Back in 2012, county officials in Carson City, Nevada, found over seven million dollars in gold coins in a dead man’s garage. Five years later, police discovered 20 million bucks hidden away in a bed frame at an apartment in Massachusetts. Absurd as these cases might seem, they do make you wonder—where do people actually keep their money?

You’re about to find out—

Team Life And My Finances did some digging into America’s saving habits in 2023.

We carried out an extensive survey with over a thousand respondents across America. What we found blew our minds—and we’re sure you’re going to enjoy this, too.

Where Do Americans Store Their Cash?

Let’s kick things off with some astonishing stats:

A whopping 91.5% of Americans keep cash at home.

More men than women (93.4% vs. 88.5%) in America stash the cash in their dwellings.

The highest percentage of folks who don’t hoard money at home had a bachelor’s degree (57%), followed by a high school diploma (25%), and a master's degree (15.4%).

What are America’s Favorite Home-Hiding Spots?

We’re nosy and couldn’t help but wonder what spots Americans choose as their treasure trove—

How Americans manage their finances didn't surprise us much: most people put their money in a safe. Others get a bit more creative:

HIDING SPOT | % OF AMERICANS STORING CASH THERE IN 2023 |

In a safe | 63.3% |

Inside the refrigerator | 13.3% |

In a suitcase | 6.1% |

In a closet | 5% |

In a water tank | 4% |

These figures don’t seem too surprising when you take into account that North America is the largest consumer of safes and vaults in the world.

You could argue that a safe is, well, safe.

But a freezer?

That’s taking the meaning of frozen assets to the next level—

Ladies seem to be a bit more eager to stash their dough between burger patties and chicken nuggets (18.1% women vs. 10.7% men).

They’re also more likely to keep their cash in a safe (66.3% women vs. 61.6% men).

On the other hand, more men keep their money inside a closet (7.1% men vs. 1.2% women).

A Deep-dive Into America’s Financial Savviness

Wondering what other (actual) saving tools Americans are using?

Here’s what we found:

Almost every respondent we surveyed (99.6%) has a savings account.

Most (96.4%) have checking accounts, too.

You’d think banking is a thing of the past, but almost all Gen Zeds we asked own a checking account.

And—on a positive note—over 98% of respondents have some amount of rainy day savings.

A study by the Federal Reserve confirms that 98% of American households indeed have a transaction account, while a fool.com study shows about 78% of Americans have a savings account.

It’s pretty astonishing then that we have financially savvy folks who are still storing cash in a freezer—

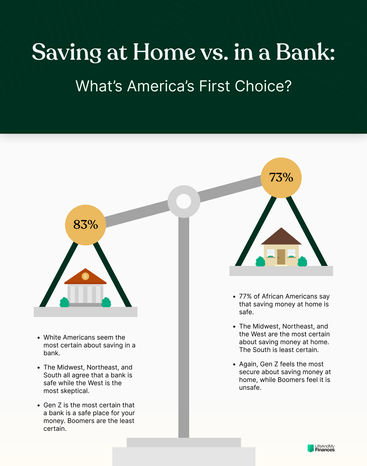

Saving at Home vs. in a Bank: What’s America’s First Choice?

By the look of it, most Americans seem to be saving both at home and in a bank account.

But what do they prefer? And how safe do they think these saving spots are?

How Does America Feel About Saving in a Bank Account?

83% of respondents (of which 15% strongly) agree that keeping money in the bank is safe.

Folks with bachelor’s degrees seem to have the most confidence in bank accounts (with over 87% agreeing that they’re safe), followed by people with a master’s degree (84%), associate’s degree (83%), and a high school diploma (73%).

A closer look revealed that over 85% of White Americans think it’s safe to save in a bank.

Latinos seem to be the most uncertain about bank accounts, with a majority harbouring a neutral sentiment.

People in Alabama, Utah, Alaska, Arizona, and Connecticut seem to have the least trust in bank accounts. Regionally, people in the West trust banks the least.

Residents of Delaware, Kansas, Louisiana, Minnesota, Montana, and Nevada are the most certain about saving in a bank account. Regionally, people in the South are the most trusting of banks.

How Does America Feel About Saving Cash At Home?

On the surface, Americans seem to think that banks are safer than stashing cash at home, with 73% of respondents considering keeping money at home safe.

African Americans seem to be the most sure about storing money at home—over 77% agree that it’s safe.

Colorado, Virginia, Montana, and Rhode Island residents are the most uncertain about saving at home. Regionally, the greatest uncertainty was in the South.

Folks in Nevada, Oklahoma, Washington, and Kentucky are the most certain about saving at home. Regionally, the greatest certainty was in the Midwest.

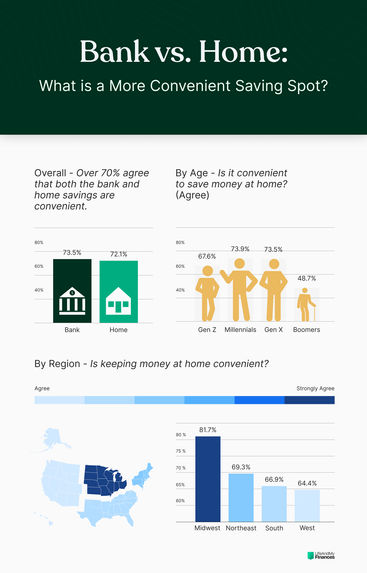

Bank vs. Home: Which is a More Convenient Saving Spot?

We’ve talked about safety. But what about comfort?

Let’s find out—

More than 73% of Americans agree that saving money in a bank is convenient.

Only a slightly smaller share (72.1%) think that keeping money at home is handy.

About 67.6% of Generation Z, 73.9% of Millennials, and 73.5% of Generation X believe it’s convenient to save at home. On the other hand, only 48.7% boomers think the same.

The Most Popular Retirement Saving Options

A lot of us are saving for retirement—and we were curious to see where Americans are saving for it.

About 72% of respondents are likely (of which 12.2% very likely) to keep their retirement savings at home.

The Midwest folks seem the most likely to stash their retirement funds around the house, while those from the northeastern, western, and southern states tend to be the most wary.

About 71% are likely (of which 22% very likely) to save for retirement in a bank account.

The southern states are the most likely to use a bank account to save for retirement. (The northeast region seems the most uncertain.)

Over 74% of the surveyed group are likely (of which 14% very likely) to save in an IRA (Individual Retirement Account) for the golden years.

The Midwest and the Northeast seem the most likely to save in an IRA. (The southern states seem the least likely to do so.)

Over 68% of respondents are likely (of which 15.4% very likely) to save for retirement in a CD (Certificate of Deposit) account.

The Midwest seems the most likely (and the Northeast region the least likely) to save for retirement in a CD account.

Over 72% of respondents are likely (of which 13% very likely) to save for retirement in physical assets.

Interestingly, Asians and folks with an associate degree seem to be the least likely group to buy physical assets for retirement.

Almost 67% of respondents are likely (of which 51.7% very likely) to save in a 401K for retirement.

15- to 19-year-olds are the least likely age group to save for retirement in a 401k.

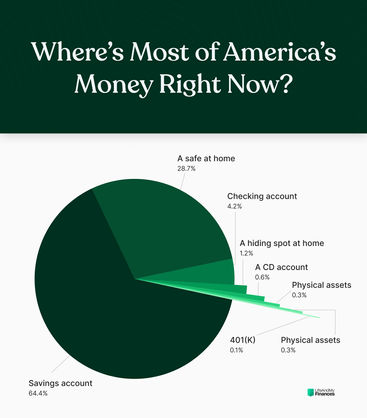

Where’s Most of America’s Money Right Now?

Do Americans know how to make their money work for them? And where’s all this cash sitting?

Let’s find out—

WHERE AMERICANS SAVE MOST OF THEIR CASH | % OF AMERICANS SAVING IN 2023 |

Savings account | 64.4% |

A safe at home | 28.7% |

Checking account | 4.2% |

A hiding spot at home | 1.2% |

A CD account | 0.6% |

Physical assets | 0.3% |

Digital wallets | 0.2% |

401(K) | 0.1% |

These are overall figures. But what about the differences among ethnicities?

The numbers might surprise you—

Here’s the percentage of folks from different ethnic backgrounds that are saving most of their money in a savings account:

ETHNICITY | % OF ETHNICITY WITH MAJORITY OF FUNDS IN A SAVINGS ACCOUNT |

White | 66.8% |

Latino | 60.9% |

African American | 28.2% |

Asian | 18.8% |

And here’s the percentage of people from different ethnicities that are saving most of their cash in a safe at home:

ETHNICITY | % OF AMERICANS WITH THE MAJORITY OF THEIR MONEY IN A SAFE |

African American | 66.7% |

Asian | 63.6% |

White | 27% |

Latino | 23.4% |

While America’s Whites and Latinos are on “Team Savings Account”, Asians and African Americans seem to trust their in-house safe.

A 2017 FDIC survey found that the top reason people don’t open a bank account is because they simply don’t have enough money.

Details on Our Sample Size

We did this survey on a sample of 1,007 respondents.

Here are more details:

The respondents range from 15- to 70-year-olds (most are 25–35, followed by 45- to 55-year-olds).

Over 65% of respondents have a bachelor’s degree, 19% have a high school diploma, and 12.7%—a master’s degree.

More than 95% of respondents are married.

61% have two kids, while 27.5% have one child.

The majority of respondents earn between $50,000 and $75,000 a year.

Over 88% were white, 6.3% Latinos, 3.8% African American, and 1% Asian.

Why are Americans Stashing Cash at Home?

Even though most personal bank accounts are insured for up $250,000 these days, Americans are choosing to store cash at home.

Here are some possible reasons:

Economic anxiety caused by the looming recession has driven the more cautious folks to go back to Depression-era money stashes. (This is similar to the “cash is king” sentiment we saw after the recession of the late 2000s.)

Another factor is the mistrust of banks following the fall of the Silicon Valley Bank (and the possibility for more to come the near future). So far, three American banks have failed in 2023 alone (including Silicon Valley Bank, Signature Bank and—most recently—the First Republic Bank). America’s banking sector seems to be facing more lingering concerns—Goldman Sachs lost nearly $200 million since the SVB collapse.

A recent survey from the FDIC found that 36% of unbanked individuals don’t trust banks.

Emergency preparedness is another common factor. There are situations where it may not be possible to access a bank account. (A hurricane could damage the electric grid, or you could simply lose your wallet and debit cards and need some cash immediately.)

Why Keeping Cash at Home is a Risk

Planning to stash cash in your home? You may be overlooking some critical drawbacks—

Robert R. Johnson, professor of finance at Creighton University, says, “I can think of no worse way to manage cash than to “stash it at home.” For one, when you stash cash at home it’s a non-earning asset. In fact, in an inflationary environment holding cash makes it a depreciating asset.

Second, safety is a huge concern. Your cash stash can be stolen, misplaced, or destroyed. You may be concerned about losing money in the recent bank runs, but that concern is misplaced.

You’re insured for up to $250,000 per depositor, per insured bank. Since 1933, no depositor has ever lost a penny of FDIC-insured funds. Simply put, an FDIC-insured account is the safest place for consumers to keep their money.”

FBI’s burglary statistics are worrying. Their study points out that a burglar strikes close to every 30 seconds in the US—that’s about two burglaries every minute and over 3,000 crimes a day. (What’s more, people lose an average of $2,661 in a burglary.)

In addition to the very real risk of theft and missing out on interest-rate earnings, you want to keep in mind that some places simply won’t accept cash anymore. The coronavirus pandemic has forced us to reconsider what we touch, and many merchants have permanently shifted to cashless and contactless transactions.

Key Takeaways

SUMMARY

A whopping 91.5% of Americans store cash at home.

The top money-hiding spots include a safe (63.3%), a refrigerator (13.3%), and a suitcase (6.1%).

Americans may be stashing their savings around the house because of recession-induced economic anxiety, lack of confidence in banks, or to be prepared for an emergency.

Keeping cash at home isn’t very effective as it makes your money a non-earning asset. Your money is also prone to being stolen, misplaced, or destroyed.

.jpg)

.jpg)