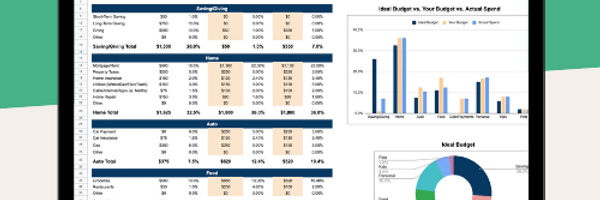

This family budget calculator helps you to figure out how your family expenses compare to an average family's expenses. Using information from the Bureau of Labor Statistics, this calculator allows you to input your monthly or annual expenses in each of 14 different categories, the calculator then figures out the percentage spent in each category and compares your budget to the national average.

Simple, quick, and easy monthly budget template for Google Sheets and Excel.

With this template, you will get:

Pre-set expense categories

Simplified dashboard and day-by-day monthly tracker

Automated charts for comparison

Day-by-day views for budgets and actual spend

Calculator Definitions

The variables used in our online calculator are defined in detail below, including how to interpret the results.

Average Annual or Monthly Income ($)

Additional Resources |

Credit Card Payoff Calculator Debt Ratio Calculator Debt Reduction Calculator Lump Sum Debt Reduction Calculator |

This is your average annual or monthly income, stated in after-tax dollars. This value will be used later in the calculator to figure out the total monthly or annual savings.

Family Expenses (Annual or Monthly)

This next section allows you to input either your monthly or annual family expenses in each of fourteen different categories. These categories of costs include: food, alcoholic beverages, housing, clothing, transportation, healthcare, entertainment, personal care, reading, education, smoking or tobacco, other expenses, contributions, insurance and pensions. Where necessary, explanations are given below.

Food ($)

Your family food expenses should include both dining away from home, and money spent on groceries eaten at home.

Housing ($)

Housing expenses should include mortgage payments and property taxes, home repairs, furnishings, and utilities.

Transportation ($)

Your family transportation budget or expense should include car leases, car loans, gasoline and maintenance. It should also include any budgeted money for public transportation.

Personal Insurance and Pensions ($)

Personal insurance and pension should include all family expenses including homeowners insurance, life insurance, and payments made to retirement plans such as pension plans and 401k plans.

Family Budget / Expenses

This next section of the calculator displays the results of your family budget / expenses compared to the national average for each category of expense. Keep in mind this calculator provides budget information as a guide. The real value of this calculator is that it allows you evaluate each expense type and then decide if you need to make an adjustment to your family budget.

Total Family Expenses ($)

This is the total of all the family expenses you've entered earlier. This value is used by the calculator to figure out your total savings.

Total Savings ($)

This is the total family savings each month or year. This value is calculated by taking your after-tax income and subtracting your total family's budgeted or actual expenses.

Family Budget Calculator

Disclaimer: These online calculators are made available and meant to be used as a screening tool for the investor. The accuracy of these calculations is not guaranteed nor is its applicability to your individual circumstances. You should always obtain personal advice from qualified professionals.

.jpg)