Do you have a passion for real estate? Have you ever wondered how fast your rental empire could grow? And how quickly you’d become wealthy?

Why Trust Us

Advertiser Disclosure

I’ve spent quite a few nights trying to figure out over the years:

When we’ll have enough money to buy the next rental

How much we’ll earn from year to year

And how much our net worth will grow asI acquire more and more rentals

Pretty much I always ended up with a notebook page filled with scribbles and cross-outs, and a very vague sense of how everything would play out with the rentals 10+ years from today.

Finally, I decided that I’ve had enough with my rough estimations! It was time to figure out all of the details exactly. So you probably know what that means! It was time to build another Excel-based calculator!

Similar calculators:

The Rental Property Wealth Calculator

The first thing you need to know is that I buy rental properties with cash, and I advise all of you to buy rentals with cash too.So, it only makes sense that my rental property wealth calculator was created for all-cash purchases.

Sounds crazy, huh? But you know what? I bet you’ll be shocked how quickly your wealth grows once you get moving.

Don’t believe me? Try the tool and see for yourself.

Download the Rental Property Wealth Calculator Here!– You’ll see the Excel file download in the lower left hand corner of your screen. Open it and follow the instructions below to see how quickly you’ll be able to buy your empire of rentals!

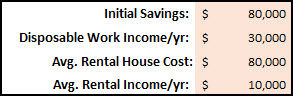

1) Enter your starting cash position

How much cash do you have saved for that first rental? $30,000? $50,000? More? Simply enter the amount into cell K11.

Do you already have some rental properties? Then just add their value into your initial savings.

2) Enter the amount you can save each year

If you really want to get ahead with your finances, you’ve got to put as much toward your investments as possible. Those that are really winning in life are earning more, spending less, and socking away $20,000 or more away toward their future rental properties.

How much are you able to sock away each year? Enter that dollar figure into cell K12.

3) Enter the average rental house cost

What’s the cost of the rental properties that you’re interested in? In our area, we’re constantly looking for 3 bedroom, 1 bath homes that cost roughly $80,000. We need to find an extreme deal to accomplish this, but it’s definitely possible! We’ve already proven it once!

What’s the average cost of your future rentals? Enter that number into cell K13.

4) Enter the average rental income per house

With the average rental house cost that you just entered, how muchwill a property like that produce each year? Be sure to deduct property taxes, insurance, and some maintenance costs to get down to the actual net income. Liz and I earn $1,200 a month with our rental house, which equates to $14,400. After subtracting the expenses, we’re left with approximately $10,000 a year.

If you have no idea what your rental income will be, just use the 1% rule. Meaning, if you purchase your property for $100,000 as a steal of a deal, figure you’ll receive a net income of $1,000 a month (1% of $100,000), or $12,000 a year.

Enter your yearly rental income into cell K14.

Read more:

Drum-roll…..The Results!

Saweet!! Since the tool is now up and running, it’s time for us to finally figure out how quickly our rental empire will grow. For Liz and I, we plan to buy properties that cost $80,000 and yield a net income of $10,000. With my work income and our tremendously low cost of living, I figure we can save nearly $30,000 a year for our rental investments. And, we bought our first $80,000 rental this past year, so I entered the “Initial Savings” amount as $80,000, the cost of that property.

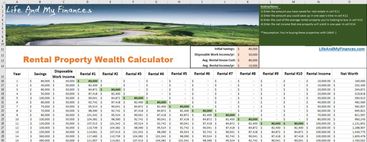

Now, let’s make sense of what this calculator is telling us.

Column A shows the number of years you’re investing, starting with Year 1 of course

In column B is your cash savings. Your additional money saved from your day job each year is in column C.

Then Columns D through M show when you’ll be able to buy your first rental, your second rental, your third…etc etc. All the way up to your 10th. Each purchase can be easily seen with the green highlight.

Column N shows your total net rental income

And finally, column O shows your total net worth of rental properties and your savings. I bet you’ll be amazed how quickly your net worth grows after the first few years of rental property investments.

In our example, the rental property wealth calculator shows our first property in year one. Perfect. Then, we’re left saving up cash for two more years before we can buy our next one. And then another two years of savings for rental property #3.

But then things really start moving!

At that point, we’re still saving $30,000 a year from our work income, but our three rental properties are now adding another $30,000 a year. So that means in the year after we buy our 4th rental, and then the next year our 5th, and then in the very next year our 6th…

For 6 straight years we’ll be able to buy one property after the other. And then in the next year we’ll actually be able to buy two.

After just 11 years, the rental property wealth calculator projects that we’llown 10 rental properties, have a rental income of $100,000, and have a net worth of $1.1M.

BOOM.

THAT is a beautiful thing.

So What About You?

First of all, this isn’t a contest of us vs. you. It’s more a contest of you vs. you. Sure, you might be out of debt, feeling pretty good about yourself. But do you have any plans for your future? What do you want to achieve? What do you want to do? And what kind of legacy do you plant pass on to your children? Maybe it’s time to take action on this whole rental property investment idea that you’ve just been toying around with. Maybe it’s time to actually work toward becoming wealthy.

So what does your rental property wealth calculator tell you?

.jpg)