Definition

The financial accounting term improvements and replacements refers to a category of cost subsequent to acquisition. A replacement occurs when a similar asset is substituted for the original asset, while an improvement involves the substitution for a more advanced asset.

Explanation

Subsequent to assets being placed into service, they oftentimes require additional investments to either improve or maintain their productivity. Improvements and replacements are one of four categories of these investments; the others include additions, reinstallations and rearrangements, and repairs.

To capitalize costs associated with existing property, plant, and equipment, one of the following three conditions must be met:

The quality of output is enhanced in some manner. The units produced contain functionality that was not present prior to the investment.

The useful life of the asset is extended. For example, the expected service life of the asset is longer after the investment.

The capacity or productivity of the equipment increases. The units of output are higher.

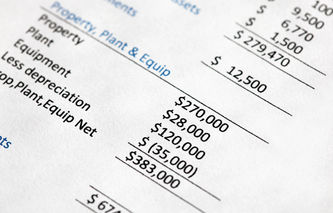

As companies strive to increase their operating efficiency, they may look to replace or improve existing assets. As part of that continuous process, accountants need to classify the cost as either an expense or capitalize it to the proper property, plant, and equipment asset. If the cost satisfies one of the above capitalization tests, the company has three options:

Substitution: if the cost of the original asset is known, it should be removed from the company's books and the new asset's cost added.

Addition: the company can assume the original asset has been sufficiently depreciated such that the carrying cost on the books is near zero. The cost of the new asset is added to the company's asset base. This option is typically selected with improvements.

Book to Accumulated Depreciation: this final option may be selected when the new asset extends the life of the existing asset. The argument would be the replacement has effectively eliminated some of the accumulated depreciation of the existing asset. Lowering the balance found in the contra asset account of accumulated depreciation effectively capitalizes the cost of the replacement.