Definition

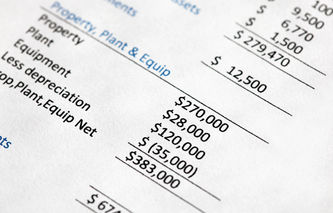

The financial accounting term costs subsequent to acquisition refers to additional expenditures associated with property, plant and equipment. In general, companies make four types of investments in existing assets: additions to plant, improvements, reinstallations and repairs.

Explanation

Subsequent to assets being placed into service, they oftentimes require additional investments to either improve or maintain their productivity. When companies make additional investments in existing equipment that will increase its productivity or add new functionality, that investment is capitalized. When costs are incurred to maintain a given level of productivity, the cost should be expensed.

To capitalize costs associated with existing property, plant and equipment, one of the following three conditions must be met:

The quality of output is enhanced in some manner. The units produced contain functionality that was not present prior to the investment.

The useful life of the asset is extended. For example, the expected service life of the asset is longer after the investment.

The capacity or productivity of the equipment increases. The units of output are higher.

Accounting practices categorize new investments in existing assets in one of four ways:

Additions: an ad-on or increase to plant, property or equipment. Additions are typically capitalized.

Improvements: the replacement of a new (and improved) asset for an existing one. Capitalization of the improvement occurs when it meets one of the criteria mentioned above.

Reinstallations: moving an asset from one location to another. Capitalization of the reinstallation occurs when it meets one of the criteria mentioned above.

Repairs: costs associated with the restoration of equipment to a state of satisfactory operating condition. Ordinary repairs are typically expensed; however, if one of the above criteria applies, it may be capitalized.