Americans’ biggest fears:

Public speaking

Heights

Clowns

—and running out of money in retirement.

While my stress level increases with the first three bullet points, the fourth should top the list for all our biggest fears.

Can you imagine being a healthy 85-year-old and suddenly realizing you’re going to run out of money in ayear? All this because of a miscalculation you made a couple of decades ago when you hung up your work apron for the last time.

Oops.

No—that’s a big, hairy, all-caps—OOPS.

Nobody wants this to happen to them—so what can you do to avoid this catastrophic event? First off, download our “How long will my money last calculator”.

Then read the rest of this article to:

Learn how common it is to run out of money in retirement.

See examples of retirement savings drawdown for various amounts and percentages.

Calculate how long your retirement savings will last.

Understand the 4% rule and the 7% rule, and if either is right for you.

How to make your savings last longer.

And, in the spirit of investing and retirement, you may also find the below links to be helpful:

And, our Products page with tools that can help you in every situation

How Many Retirees Run Out of Money?

Does this happen? Absolutely. I actually have a first-hand account—my grandparents.

They worked hard, saved for their retirement—and retired in their early 60s. They had a decent nest egg, but they lived longer than they expected—my grandpa till he was 84, and my grandma till she was 89.

In their final years, they lived solely on social security and had Medicaid for health insurance. It happens to more people than we realize.

Will I run out of money in retirement?

The 2019 Employee Benefit Research Institute report says over 40% of those 35 to 64 years old are likely to run out of money in retirement. That’s a lot. If you’re asking, “Will I run out of money in retirement?” you’re wise to consider that fate—use the investment withdrawal calculator to understand how long your money might last.

When will my money run out?

First, you want to know if your retirement funds will run out — then you’ll probably ask when. Will you be eighty? Ninety? Older? How long should your money last? The average person will live into their eighties.

According to the life expectancy calculator at Blue Print Income, I’ll likely live to 101 years old! (And I have a 25% chance of living to 107.)

If you don’t know how long you’re likely to live, then you won’t have a clue if you have enough money stashed away—and if your money runs out before your projected death date, that’s a massive problem.

(Scared you'll run out of money? You may want to take a look at our best investment apps post to see if you can improve on what you're doing already.)

How Long Will My Savings Last?

Let’s get into the meat and potatoes of this article—how does this retirement depletion calculator work? Have a look at some examples so you can confidently fill this tool out for yourself—

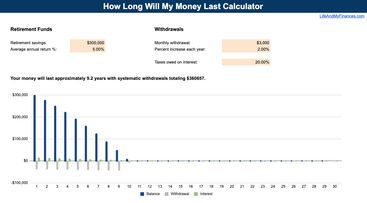

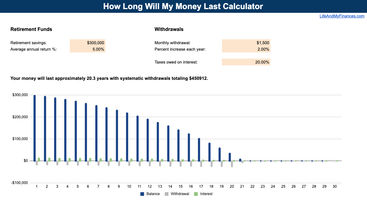

How long will 300k last in retirement?

What if you have $300,000? How long will that last in retirement? Our assumed inputs:

Annual return on our retirement funds: 5%

Monthly withdrawals needed: $3,000

Inflated withdrawal each year: 2%

Assumed tax on the interest: 20%

When we plug those figures into the “How long will my money last calculator,” we see that the money will run out in 9.2 years. (Unless you retire in your eighties, that’s probably not going to be long enough.)

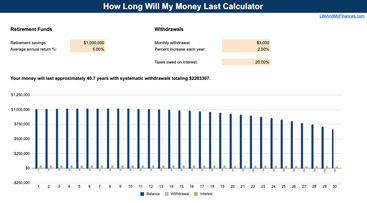

How long will $1 million last in retirement?

Let’s bump that nest egg up a bit— What if you had a million bucks in retirement? How long would that last?

Our assumed inputs:

Annual return on our retirement funds: 5%

Monthly withdrawals needed: $3,000

Inflated withdrawal each year: 2%

Assumed tax on the interest: 20%

Yup, you guessed it—having a million dollars vs. 300,000 makes a huge difference. Instead of your money lasting nine years, it’s now projected to last over forty years. (Now we’re talking!)

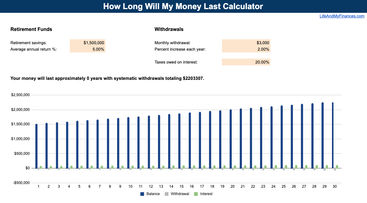

How long will $1,500,000 last in retirement?

What if we bump up our retirement savings to $1.5 million and still only withdraw $3,000 a month? How long will our retirement savings last?

Our assumed inputs (still unchanged):

Annual return on our retirement funds: 5%

Monthly withdrawals needed: $3,000

Inflated withdrawal each year: 2%

Assumed tax on the interest: 20%

It looks like we broke the tool (which is a good thing!). By drawing $3,000 a month from a $1.5 million pool of money, your retirement savings keep going up—and will last for over 50 years!

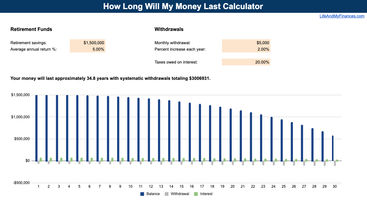

Perhaps we should live more lavishly. What do you say? Let’s bump up the draw to $5,000 a month. What happens then? Our money would last for nearly 35 years. That’s a solid result. You can live larger—and you likely won’t outlive your money.

How Do You Know If You Have Enough Money?

The math is pretty simple. Do you think you’ll live to a hundred and want to retire at sixty? You’ll need a retirement fund that lasts forty years.

If you put your numbers into the calculator, and run out of funds after thirty years—you don’t have enough money!

Also, if I were you, I’d err on the side of caution with your withdrawal amounts. You might think you can get away with spending just $3,000 a month—but yourbody might tell you otherwise. (Medical bills and long-term care are retirement fund killers.)

If you think you can squeak by on $3,000 a month—put $4,000 into the tool and see if it lasts. (If it doesn’t, you may want to save moreaggressively during your working years.)

How Long Will My Retirement Savings Last? More Great Questions

How long will my money last with systematic withdrawals?

Some people ask the retirement question a bit differently—they’re wondering what happens to their retirement savings if they make systematic withdrawals.

What does this mean?

This is exactly what we’ve been doing this entire post—we’ve been setting up withdrawals of $3,000 a month (and, on one occasion, $5,000 a month). Those are systematic—they happen consistently throughout the year.

Say we had $1,000,000 in a fund that earned 5% interest—and made systematic withdrawals of $3,000 a month, with 2% inflation each year—our money would last overforty years! If you want to test your personal systematic withdrawals, download the retirement drawdown calculator—and try it out.

How long will my money last in retirement with Social Security?

Do you expect to get Social Security income when you retire? Given the uncertainty around Social Security, I’m not planning on it—but if you’d like to factor this in, we can certainly do it with the free retirement withdrawal calculator.

Here’show you figure out how long your money will last with Social Security:

Come up with the monthly figure you need to live off in retirement.

Estimate your Social Security payments each month.

Subtract the Social Security amount from the total you need—this is the amount you’ll put into the retirement spend down calculator.

Here’s an example:

The total you need monthly to live: $5,000

The amount you’ll receive in Social Security each month: $2,000

Remaining amount: $3,000—this is the amount you enter into the calculator

Let’s rework one of our examples above—the $300,000 retirement amount.

How long will 300k last in retirement with Social Security?

Previously, the retirement funds only lasted 9.2 years—but what if we have a $1,500 Social Security benefit each month? Instead of withdrawing 3,000 a month, we’ll only need $1,500. As the doorkeeper of the Wizard once said, “Well, that’s a horse of a different color!”

Instead of lasting just 9.2 years, our $300,000 will suddenly last for over twenty years! If you’re nearing retirement and only need funds for the next 20 years, then $300,000 might just be enough for you.

(Want to take more of a deep-dive into this? Check out our recent post, “How Long Will 400k Last in Retirement?”)

What is a safe withdrawal rate?

Here’s the ultimate question—what withdrawal rate should you use in your retirement years? What rate is safe? This all depends on your assumed rate of earnings.

If you earn 15% a year with your retirement funds—and withdraw 10%—you won’t ever run out of money. However, if you earn nothing—and spend 10% of your retirement each year—you’ll be out of money in ten years.

How Long Will Money Last Using The 4% Rule?

The 4% rule is simple—it assumes you’ll live on 4% of your total retirement fund each year.

If you have $1,000,000, you’ll withdraw 4%—or $40,000. If your investments also earned 4%, you’d still have $1,000,000—and you’d withdraw $40,000again the following year.

The 4% rule is a conservative approach to retirement spending—more often than not, your investments will earn 4% or more each year (and you’d still have over $1,000,000 when you die).

Heck, even if you earned nothing on your million bucks, and withdrew $40,000 every year—your retirement funds would still last 25 years. If you’re looking for a safe withdrawal rate, the 4% rule is for you.

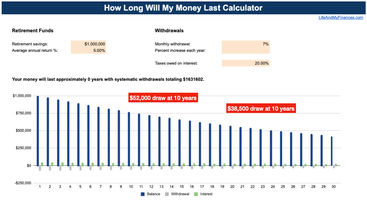

What is the 7% rule in retirement?

The 7% rule in retirement is just what you’d expect it to be—this is when you withdraw 7% a year from your retirement funds.

The 4% withdrawal rate didn’t seem aggressive enough—but 7% is quite the jump up. Is it a bit too bold? I quickly tweaked the retirement withdrawal calculator so we could see this in action—

If you earn 5%, and you withdraw money at a 7% rate, here’s what happens—

At year 10:

There’s $742,000 in your retirement account.

Your 7% withdrawal amount is down to $52,000 a year.

At year 20:

There’s $550,000 in your retirement account.

Your withdrawal amount is down to $38,500 per year.

I don’t know about you, but this doesn’t seem ideal to me—in 20 years, I’d like to be spending more money, not less.

If you want to draw down funds at a specific rate per year, I’d target 5% or less. It’s safer—and you’re more likely to maintain your standard of living. Sure, you might need to accumulate more funds up front—but I bet your much older self will thank you (when you’re not eating Beefaroni for dinner).

How to Make Your Savings Last Longer

What if you really want to retire soon, but this “How long will my retirement savings last calculator” says your money will only last 20 years (or maybe even less)?

What can you do? Four things:

1. Put more in now

If you want your funds to last longer, find more money.

Get out of debt.

If you're in debt, you're not maximizing your income.

Use our debt snowball spreadsheet to pay off your debt fast.

Sell stuff and invest the money.

Downsize your house.

Downgrade your car.

Sell any classics or collectibles you may have.

Sell off some land.

Make more money.

Ask for a raise at work.

Take on a second job.

Start your own side gig.

Cut your expenses.

Negotiate your bills.

Get rid of subscriptions you don’t need.

Eat out less.

Take fewer trips.

Sell stuff that costs you money.

Time to get out of debt with this debt snowball worksheet! 💪

As seen on CNBC and Business Insider, this is the best debt snowball spreadsheet template for Microsoft Excel and Google Sheets that is out there!

A few key features of this template:

It will show you when you can pay off your debt

Detailed but super easy and suitable for beginners

Can handle up to 32 debts!

Put anything you can into retirement so the money can grow, and carry your farther into your retirement years. It’s never too late to save money!

2. Withdraw less early on

If you want your money to stretch further in retirement, it’s important to spend as little as you can early on. This will allow your retirement savings to grow rather than shrink. Use some of the ideas above to cut costs and keep your retirement account as beefy as possible.

3. Make money in retirement

Just because you retire, doesn’t mean you need to stop making money. Do you have something you like to do that could earn a few bucks?

Writing

Fixing machinery

Art

Web design

Engineering

Teaching

Consulting

Or maybe you just love talking to people, so you get a part-time job at a local store. You might enjoy it (and bring home a few hundred bucks a month at the same time).

Making some extra money in your seasoned years will improve the longevity of your retirement accounts—and give you something fun and purposeful to do.

4. Retire later

If you don’t have any hope of quickly loading up your retirement accounts, cutting your expenses, or making money in retirement—then your last option is to keep working and retiring later.

If you’re 60 years old, and the calculator shows that your money will only last 20 years—you may want to wait another five years before pulling the plug on your work.

Nobody wants to run out of money when they’re old and incapable of working. (That’s just too scary of a place to be.) When in doubt, work a few more years while you can.

Key Takeaways

With the savings withdrawal calculator, you should have learned:

How long your money will last in retirement with a lump sum amount.

How to calculate how long your money will last with systematic withdrawals and additional Social Security benefits.

How much money you’ll need in your account before you retire.

We also learned about:

The 4% rule and the 7% rule—and which might work best for you.

How to make your retirement savings last longer.

At this point, you should know exactly where you stand with your retirement. (Either you need to keep working at it, or you’re ready to throw a retirement party tomorrow.) Whatever the case may be—at least you know where you stand!

.jpg)

.jpg)