Have you ever started talking with someone about money and thought, "This person really has it all together"? ...and then later realized they waste their money by going out to lunch every. single. day. ?

Similar calculators and budgeting templates:

Is Your Lunch Eating You?

It's innocent enough, right? You manage your money well by driving a 10 year-old car and you live in a modest house, which saves you hundreds of dollars a month compared to your frivolous friends, so why not treat yourself a little bit for lunch? After all, it can't make that much of an impact in the grand scheme of things, right? Wrong.

My lunch that I take from home costs me $1.78:

Sandwich

Bread = $0.17

Turkey = $0.40

Cheese = $0.08

Banana = $0.15

Clementines = $0.32

Granola = $0.66

The average lunch in our work cafeteria costs $6.00. The food might be a little tastier than my lunch, but there's definitely less of it (which leaves me hungry), and then of course there's the obvious - it's $4.22 more expensive.

For those of you that like to indulge in your cafeteria food - or worse yet, going out to eat at a restaurant -you're shelling out a minimum of $91.43 extra a month.... and $1,097.20 a year!

And let's take it one step further.

For every dollar that I save, I almost always invest it (seriously, my wife and I live on just 33% of our income), so let's say that over the next 40 years of our working lifetime, I invested an extra $1,097.20 a year more than you. Are you ready for this?

By simply eating my self-made lunch vs. your cafeteria fanciness, I'll have $319,000 more dollars than you in retirement... Three. hundred. THOUSAND dollars!! Don't tell me the small changes don't matter! It sounds like your lunch is DEFINITELY eating you!

Read more:

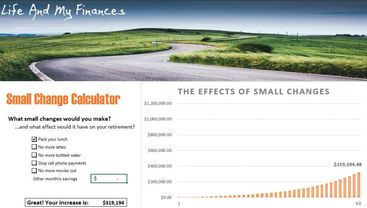

The Small Changes Investment Calculator

What if you not only switched from a cafeteria lunch to your take-from-home lunch, but you also made a few other small tweaks? Stuff like, cutting out your:

daily latte

bottled water

cell phone payments

weekend trip to the movies

If you got rid of these things and invested your savings instead into high-yield savings accounts, how much of an impact would this have on your future retirement? It's time to play around with the newest calculator I just created!

Download the Small Changes Calculator Here

Open the file and simply put a check mark next to each item you'd be willing to give up over the next 40 years (you can even add an extra item if you're really feeling frugal). Then, the graph will show you how much your savings would grow into if the money was invested instead! It's pretty simple, but I bet it will blow your mind!

.jpg)

.jpg)