It’s a painful drill—you’re short on cash, so you swipe your plastic, thinking you’ll catch up later. But you never really catch up, and now your balance looks like a nightmare. So what now?

Simple—you help your anxiety and your credit score by paying off your credit card debt.

You can commit to a payoff strategy, consolidate your debt, negotiate with creditors, and more. Overwhelmed? Don’t worry. We’re going to break down six different ways you can deal with credit card debt without ruining your credit.

This article will show you:

Different strategies to get rid of credit card debt.

Everything you need to know about debt consolidation.

Top tips for paying off credit cards.

Read more:

Check out more free tools for a debt-free life:

6 Ways of Getting Rid of Credit Card Debt

If your debt is piling up as fast as your laundry basket, you’re not alone. America’s household debt is steadily increasing, up to a record $16 trillion in 2022.

Credit cards are a big part of it ($890 billion to be precise).

Cheer up, though—because we’ve done the research and compiled six of the smartest ways of paying off credit card debt.

Check them out—

1. Debt payment strategy

These bad boys are clever plans and tactics that you can use to deal with outstanding debts.

You want these strategies in your arsenal to navigate tough financial obligations and inch closer to debt freedom.

Here are two tangible debt repayment strategies you can consider:

Debt snowball

The debt snowball method is a popular repayment strategy that can put an end to your vicious cycle of credit card debt.

The Harvard Business Review agrees that this may be the best way to pay off credit card debt.

In their research “The Best Strategy for Paying Off Credit Card Debt,” Harvard says the snowball technique works because:

It gives you a clear roadmap of your finances, eventually leading to a debt-free life.

Increases your motivation by focusing on individual debts.

Helps you gain momentum through a series of small wins.

Wondering how the debt snowball method works?

This method focuses on paying off your smallest debt first with minimum payments.

Once you’re done clearing debt, you use the momentum you’ve gained to eliminate the next smallest debt, and so on.

Snowballing your credit card debt will ensure you’re dealing with one debt at a time, making it easier for you to achieve small victories.

Curious to see if this method works for you? Check out our Free Debt Snowball Spreadsheet.

(Want more? Check out our new Get Out of Debt course.)

Debt avalanche

The debt avalanche method focuses on paying off debts with the highest interest rates first.

So, you’ll first pay off the debt with the highest interest rate, and then move on to the debt with the second-highest interest rate.

You repeat the process until you’ve paid off all of your credit card debt.

Here’s an example. Let’s assume you have these credit card debts:

$10,000 at an 18% interest rate.

$5,000 at a 16% interest rate.

And $4,000 at a 7% interest rate.

With the debt avalanche method, you’d pay off the $10,000 balance first (debt with the highest interest rate), followed by the debts of $5,000 and $4,000 respectively.

On the other hand, following the debt snowball method would mean you’d pay off the $4,000 balance first (the smallest debt), followed by the debts of $5,000 and $10,000 respectively.

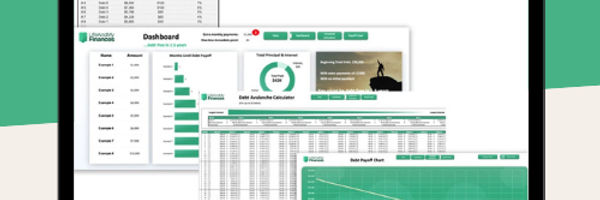

You can check out our Free Debt Avalanche Spreadsheet to see if this works for you 👇

Want to get out of debt this year? This avalanche debt payoff spreadsheet is what you need!

A few top features of this template:

Fully customizable and easy to “play around” with

This tool is awesome for motivation!

Room for up to 32 debts!

2. Debt consolidation

Is your debt scattered across credit card accounts like confetti? You want to pay attention to this cool debt management technique.

Debt consolidation can help streamline your debt repayment process if you owe several creditors.

It gathers your pesky debts and lets you organize your accounts in one place. This way, you’ll have a single credit card debt to deal with—you may also secure a lower interest rate.

But what’s the best way to consolidate debt without hurting credit?

Now there are several ways you can streamline and pay off your credit card debt. Here’s a peek into some of the best ways to consolidate credit card debt—

Debt consolidation loan

You can likely get a debt consolidation loan that offers a lower APR (Annual Percentage Rate) than you’re paying on your current debt.

If your credit score is still in good shape, this type of personal loan can help you reduce your total interest charges by hundreds or even thousands of dollars.

Why would trade your credit card loans for a personal loan?

Unlike credit cards, personal loans have set repayment terms. If your card’s minimum payment is the reason you’re complacent about debt repayment, a personal loan can help.

But before you jump in on this, here are some things to consider:

You’ll need good credit to make a debt consolidation loan worthwhile. Sure, you can get a personal loan even with bad credit. But to qualify for an interest rate that’s low enough to be helpful, you’ll need to build good or excellent credit.

You want to make sure you can afford the monthly payment. Paying just the minimum on your credit card? The monthly payment on a personal loan will be higher. So, run the numbers on your budget before you apply for one.

Keep an eye out for origination fees. Some lenders will want upfront origination fees of up to 10% of the loan amount. Plus, this fee is subtracted from your loan disbursement, so you’ll need to borrow extra to get the whole amount. If you have excellent credit, you should be able to find lenders who don’t charge a fee.

Make sure this isn’t the only thing you do. Yes, it’s great to get a lower rate on your debt, but you should still actively work to pay your debt off.

Credit card balance transfer

You can also consolidate your debt using a balance transfer credit card.

These cards typically come with an introductory 0% APR on balance transfers for a set period (usually nine to 21 months).

The idea is simple: You transfer your debts to this new card and pay off that debt during the interest-free introductory period.

Play your cards right and this technique can save you hundreds of dollars on interest charges.

However, there are some things to consider:

You may not be able to transfer all your debt. You usually can’t transfer more than your new card’s credit limit. The worst part? You won’t know what this new credit limit is until after you get approved.

You may need to pay a balance transfer fee. Balance transfer credit cards usually charge an upfront fee of 3% to 5% of the transferred amount. Before you apply, do the math to determine how the fee will impact your savings.

Keep in mind that a balance transfer credit card typically only offers the 0% intro APR on balance transfers. This doesn’t include purchases, which may start accruing interest immediately.

Like with any other form of consolidation, this isn’t the only step you should take. Keeping paying off your debt.

3. Home equity

Have equity in your house? You may want to use a home equity loan or home equity line of credit (HELOC) to pay off your credit card debts.

But why would you trade your credit card debt for a home equity loan?

Home equity loans and lines of credit typically offer low-interest rates, as they use your home as collateral for the loan.

Plus, if you get a HELOC, you’ll still have access to that relatively inexpensive line of credit after you’ve paid off your credit card debt.

That said, here are a few things to consider:

You may face limitations. Most lenders will only let you borrow up to 85% of your house’s value. This includes both your principal mortgage and your home equity loan or HELOC. So, you may not be able to borrow as much as you need depending on how much equity you have.

You could lose your house. If you default on this loan, your lender could foreclose on your house—even if you’re still up to date on your primary mortgage loan.

You may be responsible for closing costs. Closing expenses for home equity loans normally range from 2% to 5% of the loan amount—and HELOCs occasionally levy annual fees. Make sure you understand the costs before you proceed.

Read more:

4. Debt management plan

Non-profit credit counseling agencies offer programs called Debt Management Plans (DMPs) to help consumers struggling with a large amount of unsecured debt.

This typically includes personal loans and credit card debt. (They don’t cover student loans or secured debts such as mortgages or auto loans.)

You’ll want to go over a DMP with a credit counselor before signing up.

If you decide it’s a good financial move, the counselor will begin negotiating with your creditor. They’ll usually negotiate lower interest rates, monthly payments, fees, or all of the above.

Once they reach an agreement with your creditors, you’ll start paying the credit counseling agency. The agency will then pay your creditors on your behalf.

Check out the list of government-approved credit counseling agencies here.

Some things to keep in mind while speaking with a credit counselor:

You may have to close your credit cards as part of your agreement with the credit counselor. This can cause your credit utilization rate to spike, damaging your credit until you pay down the balances.

You’ll probably deal with a long “no new credit card” period. Applying for a new credit while you’re on a DMP can cause your creditors to withdraw from the program.

There are fees involved. You’ll typically need to pay a one-time setup fee—typically $30 to $50—along with a monthly fee, ranging from $20 to $75. Review your budget to figure out if you can afford to pay before you start the process.

5. Debt Settlement

Debt settlement involves bargaining with your creditors to pay less than what you owe. Companies have to understand the alternative to reducing what is owed them may be declaring bankruptcy. If they think they will eventually get paid, they have no incentive to forgive any portion of someone's debt.

You can conduct debt negotiation on your own if you’re up for the legwork. But work with a debt settlement company or law firm if you feel overwhelmed.

When you work with a debt settlement firm, you’re typically required to stop paying your bills while the organization negotiates your new settled amount.

Although settlement can save you thousands of dollars, there are several key drawbacks to consider:

It can damage your credit. You’re bound to miss a few payments while negotiating and this can result in significant negative damage to your credit score. But that’s not all—once you’ve settled, the creditor will add a note to your credit reports, causing more damage.

It can be pricey. Working with a debt settlement company or law firm may help you bag a better settlement, but it can cost you 15% to 25% of the settled amount.

You can also end up with a tax bill. The forgiven debt may be reported to the IRS as income, so you may have to pay taxes on it.

Read more:

6. Declare Bankruptcy

Declaring bankruptcy should only be considered when all other alternatives have failed to produce the desired outcome. Bankruptcy is the end of the line; that's why it is the last option listed. Once in this process, individuals can lose their home to foreclosure, and may still have to pay down some credit card debt as part of the settlement. Credit reports will be impacted, credit scores lowered, and that makes getting a loan in the future much more difficult.

Anyone that wants to learn more about this process can find more information in our article dedicated to the topic of: Bankruptcy. Finally, declaring bankruptcy is a legal matter; consulting an attorney is highly recommended for any, and all, matters involving the law.

Debt Consolidation Basics

Of all the debt repayment strategies, debt consolidation is probably the most confusing one.

So let’s break it down for you—

1. How does consolidated credit work?

Debt consolidation involves working with a new lender to refinance multiple loans into a single loan.

There are tons of options for loan consolidation.

The most common one is to take out a personal loan and use the money to pay off your other debts. Using home equity loans or balance transfer credit cards are other popular choices.

Regardless of the method you choose, the process is generally the same.

You’ll begin by evaluating interest rates among lenders to discover who’s offering the best deal. You’ll then apply for enough money to meet your current debts. You start making payments on your new loan once you receive your loan funds.

When done right, debt consolidation can fetch you more favorable terms, such as a lower interest rate or lower monthly payments.

2. Is debt consolidation bad for your credit?

Debt consolidation isn’t inherently bad for your credit. Manage it properly and it can potentially boost your credit score.

Consolidating your debts can initially have a negative effect on your credit score. This is because the process typically involves applying for a new loan or credit account, resulting in a hard inquiry on your credit report.

Additionally, closing existing credit accounts as part of the consolidation process can affect your credit utilization ratio, another factor that influences your credit score.

However, in the long run, consistently making on-time payments and effectively managing your consolidated debt, can help improve your credit score.

3. Is it a good idea to consolidate debt?

To consolidate or not to consolidate? The answer depends on your unique financial situation and the specific debts you’re targeting.

You want to take a good, hard look at your finances to figure out if this is a wise move.

We’re going to help you with this list of scenarios where debt consolidation makes perfect sense—

You have good credit. Having a high credit score can help you qualify for 0% balance transfer cards and low-interest loans, making the whole process effective.

You have high-interest debt. Debt consolidation can help you save money by reducing the interest you’re paying on high-interest loans.

You’re overwhelmed with payments. Having a hard time keeping track of your debt payments? Debt consolidation can solve that by helping you merge multiple payments into one.

You have a repayment plan. Consolidating debt without a repayment strategy (like the debt snowball method) in place can prove to be a financial disaster. Before taking this step, decide on the payment strategy and make sure you’ll be able to stick to it.

Kendall Meade, financial planner at SoFi, shares the secret to making debt consolidation work,

The biggest piece of advice I can give to anyone who does debt consolidation is to stop using their credit cards until they have paid off the debt in full. I have seen many people consolidate their debts into a loan but then continue to run the credit cards back up. Now they have double the payments.Kendall Meade, financial planner at SoFi

5 Step Process For Paying Off Credit Cards

Ready to swipe away your credit card debt and reclaim financial freedom? Here are some smart tips to help you—

1. Create a budget

We get it. You don’t want to be spending your Sundays planning how you’ll pay your bills this month.

But there’s no substitute for budgeting. It can help you prioritize your expenses, ultimately ensuring you don’t overspend.

This way, you can easily set aside some money to repay your debt sooner. You may also be able to sneak in some extra payments, reducing your overall loan cost.

Budgeting can come off as an intimidating task. But we’ve got your back.

Budget Worksheets: walks through the process of creating a budget, leveraging a high-level template available for download.

Family Budget Basics: uses a slightly different approach, and allows end users to compare their budget to that of an average American family.

Household Budget Basics: provides additional hints on creating a viable budget that can help individuals to get their credit card debt back under control.

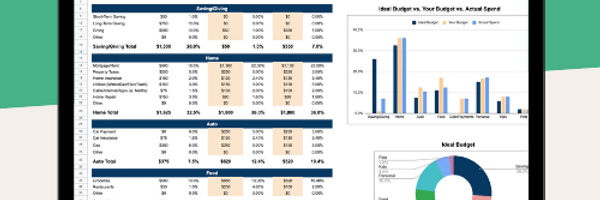

We suggest starting with a monthly budget below 👇

Simple, quick, and easy monthly budget template for Google Sheets and Excel.

With this template, you will get:

Pre-set expense categories

Simplified dashboard and day-by-day monthly tracker

Automated charts for comparison

Day-by-day views for budgets and actual spend

The single most important action anyone can take when going through this exercise is identifying essential versus discretionary expenses.

Essential Expenses: are those costs people need to survive: food, clothing, and shelter. They also include costs that are required to generate income. For example, gasoline is essential when it's used to transport someone to and from work.

Discretionary Expenses: are those costs that are "optional;" they make life more enjoyable. Discretionary expenses include entertainment, eating out, lavish vacations and expensive cars, clothing, or jewelry.

Start budgeting efficiently with our free and ready-to-use budget templates:

2. Automate payments

Automating your payments is a simple approach to ensure that your debts are paid on time, saving you money on late penalties.

However, if you choose a debt snowballor debt avalanche strategy, you’ll need to be a little more hands-on to ensure you’re paying exactly what you want to each account.

3. Pay more than the minimum

Whenever your budget allows it, make extra payments. Credit card companies charge you a monthly minimum payment (typically 2% of the balance).

But keep in mind that banks make money from the interest they charge each billing cycle. This means the longer you take to pay, the more money they make.

To add to it all, the average amount of credit card interest paid is rising because of the Fed’s rate hikes and the rising levels of revolving credit card debt. In fact, credit card debtors in the US may pay an average of $1,380 in credit card interest this year.

Lay out your credit card debt with the minimum payments and interest to see how long it will take to pay off!

What you will get:

Interactive dashboard

Customizable to your needs

Stay on track with charts and graphs

Suitable for up to 16 or 32 debts!

4. Limit Hard Inquiries When Paying Down Credit Cards

If you don’t already have a balance transfer card, you can either open a new one with the 0% rate and minimal fees you’re looking for or look into another type of consolidation loan.

But when applying for new credit, you should be cautious.

When you shop around for loan rates, look for lenders who are ready to pre-approve you and estimate your rate without a hard investigation on your credit.

5. Try Not to Max Out Your Card

If you use a balance transfer credit card to consolidate your debt, shifting your transferred balances to the card may result in you maxing out your credit line.

If the card is maxed out to nearly 100%, you may have a problem with your credit utilization ratio.

The recommended ratio for each of your accounts is 30% or less. Exceeding one hundred might have a significant impact on your credit.

To the lender, you effectively maxing out a credit card makes them concerned that you won’t pay it back, lowering your credit score.

Helpful Debt Reduction Tips and Support

Here are a couple of things you should bear in mind when trying to navigate credit card debt.

Sign up for educational courses

Enrolling in online educational courses can be a savvy move when you’re grappling with debt.

These courses provide valuable knowledge and skills—plus, flexible learning options that can fit into busy schedules.

Moreover, a select few courses also come with affordable price tags, making them accessible if you’re on a tight budget.

Ready to do some serious learning? Check out our course on “How To Get Out Of Debt Fast”. (This course is perfect for you if you’re struggling to get out of debt, and don’t know how to budget. You’re about to get your hands on some of the best personal finance tools.)

Seek Credit Counseling

With the growing problem of consumer credit, there has been a steady increase in companies providing credit counseling services. These counselors will help families to develop a household budget, and educate individuals on the basics of home economics. Reputable credit counselors can be found through the National Foundation for Credit Counselors, or NFCC. Member agencies are accredited by the Council on Accreditation (COA), which ensures the highest standards are maintained as a nonprofit credit counseling agency.

Social workers can help individuals that have debt problems due to a social situation that affects the income earners in a household. Credit counselors should be able to help with this problem too, by making arrangements to get in touch with a social worker. Many times, changes to family structure or illnesses are at the heart of runaway credit card problems.

Avoid Debt Elimination Scams

If someone has a lot of debt, the last thing they need is to fall prey to someone that is going to hustle them out of even more money. Unfortunately, victims of these scams often have their good judgment clouded by their dire financial situations.

The Internet Crime Complaint Center was established as a partnership between the Federal Bureau of Investigation (FBI) and the National White Collar Crime Center. Anyone that believes they're a victim of a crime involving credit card debt is encouraged to report the incident to the IC3 Website.

If All Else Fails, Declare Bankruptcy

Declaring bankruptcy should only be considered when all other alternatives have failed to produce the desired outcome. Bankruptcy is the end of the line; that's why it is the last option listed. Once in this process, individuals can lose their home to foreclosure, and may still have to pay down some credit card debt as part of the settlement. Credit reports will be impacted, credit scores lowered, and that makes getting a loan in the future much more difficult.

Anyone that wants to learn more about this process can find more information in our article dedicated to the topic of: Bankruptcy. Finally, declaring bankruptcy is a legal matter; consulting an attorney is highly recommended for any, and all, matters involving the law.

Key Takeaways

Getting rid of credit card debt without wrecking your credit is tough but doable.

Follow the tips in this article, and you’ll be on your way to living a debt-free life.

You can try different strategies (like the snowball or avalanche method) to pay off your debts, look into consolidating your debts, tap into your home equity, consider a debt management plan, or even negotiate settlements.

Remember to assess your situation and choose the approach that works best for you.

Don’t forget to make a budget, automate payments, and be careful about applying for new credit.

.jpg)