Looking for an investment calculator that you can download and keep on your desktop? You came to the right place!

This free investment calculator was built in Excel so that it's easy to use and you can take it with you anywhere, even if you don't have an internet connection!

Download your Investment Calculator Here

When you click the link, the Excel file will begin downloading onto your computer. You'll probably see it in the lower left of your screen.

Once it downloads, just double-click it to open it up. When the file opens, be sure to first, "Enable Editing"

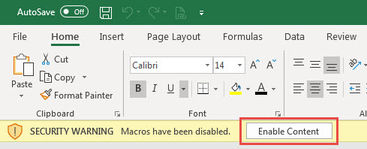

Then, "Enable Content"

Now your investment calculator is open and ready for your inputs!

More calculators and templates:

Using Your New Investment Calculator

This investment calculator is clean, neat, and simple to use. Simply enter in your:

Age

Retirement Age

Current Investment Balance

Monthly Contribution

Expected Rate of Return

Then, click "Calculate" and the chart updates with your own personalized investment estimates! There's even text at the top of the chart to show you your exact dollar figure estimate.

Pretty cool, huh? I hope you enjoy the tool and that it propels you to become immensely wealthy with your investments!

Other Helpful Free Tools

...and many more! Just head to our "Free Tools" page.

Further Detail For the Investment Calculator Inputs

See below for more detail if you're not exactly sure what each of the entries mean.

Age

This one is the most basic entry needed here. Simply enter in your current age!

Retirement Age

When do you plan on retiring? Enter that age here. Also, if you simply want to see how much money you have at a certain age (not necessarily when you retire), you can enter that age here too.

Current Investment Balance

How much money do you have in your investment accounts right now at your current age? That's the amount that needs to be placed in this cell. No need for dollar signs or commas, just key in the number.

Monthly Contribution

How much do you intend to contribute to your investments each month? If you have an employer match, be sure to include those funds too! No need for dollar signs or commas, just key in the number.

Expected Rate of Return

And, what percent do you expect to return on your money?

If your money is in a savings account, it's probably earning you 1% or less

If you invest in individual stocks, the average investor earns 5%-6% this way

But, if you invest in an S&P 500 Index fund, history has shown you could earn 11%-12%

(I personally invest in index funds and use a 10% rate as my estimate) No need for the '%' sign, just key in the number.

Read more on investing:

The Investment Calculator - It's Yours to Keep!

In case you missed it, here's the link to the free investment calculator. Download it, enter your numbers, and save it to your desktop!

Have any more questions? Be sure to ask! Just find the "Contact" link at the bottom of our page. We're happy to help!!

.jpg)