Details Last Updated: Tuesday, 06 October 2020

Buying a home is a big financial step. Buyers typically need to borrow money to finance the purchase, which is a serious financial commitment to the mortgage company. But to really appreciate the total cost of owning a home, buyers need to look beyond their mortgage. They should also consider things like their home security. According to burglary statistics, this is one of the most common crimes in the world and a great concern for homeowners.

In this article, we're going to use information from surveys conducted by the Census Bureau and the Bureau of Labor Statistics, to examine the average cost of home ownership. First, we'll quickly discuss the two survey methods themselves, and then we'll take a look at some of the statistics relating to the cost of owning a home. Then we'll finish up by summarizing all of the information we've found, to help figure out exactly what it costs to own a home.

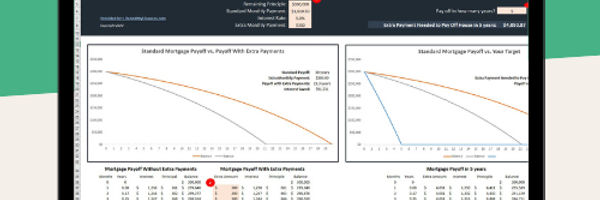

Ready to pay off your mortgage early? This spreadsheet will help you understand what it’s going to take!

With this template, you will get:

Clean and simple with no extra fuss

Fully automated and easy to customize

Future-proofed for any year (be it for 2023, 2024, 2025, or more!)

Works with Excel and Google Sheets

Home Ownership Surveys

Additional Resources |

How Much House Can I Afford? How to Buy a Home Buying HUD HomesBuying a Second Home Six Important Home Inspections |

Each year, the U.S. Census Bureau conducts what they call the American Housing Survey. The survey provides up-to-date information on certain aspects of home ownership to the U.S. Department of Housing and Urban Development (HUD). The results of the survey are based on the responses from approximately 55,000 participants.

The second survey we examined is sponsored by the Bureau of Labor Statistics, and it's called the annual report on Consumer Expenditures. The survey, which is also conducted by the U.S. Census Bureau, consists of two components:

Recordkeeping Survey: this is a diary that is used by survey participants to record their daily expenditures.

Interview Survey: this involves five telephone interviews conducted at three-month intervals.

The results of this second survey are based on 15,000 recordkeeping diaries and 30,000 interviews. While there is certainly some data overlap between these two studies, there is also information that is unique to each survey.

Average Home Characteristics

Using the 2019 American Housing Survey (published September 2020), we're able to draw some conclusions as to what constitutes an average American home. More accurately, the report tells us about the "median" home. The median is the midpoint in the data, meaning half the American homes have more, and half have less, than the midpoint values below.

Typical American Home

Given the above definition, the following are characteristics of the typical American home:

Built in 1978, meaning the home was around 42 years old

Two Stories High

Five Rooms

Three Bedrooms

2.0 or more Bathrooms

1,500 Square Feet

0.31 Acres

There really shouldn't be any surprises when examining the above information. Most of us would view this housing data as that of a modestly-sized home. Now that we have a better understanding of the size of a typical home, we can start to talk about the costs associated with owing one.

Monthly Home Expenditures

The following data are the median costs to own a home, using information from the American Housing Survey (2017 data, published in September 2018). Remember that the median means half the households will spend more than the amounts below, and half of the households will spend less than these amounts.

Real Estate Taxes: $200 per month or $2,400 per year

Mortgage Payments: $900 (principal and interest) per month or $10,800 per year

Property Insurance: $67 per month or $804 per year

Electricity: $106 per month or $1,272 per year

Natural Gas: $55 per month or $660 per year

Fuel Oil: $100 per month or $1,200 per year

Drinking Water: $50 per month or $600 per year

Trash / Garbage Disposal: $25 per month or $300 per year

Routine Maintenance: $42 per month or $504 per year

Finally, and to put things in perspective, we'd like to point out that a typical home cost $160,000. Adding the above numbers, we can conclude that owning a home costs the average American $1,545 per month or $18,500 each year. In addition, owners can consider paying monthly for an alarm to prevent theft. Burglary statistics say that only 25% of Americans have a home security system, which is a very low number in comparison with the number of burglaries.

Consumer Expenditures

The second set of data we examined comes from the Bureau of Labor Statistics' 2017 report on Consumer Expenditures (published April 2018). This survey relies on telephone interviews, as well as written records of expenses. For purposes of evaluating the cost to own a home, we'll be looking at the following types of expenses:

Housekeeping Supplies and Services: includes bathroom tissue, brooms, laundry and cleaning detergents, light bulbs, maid service, mops, paper towels, and sponges.

Housewares and Small Household Appliances: such as blenders, coffee makers, cooking utensils, dinnerware, glassware, irons, utensils, pots and pans, telephones, and toasters.

Home Furnishings: such as art work, clocks, curtains, lamps, picture frames, pillows, plants, refrigerators, rugs, sheets, sofas, stoves, table cloths, tables, towels and vases.

Housing Expenses: includes cable TV, electricity, garbage removal, heating / cooling, insurance, maintenance fees, mortgage payments, property taxes, rent, and telephone charges.

Home Maintenance: such as hardware, lawn supplies, hand tools, improvement and repair equipment, lawn / garden equipment, nails, power tools, screws, supplies, and services.

The corresponding monthly and annual costs for the above items as found in this study, and which pertain to the cost of owning a home, include:

Utilities, Fuels, and Public Services: $319.66 per month or $3,836 per year

Household Operations: $117.67 per month or $1,412 per year

Household Supplies: $62.92 per month or $755 per year

House Furnishing and Equipment: $165.58 per month or $1,987 per year

Housing: $991.25 per month or $11,895 per year

Cost of Owning a Home

Based on the survey results above, what conclusions can we draw concerning the cost of owning a home? To answer this question, we need to see how the results of the two surveys compare.

The Consumer Expenditures survey is clearly a more comprehensive study, since it relies on a written record of expenditures and the span of household expenses is more wide-ranging. Overall, the claim would be that it costs around $20,000 per year, or $1,700 per month, to own a home.

From the American Housing Survey we initially concluded that it cost around $18,500 a year to own a home. But that result did not include some of the expenses found in the Consumer Expenditures survey such as home furnishings, household supplies, operating expenses, and some of the utilities. If we were to add these values to the American Housing Survey results, we'd conclude the cost to own a home would be around $24,000 per year, or $2,000 per month.

Based on the information contained in these two surveys, it's safe to say that owning a home costs around $24,000 per year, or $2,000 per month.

Renting versus Buying a Home

When interpreting these results, be careful about comparing the cost of owning a home to the cost of renting a home. The values mentioned earlier go beyond the simple rent or lease payment made each month.

When deciding between buying and renting a home, we have an online calculator that can help. Our Rent versus Buy a Home calculator takes into consideration not only the expenses associated with these two options, but will also consider increases in rent over the years, along with the appreciation in a home's value.

About the Author - Owning a Home

.jpg)