If you're anything like the millions of young Americans, you may be worried about your finances and what they're supposed to look like. If you've found yourself asking "Where should I be financially at 25," you've come to the right place.

Keep reading below, but if you want to learn more about getting out of debt and investing, consider reading these posts as well:

Ready to invest already? Check out the cool alternative options below from trusted affiliate partners!

Vinovest: Invest in wine without actually storing it all in your basement.

Fundrise: Invest in real estate investments with as little as $10.

Crowdstreet: Invest in online private equity real estate.

YieldStreet: For high-income earners only. Invest in art, real estate, legal finance, etc.

Where Should I Be Financially at 25?

If you're asking the question, you may be surprised to learn that you're right where you need to be, and that you can make changes to your finances at any time to make them work for you. So let's talk about it!

How much money should a 25-year-old have?

Let's be honest, most 25-year-olds aren't going to have a lot of money. This is especially true if you went to college and had to take out student loans.

But how much should you save in your 20s? What's a good number?

By age 25, you should have saved at least half of your annual expenses. This means, if you spend $100,000 a year, you should have saved about $50,000.

Similarly, if you spend $200,000 every year, you should have at least $100,000 saved up.

Experts agree that building an emergency fund and staying debt-free are key financial aspects at 25. But, the average 25-year-old has less than $1,000 saved, according to some recent surveys. The other 45% has saved under $10,000.

So anything you save is better than nothing...and likely better than the average 25 year old!

What should your net worth at 25 be?

Did you realize that the average 25-year-old has a negative net worth (so sure, they may have $1,000-$10,000 saved, but they're worth far less than that)?

How?

Between loans (student, car, etc) and even consumer debt, many 25-year-olds have a net worth of around -$23,000 on average.

But, this doesn't mean that young people aren't investing or saving money. This simply just means their liabilities are larger than their assets around this age.

Want to get out of debt? Want help lining up your loans and calculating how quickly they could pay off? Check out our top-selling Debt Snowball Excel Calculator for just $9.99 on Etsy!

How much should I have in my 401k at 25?

According to Empower, the average 25-year-old has around$26,000 saved in their 401k. This is great! The earlier you start investing and saving, the longer your money has to grow in your account.

However, don't be worried if you haven't started investing yet. While it is true that the earlier you start, the better, you can start investing at any time. Age 25 is not too late to start.

Roth IRA or 401k? This template will answer your questions.

With this template, you will get:

All DFY, simply add your details

Charts for comparison and clear answer

Easily update for any year (2023, 2024, 2025, etc…)

Read more:

Is 25 too old to start investing?

Are you really asking yourself this? Is 25 too old to start investing? Absolutely not!

In fact, 25 is a great age to start investing. This can give you up to 40 years (if retiring at 65) for your money to grow.

How much should you have saved by 30?

So what about the future you? How much should you have saved by 30?

A good rule of thumb is to have 1x your annual salary saved by age 30. So, if you make $60,000 a year, that's how much the experts say you should have saved.

Again, this may not be possible for many Americans, but it is a goal to aspire to.

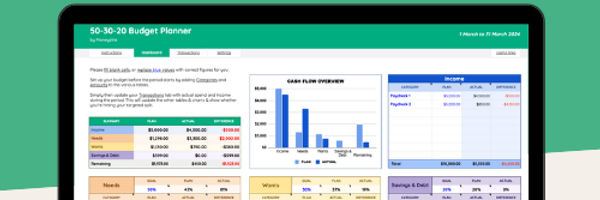

If you're ready to start saving, we've created this 50/30/20 budget template to help you get started 👇

50/30/20 budget template perfect for beginners!

A few key features of this template:

Only includes the things you need – no unnecessary tabs

Included clear instructions

Pre-filled with sample data

Fully customizable to your needs

How much do 25 year-olds make?

We've talked about how much 25 year-olds should have saved, and how much they should have in retirement. But what about their income? How much do 25 year-olds make?

According to the National Association of Colleges and Employers, the average salary for a new college graduate in 2020 was $55,260. Keep in mind that this is for college graduates. If you have less than a bachelor's degree, the earning average will be a bit less.

Read more:

How much is 50,000 a year per hour?

So let's say you're earning roughly the average salary for a 25 year old at $50k a year. But is that a lot? How much is 50,000 a year per hour?

If you're making around $50k a year with a full-time job, you'll be making roughly $23 an hour. Keep in mind that after-tax, insurance, and social security, that $50,000 will be lower in net pay.

Read more:

Where Should I Be Financially At 25? Here's What To Do

As you can see, the average 25-year-old is making good money, but is usually catching up with saving, investing, and paying off debt like student loans.

So you're not alone if you're just getting started on your personal finance journey.

But, you're still asking yourself the question, "Where should I be financially at 25?" And you're wondering what you should do to hit some of the milestones we discussed earlier in this article.

Not sure what to do now? Here are some ideas!

Focus On Saving/Investing

The first thing to do as a young person is to start focusing on saving and investing. Remember, the longer your money has to grow, the better you can take advantage of compound interest.

Read more:

First, make sure you have an emergency fund in place.

Experts recommend at least 6 months of your monthly expenses. But, even saving at least $1,000 is better than nothing.

Then, once your emergency fund is built, you can save a set amount each paycheck to keep it growing.

When it comes to investing, you can get started with your job if they offer a 401k.

All you have to do is talk to HR about saving a certain percentage of each paycheck. And, if your job matches your contributions, take advantage of it! That's free money.

If your company doesn't offer a 401k option, no worries. You can still invest separately. The easiest way to do so is to start a Roth IRA. Or, you can also learn how to invest in individual stocks, mutual funds, bonds, and more on your own.

Read more:

Pay Off Consumer Debt

Another thing to focus on is paying off debt.

While student loans may take longer for you to pay off, consumer debt should be your first priority. This debt is usually high in interest and avoidable once you get a budget.

List your consumer debt — from car loans to credit cards and personal loans. Then, make a plan to pay it off. You could focus on smaller debts first, and move on to bigger debts.

Or, if you want to save as much in interest as possible, pay off high-interest debts first (known as Avalanche method).

Once your consumer debt is paid off, you can then start transferring that money into savings and investments.

Lower Your Expenses

One of the easiest ways to pay off debt and have more money to save? Lower your expenses!

Yes, rent and mortgages are expensive.

Yes, groceries have gone up.

But, where you can lower your expenses, you should.

That way, you can take that money and use it towards future goals. You don't have to drastically lower your costs either. Just a hundred dollars freed a month is still $1,200 a year that you can save or invest.

Don't Be Afraid To Earn More

Do you feel like you're underearning in your career? Or, do you want to do a 180 and get a brand new career? Go for it (within reason)!

Ask for a raise, up-level your skills, or even go back to school — if possible — to earn more.

Keep in mind that you should always do your research before making a career move or change to earn more money.

For example, if you're asking for a raise, look into what people with your experience and education are making, and what their tasks are. That way, you have a reason and proof for asking for a raise.

Or, if you want to go back to school to be in a new field, look at how many job openings there are, and what the pay is for them. It wouldn't make sense to get into more debt just to be stuck making the same amount you were before.

Read more:

Look At The Future

If you're wondering where you should financially at 25 years old, don't just think about the money today. Think about the future as well!

No one expects to have trouble working or making money. But, life happens. To protect yourself at any age, look into different insurance options.

These include:

short and long-term disability,

life insurance,

and even regular health insurance.

By staying ahead on preparing for the future, you aid your future self if something bad happens. It's not morbid to think about death or disability and the possibility of it happening to you at any time.

Instead, it's smart. And, it can keep you from a life of debt or struggle, which is great for peace of mind.

Where Should I Be Financially At 25? The Choice Is Yours!

While the numbers above may not be inspiring, they're real. They show that many young people are in the same boat; surviving and trying to do better. But, 25 is still young and is the perfect time to start taking your finances seriously.

So where should you be at 25? The choice is yours!

.jpg)

.jpg)

.jpg)