Anyone that's ever purchased a "used" home is familiar with the costs that are oftentimes needed to bring it up to modern standards. Financing these home improvements is an especially important topic to anyone buying a home that's a "fixer upper."

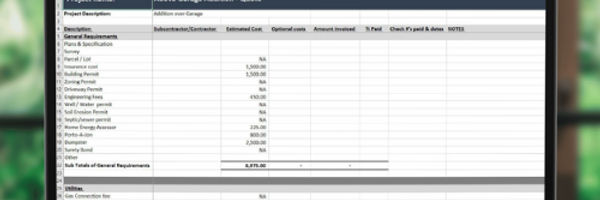

Perfect spreadsheet for any home renovation project 🏠

This template is:

Easily customizable for any project

It comes with examples and ready to use

It can be used in Excel or Google Sheets

Home Improvements

Experience tells us that unless someone's able to buy a home that's covered by a lifetime warranty; the owner will spend a significant amount of money on improvements each year. In fact, the rule of thumb is the average homeowner can expect to pay annual maintenance costs that range between 3 to 5% of the home's value

Additional Resources |

In this article, we're going to discuss some of the choices homeowners have when it comes to financing these improvements. Most owners, especially those that recently stretched themselves financially when buying the home, don't have a large cash reserve sitting in the bank.

Decision Guidelines

There is a simple rule of thumb everyone can use when deciding how to finance a home improvement project, and it has to do with the value it adds to the home. If the project adds significantly to the equity in the home, then a long-term financing option is usually the best choice. If not, the owner should consider a shorter term loan. Let's take a look at a couple of examples that demonstrate this point.

Remodeling a Kitchen

Let's say Haley has decided to remodel her kitchen. If the existing kitchen hadn't been remodeled in the last 15 years, it's very likely the new one will add significantly to the resale value of the home. Therefore, when Haley eventually sells it, she can expect to recover some of the financing costs of the kitchen.

The additional equity she now has in the home can be used to pay off the remaining balance, if any, on the project's loan.

Replacing a Home's Roof

Let's say that Lindsey decided to pay a contractor to put a new roof on her home. Now that new roof might look pretty from the outside, but most buyers expect the roof to be watertight. A new roof might add somewhat to the value of the home, but it would not be significant. Since the investment in a new roof does not add significantly to the value of the home, Lindsey would not be able to recover those costs when selling it, and could not use the additional money from the sale of the home to help pay off the project's loan. In this example, she should fund this home improvement project with short-term financing. As the above examples illustrate, the guiding rule here with respect to financing has to do with the ability to leverage the increased equity provided by the home improvement project to payback the loan in the event it's sold before the loan's term has expired. To summarize:

If a home improvement project adds significant and lasting value to the home, the financing choice can be long term.

If the project adds little perceived value to the home relative to its cost, then a short term financing arrangement is the better choice.

Remodeling Projects that Add Value

Improvement projects that will add significant value to almost any home include remodeling of bathrooms and kitchens. In some real estate markets, these two projects can actually pay for themselves many times over in terms of the additional resale value of the home. Decks and fences are often fairly inexpensive projects that add value to a home due to their perceived increase in functionality and privacy. Finally, new windows, building a home office, finishing a basement or attic space, and any other project that takes an existing space in the home and turns it into comfortable living quarters adds value. This last category includes additions that expand the size of the home too.

Long and Short Term Financing Options

In the following two sections, we describe both the long and short term financing options available for home improvement projects.

Short Term Options

When it comes to short-term financing, there are two readily available options:

Home Equity Line of Credit: also referred to as a HELOC, this is an adjustable rate line of credit whereby lenders would typically allow homeowners to borrow up to 80% of the home's value minus the balance owed on any loan using the home as collateral.

Personal Loan: similar in concept to a car loan, this type of financing arrangement does not allow the borrower to claim a deduction for the interest charges on their federal income tax return.

Long Term Options

If the project adds to the value of the home, it's reasonable to seek a longer term financing arrangement including:

Value Added Mortgages: loans that can be taken for up to 90% of the remodeling costs. This category includes improvement loans such as Fannie Mae's HomeStyle mortgage plan.

Refinancing an Existing Mortgage: includes loans for up to 80% of the home's appraised value. Refinancing a mortgage is basically swapping out the existing loan and leveraging the increase in the home's equity to refinance under a larger loan.

Second Mortgage: the term on these loans can range from 5 to 20 years, and up to around 80% of the value of the home minus the balance on an existing mortgage. Closing costs may apply, and include expenses associated with a title search, loan origination fees, and points.

Mortgage Calculators

Everyone thinking about starting a home improvement project or remodeling their home should understand the impact it will have on the family finances each month. We've an extensive collection of online mortgage calculators as well as those tailored to personal loans that can help users understand the monthly and total cost of these options.

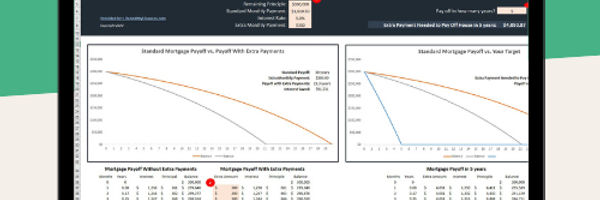

Ready to pay off your mortgage early? This spreadsheet will help you understand what it’s going to take!

With this template, you will get:

Clean and simple with no extra fuss

Fully automated and easy to customize

Future-proofed for any year (be it for 2023, 2024, 2025, or more!)

Works with Excel and Google Sheets

About the Author - Financing Home Improvements

.jpg)