In the world of economics, there are two fundamental terms used to describe the price movements of goods and services over time: inflation and deflation. As investors, it's important to understand the impact of inflationary or deflationary times can have on investments too. In this article, we're going to start by defining the two macroeconomic terms: inflation and deflation. Next, we'll talk about how these conditions are measured by the U.S. Bureau of Labor Statistics. Finally, we'll briefly describe some of the best investment options available to leverage these economic states.

Inflation and Deflation Defined

In economics, there are two ways to describe the changes in the prices of goods and services over time:

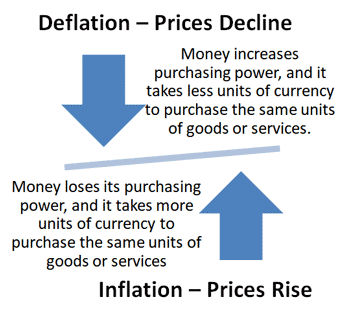

Inflation: a consistent increase in the price of goods and services over time. During inflationary times, money loses its "buying" or "purchasing" power, and it takes more units of currency to purchase the same units of goods or services. Over time, inflation lowers the value of each unit of currency.

Deflation: a consistent decrease in the price of goods and services over time. During deflationary times, money increases in its "buying" or "purchasing" power, and it takes less units of currency to purchase the same units of goods or services. Over time, deflation increases the value of each unit of currency.

Controlling Inflation

Economists generally favor a low and steady rate of inflation. The job of keeping inflation under control is assigned to the monetary authorities at the Federal Reserve. Increases and decreases to the money supply can be used to regulate the growth of the economy. The levers used to control the money supply include interest rates, buying and selling of government securities (Open Market Operations), and bank reserve requirements.

Interest Rates

The relationship between interest rates and inflation is relatively straightforward. If the economy is expanding too quickly, the Reserve can lower the money supply by raising interest rates. Higher interest rates discourage borrowing, which lowers the money supply. To increase growth, the Reserve can lower interest rates, thereby encouraging borrowing. The Federal Reserve controls interest rates through the Discount Rate, which is the rate that banks are charged when they borrow money from the Federal Reserve.

Open Market Operations

The Federal Reserve, along with the Central Bank, can also control the money supply through the buying and selling of government securities (bonds). When the Central Bank buys securities, it is exchanging money for the security. Therefore, when the Central Bank wants to lower inflation, it can sell government securities and decrease the supply of money. Conversely, when the Central Bank wants to fight deflation, it can buy government securities.

Bank Reserve Requirements

While arguably the most effective tool the Federal Reserve can use to control inflation, changing the reserve requirement is rarely used by those in charge of establishing monetary policy. The reserve requirement is the money a bank needs to keep in Federal Reserve vaults. The requirement is a fixed percentage of the customer deposits held at each depository institution or bank.

When the Federal Reserve wants to slow down the economy, they can increase the reserve requirement, thereby decreasing the supply of money. Conversely, when the Central Bank wants to fight deflation, it can decrease the reserve requirement.

Hyperinflation

When inflation is out of control, it's possible for prices to increase by several hundred percent per month. Generally, the term hyperinflation is used when prices increase in excess of 50% per month. If this continues, a country's monetary system can collapse. That is to say, the country's money becomes nearly worthless.

Measuring Inflation

In the United States, the most common measure of inflation is the Consumer Price Index. At a slightly more granular level, the Bureau of Labor Statistics publishes several other measures aimed at identifying domestic economic trends including:

Consumer Price Index (CPI): this program monitors monthly changes in the prices paid by urban consumers for a "basket" of goods and services. This basket includes food, clothing, shelter, fuels, transportation fares, doctor and dental services, and prescription medications. The CPI is used by a wide variety of organizations to adjust wages, rents, and other items affected by a change in the cost of living.

Producer Price Indexes (PPI): a family of indexes aimed at measuring the change in the selling prices received by domestic producers of goods and services. At one time, these were known as the Wholesale Price Indexes, and the measure is a good indication of the cost to produce goods and services.

Employment Cost Trends (ECT): also referred to as the National Compensation Survey, this program publishes quarterly indexes that track labor costs, overtime rates, wages, salaries, as well as the cost to supply benefits to employees.

Beating Inflation

Traditionally, investing in gold was a hedge used by investors to insulate themselves from inflation. But in September 2011, gold hit an all-time high, selling for $1,921.50 an ounce, which may not have been a good choice for many investors. In addition to gold, the following investments offer protection from inflation:

Treasury Inflation Protected Securities (TIPS): inflation index bonds issued by the United States government, the principal on these bonds are adjusted using the Consumer Price Index. The coupon rate on the bonds remains constant, so as the principal increases or decreases, the bond yield would decrease or increase.

I Bonds: United States Savings Bonds with a fixed face value, but a yield that varies with inflation. The interest rate on these bonds is made up of two components: a fixed rate that earns interest monthly, plus a cost of living adjustment that occurs every six months.

Corporate Inflation Linked Bonds: a corporate security that adjusts each month for changes in the Consumer Price Index.

Inflation-Protected Annuities (IPA): increase their payout each year based on a measure of inflation or a percentage chosen by the investor. If the investor chooses a relatively high increase each year, the starting payouts for the annuity will be lower.

Beating Deflation

When deflation occurs, the prices of goods and services are decreasing, so the primary goal for investors during these times is to hold cash since its relative value is increasing. One approach to holding cash includes placing money in money market funds or short term treasury bonds. Corporate bonds paying a fixed rate of interest is another practical option. If the Federal Reserve lowers interest rates, the value of a fixed rate bond will increase. Finally, in the same way investors traditionally held gold as a hedge against inflation, it's a bad idea to buy gold when deflation is at hand.