Definition

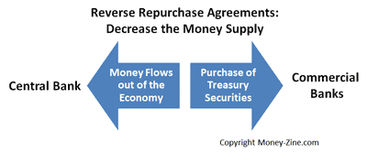

The term reverse repurchase agreement refers to a central bank selling securities to commercial banks, with the agreement to eventually buy them back. As is the case with a repurchase agreement, a reverse repurchase agreement will include both the price paid for the security as well as the date on which it will be repurchased.

Explanation

Also known as a reverse repo, a reverse repurchase agreement involves two transactions. The first transaction involves a commercial bank buying a security from a central bank. The second transaction involves the sale of the same security from the commercial bank back to the central bank. Although these transactions involve the sale and resale of a security, they are still viewed by the financial community as a collateralized loan. Typically, a reverse repurchase agreement is an overnight loan, but terms can be as long as two weeks. The Federal Reserve conducts reverse repurchase agreements with terms up to 65 business days. Reverse repos are considered very safe investments because they normally involve Treasury securities. The Federal Reserve of New York conducts reverse repurchase agreements to regulate the money supply. Specifically, the Fed conducts a reverse repurchase agreement when it wants to remove money from an economy. It does so by selling Treasury securities, thereby decreasing the money supply. The Fed conducts both reverse repurchase agreements and repurchase agreements. It conducts these transactions through open market operations, or OMO. When the Fed wishes to increase the money supply, it will enter into a repurchase agreement, which involves the sale of Treasury securities. Repurchase agreements are used to grow an economy that might be running the risk of going into a recession.

.jpg)

.jpg)