many consumers, the sharp rise in gasoline prices brought back memories of the energy crisis of 1979. Customers once willing to drive SUVs and small trucks were now looking for more energy efficient vehicles. Automobile manufacturers were stuck with huge inventories of what were once high-margin vehicles back in 2008. They found themselves scrambling to retool plants, so they could manufacture more energy efficient vehicles. The marketplace demand for gas-guzzlers was dropping, while consumer interest in hybrid vehicles was on the rise.

Economics of Buying Hybrid Cars

Hybrid vehicles owe their energy efficiency to their mechanical sophistication. Traditional combustion engines are paired with electric motors. This combination allows manufactures to deliver the performance drivers are looking for in a car from smaller engines.

Surplus energy is routed to batteries and stored there until needed. Regenerative brakes return the energy used to slow cars back to battery storage, while in conventional cars this energy is normally dissipated as heat. Unfortunately, the same technologies that are used to increase the vehicle's miles per gallon come at a cost: hybrids are expensive to manufacture.

Tax Credits for Hybrids

To boost consumer interest in hybrid vehicles, the federal government introduced a series of tax deductions and credits. Under the clean fuel tax deduction for new hybrids, vehicles purchased before 2006 were eligible for a "clean fuel" deduction of up to $2,000. Hybrids purchased after December 31, 2005 were eligible for a federal income tax credit of up to $3,400. These credits were phased-out for each vehicle type once the manufacturer sold over 60,000 units. In January 2011, the last tax credits were provided on these cars.

Gasoline Prices and Hybrid Paybacks

One of the ways to measure the performance of an investment is by using a financial metric called the payback period or break-even point. Essentially, the break-even point is the time it takes to recover an investment. We're going to use this measure in the examples below to figure out if the premium paid for a hybrid is worth the investment.

Comparing the Cost of Hybrids

In the example shown in the table that follows, we're going to compare a hybrid vehicle to its standard combustion engine look-alike. The vehicle we've chosen for this analysis is the Toyota Camry.

2019 Toyota Camry

Model | SE 4 Dr. Sedan | Hybrid 4 Dr. Sedan |

MPG City | 28.0 | 51.0 |

MPG Highway | 39.0 | 53.0 |

Combined MPG | 32.0 | 52.0 |

MSRP | $24,600 | $28,400 |

Tax Credit | $0 | $0 |

Net Cost | $24,600 | $28,400 |

Premium Paid | $3,800 | |

Annual Fuel Cost at $4.00 | $1,406 | $865 |

Breakeven at $4.00 (Years) | 7.0 | |

Annual Fuel Cost at $3.50 | $1,172 | $721 |

Breakeven at $3.50 (Years) | 8.4 |

Note: Annual Fuel Cost is based on 45% highway, 55% city driving, and 15,000 annual miles per year. As the above example demonstrates, with fuel prices in the $2.50 to $3.00 range, the break-even period for this vehicle is around seven years or 105,000 miles. Therefore, the premiums paid for these vehicles do not appear to be justified by fuel savings alone. That being said, the above analysis ignores one important variable: the resale value of the vehicle.

Car Depreciation and Hybrid Vehicles

If everything else were the same, two cars would be expected to experience the same level of depreciation. That is to say, their resale value would be the same. But a hybrid car is not the same as its standard engine counterpart. It achieves greater gas mileage. Therefore, the seller of a hybrid should expect to be paid a premium when the car is sold. It's worth more to the car's buyer. With a higher starting cost for a hybrid, and a nearly identical rate of depreciation, the resale value of a hybrid should be higher than a car with a standard engine. This is a very important point that's often overlooked when analyzing whether or not it makes sense to buy a hybrid. For example, according to Kelley Blue Book, a used 2016 Toyota Camry LE Hybrid would sell for $13,900, while its standard engine look-alike sells for $12,800 (as of June 2018). That's a $1,100 premium. Fortunately, we offer an online hybrid car calculator that takes into consideration the car's depreciation. In fact, it's possible to use the information above, along with our calculator, to determine if owning a hybrid vehicle is a sound investment.