Definition

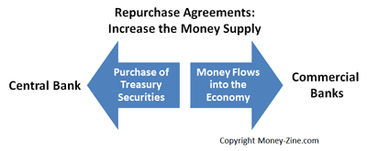

The term repurchase agreement refers to a central bank selling securities to commercial banks, with the agreement to eventually buy them back. A repurchase agreement will include both the price paid for the security as well as the date on which it will be repurchased.

Explanation

Also known as a repo, a repurchase agreement involves two transactions. The first transaction involves the sale of a security owned by a central bank to a commercial bank. The second transaction involves the sale of the same security from the commercial bank back to the central bank. Although these transactions involve the sale and resale of a security, they are viewed by the financial community as a collateralized loan. Typically, a repurchase agreement is an overnight loan, but terms can be as long as two weeks. The Federal Reserve conducts repurchase agreements with terms up to 65 business days.

Repos are considered very safe investments because they normally involve Treasury securities. The Federal Reserve of New York conducts repurchase agreements to regulate the money supply. Specifically, the Fed conducts a repurchase agreement when it wants to inject money into the economy. It does so by buying Treasury securities, thereby increasing the money supply. The Fed conducts both repurchase agreement and reverse repurchase agreements. It conducts these transactions through open market operations, or OMO. When the Fed wishes to decrease the money supply, it will enter into a reverse repurchase agreement, which involves the purchase of Treasury securities. Reverse repurchase agreements are used to slow down an economy that might be overheating.

.jpg)

.jpg)