There are a number of advantages debt consolidation loans have to offer, but the commitment is significant. By taking a variety of debt and consolidating it, the risk associated with default on each of the individual loans is now in one place.

Consolidation Loans

The lending institutions writing these loans want to make sure they're protected when assuming this risk. That's why debt consolidation loans are usually secured with collateral; often using a home or another valuable asset. This is perhaps the most important factor to understand before entering into an agreement with a lender.

Disadvantages

Additional Resources |

Debt Consolidation Service Car Title Loans Rent-to-Own Tax Refund Loans Car Title Loans |

Since the loan is secured by collateral, a lender can attempt to seize property if the borrower goes into default. Consolidation loans must not be entered into without giving thought to the possible consequences. On the one hand, an individual is attempting to gain control over their debt. On the other hand, they are risking the loss of their home. While it's possible to get an unsecured loan, lenders will be very selective. The borrower will need both a good credit rating and a reliable source of income. These two traits would be uncommon among the same individuals in need of this type of loan.

Advantages

The possibility of lower interest rates is the single biggest advantage a debt consolidation loan offers consumers. Lenders can afford to offer lower rates because their fixed costs to process payments and the application can be spread out over a larger loan.

Since the consolidation loan will be used to pay off a number of smaller loans, the borrower can focus on making one monthly payment. Consolidating also allows debtors to understand how much money is owed to creditors.

Credit Reporting

Most lenders, including credit card issuing companies, report repayment patterns to credit reporting agencies. Missing monthly payments will negatively affect both credit reports and scores over time. Since the consolidation loan will make it easier to track monthly payments, it should also help maintain a better credit score.

Finding Loan Consolidators

As credit card debt continues to grow, so does the sophistication and number of solutions available to consumers. While finding debt consolidation loans is a simple process, finding a reputable lending institution is a little more difficult.

Online Services

The best online debt consolidators are those that also have a physical presence. They might be a subsidiary of a bank, or a standalone company that's been providing loan services well before the online community evolved. It's also possible to find quality non-profit debt counseling member companies by searching the National Foundation for Credit Counseling or NFCC website. In addition to providing consumers with information on budgets and home economics, credit counselors can help consumers find consolidation loans too.

Non-Profit Organizations

To determine if an organization is considered a nonprofit service provider, look for a statement referencing IRS 501(c) (3) non-profit charitable organization status. Websites usually have this type of information in their "About" section. Nonprofit companies will offer free debt or credit counseling. This service can help determine if a family needs help beyond financial planning or a loan. The best debt counseling organizations will introduce the concept of budgeting. They'll also put together what's called a debt management plan, or DMP. While a loan can help organize debt, it won't address the problems that caused its buildup.

Student Loans

In addition to providing students with a way to manage their loans, Sallie Mae also offers former students consolidation services. It's possible to choose from convenient repayment options including level, graduated, extended, and an income-sensitive plan. Sallie Mae offers loan consolidation if the applicant has:

A private student loan from a bank or credit union

At least $5,000 in student loans

A good credit rating or a cosigner with a good credit rating

Already graduated, or will be graduating from a postsecondary program

The Department of Education also runs a Direct Consolidation loan program that can help former students to better manage their loans, and sometimes find lower interest rates too. Additional information on this topic can be found in our article: Student Loan Consolidation, or by visiting the Department of Education's loan consolidation center.

Traditional Lenders and Professional Services

This next group can be split into two subsets of providers, the first of which includes traditional lenders such as banks and credit unions. These lenders offer home equity loans, lines of credit, home refinancing, and personal loans. There are also professionals that specialize in finding debt consolidation loans and providing financial educational services to consumers too. The offerings of this group are identical to those of the nonprofit counselors. But unlike the nonprofit organizations, consumers will be paying a premium for the professional's expertise. Before working with any counselor, it's important to understand the value-added services they will provide, and carefully study the terms and conditions of the contract.

Home Equity Loans

Lenders will allow homeowners to borrow money if they have enough equity in their home. Equity is calculated by taking the current market value of the dwelling and subtracting mortgages or other loans using the home as collateral.

Home Equity Example

If Bill's home is worth $300,000, and he has $70,000 left on the original mortgage, then Bill has $300,000 - $70,000, or $230,000 of equity in his home. Lenders will typically allow homeowners to borrow up to 80% of the equity they have in their home. This means Bill could borrow up to $240,000 x 80%, or $192,000. The payback term of a home equity loan is usually in the 5 to 20-year range, which is nearly as long as a mortgage. This timeline can lower monthly payments to a more manageable level. Another nice feature of a home equity loan is the fact closing costs do not apply. The problem with using a home equity loan to consolidate debt is it doesn't address the cause of the problem. If the individual continues the same pattern of overspending, they will end up in the same situation again. A home equity loan treats the symptom, but it does not stop overspending.

Income Taxes

Generally, homeowners can borrow up to $100,000 and still deduct the interest when they file their federal income tax returns. It's a good idea to check with a tax accountant or investment advisor to see how the IRS code applies to a given situation.

Cash Out Mortgages

A cash-out mortgage involves the refinancing of a home with a new primary mortgage that is large enough to provide money to use for other purposes, such as paying off outstanding debt.

Cash Out Mortgage Example

Let's say Bill has a home worth $300,000, with $80,000 left on the original mortgage. With a cash-out mortgage, he might decide to refinance his home with a new loan of $110,000. Bill can use $80,000 of the new loan to pay off the old mortgage. He would then have $110,000 - $80,000, or $30,000, to pay off his credit card balances and other debt. The large size of a cash-out mortgage should result in a lower interest rate relative to other loans. The interest charged on the mortgage payment should also be fully tax deductible. The longer payment terms on first mortgages effectively spreads the consolidation loan over a longer period of time. Unfortunately, a cash-out mortgage requires a home closing. This means the borrower will need to pay closing costs and attorney fees. If the existing mortgage has a lower interest rate than the cash-out mortgage, then a home equity loan might be the better choice.

Evaluating Offers

When it comes to money, it's critical to carefully evaluate an offer before making a commitment. Some of the factors to look out for in the "fine print" include:

Fees: including the impact of loan origination fees, service charges, and application fees on the total cost of the loan.

Loan Terms: when evaluating a loan, it's important to examine both the annual percentage rate offered, as well as the term on the loan. The interest rate is the cost of borrowing, while the term is the length of time it takes to pay off the loan.

Credit Repair Services: there are only two services an agency is able to legally provide: financial education and correction of errors found on a credit report. If a report is found to contain an error, the credit repair service can help expedite the process of getting it corrected.

Calculators

Anyone that would like to see what a consolidation loan might cost each month can use one of the many online calculators found on this website, including:

Consolidation Loan Calculator: allows the user to bundle existing debt into a consolidated loan, and see what the monthly payments would be for the larger loan.

Refinance a Mortgage: if there is an existing mortgage, this calculator can model refinancing as an option.

Credit Card Payoff Calculator: allows the end user to see how much money it might take each month to pay off existing credit card debt.

Debt Reduction Calculator: similar to the above calculator, this tool helps to build a plan to reduce debt.

Student Loan Payoff Calculator: helps to figure out what it might take to pay off existing student loans.

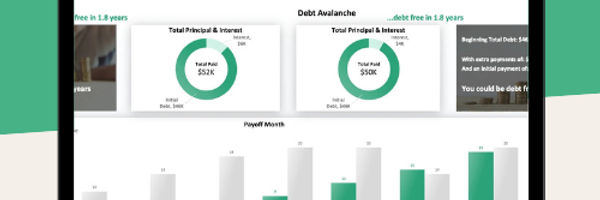

The debt snowball or the debt avalanche? This template will give you answers 💡

This template is:

Compare which method works for YOU

Fully automated and beginner-friendly

Includes both, debt snowball and debt avalanche templates in one with all the features!

About the Author - Debt Consolidation Loans

.jpg)

.jpg)