Definition

The term casualty insurance refers to an agreement whereby in exchange for the payment of a premium, an insurance company assumes some, or all, of the risk associated with the loss of assets due to fire, storms, theft and accidents.

When an asset is impaired, destroyed, or lost, a company must come to a settlement with the insurance company, and subsequently account for a gain or loss on the casualty event.

Explanation

The assets of a company are continually threatened by casualty events such as fire, storms, theft, and accidents. By entering into a contract with an insurance carrier, a company can mitigate the risk of a loss.

Companies will typically pay an insurance premium in advance for this service, which is classified as a prepaid expense. The premium charged will be a function of both the types of coverage provided, cost sharing arrangements such as coinsurance and copayments, as well as the dollar value of the assets insured.

The maximum payment provided by policies if an asset is lost is its fair market value on the date of the casualty. This is known as the insurable value of the asset. The book value of the asset is usually not taken into consideration when settling with the insurance carrier; it's only relevant to the calculation of a gain or loss.

Example

A widget maker owned by Company A was partially destroyed by an electrical fire. Company A purchased the widget maker for $210,000 three years ago. When initially purchased, the widget maker was thought to have a serviceable life of seven years.

The annual depreciation on the asset was calculated to be:

= $210,000 / 7, or $30,000 per year

After three years, the accumulated depreciation would be:

= $30,000 x 3, or $90,000

Company A carried casualty insurance on the widget maker for 80% of its insurable value. The current cost to replace the asset had grown to $220,000. Therefore, Company A was responsible for:

= $220,000 x 0.2, or $44,000

While the settlement with the insurance carrier was calculated as:

= $220,000 - $44,000, or $176,000

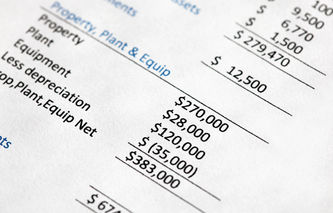

The gain or loss on the casualty would be calculated as:

Cost of Machinery | $220,000 |

Less: Accumulated Depreciation | $90,000 |

Net Book Value | $120,000 |

Proceeds from Insurance Policy | $176,000 |

Gain from Casualty | $56,000 |

The following journal entries are needed to remove the asset from the company's books:

Debit | Credit | |

Cash | $176,000 | |

Accumulated Depreciation | $120,000 | |

Gain on Disposal | $56,000 |