Anyone interested in the oil and natural gas industry should be familiar with two very interesting exchange-traded funds: DIG and DUG. Given the historical volatility in the prices of crude oil and natural gas, investing in these two industries is a speculative play. But that's the intriguing part of DIG and DUG. In this article, we're going to talk about two ETFs that allow investors to trade in two energy products without taking a position in the commodities market. Part of that discussion will include a brief explanation of exchange-traded funds, followed by a specific discussion of DIG and DUG. Then we'll finish up with a summary of how these two ETFs can be used to take speculative positions in oil and natural gas.

Exchange Traded Funds

An exchange-traded fund can be thought of as a hybrid between a stock or bond, and a mutual fund. ETFs will trade on an exchange just like stocks, but they hold bundles of stocks and bonds, just like a mutual fund. The trading price of an ETF is approximately the same as the net asset value of all of the underlying securities at that point in time. Investors are attracted to ETFs because they've combined the ability to diversify away individual stock risk (like a mutual fund), with the flexibility of common stock (which can be traded throughout the day). Many ETFs are structured to follow an index such as the S&P 500 or the Dow Jones Industrial Average. In the case of DIG and DUG, it's the Dow Jones U.S. Oil & Gas Index.

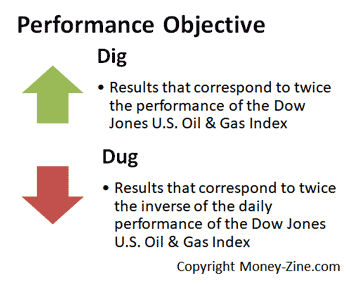

DIG: ProShares Ultra Oil & Gas

DIG is actually the ETF trading symbol for ProShares Ultra Oil & Gas. The stated performance objective for this fund is: ...daily investment results, before fees and expenses, that correspond to twice (200%) the daily performance of the Dow Jones U.S. Oil & Gas Index. This means that when the fund is meeting its objective, the rise and fall of its net asset value will be twice as volatile as the Dow Jones U.S. Oil & Gas Index. The fund's prospectus goes on to state that 80% of its net assets will be invested in equities that are contained in the index and / or financial instruments that should have similar characteristics. Typical holdings of DIG include companies such as Apache Corp., Chevron, ConocoPhillips, Devon Energy, Exxon Mobil, Halliburton, Marathon Oil, Occidental Petroleum, and Schlumberger. So how is this fund going to move at twice the rate of the index it's tracking, if 80% of its assets are invested in a bundle of securities that are contained in the index itself? The answer is once again found in the prospectus: [By] employing leveraged investment techniques and / or sampling techniques in seeking its investment objective.

The word "leveraged" is important here, because it means the fund is going to borrow money to increase its return on investment.

DUG: ProShares UltraShort Oil & Gas

DUG is the ETF trading symbol for ProShares UltraShort Oil & Gas. The stated performance objective for this fund is: ... daily investment results, before fees and expenses, that correspond to twice (200%) the inverse (opposite) of the daily performance of the Dow Jones U.S. Oil & Gas Index. As is the case with DIG, DUG aims to move at twice the rate of the index it's tracking; however, that movement is expected to be in the opposite direction. DUG's investment strategy includes derivatives, leveraged investments, and investments that, in combination, have economic characteristics that are inverse to those of the Dow Jones U.S. Oil & Gas Index. Also, we have conducted thorough research and analysis and are proud to present our carefully curated list of the best ETF platforms currently available in the market.

Speculation and DIG DUG

From an investment standpoint, speculation is the process of selecting investments that are expected to carry with them greater risks, with the hope of greater rewards. Speculation is not exactly gambling because the speculator makes an informed decision before choosing to assume this risk. On the other hand, speculation is not categorized in the same way as traditional investments because they involve taking on much greater risks. This is an important point, because the performance objective for DIG and DUG is to move at twice the rate of the Dow Jones U.S. Oil & Gas Index. Greater volatility can result in greater rewards, but can also result in greater losses.

Simple Rules for DIG and DUG

Investing in DIG and DUG should take more thought than a simple guess as to whether or not oil and natural gas prices are going to increase or decrease. As is the case with all investments (even speculation), individuals need to expend considerable thought before investing their hard earned money. That being said, there are two simple rules of thumb when investing in DIG and DUG:

Investors that think the price of oil and natural gas is going to rise should buy DIG

Investors that think the price of oil and natural gas is going to fall, should buy DUG

It's really that simple... or is it?