Mortgage loan rates have soared since their lows in 2021. It used to be you could get a 30-year mortgage for less than 3%. Today, you're looking at 6% or more! If the rates keep rising, it starts making more and more sense to pay your mortgage off!

Want to know how to pay off your mortgage in five years? Or maybe 10? Or heck, maybe 2 years?

Whatever you're looking to do, I have the tips for how to pay your mortgage faster and calculations that will show you exactly how long it will take to pay off your mortgage based on the payments you're making.

Want to pay off your mortgage in 5 years?

Use my robust mortgage calculator from Etsy to see how much you'll need to pay each month! (I'll give plenty of tips and examples in the post below, but if you want a tool that's catered just to you, then you may want to pay the small amount I'm asking and download the tool.

Not sure how to come up with extra money to pay off your mortgage in 5 years?

We've got the answers for you there too! I can already feel it. This post is going to be one of my best! Give it a read, take notes, and download the tool! And best of luck to you paying off your mortgage!!

What happens if you make 1 extra mortgage payment a year?

Before we get into the specifics of paying off your mortgage in 5 years, let's take a look at a simpler feat - paying just one extra mortgage payment a year.

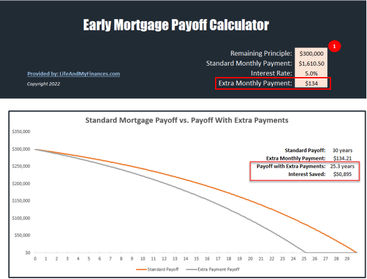

Let's say you recently signed up for a 30-year $300,000 mortgage at 5% interest. Your payment is $1,610.50 a month.

What if, instead of making the expected $19,320 worth of mortgage payments each year, you decide to add a $1,610 payment in there?

So, in total, you'll be putting $20,930 toward your mortgage instead of $19,320. $20.9k isn't that much more than $19.3k...It really can't make THAT much difference in the grand scheme of your overall mortgage payoff...can it?

Let me tell you, I'm always baffled when I calculate the impact of these once-a-year payments. Get this...

The impact of 1 extra mortgage payment a year

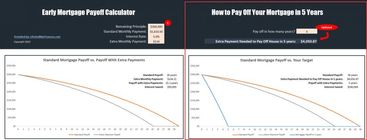

Let's plug these numbers into the early mortgage payoff calculator. If you make one $1,610 payment a year, that's roughly equivalent to an extra $134 a month ($1,610/12 months). We simply enter those numbers into the tool...

And as you can see, if you pay an extra $1,610 a year on your $300,000 mortgage, you'll pay off your mortgage 5 years early AND save over $50,000 in interest payments! Isn't that just insane?

What if I make 2 extra mortgage payments a year?

So...if making 1 extra mortgage payment a year can have such a big impact, what about making 2 extra mortgage payments a year?? What could that do?

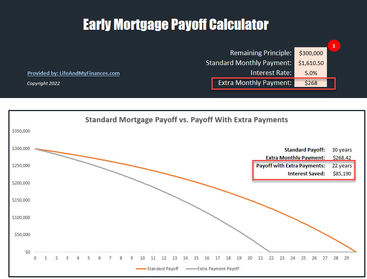

Let's continue on with our $300,000 loan example. Your interest is 5%, it's a 30-year loan, and your payment is $1,610. What if you paid an extra $3,220 a year toward your mortgage (ie. an extra $268 a month)?

When would you pay it off and how much interest would you save?

The impact of 2 extra mortgage payments a year

Again, if we just plug these numbers into the early mortgage payoff calculator...

If you pay an extra $3,220 a year on your $300,000 mortgage, you'll pay off your mortgage 8 years early AND save over $85,000 in interest payments! Sounding pretty good right?

Now that I have your wheels turning...let's start thinking about that 5 year mark again. Could you actually pay off your house in just 5 years?? (It's possible. We're building up to what that would take.)

What happens if I pay an extra $200 a month on my mortgage?

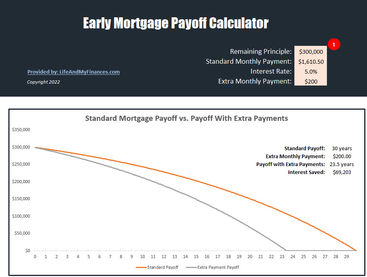

Maybe you're not interested in making one or two extra mortgage payments a year? Maybe you just want to pay an extra $200 a month on your mortgage. What impact would that have?

If you put an extra $200 toward your mortgage each month and you just started a $300,000 mortgage, this simple act would cut your payoff time from 30 years down to 23.5 years! And it would save you $69,203 in interest!!

It really is crazy. I could seriously plunk numbers into this early mortgage payoff tool all day to see what could happen in a bazillion different scenarios.

There's one thing you might be asking yourself though...What if you didn't just start your mortgage? What if you're already say...7 years into your mortgage and now you want to pay extra? How do these extra payments impact your mortgage payoff?

Simple.

All you need to do is head to Etsy, download the tool, and then enter in your...

current mortgage amount,

the monthly principle and interest payment,

the interest rate,

and, the extra payment you'd like to contribute

That's it!

What happens if I pay an extra $200 a month on my mortgage that I have had for years?

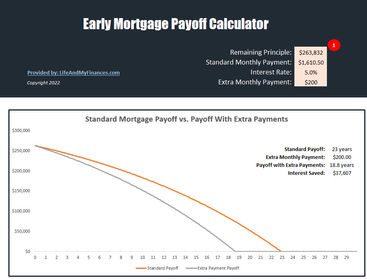

Let's follow the above example. That you took out a $300,000 mortgage seven years ago and have always made the standard payments. Based on the tool, you'd still have $263,832 of principle yet to pay. So let's put in the entries and see what the impact is now!

Honestly, it's still pretty impressive! Even if you had your mortgage for 7 years and decide to start paying an extra $200 a month, you could still save over four years on your mortgage and over $37,000 in interest payments!

How Can You Pay a 30 Year Mortgage in 5 Years?

Putting extra money toward your mortgage each month is great - and I commend people for doing it - but quite honestly, my brain doesn't operate this way. Maybe yours doesn't either.

Personally, I like to come up with a goal. Like, to accomplish something in a certain number of years.

For me, I wanted to be completely debt free by the time I turned 30. That meant I had to pay off my remaining $54,000 mortgage in one year. (Long story short, I did it! And I bet you can too!)

If you're like me, instead of asking "What if I pay an extra payment a year on my mortgage?", you're searching for phrases like, "How can you pay a 30 year mortgage in 5 years?" (...and it's probably how you landed on this article!).

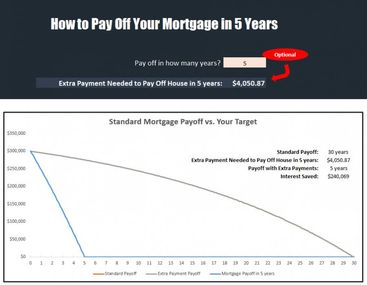

To take the guess work out of it (and because it's how my brain operates),I added a feature to the early mortgage payoff calculator for exactly this. (Check it out in the image below!)

Enter your...

Mortgage amount

Standard monthly payment

Interest rate

Then, in the right side of the tool, enter the number of years to pay off your mortgage

The tool then tells you how much extra you need to pay per month to pay off your mortgage in that particular time-frame!

How can I pay off my mortgage in 5 years?

This is such an awesome part of this tool. Sorry... I don't mean to over-sell you on this thing. I just get so excited about it! Let's go back to the initial example of making 1 extra mortgage payment a year on your $300,000 mortgage.

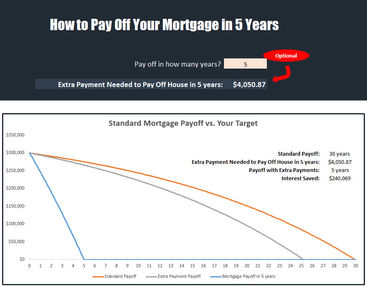

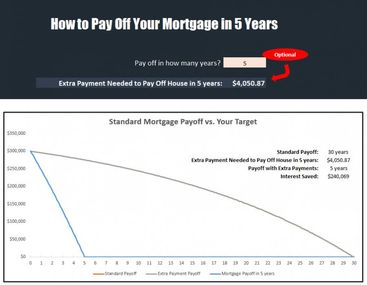

What if, instead of making one extra mortgage payment, you just wanted to pay off your mortgage in 5 years? How much extra would you need to pay per month?

And the tool says.... $4,050.87. So, if you'd like to pay off your $300,000 mortgage in five years vs. the traditional 30 years, you'll need to pay the standard payment of $1,610.50plus the extra monthly payment of $4,050.87. That's a total of $5,661.37 each month.

Sounds like a ton, but did you see how much interest this would save you?? $240,069! Nowthat's a hefty savings! If you could buckle down and pay off your 30 year mortgage in five years, you'd be so far ahead of the game financially, it would be eye-popping!

How to pay off 150k mortgage in 5 years

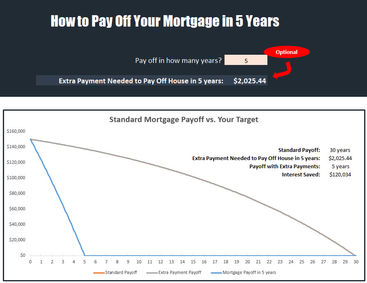

What if your mortgage isn't $300k? What if you recently took out a $150k mortgage? How much would it take to pay off a $150k mortgage in 5 years?

To pay off a $150k mortgage in 5 years, you'd need to contribute an extra $2,025 a month to your regular mortgage payments!

How can I pay a 200k mortgage in 5 years?

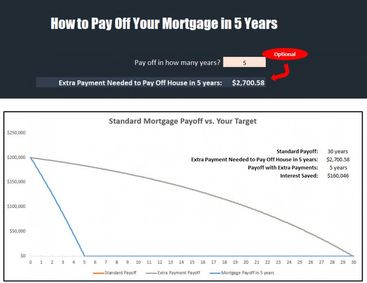

If you have a $200k mortgage at 5% interest for 30 years, how much extra would you need to pay per month to pay it off in 5 years?

To pay off a $200k mortgage in 5 years, you'd need to contribute an extra $2,700 a month to your regular mortgage payments!

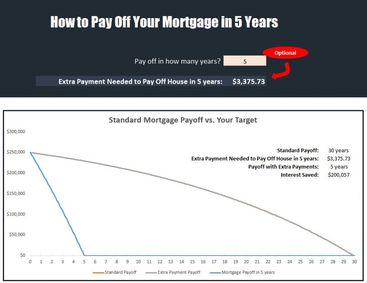

How to pay off 250k mortgage in 5 years

If you have a $250k mortgage at 5% interest for 30 years, how much extra would you need to pay per month to pay it off in 5 years?

To pay off a $200k mortgage in 5 years, you'd need to contribute an extra $3,375 a month to your regular mortgage payments!

How to pay off 300k mortgage in 5 years

If you have a $300k mortgage at 5% interest for 30 years, how much extra would you need to pay per month to pay it off in 5 years? (We already did this one near the beginning of this post, but let's make sure we answer the specific question here for anyone that's quickly searching for it!)

To pay off a $300k mortgage in 5 years, you'd need to contribute an extra $4,050 a month to your regular mortgage payments!

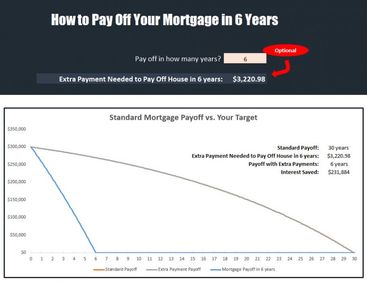

How can I pay off my mortgage in 6 years?

What if 5 years is just too aggressive? How much extra do you need to pay to pay off your mortgage in 6 years? If we stick with the $300k mortgage example above, but we just enter 6 years into the tool instead of 5 years...

The result is extra payments of $3,221 a month! So, you pay off your $300k mortgage one year slower, but youstill save nearly $232k in interest payments!

How to pay off your mortgage in 5-7 years

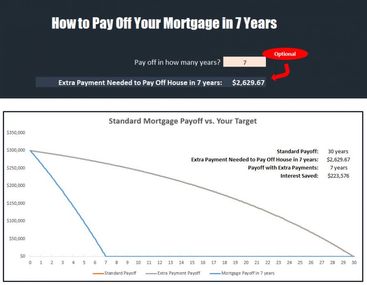

We already discussed how you can pay off your mortgage in 5 years or 6 years (with the tactical numbers anyway). What about 7 years? How can you pay off your mortgage in 7 years?

If you make extra payments of $2,630 a month on a $300,000 mortgage, you'll pay off your mortgage in 7 years. (Want to know more about how to save more money or earn more money so you can put more toward your mortgage? Skip down just a couple sections!)

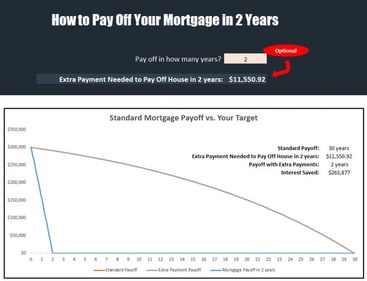

How to pay off mortgage in 2 years

What if you're absolutely sick of your mortgage? You want it gone and you want it gone as fast as possible. What about 2 years? Let's enter that into the Early Mortgage Payoff Calculator to get the numbers on how to pay off a mortgage in 2 years (again, we'll stick with our $300k mortgage example at 5% interest).

Whoa. You ready for this one? To pay off a $300k mortgage off in 2 years, you'd need to make extra monthly payments of $11,551. That a pretty steep dollar figure! But, if you can do it and you want to do it, then more power to ya!

How to Pay Off Mortgage Early (the actual how-to!)

So far, we've only talked about how many dollars you'd need to put toward your mortgage each month to pay it off early. But, what's the actual how-to of accumulating those dollars? Where can you actually find the money to make extra mortgage payments?

Check out the steps below. This is what I did to pay off my $54,000 mortgage in just 11 months!

1) Save up an emergency fund

Before doing anything with your money, you should start to save up a decent sum into a simple savings account. This is called your emergency fund. At any given time, you could...

lose your job

get injured and not be able to work

get divorced

have a kid break an arm

have a relative pass away, which means you have to travel across the country to be at the funeral

Anything can happen! Life is fragile and you should be ready with a minimum of 3 months' worth of expenses in a savings account - accessible at any moments notice. If you want to pay off your house early, first start with saving up a simple emergency fund, ideally with high yield savings account.

2) Get completely out of consumer debt (ie. everything other than your mortgage)

If you have...

payday loans

credit card debt

medical debt

car loans

...basically anything that's not a home mortgage debt, you're going to want to tackle that first (I recommend the debt snowball for a tool to get out of debt). Why? Because a home typically goes up in value. Any of the items above will not go up in value. And, the items above are likely a lower dollar amount, so you can pay them off much faster than you could a house. All great reasons to tackle the above list first and the home mortgage last.

What I did was use a debt snowball template (offered for free if you follow the link).

I lined up my debts from smallest to largest

I entered the interest rates and the minimum payments

Then, the tool showed me how quickly (or slowly) I would pay off all my debt

If I didn't like the answer I saw, I could see what adding extra payments would do to the payoff timeframe (it's amazing what a few hundreds bucks can do each month!)

(Want to know how to find the extra money? Skip ahead to #7 for some tactical advice.)

3) Start contributing to your retirement every month

Once you're out of consumer debt, I recommend that you contribute to retirement if you haven't started already (at least 15% of your income, but 20% or 25% is better). After all, when you're old, you're going to want money so you can eat and pay your heating bills. Having a paid-for house with no retirement savings doesn't help you with food or gas bills...

4) Ask yourself why you'd like to be mortgage free

Now that you have an emergency fund, no consumer debt, and you're contributing to your retirement fund, it's time to think about paying off your mortgage early. But, before you do that, ask yourself why it's important to be mortgage free.

Do you just hate owing money to someone else?

Would you like to stop paying all that interest to the bank?

Do you want to get rid of your mortgage so you can invest more?

Or, maybe you just hate the idea of having a mortgage payment in retirement?

Whatever your reason is, is it really enough of a reason to put extra money toward a mortgage for years to come? Is your reason big enough to drive you to take on extra jobs or cut back on your expenses each month?

If it is, then go ahead and do it. Pay off your mortgage early. If your reason isn't enough to move you, then don't do it. It won't be worth it for you financially. You're better off just putting more money in your retirement and keep making regular payments on your mortgage.

5) Ask yourself when you'd like to be mortgage free

If you're certain you want to tackle your mortgage debt and get it out of your life, then the next thing you need to know is when. When do you want to be mortgage free? Do you want to know how to pay off your mortgage in 5 years? Or maybe you want to be completely debt free by 40?

Whatever it is, make it your goal! Then, figure out what it's going to take to achieve that financial goal!

6) Figure out the monthly payment that will make your goal happen

Let's say you want to pay off your $300,000 mortgage in five years. That means you're going to need an extra $4,050.87 a month to put toward the principle each month.

Sounds like a lot, but you know what? Now that you know the answer to your question, you at least have a target to shoot for. Now it's up to your brain to figure out how to make it happen. And, you may not think it, but your brain is anamazingly powerful muscle.

If you want to pay off your mortgage bad enough, your brain can discover how to earn that additional $4k a month! I've been there. Trust me. It's possible.

7) Put a plan in place to hit that monthly payment every single month

Want a more tactical plan for paying off your mortgage early? Want to know what exactly you can do to hit your monthly mortgage payment target every month?

There are two main areas to look into. Cut back on spend, and earn more.

Cut back on spend

Let's say that you spend $5,000 a month. What are you spending all that money on? If you tried to write down everything that made up that $5,000, I bet you could only come up with $3,500...max. So where is the other $1,500 going? That's what you're going to have to figure out.

Print out your bank statements and credit card statements over the last 6 months.

What did you spend your money on?

Were they necessities? Or did you just piddle your money away?

Chances are, you spent some money foolishly, and then you overspent on the rest.

Did you buy some new stuff last month? Could you have bought used? Could you have done without?

What do you pay for your phone each month? What if you downgraded your phone or went with a different provider? How much could you save?

Do you still pay for cable? Do you really need it?

You probably have two cars. Is that really necessary? How much could you save if you just had one family car (under $5000)?

Do you go out to eat often? What if you stopped that? You could be healthier AND you could save money!

If you really want to get rid of your mortgage in five years, you've got to start thinking radically here! What if you really could get that $5,000 spend down to $3,500? That would mean you could put $1,500 toward your mortgage principle each month! That's nearly half way to $4,000 (if that was your goal)!

Earn more

This is the second side the equation. Earning more. How can you earn more so you can pay off your mortgage faster? There are three main ways to earn more:

Earn more at your job (via a raise or promotion)

Earn more with a side hustle

And, investing money to earn money via passive income (like real estate)

The third option probably isn't the best in this situation since you're looking to throw a bunch of money at your mortgage, and fast! There's no sense saving up a bunch of money to invest it and then earn just a small sum each month. While it's a great investment option, it just doesn't make sense here, so let's not dive into it.

The first option was earning more at your job. How can you do this?

If you feel that you're underpaid as it stands, gather up some data that proves it, tell your employer you like them and don't want to have any reason to look elsewhere, and ask for a raise. It's pretty much as simple as that. If you're not yet worth more than what you're paid, then you'd better make yourself more valuable.

Look for opportunities in your company - areas where you could make a real difference by cutting company costs or earning greater revenues. If you start doing this, you'll get noticed and you'll either get a promotion, or you'll get yourself into a position to earn more money.

The second option was to earn more with a side gig. How can you do this?

First, think about what you like to do and what you're good at. Second, think about how to earn money with it.

If you like to get exercise and love the smell of freshly cut grass, then start mowing lawns.

If you like building things out of wood, start to contract out your services

Or, maybe you like building websites. Start doing that for companies in your area. There are SO MANY companies that could use better websites! They just don't know where to look!

The ideas are endless. My side hustle is this blog. Who would have thought that putting words on a virtual page could be so lucrative? Not me!

The Most Brilliant Way to Pay Off Your Mortgage

Want to know the most brilliant way to pay off your mortgage? It's simple. Do it with a vengeance. That's the secret.

If you want your mortgage gone. Don't do it slowly. Don't just try to put a little money at it here and there. It's not effective. And quite honestly, it's better if you just invest your money at that point vs. putting little sums of money toward your mortgage here and there.

If you truly want to pay off your mortgage in 5 years or less, then rip off that band-aid and go after it! Once it's all gone, you won't regret the work that it took. It will feel soooo good, and it will open up so many doors to wealth in your future.

If you want to pay off your mortgage brilliantly, go after it with a vengeance. Oh yeah...and make sure you're putting all those extra mortgage payments toward the principle (and not prepaying your standard mortgage payments in advance).

How to Pay Off Your Mortgage in Five Years: In Summary

SO HOW DO YOU PAY OFF YOUR MORTGAGE IN FIVE YEARS?

Check out my kick-but excel tool that's for sale on Etsy

Use that tool to figure out how much you'll need to pay to get out of mortgage debt super early

Then, do all the tactical stuff!

Cut your expenses

Increase your income

Save up an emergency fund

Get out of consumer debt

Put money into your retirement accounts

And then, focus on paying off that mortgage!

.jpg)

.jpg)