You can use this mortgage cost calculator to estimate the cost of the loan in terms of fees and points paid. This calculator leverages the fact the annual percentage rate, or APR, for a loan is determined using all out-of-pocket costs associated with the mortgage. The closer the quoted interest rate is to the APR, the lower the fees and other upfront costs such as points.

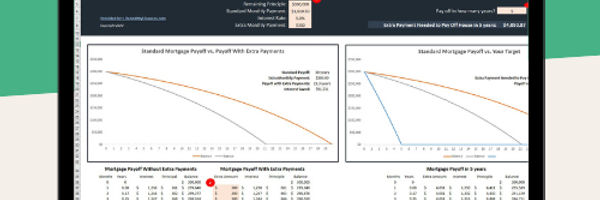

Ready to pay off your mortgage early? This spreadsheet will help you understand what it’s going to take!

With this template, you will get:

Clean and simple with no extra fuss

Fully automated and easy to customize

Future-proofed for any year (be it for 2023, 2024, 2025, or more!)

Works with Excel and Google Sheets

Calculator Definitions

The variables used in our online calculator are defined in detail below, including how to interpret the results.

Total Home Loan Amount ($)

The total amount of money borrowed for this mortgage, also referred to as the principal of the loan.

Quoted APR (%)

This is the annual percentage rate that is used to compute the overall cost of the loan.

Quoted Interest Rate (%)

This is the annual interest rate on the mortgage. This is not the APR, which was discussed earlier. The annual interest rate is used to determine the interest paid on the loan.

Term of the Loan (Years)

This is the original term or length of the personal loan, stated in years. The most common terms for mortgages are 15, 20, and 30 years.

Monthly Payment ($ / Month)

This is the monthly payment necessary to repay the mortgage over its lifetime.

Total Mortgage Cost ($)

This is the total upfront cost for this mortgage. This cost does not include interest or finance charges. These costs may include payment of upfront processing fees, or points associated with this loan. In general, if your comparing two mortgages with the same quoted interest rate, the loan with the lower total mortgage cost is a better deal. This should be reflected in a lower quoted APR.

Mortgage Cost Calculator

Disclaimer: These online calculators are made available and meant to be used as a screening tool for the investor. The accuracy of these calculations is not guaranteed nor is its applicability to your individual circumstances. You should always obtain personal advice from qualified professionals.

.jpg)