You paid off your credit cards, student loans, your car. You saved up a solid emergency fund and now you're investing 15% for your retirement. Holy crap, you're rocking it!!

And now it's time to start paying off your mortgage! Woot woot!! FYI - If you're not quite up to this step yet (ie. you still have consumer debt), be sure to use this debt snowball tool for help! And then come back to this post when you're in a better position to slay your mortgage!

Ready to pay off your mortgage early? This spreadsheet will help you understand what it’s going to take!

With this template, you will get:

Clean and simple with no extra fuss

Fully automated and easy to customize

Future-proofed for any year (be it for 2023, 2024, 2025, or more!)

Works with Excel and Google Sheets

Similar articles on Mortgage:

How Fast Could You Pay Off Your Mortgage?

Alright, so now you've got a 15-year, a 30-year, or maybe even a 50-year mortgage (hopefully not though!). What if you started throwing some extra money at it? How quickly could you pay it off? I bet you'd be surprised!

Related:

In January of 2015, I made the decision to pay off my $54,000 mortgage. I flipped cars, I mowed lawns, and I wrote a ton of articles for fellow bloggers - basically, I did everything possible to make a buck.

The result?

I paid off my entire mortgage by December 11th, 2015. That's right, it took me less than one year to plow through the mortgage...and it's absolutely possible for you too! AND, you're in luck too.

I'm so committed to YOU paying off YOUR mortgage, I made a downloadable mortgage payoff calculator to help you do it!

Check out all our personal finance tools for more.

A 30-Year Mortgage Paid Off Crazy Early!

How old will you be in 30 years? 50? 60? 70? Do you really want to wait that long to pay off your mortgage? I definitely didn't, and I'm sure you really don't either!

Stop listening to those "wise investors" that claim you should keep your mortgage forever. They're the quacks. Listen to your gut instead. It's time to pay off the mortgage!

What if I told you that you could easily pay off your 30-year mortgage in just 13 years? You absolutely can! Check it out!

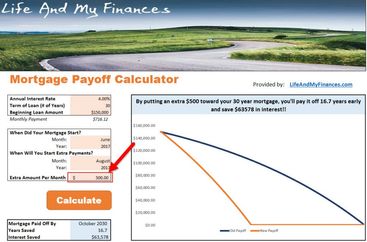

Let's say you have a...

$150,000 mortgage loan, with a

4% interest rate, on a

30-year mortgage

Your payment would be $716 a month. What if, from the beginning, you pay an extra $500 a month? How quickly do you think you'd pay off your mortgage?

5 years early?

7 years early?

10 years early?

Nope. It's even better than that. If you put an extra $500 on top of a $716 mortgage payment, you'd pay off the entire mortgage almost 17 years early!

Your 30 year mortgage would be paid off in just 13 years! BOOM! So...paying less than double the mortgage payment will cut out more than double the time....Isn't that CRAZY??

Similar calculators:

The Awesomeness of the Mortgage Payoff Calculator

If an extra $500 could pay off a 30-year mortgage in just 13 years, how quickly do you think you could pay off your mortgage? Well let's find out!

Click this link to download the Mortgage Payoff Calculator and you should see the Excel file pop up in the lower left-hand side of your screen. Simply click on the file, open it, and get started with your entries!

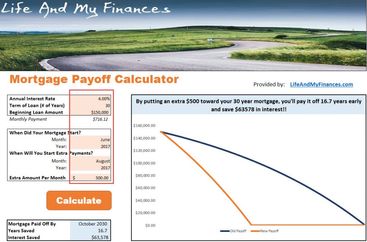

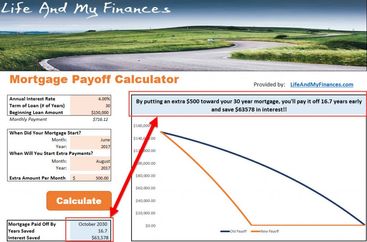

When the file opens, notice all the light orange cells - this is where you need to input information:

the mortgage interest rate

the term of the loan

the initial loan amount

the month and year the loan started

and the month and year you'd like to start making extra payments

When you've entered the info, simply click the "Calculate" button to see just how quickly you could pay off your mortgage!

The blue-shaded areas of the mortgage payoff calculator will show you the results of your extra payments.

They'll tell you:

when your mortgage will be paid off by

how many years you've saved with the extra payments

and the amount of interest money you'll save!

If you're not a big fan of reading, just look at the chart! The blue line shows the typical payoff rate (for the broke people of this world), and the orange line is your kick-butt mortgage payoff tracker! In the example above, you can visually see that adding $500 to a $716 payment cuts off 15 years or more!

Read more:

So What Will You Decide?

So what about you? What will you do with the results of this mortgage payoff calculator?

Will you buckle down, pay off the mortgage, and then invest heavily until you're ultra wealthy? Or, will you invest mildly, ignore the extra mortgage payments, and live a meager existence with the rest of this sad world?

If I were you, I'd choose option #1.

In fact, I have...and it's freaking fantastic!

What were the results of your mortgage payoff calculator? How fast will you pay off your mortgage?

.jpg)

.jpg)