One of the better-known measures of household debt load is the debt-to-income ratio, or DTI ratio. The measure is commonly used to determine if the household qualifies for a conforming mortgage or loan. A large number of non-conforming loans were written prior to the Great Recession, raising the awareness and attention financial institutions give this measure.

In this article, we're going to cover the topic of the debt-to-income ratio. As part of that discussion, we'll talk about the history of the measure, and the guidelines established by lenders. We'll run through some example calculations, and provide a link to an online debt-to-income calculator.

Understanding Debt to Income Ratio

When writing loans, lenders will evaluate an applicant's ratio to determine the risk of repayment. The DTI ratio compares gross income (before-tax income) to the debt load a household is carrying. Individuals with high DTI ratios will have difficulty repaying loans because their monthly debt payments are a relatively high proportion of their total income. This leaves very little money to pay for unplanned expenses as well as household necessities such as food.

The history of the measure goes back to the banking crisis of the 1930's. Lenders, as well as government agencies, were forced to rethink their approach to writing loans. In 1934, the National Housing Act created the Federal Housing Administration (FHA). This agency was asked to regulate interest rates as well as the terms and conditions for the mortgages it insured. One of the guidelines developed by the FHA was the ratio of debt to income, since this measure could be used to limit the total debt load of homeowners.

When the debt-to-income ratio is within the published guidelines of an agency, it is said to be a "conforming loan." The following list provides examples of such guidelines:

FHA = 29/41, or 29% to 41%

Conventional Loans = 28/36, or 28% to 36%

Veteran's Administration, or VA = 41%

Front End and Back End Ratio Calculations

The DTI ratio is further divided into what are referred to as front end and back end ratios. When paired, the ratios are expressed as Front End / Back End. The FHA guideline given above has a front end ratio of 29% and a back end ratio of 41%. The calculation for each of these measures is given below:

Front End Ratio = Household Debt / Gross Income

where:

Household Debt = PITI = Principal (mortgage), Interest, Taxes (property) and Insurance (homeowners)

Gross Income = all household pre-tax income (income before taxes)

Back End Ratio = All Debt / Gross Income

where:

All Debt = Household Debt (PITI) + credit card payments + car loans + student loans + other monthly debt payments

Gross Income = all household pre-tax income (income before taxes)

Debt to Income Examples

Since the debt-to-income ratio can be subdivided into front end and back end values, the following sections will provide an example of each calculation. Keep in mind these are examples, each agency will have a unique formula, but the fundamental elements of each approach should be consistent with the examples below.

Front End

In this first example, the borrower would like to see if they qualify for a mortgage involving a payment of $980 per month for principal and interest. Property taxes add another $400 per month and insurance is $80 per month. Gross household income in this example is $66,000 per year, or $5,500 per month. The front end ratio would be calculated as:

= Household Debt / Gross Income = ($980 + $400 + $80) / $5,500 = $1,460 / $5,500 = 26.5%

Based on this front end DTI ratio, the loan applicant would qualify for the mortgage since 26.5% is lower than the threshold of 28% for conventional loans.

Back End

In this second example, the borrower would like to see if they qualify for a mortgage involving a payment of $980 per month for principal and interest. Property taxes add another $400 per month and insurance is $80 per month. Gross household income in this example is $66,000 per year, or $5,500 per month. The borrower also has a car lease payment of $325 per month, student loans totaling $200 per month, and is making the minimum payment on a credit card of $150 per month. The back end ratio would be calculated as:

= All Debt / Gross Income = ($980 + $400 + $80 + $325 + $200 + $150) / $5,500 = $2,135 / $5,500 = 38.8%

Based on this back end debt-to-equity ratio, the loan applicant would not qualify for the mortgage since 38.8% is higher than the threshold of 36% for conventional loans.

Debt to Income Calculator

We've created an online calculator to complement the information found in this article. That tool can be used to model a variety of "what-if" scenarios; a link can be found here: Debt-to-Income Calculator. The rules and calculations used follow the conventional loan guidelines mentioned earlier.

Alternatively, if you don't know where to start, we've created a template to make your life a little bit easier 👇

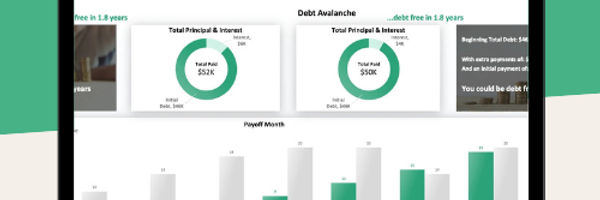

The debt snowball or the debt avalanche? This template will give you answers 💡

This template is:

Compare which method works for YOU

Fully automated and beginner-friendly

Includes both, debt snowball and debt avalanche templates in one with all the features!