Best Personal Finance Tools (Planners and Budgeting Apps)

To succeed in anything, you’ll need three things:

Drive

Knowledge

Tools

Missing one of these three? Success is unlikely.

Let’s say you want to be the best sailor in the world. To do this, you’ll have to—

Get up daily and train—do cardio, weight training, and countless hours of sailing practice.

Study boats, sailing techniques, water movement, physics (and probably a bunch of other stuff I have no clue about).

Have an actual boat—a quality one that will help you achieve at your highest level.

In finance, you’ll need—

Again, a strong desire and work ethic to do more and get better with each day.

To absorb all the financial information you can—our website is a great resource.

The best personal finance tools—debt snowball templates, monthly budget sheets, free tools, and an understanding of the best budgeting apps.

We’re going to help you with the latter today.

Scroll down to see a full description of all our top tools (and other site's tools too).

Or, take a quick look at the bulleted posts below:

Also, be sure to check out our products page for a full view of everything we have to offer.

Finally, if you just want to grab one of the templates yourself, here are the links to our shop:

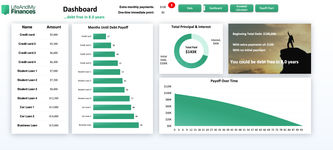

Debt Snowball vs Avalanche Calculator for Excel and Google Sheets

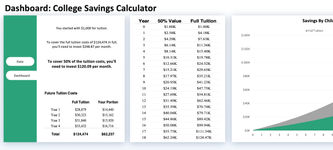

Early Mortgage Payoff Calculator for Excel and Google Sheets

Home Renovation Estimate Template for Excel and Google Sheets

Student Loan Debt Avalanche Calculator for Excel and Google Sheets

Student Loan Debt Snowball Calculator for Excel and Google Sheets

Best Personal Finance Tools from LifeAndMyFinances and Moneyzine

We’re always thinking about what you need to improve your odds of financial success.

That’s why we’re constantly developing new spreadsheets, calculators, and tools.

Below are the ones we’re most proud of—they include personal budget tools, get-out-of-debt calculators, and mortgage payoff calculators.

Best budgeting planners

Looking for a personal budget tool? The best budget programs are often the simplest to use, which is why we created a variety of budget-tracking templates in Excel.

Follow the link to learn more—choose the one that’s best for you!

Debt payoff tools

Becoming debt-free is the best feeling in the world (or maybe second-best after hitting the jackpot in Powerball—but hey, the chances of you paying off debt are way bigger).

Here you have the absolute top tools to get out of any consumer debt—credit card, medical, auto, student loan, or even payday loan debt.

Mortgage payoff calculators

Want to pay off your mortgage? It’s also a great feeling—and it frees up so much monthly cash when you don’t have a mortgage payment!

Whether you want to see what happens when you put extra money toward your mortgage each month, or calculate how much extra you’ll need to pay to become mortgage free in a certain number of years, here’s a tool for you:

Home build cost trackers

Building a home (or even adding on to it) is expensive these days. If you’re considering a building project, you’ll want a home build cost tracker.

Top Free Personal Financial Tools from Life And My Finances

What if you can’t afford to buy any financial tools right now? We offer a wide variety of free personal finance tools that can help.

Free budgeting tools

Have a look at our free budget tracking sheets—both for weekly and monthly income. They’re best to use as printable budget sheets to fill in manually.

If you’re interested in a more automated budget tracking tool, check out our robust monthly budget template and weekly budget spreadsheet on Etsy.

Free debt payoff calculators

Paying off consumer debt is one of the first steps to getting ahead financially. For this reason, we offer many of these tools for free. (They're smaller and more basic than the tools we offer for sale, but they are still quite helpful and could still be life-changing.) Check them out!

Free mortgage payoff tools

We have two mortgage payoff tools available—one provides a quick estimate of how quickly you could be mortgage free, and the other allows you to play out your payments by the month.

If you’re looking for something more detailed, check out our Early Mortgage Payoff Calculator in our shop.

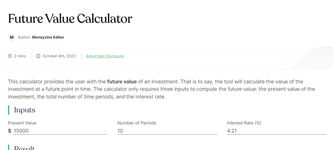

Other Fun Free Tools

Curious about our other free tools? There are tons more. Have a look—I bet you'll find something useful and eye-opening!

Top personal finance apps from other sites:

When people search for personal finance tools, they're often looking for the best budgeting app so they can start kicking butt with their budget. We don't have our own budgeting app (yet)—but we've explored dozens of other apps.

Here are the best budget apps on the market—

Best Budgeting Apps:

Mint app—best free budgeting app

Personal Capital app—best finance tracking app

Tiller budget tracker—best automated budget tracker in Excel

Pocketguard budget app—best simple budget app

YNAB app—best hands-on zero-based budgeting app

Goodbudget app—best hands-on envelope budgeting app

Honeydue app—best budgeting app for couples

Fudget app—best budgeting app without syncing accounts

Mint budget app—best free budgeting app

Why we like it

What is the Mint app? It's heaven in your hand—that's what it is. Mint is an app for all things budgeting—I have been using it for over a decade now.

While it's been around for a while, I'd still deem it the best budget planner in 2023.I love it for five reasons—

It’s free.

Setting up a budget is simple.

You’re able to link to all your banks and investment accounts.

They auto-categorize your spending for you.

One of their main screens displays your net worth, so you always know how well you’re doing overall.

What’s not to like

One downside of Mint is that it's become quite commercialized. (Half of their app experience today is just trying to sell you on their products or affiliates.) If you can ignore that, the app still has plenty to love—and it can help you tremendously with your budget and money management.

COST | APPLE STORE RATING | GOOGLE PLAY RATING |

Free | 4.8/5 ⭐⭐⭐⭐⭐ | 4.3/5 ⭐⭐⭐⭐★ |

Personal Capital app—best finance tracking app

Why we like it

Personal Capital is one of the best apps for tracking and analyzing your investments. You can use it for a budget app—but their claim to fame is how they can slice and dice your investments. This is what their company is all about, actually—wealth management.

What’s not to like

The budgeting app is pretty good, but the accounts aren’t regularly updated, making it a bit frustrating—especially if you're like me and look at your money daily.

Also, Personal Capital's goal is to sign you up as a client, and advise you on your investments—so they tend to push this on you from time to time.

COST | APPLE STORE RATING | GOOGLE PLAY RATING |

Free | 4.7/5 ⭐⭐⭐⭐⭐ | 4.3/5 ⭐⭐⭐⭐★ |

Tiller budget tracker—best automated budget tracker in Excel

Why we like it

Tiller isn't technically an app—it's an Excel tool—but it operates just like a budget app, since it can pull in your expenses automatically and categorize your spending into your budget. Once you have it all set up, it's pretty slick.

If you love to work in Excel and geek out over numbers, this is the budget tool for you.

What’s not to like

Setting up Tiller can be clunky. The instructions are in Excel—and it's a five or six-step process. (If you're not savvy in Excel or Google Sheets, you might never get fully set up.)

COST | APPLE STORE RATING | GOOGLE PLAY RATING |

One month free trial, then $79/year | N/A (Excel-based tool) | N/A (Excel-based tool) |

Pocketguard budget app—best simple budget app

Why we like it

The app download and initial process for Pocket guard are superb. The first step was to link to my bank accounts—then it found my income and regular expenses, and actually started putting together my budget for me. You can tell they thought of the user when they designed the app—they tried to make it the quickest, simplest process possible.

In terms of cost, the app is free, even with the bank account linking feature (most apps charge extra for this). You can buy upgrades—but you don’t need them to use the tool effectively.

What’s not to like

With so much automation from the start, it can get frustrating if the tool isn't doing what you want it to do, or if it miscategorises something. (It can be difficult to change and adjust on the fly.)

COST | APPLE STORE RATING | GOOGLE PLAY RATING |

Free + optional upcharges | 4.7/5 ⭐⭐⭐⭐⭐ | 4.4/5 ⭐⭐⭐⭐★ |

YNAB app—best hands-on zero-based budgeting app

Why we like it

YNAB (You Need a Budget) is based on the zero-based budgeting principle—where you budget every dollar you earn, even the amount that goes to investments and savings. The setup and look are pretty simple and easy to understand. (Many have given this app rave reviews—both Apple and Android users alike.)

What’s not to like

I had a couple of issues while using the app—

Each expense required an estimated date, which was tricky for quite a few line items.

Connecting to your bank accounts was slower than other apps—I was actually never able to link to mine.

COST | APPLE STORE RATING | GOOGLE PLAY RATING |

Free for a month, then $99/year | 4.8/5 ⭐⭐⭐⭐⭐ | 4.6/5 ⭐⭐⭐⭐⭐ |

Goodbudget app—best hands-on envelope budgeting app

Why we like it

The Goodbudget app is based on the envelope system—where you have certain envelopes for specific categories of spend (like groceries, entertainment, shopping, gas, and the like).Instead of having actual cash and envelopes, though, you just keep track in the app.

Overall, the app's process is entirely manual—there's absolutely no bank linking. (This is by design and keeps things super simple.) Based on the reviews, quite a few people like this—it saves them from worrying about getting hacked (and it keeps things free).

Another benefit is that the Goodbudget website has a ton of helpful content and videos (if you ever get stuck creating your budget).

What’s not to like

The app's look is archaic, and sometimes the functionality is difficult to understand. Also, if you want more than ten envelopes, it will cost you—roughly $8 a month.

COST | APPLE STORE RATING | GOOGLE PLAY RATING |

Free, up to 10 envelopes | 4.7/5 ⭐⭐⭐⭐⭐ | 4.3/5 ⭐⭐⭐⭐★ |

Honeydue app—best budgeting app for couples

Why we like it

This is one of the first budgeting apps built specifically for couples that might have separate accounts but want to be on the same page financially.With Honeydue, not only can you seeall of your accounts in one place—you can even send chat messages to each other through the app.

The concept is pretty cool—and there are plenty of people that could benefit from this type of app.

What’s not to like

The reviews on the app have been sub-par, especially for non-iPhone users. There is no desktop version of the app, which can be a pain. (Also, the only support is through an online forum—which makes it difficult to find specific answers to your questions.)

COST | APPLE STORE RATING | GOOGLE PLAY RATING |

Free, up to 10 envelopes | 4.5/5 ⭐⭐⭐⭐★ | 3.5/5 ⭐⭐⭐★★ |

Fudget app—best budgeting app without syncing accounts

Why we like it

Hate budgeting? Too complex and confusing for you? Then this app might just be the perfect fit.

Fudget isa free app that allows you to enter monthly budget estimates—and that's pretty much it. At the end of the month, you check your bank accounts and see how you did vs. your budget. (There's no bank linking, no daily updates, and no fancy charts to overwhelm you.)

What’s not to like

Fudget is extremely basic—more of a budgeting guide than a true tool. You could just as easily get a piece of paper, write down your budget, and carry it around in your wallet for reference. But if you want to reference your monthly plan on your phone for convenience—it's perfect for that.

COST | APPLE STORE RATING | GOOGLE PLAY RATING |

Free + potential upgrade for $1.49 | 4.8/5 ⭐⭐⭐⭐⭐ | 4.7/5 ⭐⭐⭐⭐⭐ |

Key Takeaways

YOU WERE LOOKING FOR PERSONAL FINANCE TOOLS—WE GAVE YOU:

Our best Excel sheets.

Top free Excel tools for budgeting and paying off debt.

Other fun free tools for saving, investing, and retirement.

—and we offered our take on the top budgeting apps out there.

.jpg)