Financial hardships, such as the sudden loss of a job, can often force homeowners to delay payments on their monthly mortgage. Unfortunately, when a homeowner starts to fall behind on their payments, they run the risk their lender may try to foreclose on their home. In this article, we're going to explain how homeowners can attempt to avoid foreclosure. As part of that discussion, we'll first talk about the process timeline. Then we'll provide some tips on how to avoid foreclosure, and the available alternatives. Finally, we'll talk about some of the common scams that prey upon the fears of homeowners experiencing financial problems.

Foreclosure Process

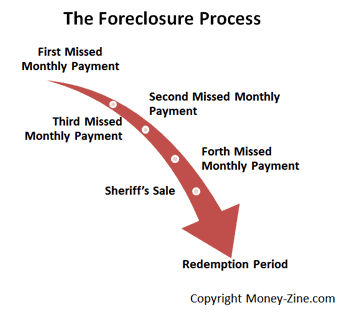

The process of going into foreclosure starts out quite innocently as the first monthly mortgage payment is missed. Eventually it progresses into a legal proceeding that involves attorneys and the public sale of the home. While each state may have a slightly different process and timeline, the steps are very similar:

First Missed Monthly Payment: Lenders typically call or write the homeowner to ensure the payment wasn't lost or forgotten, and advise the homeowner of possible late payment penalties.

Second Missed Monthly Payment: At this stage, a lender will send a written letter as well as call the homeowner to counsel them on the seriousness of the situation.

Third Missed Monthly Payment: Another letter is sent by the lender called a "Notice to Accelerate" or "Demand Letter." The purpose of this letter is to notify the homeowner that unless immediate action is taken, the lender will likely begin the formal foreclosure process.

Fourth Missed Monthly Payment: At this point, the timeline specified in the Demand Letter has expired, and the homeowner may be contacted by the lender's attorney.

Sheriff's Sale: Also known as a trustee's sale, in some states this next step can take place in as little as two to three months after the Demand Letter is sent. In this step, the lender's attorney has scheduled the sale of the home.

Redemption Period: This is the final step of the foreclosure process. Even after the home is sold at the Sheriff's sale, it's still not too late for the debtor to stop the process. It's possible to reclaim the home if the outstanding mortgage balance and the fees incurred during the foreclosure process are paid.

Avoiding Foreclosure

As mentioned earlier, it's possible to avoid foreclosure by working with the lender. It is especially important to acknowledge a problem exists. Working cooperatively with the lender includes answering all of their phone calls and responding to all of their written notices. Ignoring the problem will only make matters worse, since all legal proceedings will continue to progress. Ignorance is not an excuse in a court of law, and that advice applies to foreclosures too.

Borrowers that are having trouble making their monthly mortgage payments need to organize their original loan documents and read them carefully. These documents will outline all protections as well as obligations. It's also important to understand the exact foreclosure laws that apply since timelines and processes will vary by state. The most effective way to avoid foreclosure is to start making monthly mortgage payments again, but that's easier said than done. Creating a household budget can help the homeowner to separate discretionary spending from essential household expenses. Elimination of all optional monthly costs, including membership fees, can help free up enough money to start making payments once again. Losing a home to foreclosure is an unpleasant experience and saving the home can mean taking drastic measures. This can include delaying payments on monthly credit cards, and even the sale of a car, boat, and / or other valuable items such as jewelry.

Alternatives to Foreclosure

Even though lenders can seem heartless when borrowers are struggling, they really do want to avoid foreclosure too. That's because the process is expensive to the lender. It's really a lose / lose proposition for both the lender as well as the borrower. The biggest problem lenders have is trying to separate individuals that will never make another mortgage payment from those that are financially struggling in the short term. If the borrower is able to convince the lender they can afford the mortgage in the long term, they may be more willing to work with the borrower to find alternatives to foreclosure. The following is a list of some actions that can be taken with, or without, the lender's help.

Deferred Payment Plans: Lenders will often work with borrowers to create repayment plans that allow the money owed to be paid back over time. For example, if one mortgage payment is missed, future payments are increased to allow the borrower to pay back the amount owed over time instead of doubling-up on a payment.

Forbearance: With this type of arrangement, the lender may consent to delay foreclosure if the borrower agrees to catch-up their payment schedule in a specified amount of time. With forbearance, the lender allows the borrower to stop making their monthly payments in the near term, with the hope of recovering the money owed once the short-term financial crisis is over.

Restructuring the Mortgage: Some lenders will agree to extend the term of the loan (thereby reducing the monthly mortgage payment), reduce the interest rate charged, or add the missed payment to the balance owed on the loan.

Sale of the Home: If the home is not in a negative equity situation (more money is owed on the home than it's worth), the borrower is better off selling the home and using the proceeds from the sale to pay off the mortgage. This approach avoids the damage foreclosure can do to the borrower's credit score.

Transfer of Deed: Finally, credit ratings may suffer less damage if the lender agrees to allow the borrower to transfer the deed rather than foreclose on the home. Lenders may be willing to accept a transfer of deed if the cost of this transaction is less than the foreclosure process.

Scams and Schemes

Whenever money is involved, there are always less-than-reputable individuals willing to profit from the hardships of others. The last thing someone needs when he or she is struggling to meet a monthly mortgage obligation is to pay someone to help prevent foreclosure. Any available money in a household should be directed towards paying back a lender, not paying a company to negotiate with one. Here we're not necessarily talking about a fraudulent offer or a scheme that will charge fees and not provide any real help, which does happen. We're talking about legitimate businesses that charge extremely high fees for a service that can be obtained free from the lender or a government agency such as the U.S. Department of Housing and Urban Development.

Stopping the Process

Beware of companies stating they can stop the foreclosure process if the borrower signs documents turning over control of the home. This is sometimes referred to as a repurchase or leaseback scam. Signing the deed to a home over to another party gives that person the ability to charge rent and / or evict everyone from the home. Since the mortgage is still in the borrower's name, they remain the responsible party for paying the mortgage if the scam artist stops paying. In fact, anytime the title to the home or the deed is signed over to another company, there is a risk of losing the home. Don't ever sign a legal document without reading it thoroughly, and seeking the advice of an experienced attorney.