What's the difference between the debt avalanche and the debt snowball method? Which one will help you pay off your debts the fastest? And, is there a debt snowball vs avalanche calculator out there that can actually show you the debt payoff journey for both methods?

Spoiler alert on the last question—yes.

I officially built a debt avalanche vs snowball calculator where you can enter in all your debts! And, you can actually see how quickly each debt will pay off for either method, the debt snowball or debt avalanche.

Want to set up your debt snowball vs avalanche method calculator in just a few minutes? Check out our digital tools on Etsy.

Make a small investment, get your instant download, and create a plan to become debt-free today.

One of our recent users, Leonard, had this to say:

“Exactly what I needed and if I stick to it I'll be debt free again in about 18 months!! Derek is a great inspiration, as well as takes the time to make sure things are working for those of us who are Excel illiterate. I messed up on mine and he was kind enough to take the time and effort to fix it for me...above and beyond customer service much appreciated! Thank you Derek!!”

If you just can't wait to walk through the helpful text and instruction below (I don't blame you), just click the links above to head to my Etsy page.

BUT, BE SURE TO COME BACK to learn more about the difference between the debt avalanche and the debt snowball.

And of course, so you can learn how to best utilize this tool!! If you still want to learn more about the debt avalanche vs debt snowball tool, check out this video we made, walking you through what it looks like and how it works!

Intrigued? I hope so! Now, let's move on and talk all about debt trackers, the debt snowball, the debt avalanche, the snowball vs debt avalanche payoff tool, and then most importantly...how to use it!

Check out similar tools and concepts:

(Want Something More? Check Out Our New Get Out of Debt Course!)

Want to get out of debt even faster?

We recently created a full get out of debt course. This is for those that want more. For those that want to pay off debtfast.For those absolutelyhate their debt and want it gone for good.

This course includes the debt snowball spreadsheet, but also includes sooo many more extras!

This course includes...

The debt snowball vs. debt avalanche calculator ($15 value)

The weeklyand monthly budget template ($10 value)

An early mortgage payoff calculator ($10 value)

80 minutes of video instruction ($200 value)

A complete slide deck of the video

A full workbook

And a live Q&A session with me in the next few weeks... ($100 value)

That's $335 of value...all for just $79? Yeah, we're doing that! Oh, and if you buy it and you're not satisfied, we'll give you a full refund.

It's a complete steal—we truly want to help as many people as possible.

If you want to get serious about your debt payoff journey, take the course. You won't regret it. I can't wait to meet you and hear your questions in the live Q&A!

How Do You Track Debt in Excel?

This is a question that comes up often, and I see it asked throughout Google and in forums everywhere -- "How do I track debt in excel?" Unfortunately, there's usually not a great answer out there. Sure, you can list your debts in excel with the debt amount for each, but then what? How do you develop a plan to pay them off?

You can't...unless you have some serious excel skills.

The best you can do is update your debts each month and track your debts that way. But, that's not going to tell you anything aboutwhen you're going to pay off all your debts, or what might happen if you decide to ramp up your efforts and try to pay off your debts more quickly. Truly tracking debt in excel...It's just a black hole mystery... It's never very effective.

What is the Debt Snowball?

I don't know about you, but I'm definitely aware of what the debt snowball is. In fact, I used the debt snowball myself just a few years back. It helped me clear $21,000 of debt in just 6 months, and then I used the concept again to pay off my $54,000 mortgage!

So what is it really? What is the debt snowball?

The debt snowball is a method for paying off your debts. You simply line up your debts from smallest to largest and pay them off in that order (smallest first).

Pay only the minimum payments on all debts except the smallest one, and tackle that smallest one with a vengeance until it’s gone.

Then, when that’s paid off, move onto the next largest one (which is now the smallest of all your debts) and tackle that while still making the minimum payments on everything else!

Then, just keep doing this until all your debt is gone!!

Interest rates are not considered when lining up your debts for the debt snowball (mainly because the intent is to pay off your debt quickly, so the interest doesn’t matter as much).

Is the debt snowball a good idea?

So…this method sounds pretty basic.But is the debt snowball a good idea really?I mean, is it really the best option out there? Like I said, I’ve been in debt. I’ve used the debt snowball to get out, and get out QUICKLY. (And the almighty Harvard backs this method too!)

Here’s my take on why the debt snowball is a good idea, and why it works so well:

The debt snowball is super basic. It’s easy to set up and easy to understand.

You get early momentum when you pay off those smaller debts – it fires you up to keep going and to get after your debts with even more vengeance!

When you pay off those smaller debts, it frees up MORE money to put toward the next debt. It feels great to put big chunks of money toward debt each month!

When I got started with my debt snowball, I was able to put mayyybe $200 toward my debts. It felt good to pay down debt, even though it wasn’t a huge amount.

Soon, I figured out how to make more, spend less, and put MORE toward the debt snowball. By the end, I was throwing thousands of dollars at the debt each month! That’s what the debt snowball can do!

Related:

What is a Debt Snowball Spreadsheet?

So we just explained the debt snowball method in detail. But what is a debt snowball spreadsheet? Is it just a place to enter debts? Or is it more than that? A debt snowball spreadsheet is an excel sheet where you can enter your debts, and then actuallysee how quickly they would pay off over time.

It's honestly a beautiful thing. And then, if you find the good debt snowball spreadsheets, they'll have an option for you to pay extra toward your debts and then see how quickly that reduces your debt payoff timeline! (My debt avalanche vs debt snowball calculator (that we'll explore throughout this article) is a robust one.

You can enter in all debts, you can enter in a lump sum beginning payment, and you can also enter in extra payments if you want to! And then, that same debt calculator spreadsheet will show you exactly how fast everything pays off!

How do you calculate snowball debt reduction?

This is a question that people ask A LOT. They want to know how fast they can get out of debt. They want hope, they want goals, and they want direction. But, as we already established, the calculation isn't easy.

So, the best thing you can do is find a debt snowball spreadsheet that already exists. Or, you can download my newly created debt avalanche vs debt snowball calculator to get a look at your debt payoff from all angles!

The most important part though...How do you calculate snowball debt reduction? You find a great tool and use it. Don't mess around making your own...but, now I'm getting ahead of myself.

How do I create a debt snowball spreadsheet in Excel?

As you may have guessed, the search volume on the following topics is through the roof right now:

“How do I make a debt snowball spreadsheet?”

“How do I create a debt snowball spreadsheet in Excel?”

And, “How do I create a debt snowball spreadsheet in Google Sheets?”

I had the very same questions a few years back, which is why I eventually made one in Excel! But let me tell you, it isn’t easy! There are so many variables, which leads to a ton of very lengthy formulas!

Lucky for you, I was able to make one. And, even luckier for you, I’m willing to give it to you for FREE!! So why make one for yourself? I really wouldn’t recommend it. Just use mine!

How do I create a debt snowball spreadsheet in google sheets?

First off, if you're still asking the question, "How do I make a debt payoff spreadsheet?" DON'T!! And don't create your own debt snowball spreadsheet in Google sheets either. Use an existing template (preferably mine!), and then just download it into Google Sheets!

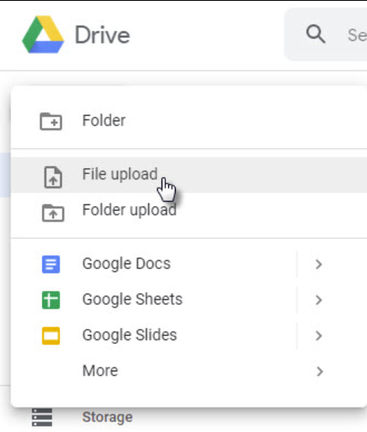

Here’s how you can use this debt snowball spreadsheet in Google Docs.

Then, when the download appears on the bottom of your screen, click on the down arrow and choose to save the file to your computer (instead of trying to open it)

Then, open Google Drive

Click “New” in the upper left

Then click “File Upload”

Find “the best debt snowball Excel template” that you just uploaded and saved. Select it, then click “Open”

It will show up on the bottom-right of your screen, click it

And then once it opens, at the top of the file select “Open with Google Sheets”

There you go! You’re ready to enter in some numbers to see how long it will take you to get out of debt! Read on to unlock the secrets of this tool and how to get out of debt fast!

Free Debt Snowball Spreadsheet Excel

I gave this detail away a long time ago... ;) I have created quite a few helpful templates over the past five years. The first of which was a free debt snowball excel spreadsheet (click the link to check it out). I believe it has helped hundreds, perhapsthousands of people get out of debt, and I just absolutely LOVE that!

If you've got a large number of debts and you need a bigger debt snowball excel calculator, then you can always hop on Etsy and find my larger debt payoff excel calculators there!

Debt Snowball Excel Calculator Downloads on Etsy

(I'm often running sales too, so they're likely even cheaper!). They're simply the best tools out there for the price. I truly believe that.

What is the Avalanche Method to Pay Off Debt?

Almost everyone has heard of the debt snowball, but what about the debt avalanche? Have you heard of this? Only the more nerdy types dig in deep enough to ask this question, but it's a good one! "What is the debt avalanche method to pay off debt?"

While the debt snowball has you line up your debts from smallest to largest and ignores the amount of interest on each debt,the avalanche method pays off debt from largest interest to smallest interest and ignores the size of the debt!

Debt Avalanche Example

So, if you have two debts, one with 20% interest and the other with 5% interest, you'd tackle the 20% interest debt first! It only makes sense, right? Well...yes...and no. ;) We'll get into this in a bit.

Free Debt Avalanche Calculator

Curious about the debt avalanche? Want to see a debt avalanche calculator tool? Lucky for you, I built one of those too! Click this link to download a free debt avalanche spreadsheet.

It's only built for 8 debts, but again, if you want a bigger debt avalanche calculator, I built a few more that can handle more debts. And they don't cost that much either!

Debt Avalanche Excel Calculator Downloads on Etsy

(Again...I often have these on sale, so be sure to click the link to see the reduced prices on these!)

Free Debt Avalanche Spreadsheet: Google Sheets

Want the free debt avalanche template for Google sheets? Again, just follow the instructions below.

Click this debt avalanche template download link

Then, when the download appears on the bottom of your screen, click on the down arrow and choose to save the file to your computer (instead of trying to open it)

Then, open Google Drive

Click “New” in the upper left

Then click “File Upload”

Find “the best debt avalanche excel template” that you just uploaded and saved. Select it, then click “Open”

It will show up on the bottom-right of your screen, click it

And then once it opens, at the top of the file select “Open with Google Sheets”

But Which Is Faster? Debt Snowball or Debt Avalanche?

Soooo, I built tools for both the debt snowball and the debt avalanche...but which one is better? Which one would I choose if I woke up in debt tomorrow?

If you download the free debt avalanche vs the debt snowball calculator (just click the link), you'll quickly discover that with almost every debt scenario, the debt avalanche method will pay off slightly faster than the debt snowball method...and for less money too. But...I wouldn't choose it.

Instead, I'd choose the debt snowball method to pay off my debts.

Snowball vs Avalanche Method: Why the Debt Snowball is Better

"What??! But Derek...If the debt avalanche method will pay off the debt faster than the debt snowball, AND it will save you more money, why on earth would you choose the debt snowball method? That makes no sense!"

I said the calculatorshows that the debt avalanche will pay off faster. But the calculator isn't necessarily reality.

The difference is, we're not robots.

We don't just commit to paying debt off and then do it without any issues. What if your highest interest debt was $10,000 and you could put $500 a month toward it? It's going to take you nearly 2 years to get through your first debt!

How motivated do you think you'll be during that 2-year stretch? Do you think you'll still be hard-charging that debt, excited and pumped to keep tackling it? Not likely... What if instead, your first debt was $1,000 and you paid it off in 2 months?

Then you took the payment you were making on that one and you snowball it into the next debt? Heck yeah!! Now that's progress! You're winning at paying off your debts!! That's the power of the debt snowball. Want to see more? Want to know more?

Then you've got to check out the FREE debt avalanche vs snowball calculator. Click the link and open the excel download from the bottom of your screen.

Debt Snowball vs Avalanche Calculator

Alright. Now we're at the exciting part! It's time to officially unveil the debt snowball vs avalanche calculator (if you haven't already clicked the above links and checked it out yourself that is).

I freakin' can't wait to show you all that this tool can do - and for you to experience it too. It's the mother of all debt snowball and avalanche calculators and it's going to fulfill all your needs and desires when it comes to paying off your debts!

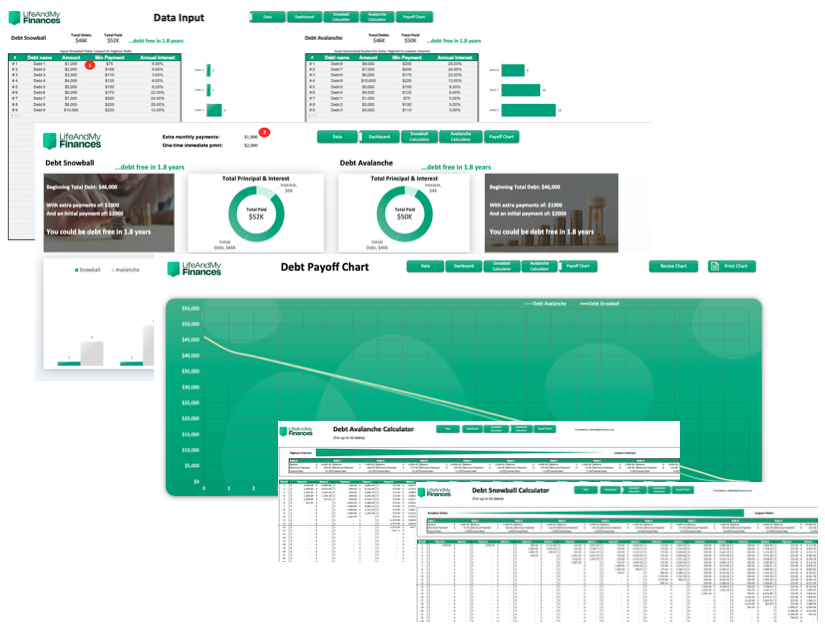

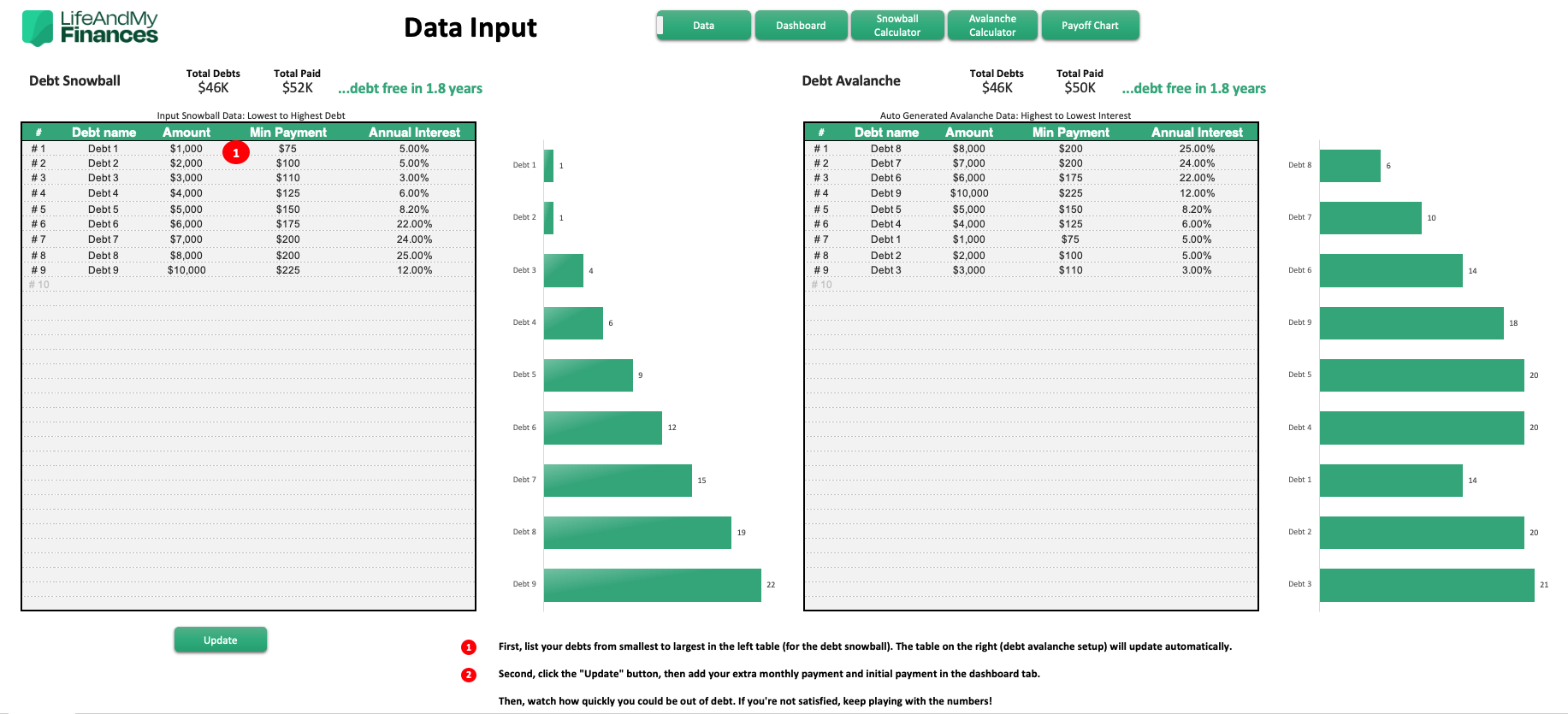

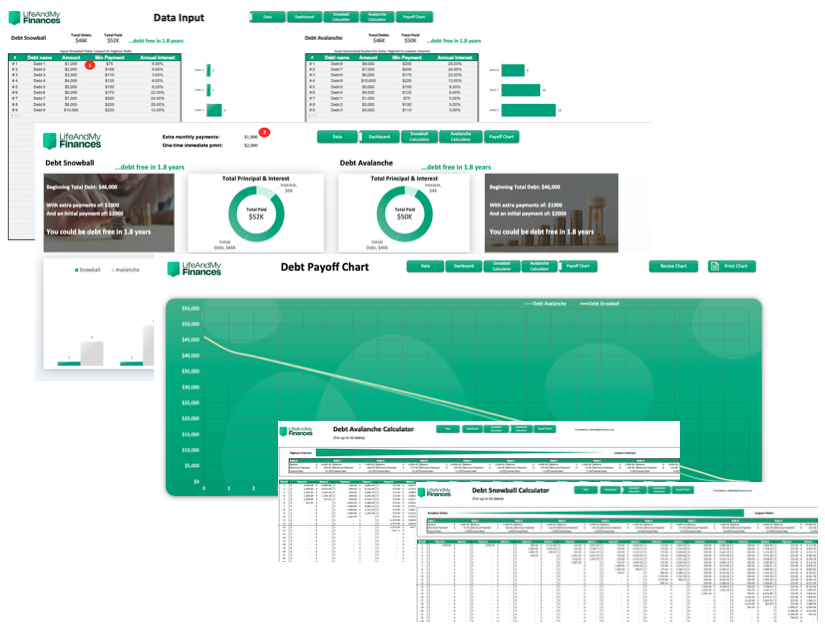

Here's what the main dashboard looks like:

BOOM! Cool, right? Next, how to use it to the fullest!

How to use the debt avalanche vs debt snowball calculator

Using the debt avalanche vs snowball excel spreadsheet is incredibly easy. It's just a quick 3-step process.

Enter all your debts into the left pane of the data tab, debt-snowball style from smallest debt to largest, along with the minimum payments and interest rates of each. The debt avalanche numbers will update automatically on the right-hand pane. Click the update button.

Enter your extra monthly payment and your potential one-time payment in the upper portion of the dashboard.

And then you're done!

The Debt Avalanche vs Snowball Spreadsheet: Understanding the Results

The tables above each of the debt methods will show...

Your total debt amount

The amount you'll end up paying with interest

And, the number of months it will take you to become debt free

Study each table to see how quickly you'll get out of debt with the debt snowball method and the debt avalanche method. Then, there's another great visual as well - the bar charts next to each one of your debts where you can see how long it will take you to clear out each debt!

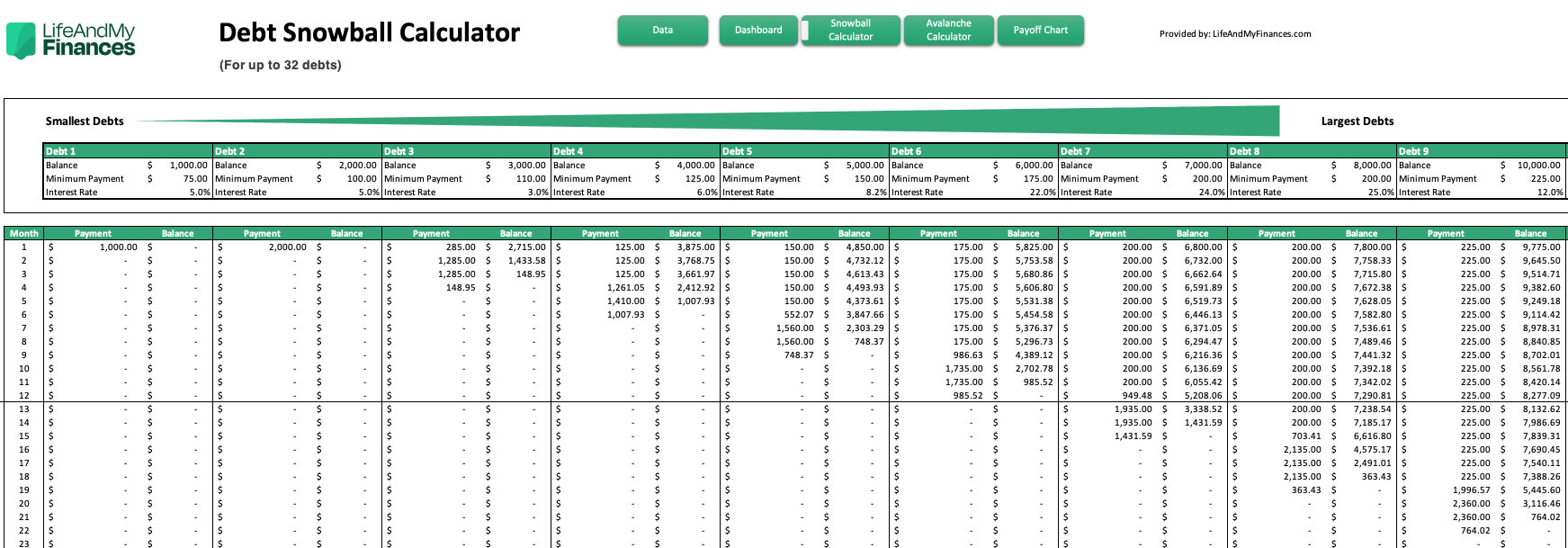

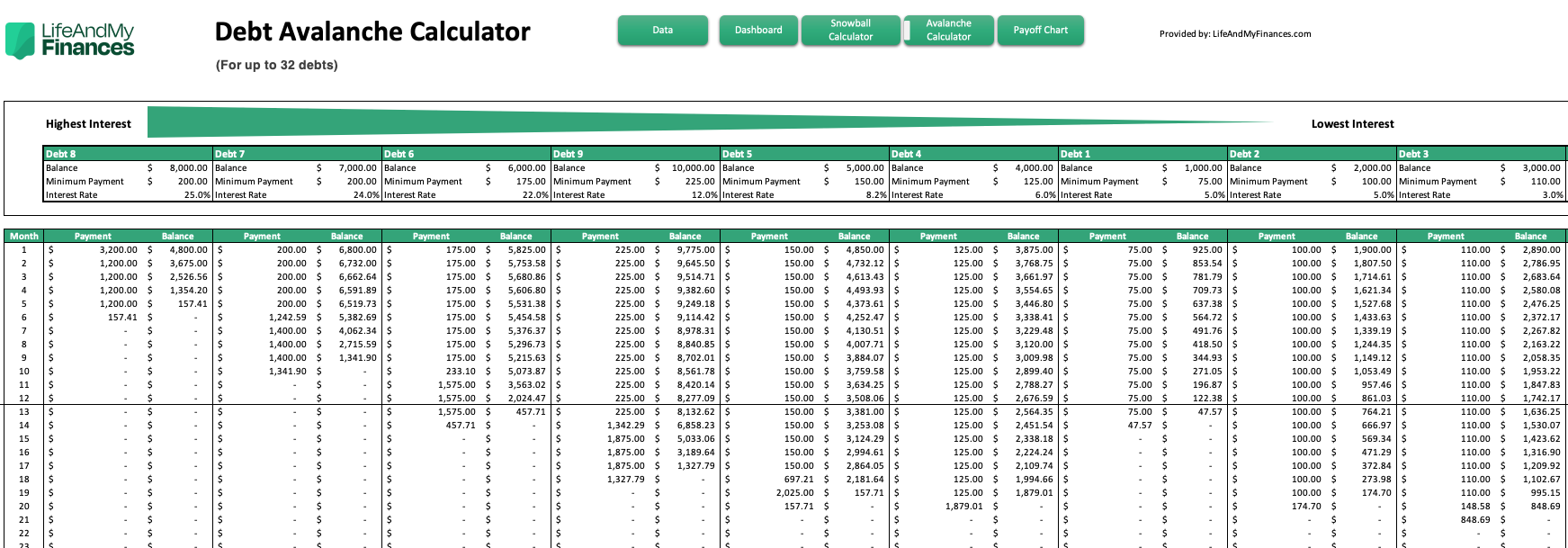

Dang, I wish I had this tool when I was getting out of debt! And finally (yes, there's still more that you can see with this tool), if you want to see the detail behind each debt payoff, there are tabs for that as well! For the screenshot above, the total debt load was $6,000 across three debts: one for $1,000, one for $2,000, and the other for $3,000, all with different minimum payments and interest.

Want to see how those numbers calculate out with the debt snowball vs the debt avalanche? You can! The detail is also part of the tool!

Here's a screenshot of those tabs:

Debt Snowball Payoff Detail

Debt Avalanche Payoff Detail

Can you even believe I'm offering this tool for free? If you haven't done it yet, download the free debt snowball vs debt avalanche excel template here.

And, if you have more than 8 debts, but still really love the tool, head to my Etsy page and download the 32-debt debt snowball vs avalanche excel spreadsheet there!

Or, click below:

At $14.99, this tool is a steal. Most Etsy sellers are selling the debt snowball tool by itself for $15. This tool provides the detailed tabs of the debt snowball AND the debt avalanche. AND, it also provides you with an easy interface to enter your debts and seamlessly see your debt payoff results!

This tool could easily be worth $30+, but I'm selling it for just $14.99 because I want you to have it. It's something that nearly everyone on this planet could benefit from!

Check it out! Message me on Etsy if you have any questions at all!

How to Use This Tool to Pay Off Your Debt Faster

Want to get out of debt fast? Of course you do. We all do. Nobody wants to be in debt longer than they have to be. In addition to being able to see the progress of the debt snowball vs the debt avalanche, this tool also allows you to tweak your extra payments - both monthly and at the beginning of your debt payoff journey.

If you initially put in all your debts and extra payments into the file and it says it will take 5 years to pay off all your debt, it's time to change the script!

Increase your income

Add more to your monthly payment and get out of debt faster!

This tool could just be your ticket out of debt! I really hope it is!

Debt Avalanche vs Snowball Method Calculator - Is It For You?

If you have always wondered what the most effective way is for you to pay your debt off, and you just haven't done it because you don't know...then you probably want to download this tool. (Start with the free version just to check it out!)

With the debt snowball vs avalanche calculator, you can visibly see how long it will take you to pay off your first debt, your second debt, the third one, etc. All the way until they're all gone! If it takes you more than 6 months to pay off your first debt with the debt avalanche method, I'd say don't do it. Use the debt snowball method instead.

If, however, that first payoff timeframe is roughly the same between both methods, then I'd probably go with the debt avalanche method. You'll pay less interest that way!

Sources

Trudel, R. (2016, December 27). Research: The Best Strategy for Paying Off Credit Card Debt. Harvard Business Review. https://hbr.org/2016/12/research-the-best-strategy-for-paying-off-credit-card-debt

.jpg)