Want out of debt? Good for you. The only problem is, it all sounds so confusing. There are so many methods, terminologies, and calculations. How do you even do it? This is where I've got you covered.

I created a free debt avalanche excel spreadsheet to take all the guesswork out of your debt journey. Just enter in your debts and the free debt avalanche payoff worksheet will do the rest 👇

Want to get out of debt this year? This avalanche debt payoff spreadsheet is what you need!

A few top features of this template:

Fully customizable and easy to “play around” with

This tool is awesome for motivation!

Room for up to 32 debts!

But I'm getting a little ahead of myself here.

You want to get out of debt. Let's first go through the basics of what you should do, then I'll introduce the free debt reduction spreadsheet, and then we'll talk about one other method that might work for you too (don't worry, it's not complex—just another simple free tool that I made).

Let's hit it. And let's get you out of debt—

Similar tools and concepts:

Free Debt Snowball Spreadsheet and more explanation on the Debt Snowball Method

FREE Debt Snowball vs Avalanche Calculator and a more extensive explanation of the Debt Snowball vs Avalanche Method

What Debts Should I Pay Off First?

First things first. What debts should you pay off first—

Your student loans?

Credit card debt?

Mortgage loan?

Which type of debt should you pay off first?

The general rule of thumb is to start with your consumer debt (i.e. your non-mortgage debt).

This includes payday loans, government debt, credit cards, medical bills, car loan debt, student loans, etc. Again, pretty much every kind of debt other than your home mortgage.

Okay, so of the consumer debt, where should you start? Which debt should you pay off first?

Put simply, pay off the debt that's doing you the most harm.

Number one on the list should probably be government debt (since they have infinite power and can actually take money out of your bank account to pay themselves).

If you owe the government money, it's likely backtaxes that you haven't been able to pay. Don't upset the government. Pay them what you owe and be done with it.

Beyond the government debt, you want to pay off the obscenely high-interest debts, which means payday loans and super high-interest credit cards. But after ticking off the obvious debts above, what's next?

This is where the answers become less clear (everyone has their own opinions).And, this is why the debt avalanche excel spreadsheet is such an awesome tool. More on this coming in the sections below.

Want to set up your debt avalanche worksheet in just a few minutes? Check out our digital tools on our shop. Make a small investment, get your instant download, and create a plan to become debt-free today.

One of our clients, Courtney, had this to say:

"SAVED my life! This spreadsheet guided us to the path of being debt free in 2 years! And even mortgage free in 8! It has motivated us! Thank you so much!"

Want to see how the avalanche tool works? We made a quick video for you:

How Long Will It Take to Get Out of Debt?

Here's another great question that everyone seems to be asking, "How long will it take to get out of debt?"

If you have $20,000 of debt and you have an extra $200 to put toward the debts each month, it will take you 100 months to pay it all off, right?

Wrong.

First off, you're forgetting that when you pay off that first debt, you have now freed up more money that can be used toward the next debt, which of course means that you'll pay it off faster than your estimated 100 months.

Second, people often underestimate themselves. You can often spend less per month and find a way to make more income too, which severely changes how long it could take you to pay off all your debts.

For many, if they could just pay an extra $100 or $200 a month toward their debts, it could save them years of debt payoff time.

If you want a crystal clear picture of how long it will take to get out of debt, use the free debt avalanche Excel spreadsheet that's linked a few sections below. With it, you'll see exactly how much time it will take you to pay off all your debts.

Related: Free Credit Card Payoff Spreadsheet

(Want Something More? Check Out Our New Get Out of Debt Course!)

Want to get out of debt even faster?

We recently created a full get out of debt course. This is for those that want more. For those that want to pay off debt fast. For those absolutely hate their debt and want it gone for good.

This course includes the debt snowball spreadsheet, but also includes sooo many more extras!

This course includes...

The debt snowball vs. debt avalanche calculator ($15 value)

The weekly and monthly budget template ($10 value)

An early mortgage payoff calculator ($10 value)

80 minutes of video instruction ($200 value)

A complete slide deck of the video

A full workbook

And a live Q&A session with me in the next few weeks... ($100 value)

That's $335 of value...all for just $79? Yeah, we're doing that! Oh, and if you buy it and you're not satisfied, we'll give you a full refund.

It's a complete steal—we truly want to help as many people as possible.

If you want to get serious about your debt payoff journey, take the course. You won't regret it. I can't wait to meet you and hear your questions in the live Q&A!

How Do You Create a Debt Spreadsheet?

Alright, so you're ready to jump in and pay off your debts. Good for you. It's time to get organized and put all your debts down on paper or in an Excel spreadsheet.

You've got to know—

What debts you actually have.

What's owed on each one.

The interest payment for each.

And, the minimum payment on each debt.

Seems like a lot, but it's really not that big of a deal. Just check out your monthly statements for each debt. All the info should be on them. Once people do that, the next natural question is, "How do you create a debt spreadsheet?"

How to Create a Debt Spreadsheet

Here's my advice for them. Don't. Use my free debt avalanche worksheet. It will save you hours of time.

Over the years, I have created multiple debt tracker spreadsheets and I offer them for free on my website.

If you want to download them, simply keep scrolling. You'll find the free debt avalanche Excel spreadsheet in the nearby section below, and you'll also find the debt snowball Excel template soon after that.

And, if those debt payoff downloads don't have enough lines for all your debts, I created some larger, more robust debt payoff Excel worksheets that you can buy through Etsy for less than $4.

So, again, if you're asking yourself the following questions—

"How do you set up a debt spreadsheet?"

"How do you track debt in Excel?"

Or, "How do I make a debt payoff chart?"

Don't worry about it. I've got you covered.

Use the Free Debt Reduction Spreadsheet Instead

It takes far too many hours to create the free debt reduction spreadsheets that I've already created. Trust me, the debt payoff tools I created really work, and you're going to love them.(Again, the free links are just a few sections below.)

What Is The Avalanche Method to Pay Off Debt?

You've likely heard of the debt snowball method of paying off debt. It's where you pay off your debts from smallest to largest (we'll cover more on this later if you're not familiar). But what is the debt avalanche method?

What is the debt avalanche definition?

What is avalanche debt payoff?

The debt avalanche is where you focus on your largest interest debts first.

This debt payoff method is highly regarded by all the math nerds out there since technically, it pays off faster than the debt snowball if you purely look at the math.

Why does the math show that the debt avalanche pays off faster than the debt snowball?

Let's think about this. Let's say you had two debts—

The first debt is $10,000 and has 20% interest on it.

The second is $1,000 and has 3% interest.

So, the $10,000 debt would incur interest payments of $2,000 a year, while the $1,000 debt would only incur an interest payment of $30. With the debt snowball, you'd start with the $1,000 debt and ignore the debt that's costing you $2,000 a year.

That's not a great solution. If you're looking for how to avalanche debt, you'd start with the highest-interest debt and tackle that $10,000 amount first. After all, it has the highest interest rate, so naturally, you'd be paying more per month on it. It's time to get rid of it, and fast. And, by doing so, you're starting your debt avalanche.

How Do You Create a Debt Avalanche Spreadsheet?

Alright, so you decided that you want to avalanche your debt. How do you create a debt avalanche spreadsheet?

I started working on a debt avalanche Excel spreadsheet years ago, thinking it would be easy. It wasn't. Then—when I was finally finished—it didn't always work quite right.

To make a debt avalanche calculator, it took me many dozens of hours of work to develop that initial Excel template, and then it took many years of people using it for me to get the formulas exactly right.

This debt payoff spreadsheet has truly been 5+ years in the making. But you want to make a free debt avalanche spreadsheet. My advice to you? Don't. I already did it for you.

And I'm offering it to you for free.

Just download your free debt avalanche Excel spreadsheet here

It's accurate, it's pretty, and it can handle up to eight debts. (Need more space? Then check out my bigger debt avalanche Excel spreadsheets by clicking the icons below.)

You can either choose the 16-debt option or the 32-debt Excel template. The first is $3.99 and the second (huge version) is just $9.99. At these prices, it's totally worth not trying to create them by yourself.

Oh, and if you're curious about how the debt snowball pays off vs. the debt avalanche, you might want to check out this tool where you can see the payoff journey for each method side by side—

Related: Debt Snowball vs Avalanche Excel Spreadsheet (Free Small Calculator)

Free Debt Avalanche Spreadsheet in Google Docs

Don't have Excel? Want the free debt avalanche spreadsheet in Google Docs?

Lucky for you, all my debt payoff tools work in Google sheets too. Just follow these directions.

Here’s how you can use the debt avalanche spreadsheet in Google Docs:

Then—when the download appears on the bottom of your screen—click on the down arrow and choose to save the file to your computer (instead of trying to open it).

Open Google Drive.

Click “New” in the upper left.

Then click “File Upload”.

Find “The best debt avalanche Excel spreadsheet” that you just uploaded and saved. Select it, then click “Open”.

It will show up on the bottom-right of your screen. Click it.

And then—once it opens—at the top of the file select “Open with Google Sheets”.

If you have questions about either of these tools, I’m happy to answer them. Just reach out to me via the “Contact” link at the bottom of this page.

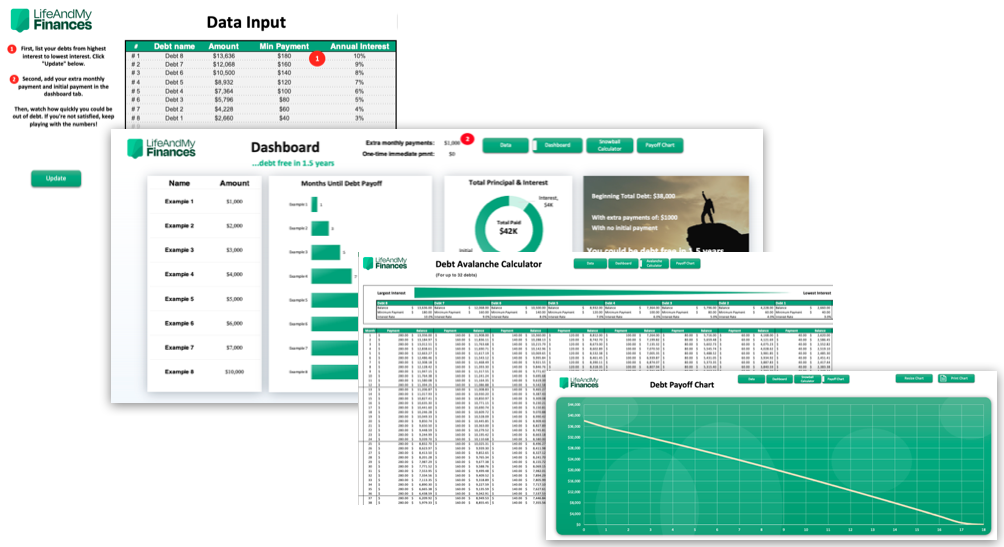

How to Use the Free Debt Avalanche Worksheet

Now that you've got the debt avalanche Excel template downloaded, how do you use it?

While there are a lot of available inputs for your debts and quite a few numbers on the page, the debt avalanche tool is actually incredibly simple to use—

Here's how to use the free debt reduction spreadsheet in Excel:

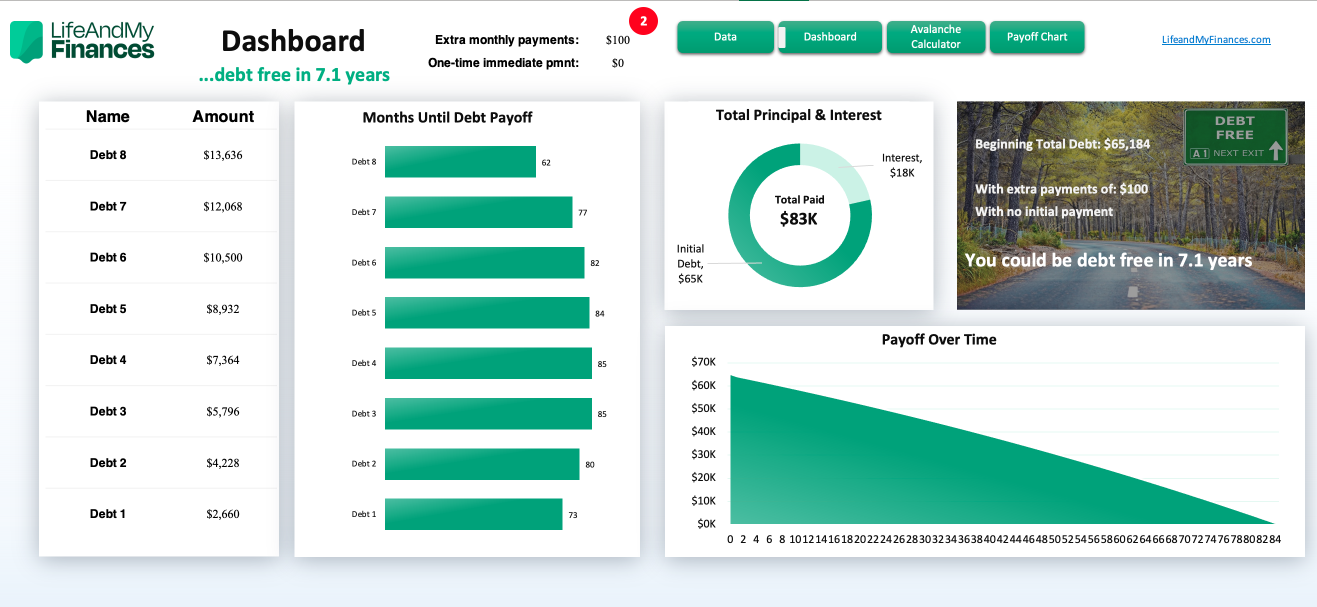

Input your debt—from the highest interest down to the lowest interest (from left to right) in the data tab. Be sure to include the debt amount, the minimum payment, and the interest percentage.

Then adjust the two amounts at the top of the dashboard tab—the additional monthly payment, and the one-time amount you can put toward your debts to give it a kick-start (perhaps you have some savings that you'd like to throw at the debt).

After this, just look at your debts and how they are paying off. When are all your debts gone? How long will it take for you to be debt free?

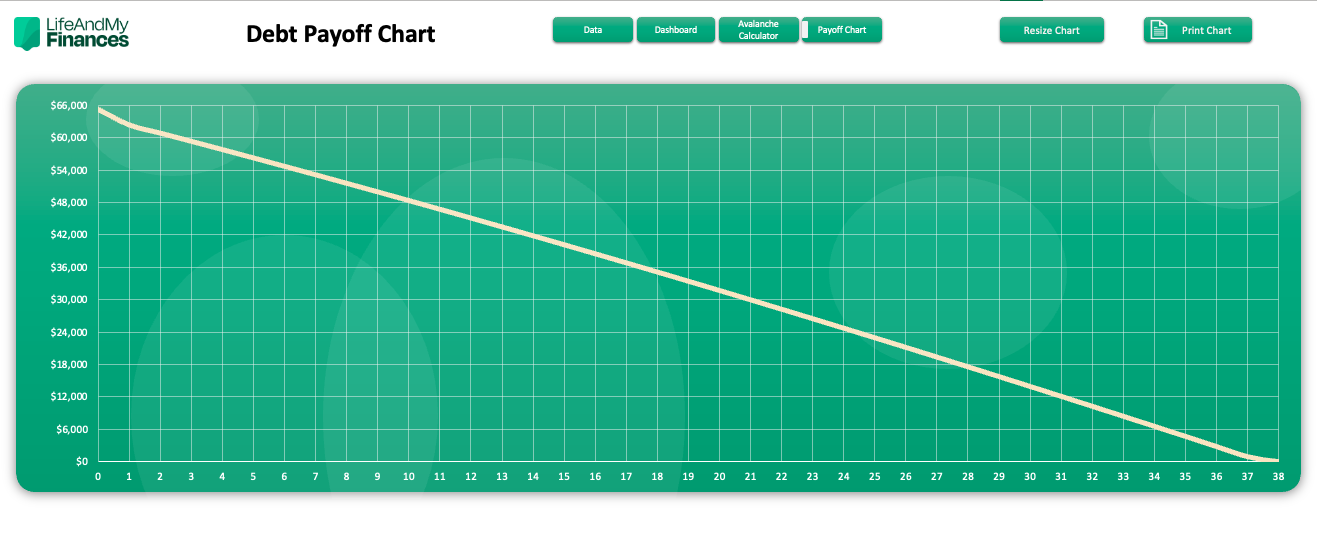

If you'd like to see your debt payoff in chart form, just go to the debt payoff chart tab and click "Refresh". You can even print this out and use it as a debt payoff printable chart.

Super simple, right? It really is.

The best part though, is tweaking your one-time extra amount and the extra monthly payment amount. You'll be amazed how much of an impact these numbers can have. If you could just spend a little less during the month or earn a little more, you could really decrease your debt payoff timeframe.

Try it. Play with it. Use this free debt avalanche Excel spreadsheet to get out of debt.

Debt Avalanche Worksheet With Extra Payments?

One other question I get a lot. When using this free debt payoff worksheet in Excel, is it possible to add extra payments along the way? It certainly is.

While we don't have this part of the file looking pretty (yet), if you have an extra chunk of change that you want to throw at the debt (above and beyond the extra monthly amounts you're already planning on), you can simply hop into a specific cell and enter, "+200" at the end of the formula (or, you know, whatever the additional dollars are that you're putting toward the debt that month.

The debt avalanche calculator will figure out the rest. Now, on to the other method besides the debt avalanche. The debt snowball—

What is the Debt Snowball?

It's time to switch gears here. When people ask about the debt avalanche, naturally, they also want to know about the debt snowball. So let's dive into the debt snowball and take a look at all its advantages and disadvantages.

I used the debt snowball just a few years back. It helped me clear $21,000 of debt in just six months, and then I used the concept again to pay off my $54,000 mortgage.

So what is it really? What is the debt snowball?

The debt snowball is a method for paying off your debts. You simply line up your debts from smallest to largest and pay them off in that order (smallest first).

Pay only the minimum payments on all debts except the smallest one, and tackle that smallest one with a vengeance until it’s gone.

Then—when that’s paid off—move onto the next largest one (which is now the smallest of all your debts) and tackle that while still making the minimum payments on everything else.

Then just keep doing this until all your debt is gone.

Interest rates are not considered in this method (mainly because the intent is to pay off your debt quickly, so the interest doesn’t matter as much).

Related: Free Debt Snowball Spreadsheet: Excel Calculator With Chart

Why Does the Debt Snowball Work So Well?

This method sounds pretty basic. Why does the debt snowball work so well?

Like I said, I’ve been in debt. I’ve used the debt snowball to get out, and get out quickly.

Here’s my take on why the debt snowball works so well:

The debt snowball is super basic. It’s easy to set up and easy to understand.

You get early momentum when you pay off those smaller debts—it fires you up to keep going and to get after your debts with even more vengeance.

When you pay off those smaller debts, it frees up more money to put toward the next debt. It feels great to put big chunks of money toward debt each month.

When I got started with my debt snowball, I was able to put $200 toward my debts. It felt good to pay down debt, even though it wasn’t a huge amount. Soon I figured out how to make more, spend less, and put more toward the debt snowball.

By the end, I was throwing thousands of dollars on my debt each month. That’s what the debt snowball can do.

What Is a Debt Snowball Spreadsheet?

Okay, so we know what the debt snowball is now—but what is a debt snowball spreadsheet? That's a beautiful question. Since we already touched base on the debt avalanche Excel spreadsheet above, this answer probably won't shock you—

The debt snowball spreadsheet is simply an Excel spreadsheet that's made for someone to enter their debts from smallest to largest, and then show them how long it'll take to pay the debt off.

The debt snowball spreadsheet is a truly useful tool if you want to get out of debt using the debt snowball method.

Related: The Best Debt Snowball Excel Template (And It's Free)

How Do I Create a Debt Snowball Spreadsheet?

As you may have guessed, quite a lot of folks have been asking:

“How do I create a debt snowball spreadsheet?”

“How do I create a debt snowball spreadsheet in Excel?”

And, “How do I create a debt snowball spreadsheet in Google Sheets?”

I had the very same questions a few years back, which is why I eventually made one in Excel. But let me tell you, it isn’t easy. There are so many variables, which leads to a ton of very lengthy formulas.

Lucky for you, I was able to make one. And—even luckier for you—I’m willing to give it to you for free.

So why make one for yourself? Just use mine.

Free Debt Snowball Spreadsheet in Excel

You can find the free debt snowball Excel spreadsheet in the following post and download it immediately.

The Best Debt Snowball Excel Template (And It's Free).

The spreadsheet offers room for eight debts. If you have more debts than this, I built some larger versions that you can find on Etsy. Just click the option you want below, make your purchase from Etsy, and get it immediately. And, the prices are cheaper than anything else you'll find out there. Enjoy!

Free Debt Snowball Spreadsheet in Google Docs

Don't have Excel? Want the free debt snowball spreadsheet in Google Docs? All my debt payoff tools work in Google sheets as well. Just follow these directions—

Here’s how you can use the debt snowball spreadsheet (or the debt avalanche Excel spreadsheet) in Google Docs:

Then—when the download appears on the bottom of your screen—click on the down arrow and choose to save the file to your computer (instead of trying to open it).

Open Google Drive.

Click “New” in the upper left.

Then click “File Upload.”

Find “The best debt snowball Excel template” that you just uploaded and saved. Select it, then click “Open.”

It will show up on the bottom-right of your screen. Click it.

And then—once it opens—at the top of the file select “Open with Google Sheets.”

If you have questions about either of these tools, I’m happy to answer them. Just reach out to me via the “Contact” link at the bottom of this page.

The Debt Avalanche vs Snowball Calculator - Which is Best?

So when you take a look at the debt avalanche vs. the debt snowball calculator, which one is the best? Who wins out?

According to Harvard, the debt avalanche should technically pay off the fastest, since you're paying off the highest interest-rate debt first. But it rarely works out that way—

Why?

Because humans aren't calculators. Let's say your highest-interest debt is $20,000. It makes sense to start with that one—but you won't close out that debt for probably a year.

Do you think you'll keep your motivation for that long? Not likely.

Instead, if you started with a debt that was $500—and paid it off in less than a month—you're going to immediately feel like you're making progress. Naturally, you'll be excited to tackle the next debt, and then the next and the next.

Harvard confirmed this with their study and found that most people tackling their debt should use the debt snowball method. But if you're a genuine nerd and you still love the idea of tackling your debt with the debt avalanche method, then by all means, do it—and do it well.

Again, here's the download link to the free debt avalanche Excel template.

The Best Debt Avalanche Excel Spreadsheet—Time For You to Start

Are you ready to start tackling your debt with the best debt avalanche Excel spreadsheet? If you haven't opened it yet and started putting in your numbers—what are you waiting for?

Download the debt avalanche spreadsheet and figure out how you can pay off your debt the fastest. I can't wait to hear your success story.

Best of luck to you!

Sources

Trudel, R. (2016, December 27). Research: The Best Strategy for Paying Off Credit Card Debt. Harvard Business Review. https://hbr.org/2016/12/research-the-best-strategy-for-paying-off-credit-card-debt

.jpg)