“Picasso painting sells for a record $139 million”

“Banksy sets auction record with £18.5m sale of shredded painting”

Have you ever read headlines like these and thought they represent a market that’s well out of your reach?

Well, think again!

Art investment is no longer just the purview of the ultra-wealthy. Masterworks provides access to this valuable market to the average investor.

So, if you dream of buying a Basquiat or making money from a Monet, discover whether Masterworks is the platform to make it happen.

Masterworks: Key Details

Investment type | Art |

|---|---|

Fee | 1.5% annual management; 20% profit interest; up to 11% origination fee |

Minimum investment | $10,000 (recommended) |

Hold period | 3 to 10 years |

Trustpilot score | 4.3/5 |

Promotion | $200 for referrals |

Mobile app | Yes |

Customer service | (203) 518-5172 |

Pros

- Access to a usually inaccessible market

- Friendly and professional customer service

- Easy-to-use mobile app

- Research and education materials

- No upfront fees

Cons

- The minimum advised investment may be too high for some

- There may not be enough liquidity to trade shares

- A limited variety of investments available

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 8.8 | Visit |

What is Masterworks?

Masterworks is a fintech platform that democratizes art investment. While purchasing a Picasso is unachievable for most individuals, Masterworks can provide investment exposure. The company buys the painting and then sells shares in it to its members for a fraction of the price.

Masterworks holds hundreds of paintings by artists such as Monet, Warhol, and Banksy. Members can choose their preferred artworks to build a diversified portfolio.

As well as the opportunity to buy new paintings on the primary market, Masterworks provides liquidity through its Trading Market—members can place buy and sell orders here at any time to trade their shares with other members.

A Bit of Background

Masterworks was founded in 2017 by its current CEO, Scott Lynn, with the mission of making art investable for anyone. They made their first offering to clients a couple of years later in 2019.

In 2021, the company was valued at over $1 billion, achieving unicorn status and raising $110 million in its Series A fundraising round.

Based out of offices in New York City, Masterworks today comprises more than 200 employees. It has attracted over 880,000 members, purchased more than 390 artworks, and has roughly $1 billion in assets under management.

Contemporary art has outperformed the S&P for the past 26 years, but there has been no way to invest in it. Masterworks is the first company to offer art investment products to the retail investing public.Scott Lynn, Masterworks CEO

Why Art?

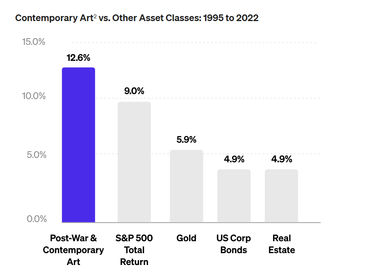

Masterworks believes that ordinary investors should consider allocating some of their portfolios to art. An important reason for this is the opportunity for price appreciation. According to Masterworks’ analysis, the compound annual growth rate of contemporary art has outperformed more traditional investments in recent decades, including the S&P 500.

During that time, contemporary art has also suffered from fewer periods of price depreciation. What’s more, art could be a good option to diversify your portfolio, since it’s shown low correlation with other types of assets during times of financial stress.

How Does Masterworks Work?

To start with, Masterworks’ research team selects artists. They track over 24,000 artists and have compiled in-house data on auction performance. Based on their analysis, the research team chooses the artists it believes to have the most momentum.

At this point, the acquisitions team takes over to source the paintings. They look for potentially undervalued works and aim to buy them at a good price, taking advantage of the buying power and negotiating leverage that Masterworks affords them.

Masterworks then files with the SEC in order to securitize the artwork. This means that they can offer shares in it to their members. Masterworks will typically hold onto paintings for 3 to 10 years.

After that, Masterworks’ private sales team will aim to sell the painting at a higher price by connecting with the top collectors. Profits from the sale will be distributed to the shareholders (minus Masterworks’ commission).

If you wish to liquidate your investment before the painting is sold, you can sell shares to other members on Masterworks’ trading market. This is also where you can buy shares in Masterworks’ previous acquisitions from other members.

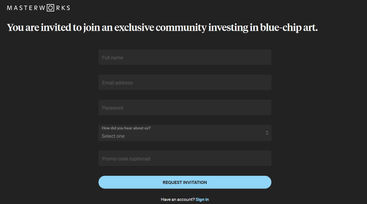

How To Open an Account and Invest With Masterworks

The vetting process means that getting started with Masterworks isn't as fast as some other platforms. You should be able to set up your account and make your first investment in as little as 1-2 days, though. Just follow the steps below.

1. Sign up on the website

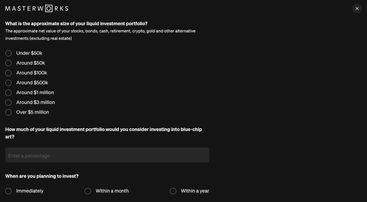

2. Complete your investing profile

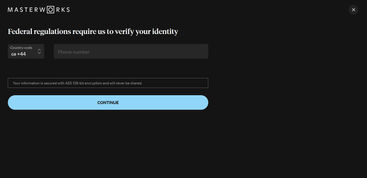

3. Have an intro call

4. Make your first art investment

Masterworks Investments

Masterworks only offers one type of investment asset—art. So if you’re looking for a platform that provides access to multiple markets, then Masterworks isn’t the one for you.

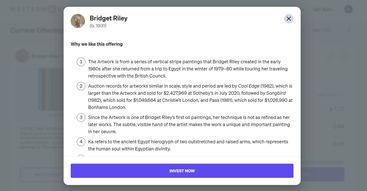

In particular, Masterworks focuses on post-war and contemporary works by blue-chip artists. Reasons for this focus include the art’s expanding market share, opportunity for capital preservation, and track record of price appreciation during both periods of recession and high inflation.

Masterworks collects data on the art market, constructs indices, and uses analytics to select a variety of the top mid-career, late-career, and deceased artists. The company acquires mature examples of their work from auction houses, galleries, and private collectors.

Masterworks only purchase about 3% of the artworks it considers, and it typically holds onto them for 3-10 years selling when they believe they can return the most to investors.

Artists represented in Masterworks current and past holdings include:

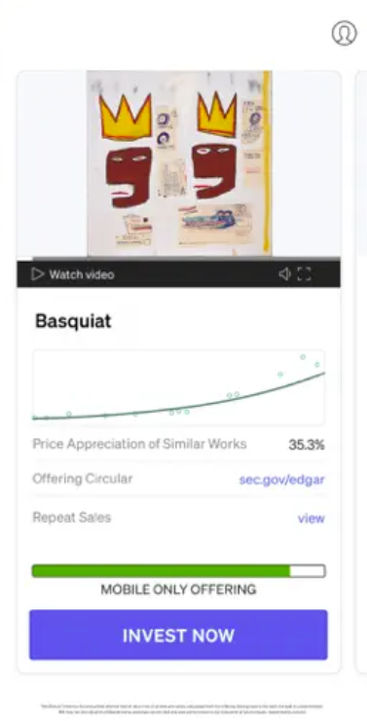

Jean-Michel Basquiat

Andy Warhol

Banksy

George Condo

Pablo Picasso

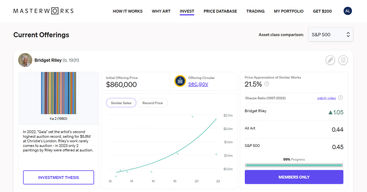

Bridget Riley

Yayoi Kusama

What is blue-chip art?

This term refers to high-value works by artists with a solid reputation and a track record of success on the art market. Well-established collector bases mean these pieces are likely to hold or increase their value. Masterworks does not invest in speculative artist markets with limited or no sales data.

Masterworks Features

Masterworks isn’t the most feature-rich investment platform out there. Unlike many traditional investment platforms, you won’t find advanced trading tools or charting functionality, demo accounts, smart portfolios, or automated or social investing.

However, given Masterworks’ limited focus on art investment, it does provide some useful features.

Invest

In the Invest section of the platform, you’ll find Masterworks’ recent acquisitions that are currently on offer to members. From this page, you can read the investment thesis for each artwork on offer and see some stats about the artist. If you want to invest in a piece, just click the button and follow the onscreen instructions.

Trading Market

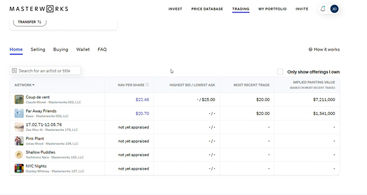

If you need to liquidate your shares before the painting sells, or if you want to buy shares in a previously acquired painting, you can head to the trading market. Here you can trade shares with other members with zero trading fees.

You won’t get all the functionality of a regular trading platform—advanced charting tools, technical analysis, detailed price alerts, multiple order types—but you can place orders, analyze order books, and view pricing data.

The available order types are far more limited than other trading platforms. If you place a buy order, it will be good-till-canceled, while sell orders are good-for-day and will be canceled at 5.30 EST if unfilled.

Portfolio

This section of the platform is for monitoring your investments. Use it to see the estimated fair value of your portfolio, a breakdown of your investments, and your historical results and stats.

Research and Education

Masterworks does pretty well on this front. It has some of the art industry’s most respected research teams analyzing millions of data points. The How It Works and Why Art sections of the platform do a great job of explaining Masterworks’ investment process and the benefits of adding contemporary art to your portfolio.

If you want to research a painting on offer, the investment thesis is a good place to start. Though not super detailed, it provides concise information on the artist, their work, and its value proposition.

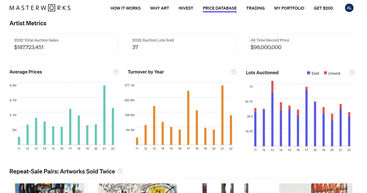

Another useful section of the platform is the Price Database. Here you can view metrics on artists’ performance at auctions and information on the sales and price appreciation of their individual works.

Finally, Masterworks has a Learn section stocked with interesting articles. These aren’t organized into structured courses as you’ll find on some other investment platforms, but you can explore guides on the topics of art, crypto, NFTs, finance, and alternative investments.

Masterworks Fees

Masterworks’ fees are very reasonable, and nothing is charged upfront. The only fees are as follows.

Annual Management Fee of 1.5% – Masterworks earns this as equity, so shareholders only feel it through share dilution. For example, if Masterworks sells 1,000 shares in an artwork, after 1 year, this would rise to 1,015 shares with Masterworks owning the extra 15 shares.

Profit Interest of 20% – When Masterworks successfully sells a painting for a profit, they keep 20% of this profit.

Origination Fee capped at 11% – This fee is included in the offering price. For example, if Masterworks acquires a painting for $1 million, they may offer it to shareholders for a total of $1.11 million.

These figures may sound high, but they're in line with other alternative asset managers. However, in the art world, you could be paying for auction fees of 10% to 25% when you buy, insurance, framing, storage, conservation, transportation, selling fees, and capital gains tax.

When you take all those costs into account, the service provided by Masterworks is way cheaper than trying to go it alone as an art investor.

Masterworks is fairly transparent about its fees. They’re mentioned on the website in the How It Works section. An advisor will also explain the fees to prospective investors during their intro call.

How Much Money Do You Need to Invest With Masterworks?

There isn’t strictly a minimum investment requirement or minimum deposit, as Masterworks provides a bespoke service tailored to your individual portfolio, income, and risk tolerance. Masterworks’ advisers will likely suggest targeting a portfolio allocation of somewhere between 15% and 25%, but members can choose how much to invest.

That being said, Masterworks advises investing no less than $500 per artwork, as they consider this to be the economic floor for extracting value from this form of long-term investment.

Masterworks App

Masterworks also provides a mobile app for Android and iOS devices. Mobile users will find all the same features as on the web platform, and the app is updated on a regular basis to fix bugs and improve performance.

The mobile app can be useful for those who want to check on their portfolio and make changes to it from anywhere.

One distinct benefit of the app is that Masterworks provides some exclusive mobile-only offerings, meaning that you may miss out on the chance to invest in certain pieces if you don’t download the app.

App Reviews

Masterworks seems to score fairly highly with app users. They praised the expertise of the Masterworks team, the app’s ease of use, and timely support. The occasional negative review criticized the amount of capital required and issues with notifications.

APPLE STORE | 4.8 (1.8k reviews) |

GOOGLE PLAY | 4.4 (625 reviews) |

Masterworks Customer Service

Masterworks really shines when it comes to customer service. There’s a help center (Knowledge Base) where you’ll find many questions and answers about using the platform. If you still need help, you can provide your details on the contact page and Masterworks will be in touch by phone or email.

You can also phone Masterworks at any time. The team is friendly, professional, and highly knowledgeable. As well as helping to resolve issues, Masterworks’ advisers can provide helpful information and advice to help you with investment decisions.

Is There an Alternative to Masterworks?

Masterworks is the largest art investment platform in the world, offering unparalleled access to some of the best contemporary art in the world. However, if you’re interested in alternative investments like real estate then there are other platforms you could try.

Yieldstreet

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 8.6 | Visit |

While you can invest in art through Yieldstreet, their offerings are extremely limited, and Yieldstreet does not have the access, acquisition and research team that Masterworks does. With Yieldstreet, you’ll also have access to real estate, transport, private credit, structured notes, and legal finance.

The main downside of Yieldstreet is that the investment minimums are typically $10,000 to $25,000, meaning it’s not accessible to a lot of investors.

Vinovest

Vinovest provides an intuitive app and web investment platform for those who want to invest in fine wines and whiskies. Experts are on hand to help you build and grow your portfolio. However, like Masterworks, investment services are limited to just one asset class.

Fundrise

Fundrise removes the barriers to private markets for regular investors by providing access to real estate, private credit, and venture capital. The minimum investment of just $10 also makes it super affordable. You won’t find art investment opportunities on Fundrise, though.

Is Masterworks Right For You?

Masterworks is best for people who already hold other types of investment assets and are looking to diversify their portfolio. The length of time for which Masterworks holds paintings means it will suit investors with longer time horizons of 3-10 years.

Although some interest in and knowledge of art could come in handy, the research provided on the platform and the expertise of Masterworks’ advisors means that those new to the art world will also be well catered for.