Our Top Forex Broker Pick for Beginners

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 9.8 | Visitplus500 | Trading in futures and options carries substantial risk of loss and is not suitable for every investor. The valuation of futures and options contracts may fluctuate rapidly and unpredictably, and, as a result, clients may lose more than their original investments. NFA ID number 0001398. | |

| 2IG | 8.9 | Visitig.com | Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. |

*Plus500 disclaimer: Beginners are advised to use the demo account and the Trading academy to gain experience before trading with real capital due to the risks involved

Allocating some of your portfolio to contemporary art could shield your wealth from inflation. This is because art has a track record of delivering strong returns during high-inflationary periods. It's also much easier to invest in art than you might think.

Beginner-Friendly Forex Trading Platforms Reviewed

Find out how leading Top forex brokers stack up against each other.

Combining good usability, sophisticated trading tools, and in-depth educational coverage, IG is easily a top choice for beginner forex traders. Its academy includes full-fledged courses packed with interactive activities and quizzes, penned by leading industry leaders.

Despite the number of moving parts, the broker platform is neatly organized across market research, analysis, and portfolio management segments. Beginners have the luxury of benefitting from in-depth features without being overwhelmed by a cluttered interface.

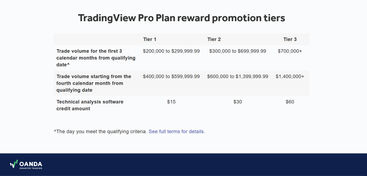

Having been around for over 25 years, Oanda is among the most trusted forex trading broker in service in the United States. The firm's experience particularly shines within its market research section MarketPulse, which includes market updates across FX, commodities, and indices markets.

The platform also offers access to TradingView, a robust charting tool that comes with over 100 indicators and drawing tools – which integrates with OANDA's web platform fully. For those who wish to advance their market research skills and knowledge in technical analysis, OANDA makes an excellent choice.

TD Ameritrade - Best Forex Broker for Educational Materials

TD Ameritrade’s platform thinkorswim is among the most well-known forex brokers in the US. The platform is geared towards traders with various experience levels thanks to its extensive range of services that stretch from in-depth educational materials to industry-grade trading tools and mechanisms.

The broker platform’s particular appeal for beginners lies mostly in its far-reaching education section, which offers a fully-fledged course with an option to work with an Educational Coach. The Immersive Curriculum, the course in question, offers self-paced goal-orientated learning paths accompanied by webinars, in-person events, podcasts, and more – making it an excellent choice for those who’d like to get a rounded training regarding the FX market and beyond.

Entered the US market in early 2022, Trading.com had a straightforward mission – to simplify trading forex in the country, which is admittedly filled with unregulated and complicated platforms, and provide low-cost trading opportunities.

And it does just that: the platform supports some of the tighter spreads available for US traders across its 70 pairing offers. The broker trading mechanism is made as straightforward as possible, and when coupled with a solid educational segment and tutorials for tools, it makes the platform particularly attractive for novice traders. Much like other platforms in this list, Trading.com offers a demo account with which you can test out all the features and functionalities with virtual money.

Ally has expanded its operations beyond banking to cover investing and wealth management, and quickly became a popular option due to straightforward platforms, versatility in tools, and competitive pricing.

Trading Forex is packed in a dedicated application for both desktops and mobile. This allows the broker platform to maintain its simplicity and ease of use without being cluttered by Ally’s many other offerings, which include IRA accounts, robo-advisors, stocks, OTC, and mutual funds trading.

Forex.com’s proprietary mobile application offers almost full functionality, with some gaps in the charting feature. Nevertheless, the broker application offers easy trade management, an intuitive outlay, access to full Trading Central suit for Reuters news feed, technical analysis and market analysis reports, and several order types including trailing stop-loss.

The broker platform is not the best option for those who seek in-depth educational materials, yet it offers dozens of platform tutorials on YouTube and within the application, so it’s still a solid choice for beginner traders who supply their education from elsewhere.

CedarFX - Best Forex Trading Platform for Good Customer Service

CedarFX’s platform in itself is not endowed with bells and whistles – it provides exposure to the robust MetaTrader 4 platform which includes strong charting, automation, and other analysis tools, but you can’t find in-depth educational materials nor extensive market research readily available.

Yet, the platform is unique in its environmentalist edge. Traders can opt for the Eco Account, which charges $1 commission per trade, and the company will match that amount and send all funds to Ecologi, an international foundation funding carbon avoidance projects. Their contributions are fully transparent and can be tracked through their website.

What makes the platform suitable for beginners is its swift customer service. While the industry on the whole struggles in this department, CedarFX continuously receives positive customer feedback for their robust and knowledgeable support available through live chat, phone, and email, which is evidenced across review aggregators like Trustpilot.

How to Find the Best Forex Trader for Beginners?

When curating our list, we took into account several factors – which can assist any novice trader when picking a suitable platform to start trading forex.

Is it regulated?

You’ll not find too many forex brokers operating in the US, especially in comparison to other hubs like the UK. This is largely due to the strict regulatory environment. Every forex broker needs to be authorized and regulated by the Commodity Futures Trading Commission (CFTC) and must hold a regulatory status with the National Futures Association (NFA). Besides the authorization from regulatory bodies as such, forex brokers also need to hold at least $20 million as a Retail Forex Exchange Dealer (RFED) with the CFTC (and as a member of the NFA).

You can check regulatory compliance directly through the broker’s website, most of which disclose their license number at the bottom of their homepage. For illustrative purposes, here’s OANDA’s disclosure;

“OANDA Corporation is a registered Futures Commission Merchant and Retail Foreign Exchange Dealer with the Commodity Futures Trading Commission and is a member of the National Futures Association. No: 0325821.”

You can then look up the firm on the NFA website using the Background Affiliation Status Information Center (BASIC) tool.

Finding a regulated FX broker is important to ensure the platform has been vetted for safe financial practices. Regulation ensures that your money is safe in the forex broker account, and you can count on the company's professionalism to look after your funds. The US holds a very tight ship, and for this reason, it's one of the most trusted FX hubs globally.

Does it have educational materials?

Beginner traders would want to learn the basics of trading currencies to increase their chances of profiting. Ideally, the brokerage platform will offer in-house training material to help you understand the basics and offer advanced strategies. The type of educational materials includes blogs, detailed tutorials, videos, webinars, and a community forum where users can discuss problems and solutions.

Are there risk management tools?

Risk management tools are a great feature for beginners to help reduce the size of potential losses and close orders before an account goes into a negative balance. Advanced platforms tend to offer sophisticated risk management tools, like Interactive forex Brokers’ IB Risk Navigator, but more often than not, risk navigation is done through different order types – most notably stop-loss orders.

Stop-loss orders allow traders to close out a position automatically by buying or selling an asset when it reaches a certain price, known as the stop price. It has more versatile versions such as trailing-stop loss, like trailing stop-loss orders, which adjusts the stop price at a fixed percentage below or above the foreign exchange market price of a security.

Here is a table with notable risk management features from the top forex broker platforms for beginners:

Risk Management Features | |

|---|---|

IG | Guaranteed stop-loss orders |

Forex.com | Trailing stop-loss |

TD Ameritrade | One-cancels-the-other (conditional orders, if one is cancelled, another is automatically triggered) |

Oanda | Stop-loss and trailing stop-loss orders |

Does it have a user-friendly interface?

Complicated interfaces are already daunting for beginners – it’s even more important to have a clear outlay when dealing with complex and risky securities such as currencies. Ideally, best forex brokers for beginners support a clearly organized interface that doesn’t forego depth in features. The best way to assess personal suitability is to simply test out every feature and platform quality through a demo account.

It’s also ideal for a platform to support full functionality across products to ensure a seamless switch between devices. While many online forex brokers now adopting a mobile-first approach, the degree to which services overlap still varies across outfits. If you prioritize being on top of your trades while on the go, seek platforms that include all their offerings within the mobile application.

Does it have a demo account?

Demo accounts are crucial for beginner to understand ins and outs of forex trading, as well as the workings of the platform to assess whether it suits your experience and personal preferences. Trading with virtual money in a simulated market environment is a much less unnerving way to get acquainted with trading risky and complex securities like forex, and is important to utilize to minimize capital loss.

What are the trading costs?

Commissions, spreads, and overnight swap charges concern the forex traders the most – and they vary widely by broker. The most common fees include;

Commission: FX brokers may charge a percentage fee for trading currencies, which tend to go lower as the trading volume increases. Yet, many brokerages now waive commissions following Robinhood’s tremendous success.

Fixed Spread: The fixed spread is beginner-friendly because it helps in accurate trade cost planning and protects against expensive trades. The catch is that it may lead to slippage and re-quotes if oline forex brokers use an instant execution model to offset the lost charges.

Variable Spread: Variable commission trades may result in a better deal, but the costs are unpredictable, especially in volatile markets.

You can start forex trading with as little as $100 as long as the minimum deposit requirements set by the forex brokers allow – but you’ll need to trade larger amounts of money to increase your chances of profiting. As a beginner, starting with a small amount makes sense to learn the ropes, but the size of your returns grows in proportion to the amount staked.

How Does FX Trading Work?

The forex market is a network of buyers and sellers transferring currencies to each other at an agreed price in a bid to turn a profit by taking advantage of price swings. Individuals, banks, and businesses participate in forex trading. Since currencies are traded in large volumes daily by big players as such, they are incredibly liquid and volatile. The sheer amount of currency converted each day, along with vulnerability against numerous foreign exchange market drivers like geopolitical factors and credit ratings, can magnify the price movements of some currencies.

This volatility, along with the large leverages offered by forex brokers, is part of the appeal of forex trading – but they are also the chief reasons why the market is risky.

How are currencies traded?

Currencies are traded in pairs in 3 different market types:

Spot Forex Market: Spot trades refer to the exchange of currencies immediately as the transaction is confirmed or within a short period of time.

Forward Forex Market: This trade type refers to the trading of currencies at an agreed price at a future date or range of dates.

Future Forex Market: This involves a contract that is legally binding to buy or sell a currency at a specific price and at a future date.

Most traders will not physically receive the currency they are trading. Instead, they are betting on the irregular price movements of a currency pair.

While there is no centralized forex trading location, FX hubs exist that account for most trades. The biggest FX trading hubs in the world are the United States, the United Kingdom, Singapore, Hong Kong, and Japan.

Base Currencies, quote currencies, and pairs

Currencies are traded in pairs with what is known as a base and quote currency. The base currency is the first currency listed, and the quote currency is the second one. When you buy a currency pair, you buy the base currency and sell the quote currency – when you sell a pair, you sell the base currency and buy the quote currency.

Each currency has a 3 letter code such as USD for the United States Dollar and GBP for British Pound Sterling and this trading pair would be expressed as USD/GBP, which involves buying British pounds and selling US dollars.

The rate for this transaction is 0.81, which means that for every US dollar sold, you would receive 0.81 British pounds.

Pips, lots, and margins

Pip: A pip is the smallest price movement possible for an exchange rate, so bid/ask spreads are quoted in pips. The pip size varies based on the exchange rate and trade value.

Lots: Buying and selling small amounts of currency is not practical; therefore lots exist. Lots are set prices for a batch that ranges from 100 to 100,000 units of currency.

Margin: Through a margin account, you can borrow from the forex broker to increase your buying power. This magnifies the profits as well as the losses and should be used with caution.

What are the risks and benefits involved in trading Forex?

Now, let’s take a look at the pros and cons of trading forex for beginners for a balanced overview and help you decide if it’s something that you'd like to venture into.

Pros

- Available 24/7, which is ideal for traders in all time zones.

- Low starting costs mean that beginners can start with just $100 to learn the ropes.

- Volatile markets allow traders to focus on short-term returns to find potential trades.

Cons

- Currencies are extremely volatile – this means potentially big gains, but it also carries high risk.

- The FX market has numerous drivers and is often difficult to predict.

- The broker-originated nature of forex markets means that there is a lack of transparency over how trades function.

Picking a currency pair

Picking the best currency pair to trade requires extensive research about the markets. Traders usually prefer the pairs with the highest volume, which include:

EUR/USD

USD/JPY

GBP/USD

USD/CHF

Forex pair categories

Major: These currencies are defined as those having the highest average trading volume such as the US dollar, Euro, British Pound, Japanese Yen, Swiss Franc, and New Zealand Dollar. Major currencies are typically liquid and stable, and come with very tight spreads, therefore most suitable for beginner traders.

Minor: Pairs that don’t include US dollars are called minors. They come with slightly higher spreads and are usually slightly less liquid than majors.

Exotic: These pairs include currencies from emerging markets. They exhibit the most volatility, come with much wider spreads, and are the least liquid in comparison.

Volatility

While the totality of the FX market is highly volatile, the aforementioned major currency pairings show the least volatility in comparison. The more volatile pairings are often enticing for many traders as steep price swings create numerous trading opportunities and increase the scope to realize a profit – but that also increases the risk exposure by a landslide.

As a beginner, it's wise to stick with less volatile currencies until you are more acquainted with the market behavior and have a greater understanding of what drives the price swings.

Active times

Forex markets are available for trading 24/7, but at certain times of the day, they have higher trading volumes. The biggest trading markets are in London, New York, Sydney and Tokyo, and they are in different time zones. Therefore, GBP currency pair trades will peak during London’s working hours.

However, the trading volume is highest when the working hours of several market hubs overlap. This is the time when you can expect the highest volatility levels and the difference between the bid and ask prices narrows.

Should You Trade Forex?

Forex is typically traded by banks, businesses, and retail traders, but the biggest price movers are central banks, news reports, market sentiment, credit ratings, and economic data. Traders should understand how to research and interpret these factors, and develop market understanding to make better-informed decisions. Overall, FX trading is considered among the riskiest types of trading because of the high volatility compared with other trading forms. It is also important to have a substantial bankroll to ensure that losses can be absorbed without running out of money.

.jpg)