I was on a road trip with the kiddos just last week. Midway through the trip, a Volvo wagon passed us. I stared at it longingly, thinking, “That’s a nice car. I could see myself in that—but I wonder what it costs?” And that’s when I saw the license plate—IMPULSE.

I laughed so loud that my six-year-old wanted to know what was going on.

It sounds like Mr. Impulse got himself into some debt with his ride.

When he gets sick of his payments on that thing, maybe he’ll dig into the snowball vs avalanche method—and then discover the best way to pay off his debt. (I hope so, at least.)

You can download my avalanche vs. snowball template below 👇, or keep reading to learn how to make one yourself.

The debt snowball or the debt avalanche? This template will give you answers 💡

This template is:

Compare which method works for YOU

Fully automated and beginner-friendly

Includes both, debt snowball and debt avalanche templates in one with all the features!

In this post, you'll learn about:

The debt snowball method for paying off debt.

The debt avalanche method.

Which method is best for you and your situation.

The best and fastest way to pay off your credit card debt.

Debt Snowball vs Debt Avalanche: An Overview

There are a few different ways to pay off your debt, but mostly it comes down to just two—

The debt snowball method

The debt avalanche method

And the setup of these methods is similar. For both, you’ll—

Line up your debts.

Make the minimum payments on all but one.

Pay as much as possible toward the first debt until it’s completely gone.

Then, you’ll move on to the next debt in sequence and pay as much as you can toward that one.

And continue the process until all your debts are paid.

The goal of this post is to learn about each of the debt payoff strategies individually—walk through an example of each—and then decide what approach works best for you and your situation (either the debt avalanche or debt snowball method).

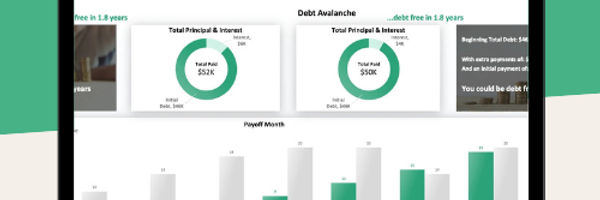

Do you want to see how they play out right next to each other? Download my Excel tool from Etsy. (On the main tab, you’ll immediately see which method pays off first. And if you want to see the detailed month-by-month payoff of each, there are tabs for that too.)

Brendan recently purchased this tool in January 2023 and had this to say:

“This was exactly what I was looking for!”

He gave the debt snowball vs debt avalanche Excel template a rating of 5 out of 5.

Here’s a quick sneak peek of the debt avalanche method vs snowball method:

DEBT AVALANCHE | DEBT SNOWBALL |

|---|---|

Line up debts from largest interest to smallest | Line up your debts from smallest balance to largest |

Pay highest interest debt first | Pay smallest balance first |

Make minimum payments on everything else | Make minimum payments on everything else |

When you pay off the highest interest debt, move on to the next highest interest | When you pay off the smallest balance, move on to the next smallest balance |

Continue until you pay all your debts | Continue until you pay all your debts |

(Want Something More? Check Out Our New Get Out of Debt Course!)

Want to get out of debt even faster?

We recently created a full get out of debt course. This is for those that want more. For those that want to pay off debtfast.For those absolutelyhate their debt and want it gone for good.

This course includes the debt snowball spreadsheet, but also includes sooo many more extras!

This course includes...

The debt snowball vs. debt avalanche calculator ($15 value)

The weeklyand monthly budget template ($10 value)

An early mortgage payoff calculator ($10 value)

80 minutes of video instruction ($200 value)

A complete slide deck of the video

A full workbook

And a live Q&A session with me in the next few weeks... ($100 value)

That's $335 of value...all for just $39? Yeah, we're doing that! It's a complete steal, but it's only available at this price until May 14th.

If you want to get serious about your debt payoff journey, take the course. You won't regret it. I can't wait to meet you and hear your questions in the live Q&A!

What Is The Debt Avalanche Method?

Between the debt snowball and debt avalanche, the avalanche method is the less popular one.

And—to make things more difficult—it goes by a few other names as well:

High rate method

Debt stacking method

(Throughout this post, we’ll only call it the “avalanche” or “debt avalanche” method to keep things simple. Just know, though—if you hear the other terms—they mean the avalanche method.)

Which debts do you pay first?

With the avalanche method, line up your debts from highest interest to lowest.

You’ll start paying on the highest interest debts first.

How does the debt avalanche work?

The process of the debt avalanche method is quite simple—

Line up your debts from the highest interest to the lowest.

Make the minimum payments on all the debts except the highest-interest one.

On the high-interest debt, plow as much money toward it as possible until it’s gone.

Then, move on to the next highest-interest debt and pay that one off.

Repeat this process until you pay off all your debts.

Why does paying off the highest interest rate credit card first make the most mathematical sense?

Most people use this method to pay off their high-interest credit card debt. (I often get the question above because people just can’t wrap their heads around the math.)

If you step back and really think about it though (without writing out the big algebraic formula and solving for “x”), of course this method makes the most mathematical sense.

The highest-interest debt costs you more each month because it’s the biggest charge on your balance. Get rid of the highest interest debt first, and you’ll save money (in almost every scenario).

So, does this make the debt avalanche the best method?

Hold your horses—we’ll get there.

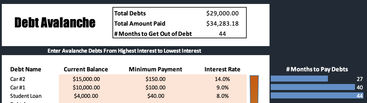

Debt avalanche example

Let’s say you have the following debts:

Student loan: $4,000 at 8% interest.

Car #1: $10,000 at 9% interest.

Car #2: $15,000 at 14% interest.

Using the avalanche payment method on your debt, you’d order them from the largest interest to the smallest:

Car #2: $15,000 at 14% interest.

Car #1: $10,000 at 9% interest.

Student loan: $4,000 at 8% interest.

So first, you’d pile money at Car #2—while making the minimum payments on Car #1 and your student loan.

Then—once you pay off Car #2—you’d put as much money toward Car #1 as you can each month (while continuing to make the minimum payments on the student loan).

When the debt on Car #1 is gone, you’d then focus on your final debt and get that student loan paid off quickly.

Here’s how it all plays out according to my debt avalanche vs debt snowball Excel tool (with an assumed extra payment of $500 each month):

You’d be completely debt free in 44 months.

Advantages and disadvantages of the debt avalanche method

Pros:

You’ll save more money over time by paying off the highest-interest debt first.

This method also pays off faster than the other methods.

Cons:

It might take longer to see progress (your highest interest debt might be your largest).

It can be tough to stay motivated if you’re not paying off debt immediately.

What Is The Debt Snowball Method?

Unlike with the debt avalanche method, you’ll completely ignore interest rates with the debt snowball method of paying off debt.

You’ll focus on the size of each loan instead.

Which debts to pay first

When using the debt snowball method to pay off debt, you’ll line up your loans from the smallest to the largest (again, regardless of the interest rate on each)

Now—the first debt you’ll tackle will be the smallest one.

How does the debt snowball work?

Here’s the payoff process for the snowball debt method:

Line up your debts from smallest to largest.

Make the minimum payments on all debts except for the smallest one.

Put as much money toward your smallest debt as possible each month.

When you pay off the smallest debt, move on to the next smallest debt and work to pay that one off as quickly as possible—all while making the minimum payments on all other debts.

Repeat this process until you pay off all of your debts.

Debt snowball example

How does the debt snowball work in a practical setting?

Let’s reuse the above example and walk through the process with real numbers.

Here’s the list of debts:

Student loan: $4,000 at 8% interest.

Car #1: $10,000 at 9% interest.

Car #2: $15,000 at 14% interest.

And there’s no need to re-order them, because they’re already listed from smallest to largest.

First, you’d tackle the $4,000 debt (since it’s the smallest)—and make the minimum payments on Car #1 and #2.

Then—once that’s paid off—you’d move on to Car #1 since it’s the next smallest debt.

When you pay off the $10,000 note—you can move on to the final debt (the $15,000 Car #2).

Here’s how the debt snowball strategy plays out according to the debt avalanche vs snowball debt payment Excel tool (again, with an assumed $500 extra payment each month):

You’d be completely debt free in 46 months.

Advantages and disadvantages of the debt snowball method

Pros:

You’ll feel energized with your immediate progress and more likely to stick to the debt payoff strategy.

Paying those first debts off will free up extra money that you can then snowball into the next debts—creating momentum in your debt payoff journey.

Cons:

This method will take longer than the debt avalanche plan.

It will cost you more in the long run, because you’ll owe more interest while paying off your debts.

Which Is Better? Debt Avalanche vs Snowball Debt Method

The snowball method vs avalanche method—which of these debt repayment strategies is best?

It’s a pretty equal race, actually.

Let’s dive into a few key points—and then you can make this tough call for yourself.

Which method of debt reduction saves you the most money in interest?

If you’re comparing the two on paper, the debt avalanche is the way to go if you want to save the most money on interest.

By paying off the highest interest debt first, you eliminate those additional dollars paid in interest—which means you’ll save money and time in your debt payoff journey.

You can see this with our example in the debt snowball vs debt avalanche Excel spreadsheet:

The debt snowball pays off in 46 months, whereas the debt avalanche pays off in 44 months.

Is it better to pay off small debts first?

After walking through the above section, you might say, “Of course not! Don’t start with the smallest debts. Choose the method that pays off the fastest!”

But after being in this personal finance game for nearly 15 years now, I’m not convinced—and neither is Harvard.

In 2016, Harvard University ran a study to see once and for all which debt repayment method was best.

It turns out that a greater percentage of those using the debt snowball method stuck with their plans and achieved debt freedom—primarily because of the motivating progress they saw early in their journey.

As Remi Trudel recollects:

“This aligns with other research on the power of small wins to keep people motivated.”

(Still not convinced? Take a look at the snowball vs. avalanche tool again.)

How long did it take to pay off the first debt in the avalanche method?

About 27 months. (That’s over two years!)

When would you pay off your first debt with the debt snowball method?

Only eight months.

Which plan would you stick with?

Should you pay off the lowest balance or highest interest?

So what’s better?

To start paying off your debts faster but give up along the way?

Or take a couple of extra months—and actually make it to the finish line?

Personally, I’d vote for the latter—for the reasons above, but for another reason as well.

(One that you’d only know if you’ve fought your way out of debt before. And I’ve done it three times—don’t ask.)

The snowball effect on debt

When you pay off your debts via the debt snowball, you get a snowball effect (the minimum payments from the first debt go toward the second debt, and so on)—but it’s the same with the debt avalanche.

The true effect of the debt snowball is the feeling you get when you pay off that first debt—and then the effort you’re willing to put into paying off the next one.

I remember paying off $21,000 in just six months with the snowball method. It was monumental—-something I didn’t think I could accomplish in such a short time.

I had another $54,500 of debts to tackle.

I figured, “If I could pay off $21,000 in 6 months, I bet I can pay the remaining $54,500 in less than a year!”

Never would I have had this thought had I been using the debt avalanche. I’d just continue plodding, making slow progress—and feeling no motivation to do more.

On paper, the debt snowball looks slower—but in reality, it’s faster, because you end up tackling and doing more.

Why?

Sheer enthusiasm.

So which is best?

Which one takes the prize?

For me—it’s the debt snowball.

But that’s me.

Maybe you’re super calculated and not very emotional—and you wouldn’t get all pumped up from progress like I did.

If you’re a calculated math nerd, the debt avalanche method might be for you.

For the other 80% of the world—go with the debt snowball.

What’s the Fastest Way to Pay Off Credit Card Debt?

We’ve talked a lot about paying off cars and student loans, but we haven’t really discussed paying off high-interest credit cards.

While the debt is in a slightly different form, the premise doesn’t really change—they’re still debts with interest rates and minimum payments.

To pay off credit card debt fast, the math says to use the debt avalanche.

(And honestly, since most of your credit cards will have similar balances, it might hold true.)

It’s technically the best way to pay off high-interest credit cards.

How to aggressively pay off credit card debt

Here are some quick tips here on how to pay off credit card debt quickly:

Unless you’re drowning in your debts, don’t try to get all fancy with balance transfers and debt consolidation.

Instead, download the snowball vs avalanche debt Excel tool, enter your debts, and make a plan to pay them off.

Use a budget sheet to lay out your monthly expenses, find any unnecessary spending and get rid of it.

Do whatever you can to increase your income—ask for a raise, get a better job, or take on a side hustle from home.

Credit card debt is one of the worst financial poisons. Get rid of it as soon as you can!

What is the Best Way to Pay Off Credit Card Debt?

If you’re not asking about the quickest way to get out of debt—but about the smartest way to pay off credit card debt instead, then I’d vote for the debt snowball option.

Start by paying off the smallest card, get rid of it in a month or two, build momentum—and propel yourself into the next one.

The credit card snowball will fire you up and push you to do more, be better—and move faster.

Give it a shot. I think you’ll agree.

If You’re Drowning, Consider a Balance Transfer Credit Card

I only recommend this if you’re barely getting by each month (after taking on extra jobs and cutting way back on expenses).

I’ve spent dozens of hours researching the top cards. One of the best balance transfer credit cards is the Citi® Double Cash Card.

To transfer your balance, it costs 3%—but then you’ll have 0% interest for the next 18 months. This will give you a chance to start paying off your debts without fighting upstream against the interest river.

(And, by the way, once your debts are all paid, you’re left with a great card that offers 2% cash back rewards—1% when you spend, and the other 1% when you pay the bill.)

Key Takeaways

We dove pretty deep into the avalanche vs snowball methods.

Here’s the overall summary—

The debt avalanche method lines up debts from the highest interest to the lowest.

Start by paying off the highest interest debt while making the minimum payments on everything else. When the first debt is paid off, move to the next highest interest debt.

(This method is best for the math nerds and non-emotional people of the world.)

The debt snowball method lines up debts from the lowest balance to the highest.

Start by paying off the lowest balance while making minimum payments on everything else. When the first debt is paid off, move on to the next largest debt.

(This method is best for most—especially those who get excited and motivated when they see immediate progress.)

If you need a tool to help you sort through the snowball method vs avalanche, our resource is best.

(We do offer a much smaller free debt snowball vs debt avalanche tool if you want to get a sense for how it works—and if you want to pull the trigger on the larger tool.)

FAQ

Is it better to put money in savings or pay off debt first?

Should I pay off big debt or small debt first?

What is the fastest repayment strategy?

Sources

Amabile, T. M., & Kramer, S. J. (2011, May 1). The Power of Small Wins. Harvard Business Review. https://hbr.org/2011/05/the-power-of-small-wins

Trudel, R. (2016, December 27). Research: The Best Strategy for Paying Off Credit Card Debt. Harvard Business Review. https://hbr.org/2016/12/research-the-best-strategy-for-paying-off-credit-card-debt

.jpg)