Almost every survey shows a high interest in learning personal finance in formal education and many people admit they need help. How confident are you in your personal finance management skills? You think you do a better job at planning and budgeting your funds? Check out the latest stats about personal finance and see how do you hold up compared to the average American.

Top 10 Personal Finance Stats and Facts

68% of Americans say they would be worried to cover their living expenses for a month if they lost their primary source of income.

17% of US adults say their savings are now higher than before the Covid-19 pandemic.

The average amount of personal savings in the US is $62,086 in 2022.

73% of US consumers in 2022 say they developed better financial habits because of the pandemic.

The average amount of retirement savings in the US is $98,800.

The average amount of debt US consumers had in 2022 was $22,354

43% of Americans expect to be in debt for the next one to five years.

44% of US adults say they have adjusted their financial planning to account for emergencies and risks.

61% of US consumers live paycheck to paycheck as of April 2022.

88% of Americans believe financial education should be mandatory in high school.

Statistics on Saving Money in the US

68% of Americans say they would be worried to cover their living expenses for a month if they lost their primary source of income.

Another 45% claim they would be very worried, and only 14% they would not be worried at all.

Furthemore, 72% of women claim they would be worried, compared to 64% of men.

(Bankrate 2023 report)

14% of Americans have no credit card debt and no savings.

American savings statistics also show that 36% of people have more credit card debt than they have emergency savings in 2023, the highest percentage in the last 12 years.

However, 51% claim that, according to money saving statistics in the US, they have more in their emergency fund than they have credit card debt.

(Bankrate 2023 report)

In 2021, 49% of American households with an annual income of less than $30,000 have no emergency savings.

Unsurprisingly, emergency savings are closely related to the amount of money US families are making. While almost half of the low-earners have no savings, this percentage drops to 35% for households with an income of between $30,000 and $49,999.

Moreover, the percentage drops down to 13% for homes with an income of between $50,000 and $74,999, but it unexpectedly increases to 14% for households with incomes of $75,000 and more. American family financial statistics also reveal that 43% of the high-earning households have savings enough for at least six months, while only 9% of the lowest income families have the same.

(Bankrate)

In 2021, 17% of US adults said their savings were higher than before the Covid-19 pandemic.

In contrast, twice as many, or 34% of the American population, say their savings are lower than before the pandemic, while they are about the same for 42% of respondents. Moreover, 47% of households with incomes of up to $30,000 report their savings got lowered, and only 13% of them say their savings have increased. Saving money statistics also show that households with incomes over $75,000 whose savings are higher and lower after the pandemic have an equal share of 27%.

(Bankrate)

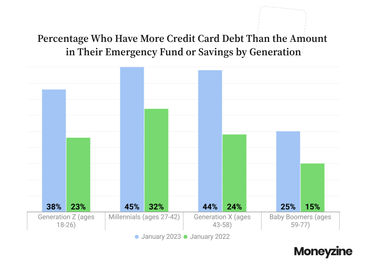

45% of Millennials have more credit card debt than savings.

According to the personal finance by age group statistics, Millennials have the lowest savings-to-debt ratio. In comparison, only 25% of Baby boomers have more credit card debt than they have savings.

Gen Z is also low, at 38%, while Gen X are very close to Millenials, with 44%.

(Bankrate 2023 report)

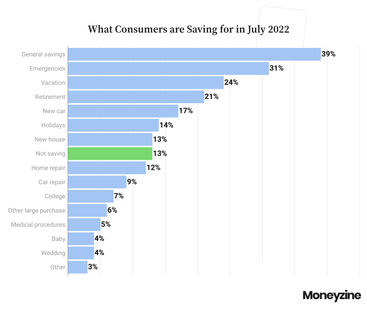

13% of US consumers say they are not saving, according to data from July 2022.

Of those who are saving, the largest percentages of 39% and 31% describe their savings as general and emergency savings, respectively. In addition, 24% say they are saving for a vacation, and 21% are saving for retirement. Furthermore, personal finance statistics reveal that 17% of Americans are saving for a new car, 14% for the holidays, and 13% of them report saving for a new house. 12% and 9% are saving for home and car repairs, while only 7% of Americans report saving up for college.

(Magnify Money)

The average amount of personal savings for American citizens is $62,086 in 2022.

Statistics from 2021 show that the average personal savings that year was $73,100, suggesting a $9,000 (15%) drop this year compared to the year before.

(CNBC)

Financial Planning Statistics

60% of Americans say that the Covid-19 pandemic has been highly disruptive to their financial management.

Of them, 48% say they were able to adapt to the new situation, but 13% say they weren’t. Moreover, 43% of Americans say they have already made up ground for the financial implications they suffered because of the pandemic.

10% say they made up for all of it and even exceeded their financial expectations, 12% say they are back on track financially, and 21% say they made up for some of the ground lost, but are not fully back on track. Post-Covid financial statistics also show that 30% of Americans haven’t made up any ground, and 27% didn’t lose any ground, financially, because of the pandemic.

(Northwestern Mutual)

73% of US consumers in 2022 say they developed better financial habits because of the pandemic.

An equal percentage say that they intend on keeping these habits going forward. While 73% is a relatively high percentage, the share of Americans who reported that the pandemic improved their financial habits in 2021 was 95%. The most commonly practiced behavior, aimed at improving personal finance is the reduction of living costs and spending, adopted by 35% of the consumers.

Personal finance data shows that 22% of Americans paid down their debt, while 19% increased their investing. Another 19% say they started to rely more heavily on technology to manage their finances, and 17% say they visit their financial plans more regularly.

(Northwestern Mutual)

The primary obstacle to reaching financial security in retirement is inflation, according to 41% of Americans.

However, 35% of them believe that inflation will go down in 2022, and 56% are confident that social security will be there when they need it. Furthermore, US personal finance statistics reveal that 39% of consumers view the economy as an obstacle to reaching financial security in retirement. The lack of savings is a hurdle for 29%, 26% of Americans struggle with personal debt, and 22% cite healthcare costs as a barrier to reaching financial security in retirement.

(Northwestern Mutual)

Financial advisors are the most trusted source for financial advice, according to 26% of US adults.

The personal finance statistics from a recent survey show that 20% of Americans only trust themselves, while 16% believe their spouse is their best source of financial advice. However, 38% of them currently work with a financial advisor, which is a significant jump from the 29% from before the pandemic.

Moreover, 15% of Americans who didn’t have a financial advisor before Covid, either have one now, or plan on hiring one in the near future. This trend is particularly prevalent with younger generations, as 23% of Gen Zers and just as many Millennials agree with the above statement, as per the latest statistics on personal finance.

(Northwestern Mutual)

The Covid-19 pandemic caused 35% of Americans to change their retirement plans.

More precisely, 24% of US workers will have to retire later, and 11% will retire earlier due to Covid implications. The average age that Americans expect to retire is 62.6, with Gen Zers and Millennials planning on the earliest retirements, at age 59.4 and 59.5, respectively.

Furthermore, 55% of the workers who delayed it cite additional flexibility at the workplace as the main reason for pushing back retirement. On the other hand, American personal finance statistics reveal the wish to spend more time with their loved ones as the main reason for earlier retirement, according to 42% of the employees.

(Northwestern Mutual)

The average amount of retirement savings in the US is $98,800.

Historical data shows that the average retirement savings had increased considerably, compared to 2020, when it was $87,500. However, expectations have risen as well, as the average American believes they need $1,047,200 to retire comfortably, while the ideal amount in 2020 was $950,800.

(Northwestern Mutual)

Personal Budgeting Statistics

The average amount of debt of US consumers for 2022 is $22,354.

The above figure represents a 22% decrease from the average debt of $29,800 in 2019. The stats also show that the average American spends about 32% of their monthly income on paying debt, other than mortgages. With mortgages excluded, the biggest source of debt for US consumers is credit card debt, accounting for 209% of the whole amount. Car and education loans account for 8% and 6%, while home equities only account for 4% of their total debt, according to the most recent debt budgeting statistics.

(Northwestern Mutual)

43% of Americans expect to be in debt for the next one to five years.

In addition, 20% of them believe they can pay off their debt in six to 10 years, 12% in 11 to 20 years, and 12% don’t expect to pay off their debt in their lifetime. Besides complicating their personal budgeting and financial planning, debt has been a barrier to achieving various life goals for Americans.

For example, 31% of US consumers say they have delayed significant purchases because of their debt, while 20% have delayed their retirement savings. Furthermore, statistics on budgeting show that 18% delayed buying a home, 8% delayed having children, and another 8% delayed marriage because of their debt.

.png)

(Northwestern Mutual)

Paying bills and expenses is the financial planning priority for 48% of Americans.

The statistics further reveal that while nearly half of the US population focuses on paying their bills, saving for retirement is a priority for 39% of US adults. In addition, 38% of them say their main focus is on paying off their debt and loans, while 37% prioritize taking care of their families when doing their financial planning. Finally, statistics about budgeting reveal that investing is the biggest priority for 32% of Americans.

(Northwestern Mutual)

30% of Americans believe that having an emergency fund or personal savings is the best defense against financial uncertainty.

Another 27% believe having a financial plan is the best option, while 35% of the US consumers who were able to increase their savings, attribute this feat to reduced discretionary expenses. Moreover, 23% say they did it by prioritizing saving over spending, while 18% were able to save more because their incomes increased. Personal budget statistics show that only 15% of Americans chalk up their increased savings to a reduction in living costs and necessary expenses.

(Northwestern Mutual)

53% of US adults say that the Covid-19 pandemic caused them to change their views on long-term care.

As a result, more than a third, or 34% of Americans, have already planned their own long-term care needs. In addition, 46% report they have increased their savings, while 39% incorporated long-term care into their financial planning. Furthermore, facts about personal finance show that 37% of Americans spoke to their financial advisor about long-term care, and 36% purchased long-term care insurance.

(Northwestern Mutual)

44% of US adults say they have adjusted their financial planning to account for emergencies and risks.

While 71% of Americans say they have good clarity on how much they should spend vs how much they should save, this percentage jumps to 82% for consumers who use the services of a financial advisor. Stats on personal finance further reveal that 66% of Americans believe they have achieved, or will achieve financial security, while 68% say their financial planning considers the possibility of unplanned emergencies. Finally, 60% are confident they will have enough money saved when the time for retirement comes.

(Northwestern Mutual)

Personal Finance – General Statistics

61% of US consumers live paycheck to paycheck as of April 2022.

Of them, 21.7% report living paycheck to paycheck with difficulty, while 39.6% say they still live comfortably, according to the latest living paycheck to paycheck statistics. The data also shows that 36% of consumers with annual incomes of between $100,000 and $150,000 and 31% of those with $150,000 to $200,000 yearly incomes live paycheck to paycheck. The percentage drops to 26% for consumers with earnings of between $200,000 and $250,000. Interestingly, even 24% of the Americans with annual incomes of over $250,000 report living paycheck to paycheck.

(PYMNTS)

The USA ranks 14th on the global financial freedom list.

The financial freedom statistics of 2022 also reveal that another 11 countries, including Canada and the UK, have the same score (80) as USA. The only two countries in the world with a score higher than 80 are Australia and Switzerland, holding the top two spots with 90 points. Financial freedom bonus fact: North Korea is the only country in the world with a financial freedom score of 0.

(The Global Economy)

54% of the teenagers in the USA say they are worried about financing their futures.

Statistics about teens and personal finance show that the rising costs of higher education have affected the plans of 69% of American teenagers. Namely, 28% of teens say they now only consider in-state schools, 22% plan on living at home and commuting to college, and 10% want to get a two-year instead of a four-year degree.

Furthermore, 41% of teenagers are unhappy with the lack of financial literacy classes in school. 39% say they would like more education on how student loans work, while 38% want to know more about how education ties to jobs.

(Citizens Bank)

88% of Americans believe financial education should be mandatory in high school.

Personal finance statistics on college students show that many do not feel confident about the level of financial literacy they have once they graduate.

Furthermore, of those surveyed in a National Endowment for Financial Education study in 2022, 75% believed spending and budgeting should be the focus of said financial education. Another 55% believed managing credit is also very important, and 49% believed the same about saving.

(CNBC - education,US News)

Personal Finance Stats FAQs

What are the five most important aspects of personal finance?

What percentage of personal finance is behavior?

How many people actually have a financial plan?

What is the number one rule in personal finance?

Conclusion

And that is all we have for you today. Hopefully, you enjoyed these interesting personal finance facts and stats we prepared for you, and now you have a clearer picture of how your financial well-being compares to the other consumers.

.jpg)

.jpg)

.jpg)