One of the more interesting developments in the world of derivatives is the credit default swap, or CDS. First used by bond investors as protection against nonpayment by the issuer of a bond; today these instruments are used by investors to fine tune their overall exposure to corporate credit, as well as for speculation. In this article, we're going to first provide a broad definition of a credit default swap. Next, we're going to talk a little bit about how the market works, including the typical structure / characteristics of these contracts. Finally, we'll talk about some of the innovative ways these swaps are used to hedge against certain credit risks, and how speculators take advantage of these contracts too.

What is a Credit Default Swap?

A credit default swap, or CDS, is often compared to the concept of buying insurance. Until recently, these contracts were primarily used to reduce the risk associated with holding bonds, promissory notes, loans, and / or commercial paper. With a CDS, there are two parties involved, and the swap entails the transfer of a third-party credit risk from one party to the second. Fundamentally, the first party in the swap faces credit risk from a third party. The counterparty in this agreement insures against this risk. In exchange for this "insurance," the counterparty receives regular periodic payments, just like an insurance premium. If the third party defaults on the bond, the party responsible for providing insurance will have to purchase the bond from the insured party. In this way, the CDS can mitigate the risk associated with bonds by transferring credit risk from one party to another without actually transferring the asset. Credit default swaps can mitigate several different kinds of risks such as credit rating downgrades, bankruptcy, as well as default on a loan.

Market Size

The size of the credit default swap market is large by any measure. The notational amount on outstanding OTC CDS was nearly $30 trillion in 2006 according to the Bank for International Settlements. Information published by the British Bankers' Association indicates these contracts represent over half of the global credit derivatives market. Generally, there are three sectors that make up the marketplace: corporate offerings, emerging market sovereigns, and bank credits.

Contracts

A contract can reference a single credit or multiple credits. A multi-credit CDS will normally reference a specific portfolio of credits that are previously agreed upon by both the buyer and seller. Credit default swaps can range in maturity from one to ten years, with a term of five years being the most commonly traded.

Within the contract, the buyer agrees to pay the seller a fixed spread. For corporate issues, the spread is paid on a quarterly basis. For example, a contract with a spread of 20 basis points (bps) entitles the buyer to payments of 5 bps each quarter. In exchange for this quarterly payment, the seller of the contract typically agrees to one of two types of settlement:

Cash: with an agreement to cash settlement, there is no physical delivery of the asset. Following a qualifying event, a market auction of the asset occurs and the seller pays the buyer the difference between the asset's calculated (nominal) value and the recovery value.

Physical: with a physical settlement agreement, the buyer delivers the title to the asset to the seller of the protection. The seller now has a claim on the asset. The seller would then make a cash payment to the buyer for the nominal value of the bond less any fees.

Keep in mind that a credit default swap provides protection only against the events agreed to in the contract.

Investing in CDS

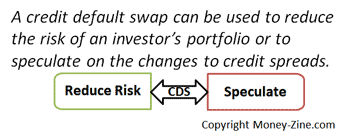

Just like many other financial derivatives, a credit default swap can be used to reduce the risk of an investor's portfolio and / or as a way to speculate on the changes to credit spreads. We're going to finish our article on this topic by briefly describing these two concepts in the sections below.

Credit Risk Hedge

Most of this article has focused on the use of a CDS as a way to control credit risk. The owner of a corporate bond can simply protect their investment from the risk of default by purchasing a contract on that asset. By buying this "insurance," the investor can hedge, or insulate, themselves from a pre-defined set of credit risks.

Speculating

On the other side of the contract is an investor willing to speculate. The rewards for speculators come in three forms: the eventual repayment of debt acquired at a discount, the payment of premiums for providing protection, and / or the trading of the asset itself.

Repayment of Debt: when a company is having financial difficulty, the speculator might be able to buy that company's bond at a discount to par. If the company does pay back the entire debt, the speculator profits by receiving the difference between the discounted purchase price and the bond's full par value.

Providing Protection: in exchange for providing protection against credit risk, the speculator receives quarterly premiums. If the company does not go into default, or trigger any of the identified events, the speculator would have received money without having to invest in any security.

Trading CDS: the third, and final, way a speculator can profit from a contract is through the purchase and sale of outstanding credit default swaps. In the same way the price of a bond fluctuates as the creditworthiness of a company increases or declines, the price of a swap fluctuates. In fact, this volatility is much greater than that of the underlying bond. This market allows the speculator to realize greater gains, and losses, compared to investing in the bond itself.