The latest cryptocurrency statistics show that the growth of everything related to the blockchain network has been dwindling across the world. Regardless, the top cryptocurrencies and markets are still holding their own.

To learn more about how cryptocurrencies, and some of the best crypto exchanges, are faring globally, we have compiled a list of the most interesting cryptocurrency statistics and facts. Read on!

Most Important Cryptocurrency Statistics (Editor’s Choice)

17% of US citizens use cryptocurrency in 2023.

Ten countries have banned all forms of cryptocurrencies.

The size of the Bitcoin market stands at $525.2 billion.

There are more than 18,000 cryptocurrencies as of 2023.

$3.5 billion was sent in Bitcoin to crypto wallets surrounding criminal activity.

Every 2 seconds a cryptocurrency post appears on social media.

1.1% of all cryptocurrency transactions are illegal

Over 87 million people worldwide own a blockchain wallet

In 2023, the number of global crypto users is estimated at 420 million.

72% of global crypto users are younger than 34.

Essential Cryptocurrency Stats

The top 20 cryptocurrencies account for almost 90% of the market.

Bitcoin is still the most used cryptocurrency and it accounts for one half of the market at the time of writing. Broken into percentages, Bitcoin has a dominance of 50.2% of the total crypto market cap, followed by Ethereum with 17.7%, and TetherUSD with 7.6%, and BNB at 3%. Cryptocurrencies that are not in the top ten make up for only 13.6% of the total market capitalization.

Around 17% of Americans use cryptocurrency in 2023.

Have you ever wondered about the number of people who use cryptocurrency in the US? 17% of people in the US using cryptocurrencies highlights a growing trend. The number represents around 53 million people, which is not neglectable by any means.

(Pew Research Center)

Valued at $1.2 trillion, North America is the world’s largest crypto market in 2023.

Despite its transaction volume and adoption decreasing, North America is still the largest crypto market in the world. According to analysis between July 2022 and June 2022, its on-chain transaction activity represented around 24.4% of the world’s total on-chain activity.

In the last year, North American crypto activity decreased significantly. over the last year.

The main events that affected crypto activity in the world’s biggest market include the notorious fall of the FTX exchange in November 2022 and crises hitting crypto’s key banks, Signature, Silvergate, and Silicon Valley Bank in March 2023.

Over 90% of stablecoin activity takes place in US dollar-pegged stablecoins.

Stablecoins, or crypto coins whose value tracks the value of a fiat currency, play a vital role in fast, low-cost cross border payments. However, given that most of them are pegged to the US dollar, and that most transactions happen with these coins, the convenience has not been overlooked by criminals. This makes the regulation of stablecoins a primary goal for US lawmakers

The total market cap of cryptocurrency is $1 trillion in October 2023.

The massive size of the cryptocurrency market shows that it is here to stay for the long term, despite the market’s recent crashes. The large capital gains from these huge wealth increases mean the tax bills are massive. Recently governments like the US classed crypto as an asset, which incurs taxes, and the gains must be shared with the IRS.

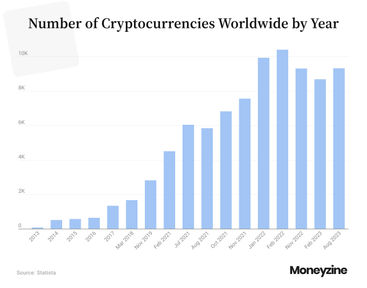

As of 2023, there are over 18,000 cryptocurrencies in the world, although most are inactive.

Many developers have created their cryptocurrencies, hoping that it will be the next Bitcoin, or making them just for fun. Still, most of these are inactive, especially after the crypto winter changed the market and reduced the hype in 2022. The number of active tokens is estimated at 9,000.

Bitcoin’s value has increased by 173,000% from 2015 to 2023.

The impressive growth of Bitcoin has literally turned regular folk into millionaires and/or billionaires. Bitcoin is the most popular cryptocurrency and an example of rapid wealth creation if you get in at the right time.

As of October 2023, there are 32,693 crypto ATMs globally, compared to 15,000 in 2021.

Between February 2021 and November 2022, the number of crypto ATMs more than doubled, only to drop again in 2023. More precisely, between August 2022 and October 2023, it dropped by 16.9%. Bitcoin ATMs allow you to withdraw cash when depositing the most common type of cryptocurrency, or you can deposit cash and receive Bitcoin to a wallet of your choosing. Around 83% of these ATMs are located in the US.

Cryptocurrency Growth Statistics

Countries with Lower Middle Income have seen the greatest recovery in crypto adoption during the last year.

Countries like India, Vietnam, Turkey, and Ukraine are at the top of the Chainalysis list when it comes to grassroots adoption. In these countries, crypto plays an important role, especially when it comes to battling inflation and receiving remittances.

India is the first on the crypto adoption index in 2023.

Nigeria, Vietnam, the US, and Ukraine are next on the list. In fact, the US is the only highly developed market in the top ten, even though it has seen a drop in crypto adoption between June 2022 and June 2023.

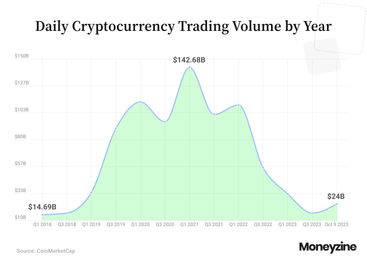

The worldwide cryptocurrency trade volume has dropped to around $24 billion per day (as of October 9, 2023).

Compared to the same period 2022, the global trade volume dropped by half in 2023. According to CoinMarketCap, the amount of crypto traded in October 2022 was around $50 billion.

Cryptocurrency revenue is expected to grow at a CAGR of 14.4% by 2027.

Cryptocurrency revenue growth is expected to continue in the next four years, with the forecasted total amount of $64.9 billion in 2027. For comparison, in 2023, crypto market revenue is estimated at $37.9 billion in 2023.

The total size of the Bitcoin market is $535.2 billion as of October 9, 2023.

Cryptocurrency statistics show that the peak of the Bitcoin market was $1.27 trillion in November 2021, but since then, it has decreased. Currently, the market cap is $535.2 billion, which means that if you wanted to buy every single Bitcoin in existence, you would need to spend $535.2 billion.

Compared to 2022, the number of yearly transactions is about 17% higher in 2023.

The number of yearly Bitcoin transactions was 120 million in 2020, compared to an estimated 900 million in 2023. Expect the growth rate to continue as the cryptocurrencymarket develops and continues to be accepted by businesses worldwide, increasing the Bitcoin adoption rate. For instance, many online casinos are allowing Bitcoin as a form of payment.

Cryptocurrency Demographics

In 2023, the number of global crypto users is estimated at 420 million.

How many people use cryptocurrency? According to TripleA, 420 million people in the world are crypto users, or 8.77% of the population. This number is expected to reach 994.3 million users or 12.51% of the population in 2027.

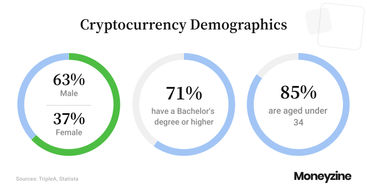

72% of global crypto users are younger than 34.

In the US, crypto users also skew younger. Around 82% of crypto users are between 18 and 44. People aged between 45 and 54 make around 11%, while those above 55 account for around 7% of cryptocurrency users, according to statistics.

As of 2023, 63% of global crypto owners are male.

An interesting fact is that users in the US have the highest crypto ownership gender gap (out of 26 surveyed countries according to Statista’s numbers). And in the US, men are two-and-a-half times more likely to own crypto than women. By contrast, countries like Vietnam are much closer to parity, with 56% of men and 44% of women among crypto owners.

Over 87 million people have blockchain wallets worldwide as of 2023.

Blockchain wallets are protected by encryption keys that allow the user to gain entry to the currency. Wallets can be in physical form, as well, if they are sorted on an external hard drive.On blockchain.com, there are currently over 37 million users.

71% of global crypto owners have at least a Bachelor’s degree.

Looking at crypto owners by education, it is safe to conclude those with a higher education are more likely to own crypto. The situation is the same in the US, with 26.5% of crypto owners having a postgraduate degree, 39.3% a uni degree, 9.9% having a vocational or technical college degree, 21.9% high school, and 2.52% a middle school degree.

Asian and Black adults are more likely to have invested in or used crypto in the US.

Cryptocurrency statistics by race show 24% of Asian adults have used crypto, as have 21% of Black or Hispanic adults. By comparison, only 14% of White adults say the same.

32% of Nigerians have owned a cryptocurrency in their life – the highest percentage of any country.

Cryptocurrency users by country data shows that around 32% of Nigerians have owned crypto in their life, which is a reasonably high figure. This might be because the financial services in Nigeria are not that developed due to regulations. Therefore, cryptocurrencies are a good alternative to doing business.

67% of millennials view Bitcoin as a safer place to store wealth compared with gold.

Bitcoin is one of the most common cryptocurrencies and the increased trust in Bitcoin compared to traditional assets like gold is surprising. That is because gold is a physical asset that is finite. Bitcoin, in practice, is also finite, but it has a much shorter track history. Perhaps millennials are more eager to trust a distributed system compared to centralised assets that the government can control.

Cryptocurrency Crime Statistics

At $3 billion, 2022 was a record year for the worth of stolen cryptocurrency.

One of the disadvantages of cryptocurrency adoption is that it’s possible to steal large amounts of cryptocurrency. In 2022, over $3 billion was stolen from several networks, with over $625 million stolen just from the Ronin Network. Once the funds are stolen, it is very hard to follow the trail of where the funds were sent. Contrary to popular belief, it is not impossible.

In the first half of 2023, crypto crime dropped 65% compared to 2022.

Scams showed the highest level of decrease in the first half of the year, as did inflows to entities such as high-risk exchanges and mixers. However, given that crime was record in 2022, the drop is not so shocking.

One study discovered that 2 hacking groups claimed to be responsible for about 60% of all crypto-related crimes.

If only 2 hacking groups were eliminated, then up to 60% of all crimes would go away in the digital currency world. It’s likely that there aren’t that many criminal groups since it is very difficult to breach networks that hold and process transactions.

$3.5 billion was sent in Bitcoin to crypto wallets surrounding criminal activity.

Cryptocurrency facts suggest that Bitcoin is one of the main cryptocurrencies used in criminal activity. It is unsurprising because it is the most popular virtual currency and has the most value. As other cryptocurrencies gain popularity, they will be used by criminals as a means of transferring money as well.

However, only 1.1% of all cryptocurrency transactions are illegal.

Cryptocurrencies have gotten a bad name because they are viewed as a safe haven for money laundering and other illegal activity. However, crypto stats suggest that only a small fraction of total transactions are illegal. Criminals use all currencies, so illegal activities are a part of the entire financial industry, not just crypto.

Interesting Cryptocurrency Facts

Bitcoin mining uses the same amount of energy annually as the Netherlands.

It is no secret that Bitcoin mining is energy-intensive, and this is one of the well-known Bitcoin facts. Stats suggest that the energy spent by Bitcoin miners could power all the tumble dryers in OECD countries, China, and India combined.

Bitcoin miners spend 22.13% of their income on electricity bills.

Obviously, a large portion of the cost of mining Bitcoin is in electricity costs. Therefore, Bitcoin mining operations seek locations with cheap energy prices. Cooling the GPUs required to mine Bitcoin is a big part of the energy requirements. When looking at the use of cryptocurrency by country, we can see that countries like Iceland, which are naturally cold, have a bigger potential to host Bitcoin miners than others.

Kentucky has introduced energy and tax breaks for crypto miners.

The state of Kentucky is promoting Bitcoin mining operations by giving them breaks on energy taxes. This improves the profitability and viability of Bitcoin mining. In contrast, other countries like China have outlawed Bitcoin mining by completely banning all Bitcoin-related activities.

60% of the processing power required for Bitcoin is sourced from non-renewable energy sources.

This is one of the cryptocurrency statistics that indicates that most of the energy used for Bitcoin mining operations doesn’t come from renewable sources. Since this is one of the biggest arguments against crypto, further adoption of cryptocurrencies will largely depend on the miners’ ability to find and utilise renewable energy sources.

Ten countries do not allow cryptocurrencies to be used in any form.

While many countries are dealing with the changes that digital currencies are causing to the financial system, others are outright banning them. Countries with absolute bans include Afghanistan, Algeria, Bangladesh, Bolivia, China, Egypt, Iraq, Nepal, Morocco, and Qatar. Many other countries have implicit bans or laws that restrict the use of crypto.

A cryptocurrency post appears on social media every two seconds.

This statistic indicates that cryptocurrencies are gaining serious popularity since many people mention them in their social media posts. Also, it is estimated that around 14,000 to 32,000 crypto-related tweets are shared daily.

It costs $500K to $1 million to develop an algorithm that can detect crypto moving signals.

Software engineers can use their skills to develop algorithms that are able to trade on cryptocurrency prices profitably. Kind of like playing the stock market to make a profit. However, the reliability and profitability of these algorithms vary.

The Bottom Line

Although the crisis affecting the crypto market knocked down countless weaker cryptocurrencies, it also showed the resilience of strong players like Bitcoin (whose value remains high even after a strong decrease), and the resilience of the market itself. It also underlined the importance of regulation in the market, which will be necessary if crypto is to stay relevant.