Looking for a way to avoid swap fees while trading forex?

If you'd like to evade overnight fees, swap-free accounts might be the way to go. Swap-free accounts allow traders to speculate on various popular assets without incurring any such fees. They are particularly suitable for traders who follow the Islamic faith and avoid interest, but are available for all. Our guide provides an overview of the top swap-free account brokers in terms of spreads, markets offered, safety, minimum deposits, trading tools, and other essential features.

US Swap-Free Forex Trading Brokers Reviewed

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 8.4 | Visitoanda.com | ||

| 9.1 | Visitinteractivebrokers.com | ||

| 6.5 | Visittrading.com |

Best Swap-Free Forex Trading Platforms at a Glance

Here is a quick overview of the leading providers available in the market right now:

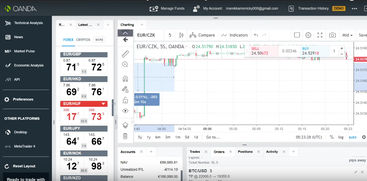

Best swap-free forex broker for beginners – OANDA

Best swap-free forex broker for advanced traders – Interactive Brokers

Swap-free forex broker with the lowest fees – Trading.com

OANDA is one of the most respected Forex brokers in the industry; the outfit is authorized by six tier-1 regulators, including the Commodity Futures Trading Commission (CFTC) and maintains an impeccable industry repetition.

OANDA’s swap-free account option enables traders to take a position on 26 popular instruments, including forex pairs and indices with exposure to Germany 40 and the UK 100. Swap-free accounts do not incur any administration charge for the first five days, after which an admin fee is applied each day the trade remains open, including the weekends.

The platform also comes with extensive educational resources and forex news coverage, along with access to over 70 tradable currency pairs. Most brokers set the minimum contract size for trading forex as one micro lot, but OANDA allows its customers to go even smaller at 1 unit or 0.001 micro lot.

Pros

- The research offerings are extensive.

- There's a wealth of educational resources.

- The platform is well-designed and easily navigable.

Cons

- The US accounts are not protected.

- US traders cannot use guaranteed stop orders.

Interactive Brokers offers investors a complete suite of products including equities, options, forex, futures, and bonds through their one-stop-shop trading account access solution. The firm offers two distinct two mobile apps: IMPACT for stocks and crypto, and IBKR for forex trading both of which are available for iOS and Android users.

Interactive Brokers delivers a powerful charting system for technical analysis featuring 127 indicators as well as the ability to execute trades directly from each chart window. Any trade placed mobile automatically syncs with the web workstation.

Interactive Brokers Auto-Swap Program

Unlike other brokers, Interactive brokers offer swap-free trading capabilities through the auto-swap program. This program continuously defers settlement of a spot forex position by entering offsetting forward positions on each day that the underlying spot position remains open.

The Automatic FX Swaps service is available without charge or additional markups, yet comes with fairly high trade value requirements – the gross FX positions must exceed $10 million to be able eligible.

Pros

- It's a professional-grade platform with plenty of advanced trading tools.

- In addition to foreign currencies, the product portfolio is far-reaching.

- The order execution is fast and reliable.

Cons

- The minimum requirement for the Auto-Swap Program is out of reach for many.

- The platform comes with a steep learning curve.

Trading.com offers clients a wide range of tradable assets including currencies, metals, stocks, stock indices, commodities, and energy products. The broker provides favorable trading conditions such as tight spreads and zero commissions, allowing news scalping and fast executions through market execution systems.

Trading.com also offers access to over 1,250 available instruments across 20 countries around the world. These can be traded on various versions of the MetaTrader 5 terminal including desktop, web, and mobile for Android and iPhone users. There are plenty of useful services such as VPS hosting for MetaTrader 5 users and an economic calendar so clients can stay up to date with current financial events that affect the Forex market.

The one-click trading feature makes it easier to place orders quickly within seconds without having to confirm manually each time. This feature is ideal for day traders and scalpers who need speedy trade executions to stay ahead of the curve.

Pros

- The spreads are very competitive.

- It provides access to MetaTrader 5 software for trading automation.

- The platform is feature-rich yet easily navigable.

Cons

- The product portfolio is limited.

- There is a lack of educational resources.

What Is Swap-Free Forex Trading?

Swap-free forex trading is a type of forex trading account that allows traders to trade without any rollover interest being applied. The swap in question refers to a fee that is charged for positions kept open overnight. It is determined by the difference between the overnight interest rate of the two currencies being purchased or sold.

Swap is charged or credited to traders’ accounts at the end of the trading day depending on the direction of their positions. If you buy a currency pair with a high interest rate against one with a lower interest rate, this would result in a positive swap and you will be paid swaps every time your trade rolls over into the new day. A negative swap occurs when you sell a currency pair with a high interest rate against one with a lower interest rate. In this case, you will be charged swap fees every time your trades roll over into the new day.

Waiving interest payments and overnight charges is the main difference between regular Forex accounts and swap-free accounts. While swap-free accounts can keep their positions open for long periods of time without an additional fee, they may be charged a fixed commission for opening and closing trades.

Workings of a swap-free Forex account

Interest-free leverage – Leverage allows traders to open larger positions with less capital. Normally, the interest rate of the currency pair traded affects the cost of leverage, however, this does not apply to swap-free accounts since no interest is charged.

Offsetting swap fees – To make up for not receiving swap fees from swap-free accounts, brokers will often increase spreads or charge administrative fees instead. It’s important to compare different brokers to find out which one offers the best combination of low spreads and no swap fees.

Keeping positions open overnight – Keeping positions open for long periods can also result in increased profits or losses depending on market conditions and the direction of the asset in question. Swing traders who hold swing trading stock positions overnight are essentially taking on more risk as their open trades may be negatively affected by slippages or black swan events. On the flip side, they may also benefit from any positive moves in the markets.

Who uses swap-free brokers?

Besides Islamic traders adhering to Sharia law (which prohibits receiving or paying interest), swap-free accounts are also attractive for short-term traders and scalpers who do not plan on holding positions for an extended period of time. Swap-free accounts are also advantageous for traders who plan to use automated trading systems or copy trading services, as they will not incur any charges if the system keeps trades open overnight.

Further Reading

How to Compare Swap-Free Forex Brokers

Swap-free forex brokers, also known as Shariah-compliant brokers, refer to brokers that offer accounts for traders who don’t wish to pay or receive overnight swaps or interest on their FX trades. This is especially attractive to traders who adhere to Islamic religious beliefs or to those looking to avoid the risk of interest-rate swaps and other financial fees associated with trading in certain global markets.

It can be difficult to find a reliable broker that offers a swap-free account. To make the selection process easier, we have compiled a list of the top brokers for swap-free forex trading based on the following criteria;

Regulation and safety

Regulatory compliance is a crucial factor to consider while evaluating brokers or opening a trading account. The regulatory bodies that oversee online brokers in the US are the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). Regulations set by these governing bodies ensure capital security, prevention of fraud, and institutional transparency. The CFTC, for example, requires all forex brokers to perform regular audits and hold sufficient funds to cover any trading losses.

Some brokers now employ security measures such as encryption protocols, firewalls, two-factor authentication, and secure login systems that help to protect the data of their clients.

The number of currency pairs and trading volume

The number of currency pairs and the trading volume available with a broker can often determine how successful a trader’s forex trading strategy is: the more currency pairs offered, the greater the opportunities for diversifying trades and optimizing profits. Additionally, some brokers offer higher leverage ratios for certain currency pairs, enabling traders to take larger positions in order to maximize their returns.

When it comes to trading volumes, high-volume traders will require brokers who can accommodate large trade sizes without causing slippage or execution issues.

Platform stability, reliability, and usability

The platform offered by a broker should be stable enough to allow traders to execute orders quickly and accurately, as slow loading times can cause a trader to miss out on trading opportunities. The interface should be easy to navigate and contain all the necessary tools and features that traders may need.

A platform with low latency speeds will help ensure quick order execution, while integrated market data feeds provide real-time pricing information for accurate trade entry.

Research and analysis tools

It is important for swap-free forex brokers to provide research and chart analysis tools that can help traders make informed decisions. The most relevant tools include charts, forex calculators, news feeds, and portfolio management software.

Charts

Charts are used to identify and interpret price patterns in specific timeframes. These are the popular charts used in forex;

Line chart - Displays the closing price of a currency pair.

Bar chart - Displays the high and low prices of a currency pair over a given period of time in addition to the opening and closing prices.

Candlestick chart - Provides more insight into the price movement than line and bar charts, displaying open, close, high, and low prices.

Analysis Tools

Analysis tools are used to help traders evaluate the potential profitability of a trade, such as;

Forex volatility calculator - Calculates how volatile a particular currency pair is.

Pivot point calculator - Useful for identifying important support and resistance levels in the market.

Position sizing calculator - Helps traders determine how much to invest in each trade.

Customer support

Having a good customer support team is important for maintaining a swap-free forex account as it allows traders to get help regarding account set-up, trading fees, and other related queries. The best swap-free forex brokers offer multiple channels of communication; phone, chat, email, and even social media should be available to contact the broker’s support staff.

Trading fees

The most important costs to consider when opening a swap-free forex account are spreads, commissions, and administrative fees.

Spreads are the difference between the bid and ask prices of a currency pair and tend to be higher for swap-free accounts than regular accounts.

Commissions are chargeable on every trade made by a trader and may differ depending on the broker. Note that the majority of online brokers now embrace a no-commission structure.

Administrative fees are usually charged for maintaining a swap-free account and may vary from one broker to another.

Swap-free forex brokers tend to charge higher fees as they have to compensate for the lack of revenue generated by swaps.

The following table outlines some of the most competitive swap-free forex brokers and their fees;

Administrative Fees | Commissions | Spreads | |

|---|---|---|---|

No administrative fees for the first 5 days on swap-free accounts | Yes | Starting from 1.4 pips | |

$0 | $0 | Starting at 0.4 pips | |

$0 | No | Starting from 0.6 pips |

Get started with Interactive Brokers now

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 9.1 | Visitinteractivebrokers.com |

.jpg)

.jpg)