Housing prices are through the roof. Mortgage loan rates are skyrocketing. And, it seems like available homes are still nowhere to be found!

Why Trust Us

Advertiser Disclosure

Is this the absolute worst time to buy a house? Should you buy a house now or wait until 2023? Or maybe you should wait until 2024...? All great questions. Want to know my take? See below for all things home-buying related.

In this post, we're going to answer the following questions:

What time of the year are houses the cheapest?

What is the slowest month for real estate sales?

Why is this the worst time to buy a house?

Should I buy a house now or wait for a recession?

Read it, ponder it, and leave your comments and opinions too!

What Time of Year Are Houses the Cheapest?

You're wondering when the worst time to buy a house is. Before we go there, let's first start with the best time to buy a house! When are houses the cheapest? Houses are cheapest when sellers are more motivated to sell. And when are sellers the most motivated? When they have to move. And fast.

When is the worst time to sell a house? In the winter time. Why?

House hunting isn't any fun in the cold or in the snow

It's an inconvenient time to move (again...it's cold and messy outside)

It's the holiday season, when people are thinking about Thanksgiving, Christmas, New Years...not moving.

So why would people put their houses up for sale in the late fall and in the winter? Many reasons...most of which aren't really their choice:

Job transfer out of state (or job loss)

Moving to take care of an ailing relative

Relationship reasons (either divorce or marriage)

Adult children selling the house of their deceased parents

Financial issues - needing to sell to pay off debts or just to survive

Rarely do people voluntarily decide to sell their house in November...

Curious about mortgage rates?

We'll cover this topic later in the post, but I just couldn't help but bring it up now. See below for some of the best rates that our partner, Credible, has been able to secure with their network of banks. Given where mortgage rates have gone, these actually look pretty fantastic!

Related questions and answers:

Ready to pay off your mortgage early? This spreadsheet will help you understand what it’s going to take!

With this template, you will get:

Clean and simple with no extra fuss

Fully automated and easy to customize

Future-proofed for any year (be it for 2023, 2024, 2025, or more!)

Works with Excel and Google Sheets

What is the Slowest Month For Real Estate Sales?

So winter might be one of the worst times to sell a house, but what about the actual month? What is the slowest month for real estate sales? See below for a chart of U.S. home sales by month over the last 10 years, provided by Trading Economics.

When you look at the data, it's pretty evident that home sales rise in the spring and summer, and then typically drop in the fall and winter. So which month is the absolute worst month if you're trying to sell your house?

According to many different sources, and it's confirmed by the chart below, the absolute slowest month for real estate sales is December. If you try to sell your house in December, plan on giving it away at a discount!

Is Now the Worst Time to Buy a House?

Alright, so we spent a few minutes talking about the worst time to sell a house (which is essentially winter time, with the worst month being December).

What is the worst time to buy a house? Housing prices are certainly up now. Is now the worst time to buy a house? When I was exploring the answer this question, I found the chart below to be super helpful!

This chart was put together by the Federal Reserve Economic Data agency (also known as FRED), and it is incredibly useful when exploring the worst time to buy a house. From this chart, I noticed two major housing trends:

Over time, the value of housing goes up. Back in the 1960s, you could buy a house for $20,000. Today, an average house costs nearly $500,000!

Housing prices are often impacted during and after a recession (gray bars denote recession years)

So let's put that into perspective today. Housing prices have shot up in the last couple years. Does that mean that now is the worst time to buy a house? Not necessarily...

Is 2022 a Good Year to Buy a House?

What about if you've been looking at homes for a while already? What if you have a bunch of money saved up and could make a sizeable down-payment? Does that change the story a bit? Is 2022 a good year to buy a house?

Well, you've got a few things going for you:

Per the above chart, housing values typically go up, so if you're going to buy and hold, there's not really a bad time to buy a house.

If you have at least 20% saved up for a down-payment, you'll likely never be under water on your house, even if it does go down in value for a bit.

Sooo...is 2022 a great time to buy a house? Not really. Supply is down, demand is up, and this is prompting premium prices in housing. So if you're looking for a deal on a house, now isn't the time.

Is It a Bad Time to Buy a House in 2022?

Would I go so far as to say that it is a bad time to buy a house in 2022? If you're looking to buy a home because:

You feel like if you don't now, you'll never be able to afford one

You want more space

Your spouse says you both deserve it

You think it's just something you're supposed to do by the time you hit 30...

...But, you're not really ready for the payments, the maintenance, the insurance costs, and the unforeseen emergencies that come with it...then NO, you should not buy a house.

And yes, 2022 is a terrible time to buy a house! If, however, you're patient, you have the appropriate funds saved, and you want a house because you plan to enjoy it for 10+ years of your life, then who cares what year it is or what it costs compared to 1965. Just do it, make the reasonable payments, and live a lovely stress-free life in your new home.

Why Is This the Worst Time to Buy a House?

So why is 2022 such a bad time to buy a house? As you can see by the chart we utilized earlier in this post, ever since 2020, the price of homes have skyrocketed.

Why is this? Why have the prices of homes gone up so much?

According to c|net, there are 6 reasons home prices have continued to jump:

Continued supply chain disruptions - ie. Housing materials are hard to come by

Low existing home inventory - With uncertainty in the future economy, many people are choosing to stay in their homes and work toward financial stability, rather than upgrading and continuing to live paycheck to paycheck

Sellers feel stuck - Since it's so tough to find a place to buy, many would-be sellers just aren't selling.

Homeowners are tapping their equity and staying put - With the above issue, many non-sellers are using the equity in their homes to make improvements and improve their quality of life that way.

Rising interest rates - This is a big one right now. Interest rates are on the rise. It's prompting new buyers to jump into the market before the interest rates rise higher, and it's keeping existing home buyers from looking because they don't want to sign up for a higher interest rate than they already have.

Renting is not getting any cheaper - People are tired of throwing their money away. They're ready to buy. This mentality is leading to an increased demand for housing.

Rising mortgage interest rates in 2022. Now, since the prices of homes is so high, it may just be the worst time to buy a house. If you find yourself in a bidding war, or if you're interested in a house only because it's one that you can actually get a bid in on...don't do it!

The market is crazy and it's making people buy houses that they don't even want! Don't do it! If you can't find the property that you want, just wait. Your opportunity is coming.

Will the Housing Market Crash in 2022?

That opportunity...the impending housing market crash...it's coming this year right? The housing market might crash in 2022?... Sorry, but that's just wishful thinking. I don't believe the housing market will crash this year (in 2022).

Here's why:

It's already nearly May, 2022. We're halfway through 2022.

The economy is still booming.

Companies are receiving far more orders than they can fill.

There are more job opportunities now than there have ever been.

It seems like everyone has excess cash flow right now. People have so much money they don't even know how to spend it!

Will the above change over the course of 6 months? I don't think so. The economy will still likely be red hot into the fall, and maybe even beyond that.

Another reason the housing market likely won't crash in 2022:

Typically, there is first an economic stumble. Then the housing market softens after that.

Take a look again at the chart below. Aside from 2008 when the housing bubble actually caused the recession, all the other dips in housing values occurred after a recession and stayed flat for a couple years after.

If you're looking for lower home prices, you'll first need a recession. Then you might need another year or two to land the house you actually want.

Will the housing market crash in 2022? Not likely. You'll have to wait till 2023 or 2024 (more to come on this later).

How to Buy a House in 2022

What if you absolutely can't wait? What if you need to buy a house now? What are my best tips on how to buy a house in 2022? In my life, I have purchased investment property and primary residences, and my home purchasing tips are the same for both:

Always be patient and be willing to walk away if the deal doesn't feel right

Look for what you want, not what's available (because yes, you can buy a house that isn't for sale!)

If you want a deal, look for ugly aspects that are easy fixes (ex. big unruly bushes in the front, pink shag carpet, gold doorknobs, etc.)

Be patient, but be ready. Get pre-approved and have a healthy down-payment saved up. You don't want to miss the next opportunity.

The housing market is still hot. You're either going to have to find a house that's not on the market, or you're going to need to jump on the next listing that meets your criteria.

Either way, you have to know what you want and act quickly when you see it. If you do these things, you're more likely to make a house purchase without overpaying for it.

Is It a Bad Time to Buy Your First House?

Perhaps you're still living with mom and dad. Or maybe you've got a crummy apartment that you reluctantly call your own. Whatever the case may be, you're tired of it and you're ready to buy a place.

But...is it a bad time to buy your first home? Should you try to suck it up and just wait longer?

Unfortunately for you, introductory single family houses are in crazy high demand right now. And this, of course, means crazy purchase prices.

If you think you're just going to spot a home online, tour it a couple days later, and then be the only one to put in an offer...you're sorely mistaken. The housing market is just too hot.

The supply of introductory houses is low

The demand of first-time home buyers is high

And, you likely don't have a ton of cash that could help persuade a seller to choose you over another bidder.

So what should you do? Should you stop looking? Not necessarily.

How to Successfully Buy Your First House in 2024

Is it the worst time to buy a house? Well...maybe not the worst. But it certainly isn't the best time. If you really want to buy your first house in 2022, I suggest you get a good realtor.

Find one that has bought and sold hundreds of houses. They know the process and can help you not only find one, but can give you all the advice on how to put your bid in and close the deal in record time. Don't go about this on your own.

A seasoned realtor will be an invaluable asset to you. Interview them, find the best one, and then listen to their every word.

Is It a Good Time to Buy Investment Property?

How about investment properties? Is it a good time to buy an investment property? For the most part...no.

Single family housing demand is through the roof

Even duplex and multiplexes are in high demand because business men and women have excess cash to invest right now

If you're looking for office buildings, retail space, warehouses, or storage facilities, these are still in high demand, but you've probably got a better shot at buying these for a reasonable price (vs. the insane prices on residential housing).

If you want to buy investment property, you're probably going to have to think outside the box a bit.

Is there commercial property that could be rezoned for residential?

Maybe there's a church that can be bought at a discount and repurposed into apartments or office space?

Or, maybe there's a dilapidated gas station that could become a much needed car wash!

Whatever it is, it might just be your next diamond in the rough. Not many people can think outside the box. If you can, there might just be a great investment property waiting for you out there!

When Will The Housing Market Crash Again?

The housing market crashed big time in 2008. It actually didn't even begin to recover until 2013. Is that coming again? Will the stock market crash again soon? Let's first study the past. Then we can more effectively predict the future.

The Housing Market Crash of 2008

Like I said earlier in this post, the economic crash in 2008 was a bit unique from many crashes in the years prior because the housing market crash actually caused the economic collapse.

In the early 2000s, banks were too frivolous with their lending policies. There were simply too many people getting loans, and for amounts greater than they could really afford.

Eventually, this caught up with the banks, and the spiral of economic doom began...

People began defaulting on their loans

The financial economy suffered

Employment began to take a hit as companies struggled

More people then defaulted on their loans

Which created more economic pressure...which further hurt the housing market.

Like I said...the spiral of doom. So what can we learn from this with our economic environment today?

The Future Housing Market Crash...It's Coming

Right now, the price of housing is high. And, mortgage interest rates are rising higher than we've seen in a long time. But, people still want to buy houses and build houses. So how do they do it? They extend themselves as far as they possibly can financially.

Example of Stretching a Budget for a House Today

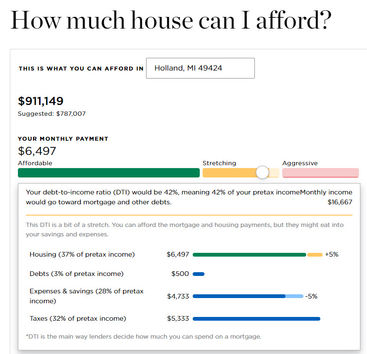

Let's say a couple earns $200,000 combined per year (each makes $100k), and they have $100,000 saved for a down payment. How much house can they afford?

According to Nerd wallet, this couple can afford roughly a $787,000 house with payments of $5,300 per month. With a take-home pay (after taxes) of approximately $140,000 per year, this means the couple will have a $5,300 mortgage with a monthly take-home amount of $11,666.

It seems doable, but there's still car payments, food costs, daycare, and plenty of other odds and ends to cover with that income as well. But, this isn't where the conversation ends.

The dream house couldn't be found for $787,000. It turns out that the house this couple wants is actually $900,000. They discover that they can borrow this amount, so they go for it. Now the monthly payments are $6,500 a month. Pretty tight given their income.

And then...let's say the economy softens. One of them loses their job. Their take-home pay is now $75,000 a year, or $6,250 a month...which is less than their house payment. Not to mention all the other bills they have to pay.

Put simply, they're sunk. They'll default on their loan, they'll get foreclosed on, and someone else will buy their house at a discount for $800,000.

Should I Buy a House Now or Wait For a Recession?

You obviously don't want to be the couple that's outlined above. Does this mean you shouldn't buy now? Is it the worst time to buy a house? As I stated earlier, it's not the worst time to buy a house.

I imagine house prices will still go up in the upcoming year or so. If you're ready to buy and you want to live in that house for 10+ years, then go ahead and buy it!

But...there likely is a recession looming. If you're young and you can wait a couple years before buying a house, you might see some discount prices in the future. And it may just be worth the wait.

So now the question is...when will the housing market finally soften?

Should I Buy a House Now or Wait Until 2023?

When will the economy tank again? Is it 2023? Will we see housing prices finally begin to fall in 2023?

Housing Market Predictions 2023

Like many other financial periodicals and institutions, Fortune predicts that an economic recession is coming at the tail end of 2023.

The rising inflation and interest rates will slow the economic growth and we'll slip into a recession. I certainly don't disagree with that. Not to mention, something might happen with this war in Ukraine that flips the economy on it's head.

That, or we all get scared back inside by the next pandemic...Or who knows what! All I know is, that next thing is on the horizon that will finger-flick us into a recession. No one knows what it is, but it seems to be coming soon. Anyway, I digress.

With this pending recession, will the housing market tank in 2023 as well?

The great consensus...is no. The housing market is hot. It might soften in the future, but it's likely not going backward. Not in 2023 anyway. Things will need to get bad, and be bad for quite a while for housing prices to do a full reversal.

Should I Buy a House Now or Wait Until 2024?

Ok, so the housing market will likely not turn into a bargain barn of deals in 2023, but what about 2024? Will housing prices start to decline then? And therefore, should you wait to buy a house until 2024?

What Will The Housing Market Look Like in 2024?

Per a recent survey from Zillow, most people don't expect the housing market to normalize until 2024. At that point, inflation on housing is expected to be back to the 3%-5% levels vs. the 15% appreciation in 2021 and 2022.

So, the housing market will likely be back to normal, but that just means you won't get into a bidding war on every house you look at. Barring any shift in the general economy, the value of houses will not go down. It just won't rise as rapidly as it has been.

Will The Housing Marketing Crash in 2024?

Most of the experts don't see a housing crash coming. They believe housing supply will grow and begin to better meet the demand. Therefore, the price increase will begin to slow, but will still continue to rise. I see things a bit differently. I see...

housing costs continuing to rise in 2022 and 2023

mortgage rates continuing to creep up

home buyers getting impatient and begin stretching their budget to get into a home that they really can't afford

something affecting the economy and the job market will suffer

people will no longer have the income they were used to and they won't be able to make their high mortgage payments

In other words, people will extend themselves for a house because they see no other way. Then the economy will tank and take the housing market down with it. I see a housing bubble.

CNN Business agrees. It's coming. I believe we'll see a housing market crash in 2024. So is now the worst time to buy a house? It may be if you believe what I'm saying above. If you can wait and it's no big deal to wait, then it might just be worth slowing your role on the next home purchase.

Will Housing Prices Go Down in 2025?

What's the overall consensus for 2025? Will housing prices go down in 2025? By 2025, I predict that all the stars will align for a softer housing market:

Interest rates will continue to rise

Jobs begin to disappear along with demand

Loans will become harder to get

An economic slow down will occur and likely cause deflation

It may happen a bit earlier even, but in 2025, I believe we'll still see the effects of a weak economy and housing values will be reduced because of it.

Housing Market Predictions for the Next 5 Years

How about the next 5 years? What will happen to the housing market between 2022-2026? What do most experts predict?

As I mentioned earlier, most experts have a rosy outlook on the housing market for years to come. I get it when you look at the current conditions. But how often do current conditions stay current? Never. And usually not for long. Something will likely change that's going to hurt the economy. And as I pointed out before, my prediction is 2024.

When Is The Right Time to Buy a House?

If the housing market actually does crash in 2024, what should you do about it today? And when is the right time to buy a house?

If you believe that we're heading into a housing bubble like I do, and you're early on in your search to buy a house, then I'd say now is not the right time to buy a house. If it were me, I'd wait and see what the housing market does over the next couple of years.

After all, most experts do believe that housing values will begin to taper, so it's not like prices are going to grow 20% per year again and leave you in the dust.

Instead, housing values will rise more normally, which will give you the sanity you'll need to properly make a decision about which home you're interested in, and which one you ultimately buy.

On the other hand, if you've been looking for a home for a few years, you have a healthy down payment, the home mortgage is well within your comfort zone (even with a future job layoff), AND you plan to live there for 10+ years, then there's really not much reason to wait.

Find the house you like and buy it for a reasonable price. Ten (or more) years from now, you likely won't regret it.

Is It True? Is It the Worst Time to Buy a House?

Based on what I've seen and read, the housing market will continue to rise for a while, then we may slip into another recession and housing prices will tumble a bit (I predict this to happen in 2024).

Likely though, prices will bounce back in a few years and continue to climb (like they've been doing for centuries).It's pretty easy to know if it is the worst time to buy a house for you right now.

Are you just barely scraping enough cash together to buy a house? Then don't do it. You might get burned.

Do you have a healthy down-payment, you're buying a modest house, and you plan to live in the house for 10+ years? Then do it. Sure, the market will rise, then fall, but it will rise again and your home will eventually be worth far more than you bought it for.

And that's it! The worst time to buy a house? It's not really about the economy. The worst time to buy a house is when you're not financially ready to buy one.

What do you think? Do you agree with my predictions above? A housing market crash coming in 2024?

.jpg)