Getting life insurance is an important decision that can help set up your loved ones financially if you were to pass away. There are many policies out there, and the specifics of each one cater to different needs. These life insurance statistics should help you stay informed and make the right choice.

Top Life Insurance Statistics to Have in Mind

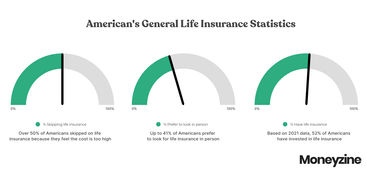

More than half of Americans think life insurance costs too much.

There are over 30 million underinsured households in the US.

52% of Americans have invested in life insurance.

Automation can reduce the cost of processing insurance claims by 30%.

It is estimated that the world’s health insurance market size will reach $108.4 billion by 2026.

8.9% of seniors have a wage below the poverty line.

29% of baby boomers research their life insurance policies online.

Up to 41% of Americans like to evaluate their life insurance options in person.

General Life Insurance Stats

Over 50% of Americans skipped on life insurance because they feel the cost is too high.

Many life insurance seekers overestimate the amount of money it will cost to get life insurance. In fact, they assume that it will cost 3x more than it actually does. Millennials are even worse in this aspect since, on average, they feel life insurance will cost 6x more than what is offered by the market.

(LIMRA)

29% of baby boomers, 32% of Generation X’s and 5.28% of millennials buy and research their life insurance policies online.

Life insurance data says that large segments of the young population are happy to look for life insurance policies while browsing the Web. That might be because you can use a price comparison website to quickly find the company offering the best deals. Furthermore, the number of providers available online is larger than what you can find in your local area.

The accuracy of price comparison websites is also improving, which helps users have more confidence in using them to get the best deals. Deciding which life insurance policy to purchase or even deciding whether you should get life insurance at all can feel overwhelming, especially when consumers are often influenced by a lot of information, some of which is not based on factually correct life insurance numbers.

(No Exam)

Up to 41% of Americans prefer to look for life insurance in person.

This figure has dropped significantly from a decade ago, when the percentage of Americans who bought life insurance in person was 64%. That might be due to technological advancement and the increased adoption by its users. Finally, the elderly part of the population is more likely to get life insurance, and that is also the group that has more difficulty keeping up with the latest tech innovations.

(LIMRA)

According to life insurance statistics, the number of underinsured American households is over 30 million.

‘Underinsured Americans’ expression refers to households that have difficulty making ends meet - even if they received the insurance payout. There must be enough money to settle debts, funeral costs, and the cost of living. The biggest problems are in households where the breadwinner has passed on.

(Nerdwallet)

Over 800 companies were offering life insurance in the US in 2019.

Since 2001, the life insurance industry size has been decreasing. Every year the number of companies providing life insurance declines steadily. This might be because the younger population is more skeptical about getting life insurance, and there are more investment opportunities than ever before.

(Insurance Information Institute)

Based on insurance statistics 2021 data, 52% of Americans have invested in life insurance.

The percentage of people who own some kind of insurance is just over half, which is a large portion of the US population. In most cases, the decision to get life insurance is made during retirement years. This means they can get limited-term deals that offer the best risk-to-reward ratio. However, the younger population is overestimating the cost of life insurance, so this figure might go down even further in the near future.

(LIMRA)

Life Insurance Trend Statistics

This section dives into the statistics that allow you to better understand the life insurance industry trends in the life insurance industry. Currently, most insurance rate prices are based on risk profiles, which are generic for the most part.

However, as technology advances, artificial intelligence can be used to create highly informative risk profiles that change the way rates are set. For example, when the insurer takes healthy steps, then the rates can go down because they will be expected to live longer. All of this will decrease the risk for insurers and potentially help increase the number of life insurance sales.

ROI of insurance companies can be increased by 200% with robotic process automation.

Automated processes allow companies to significantly reduce their overheads. For example, adding automation to customer service departments, risk profile assessments, and speeding up compliance reduces operating costs. These savings could potentially be passed down to the customer, and the companies would be able to provide a better deal.

(McKinsey)

80% of life insurance buyers are willing to use online channels for research and finalizing a transaction.

This is one of the most interesting life insurance facts that shows how the industry is changing. Traditionally, life insurance pricing is offered face-to-face once the insurer has a better idea of the risk profile. However, nowadays, consumers want to access prices online and use self-service platforms to complete checkout.

This means they can get life insurance from the comfort of their home or via their mobile devices. The fast-paced nature of modern life means the insurance industry needs to adapt and provide the service customers are seeking.

(EY)

Life insurance trends show that the industry will increase spending to $71 million by the end of 2021 in the areas of software and AI technology.

The question is not if AI will change the industry, it’s rather a question of when will it change the whole industry. It is a race between life insurance companies to see who will make the breakthroughs the fastest. The winners of this race can also get the biggest part of the life insurance market share.

(Statista)

The cost of processing claims can be reduced by 30% with automation.

It takes a significant amount of work hours to check the validity of claims and pay out the appropriate sums of money. Also, when there is a backlog of claims, it can take a long time for them to be processed.

That is because care is taken to reduce the chances of fraud and exploitation. However, automation can speed up the process and reduce the number of work hours needed to complete each claim, some of which can be astronomical. Namely, the biggest life insurance payout in 2021 was $367.2 billion.

(McKinsey, iii)

Since 2013, the number of investments has been growing in the insurtech industry.

Insurtech, in layman’s terms, is the insurance industry’s version of fintech. The primary aim of this technology is to improve data collection and efficiency. A bigger investment in the industry means that breakthroughs will allow life insurance companies to improve their processes. Also, the strides made in other industries can be harnessed by insurance companies.

(Statista)

By 2026 it is estimated that the world’s health insurance market size will reach $108.4 billion.

Health insurance facts show that the interest in purchasing health insurance is growing, and that can have an influence on life insurance as well. That is because people are actively trying to improve their health now more than ever before, and they are most likely to buy life insurance. The size of investments in the sector improves the quality of the products, which means customers are more likely to spend money on insurance.

(PR Newswire)

Senior Insurance Statistics

In this part of the article, we will look at the statistics about life insurance for seniors. This can help you figure out where the best deals are to be found.

The life insurance industry needs to rethink how to assess profiles because life expectancy is constantly going up. People in the US and worldwide live longer than ever before. The age people get life insurance determines the amount they will need to pay. However, getting insurance deals at a younger age could provide a better overall deal when looking for life insurance coverage.

The average cost of life insurance for a 20-year-old male is $10,692 ($17.02 per month) to receive $250,000 cover

The U.S. life insurance industry statistics suggest that you can get more value when opting for life insurance early on in life compared to later. Due to that fact, a person who buys insurance at the age of 60 will pay an average of $141.36 per month. Therefore, they will need to pay $18,078 for the same coverage (assuming both the 20-year-old and the 60-year-old live to 70 years of age). The opposite tends to be true for car insurance costs, where older drivers with a clean license get better deals, avoiding a higher than average life insurance policy.

(Policy Genius)

The percentage of seniors that have a wage below the poverty line is 8.9%

This statistic suggests that many seniors simply cannot afford to pay for life insurance. When living costs have to take priority over insurance, these seniors are not in the market for such products. However, if more seniors were to climb above the poverty line, then the size of the life insurance market might also increase.

(Congressional Research Service)

From 1950 to 2020, the number of senior citizens in the United States doubled

Back in 1950, the population of US senior citizens was 8%, and since 2020 that figure has risen above 16.9%. Experts predict that by 2050, the percentage will rise to 22%. This might drastically increase the life insurance market, and the average amount of life insurance during this period would increase. The rise in senior citizens can be explained by better healthcare, science, and technology improvements.

(Statista)

The average American will live to 77.3 years of age.

You were lucky to make it to 40 years of age, only 160 years ago. However, life expectancy has almost doubled since then. The life insurance market has evolved along with the increased life expectancy over the years and will continue to adapt. According to life insurance statistics from 2020, the life expectancy increase has somewhat dipped because of the 2020 pandemic, but this is expected to be a short-term effect.

(Statista)

.jpg)

.jpg)