Buying your first home— Ah, the quintessential American dream! How to start saving for a house?

Whether you’re just curious, drawing up a buying strategy, or already looking for a property, one thing’s for sure—you want to avoid surprises. Home prices are hitting record highs, and mortgage rates are soaring—it’s a great market for sellers. But don’t worry—you don’t have to walk into this minefield defenceless. We’re going to arm you with all the knowledge you need on how much (and how) to save up for a house.

How Much Money Do You Need to Buy a House: Average Cost of Buying a House

If you’re opting for a mortgage to buy a house—save at least 25% of its sale price. This will just about cover your down payment (20%), closing costs (4%), and moving fees (1%).

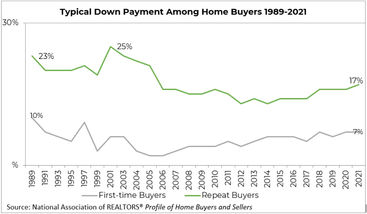

Let’s say you’re buying a house for $300,000—you want to save at least $75,000 in cash to cover initial expenses. Did your eyes go wide? We get it—these numbers look steep. And most people would agree. In fact, the National Association of Realtors says—the average first-time home buyer only made a 7% down payment in 2021.

So why are we recommending a 20% down payment? Simple—anything less than 20% means you’ll pay for private mortgage insurance (PMI) to protect your lender from losing money if you don’t pay the mortgage.

How much do you need to buy a house?

With that in mind, here’s a table with the average costs of buying a $300,000 home:

BUYING EXPENSES FOR A $300,000 HOME | % OF THE HOME PRICE | BUYING COST |

Down payment | 20% | $60,000 |

Closing costs | 4% | $12,000 |

Moving expenses | 1% | $3,000 |

Total buying expenses | 25% of $300,000 | $75,000 |

That was just an overview— now let’s get into the details.

Related questions and answers:

Ready to pay off your mortgage early? This spreadsheet will help you understand what it’s going to take!

With this template, you will get:

Clean and simple with no extra fuss

Fully automated and easy to customize

Future-proofed for any year (be it for 2023, 2024, 2025, or more!)

Works with Excel and Google Sheets

How Much Money Should I Save Before Buying a House: A Detailed Breakdown

Your home buying price will mainly consist of four expenses—down payment, mortgage calculations, closing costs, and moving expenses. Here’s a deep dive into each of these components—

1. Saving for down payment

The money you can afford to put down to purchase your dream home—the more you already have, the less you’ll have to borrow. A larger down payment is also key to impressing your lender—the risk of you defaulting on your loan is lower.

How much do you need down to buy a house?

As much as possible—every penny counts! However—we recommend a minimum 20% down payment. First-time buyers can also save a 5%–10% down payment—but keep in mind you’ll pay a higher mortgage payment + PMI for anything less than 20%. Of course, there are government-backed mortgages like:

Federal Housing Administration (FHA) loans—you’ll need just a 3.5% down payment, and a credit score above 580 to qualify.

VA loans—qualifying veterans don’t have to pay any down payment.

USDA loans—don’t require a down payment, but have income limits and a minimum credit score requirement of 640.

But if you go down this route, you’ll end up paying a ton of extra money (in interest and fees in the long run). Mind you, sellers will typically side-eye you if you’re trying to buy a home with FHA or VA loans. Why? With little to no down payment, your lender will be nit-picky during the appraisal process.

Lenders want to make sure the home is truly worth what you’re paying—just in case you default and they get stuck with the home. (Now, this nit-picky process means your seller has to update a bunch of stuff they don’t want to deal with—so they would rather sell to someone offering a decent down payment.)

Tips on how to save for a down payment

Here are some ways to get down payment for a house and hit your 20% down payment goal:

Browsing first-time homeowner programs to access interest-free loans.

Drawing up a rough budget to identify your overspending traits and cut down on expenses.

Consider breaking the bank and using most of your savings (from CDs to high-yield savings accounts)—make every extra penny go towards your down payment.

2. Closing costs

If you thought a down payment is all you’ll have to worry about—you’re in for a rude awakening. Closing costs are a range of fees your lender and other companies charge you for approving your loan and finalizing the home sale. This typically adds up to 2%–5% of your mortgage loan principal (in fact, ClosingCorp revealed borrowers paid an average of $6,387 in closing costs and taxes in 2021).

What is included in closing costs?

Closing costs include a range of fees:

Appraisal fee—what you’ll pay to have a professional appraiser evaluate your home’s market value.

Origination fee—upfront fee you’ll pay the lender to process your loan application.

Title search fee—fee to examine your property’s historical records.

Title insurance—will protect you against ownership title problems.

Underwriting fee—what you’ll sometimes pay alongside the origination fee to have your loan application processed.

Closing costs can vary from lender to lender—so pay close attention to the origination fee and underwriting fee to see where you can save some money.

Can you avoid closing costs altogether?

No, you can’t avoid paying closing costs—but you can avoid paying them all at once. Ask your lender for no-closing-cost options—they’ll roll these extra expenses into your overall loan. Keep in mind, though, that this might not be a wise move—you’ll end up paying interest on the additional amount.

3. Mortgage payment

Your money woes don’t end on closing day—you’ll also need to figure out your monthly mortgage payments. On the brighter side, this is a predictable cost—so use our free Mortgage Payoff Calculator to figure out the exact amount you’ll owe the lender each month. (For instance—if you’re signed up for a 30-year $300,000 mortgage at 5% interest—your payment is $1,610.50 a month.)

How can I get the best mortgage rate?

A Consumer Financial Protection Bureau study revealed over three-quarters of all borrowers didn’t shop around for mortgage rates. Instead, they only applied for a mortgage with one lender.

Alex Shekhtman, Founder of LBC Mortgage, doesn’t agree with this approach, ''Getting the best mortgage rate requires researching lenders and different repayment plans to find the best fit. You want to compare costs such as loan origination fees, closing costs, pre-payment penalties, and points between lenders. Plus, lenders may give you discounted rates if you have a high credit score—so focus on improving your credit score—by paying down debt and maintaining a low credit utilization ratio.”

What is mortgage insurance?

Like we’ve already said, your mortgage payment will most likely include mortgage insurance if your down payment is less than 20%. The Urban Institute's Housing Finance Policy Center says that PMI typically ranges from 0.58%–1.86% of the original loan amount per year—so for a $300,00 mortgage the PMI would cost anywhere between $1,740–$5,580 a year.

This additional payment keeps your lender in a good spot—even if you default on your loan and they end up with your house. With a conventional loan, you’ll pay PMI until you’ve built up 20% equity in the home. And with a FHA loan—you’ll most pay mortgage insurance, which includes a premium upfront and additional premiums built into your mortgage.

Ready to pay off your mortgage early? This spreadsheet will help you understand what it’s going to take!

With this template, you will get:

Clean and simple with no extra fuss

Fully automated and easy to customize

Future-proofed for any year (be it for 2023, 2024, 2025, or more!)

Works with Excel and Google Sheets

4. Moving expenses

Unless you have a squad full of friends and family helping you move—you’ll need to set aside some extra cash to pay for moving expenses. Expect to pay anywhere from $900–$2,400 for a local move.

How to Prepare to Buy a Home—and How to Save Money for a House

How to save money for a house?

You must have a rough idea of how much you’ll need to save up to buy your new home—but how do you go about saving that kind of money? Here are some tips—

1. Build a budget

Challenge: Answer these questions in less than a minute—

How much money do you make every month?

How much of it covers basic expenses like rent, loans, and utilities?

How much money do you spend on non-essentials?

Where are you spending most of your money?

Good for you if you passed this test. If you didn’t—you’ll need to start budgeting to buy a house. And this doesn’t have to be a complex mathematical drill—use our free Monthly Budget Template to track your income, expenses, and saving potential.

Simple, quick, and easy monthly budget template for Google Sheets and Excel.

With this template, you will get:

Pre-set expense categories

Simplified dashboard and day-by-day monthly tracker

Automated charts for comparison

Day-by-day views for budgets and actual spend

2. Consider downsizing

Be the poster child for all cheapskates! Practice minimalism, reduce your expenses, and live below your means while you save. We get it—it doesn’t sound appealing. But it’s well worth it if it can fetch you your dream home. Some ways to downsize include:

Renting a smaller apartment.

Moving into a more affordable neighbourhood.

Selling an extra vehicle.

3. Pick up a side hustle

When was the last time your boss promised you a raise? (Did they sound as phony as a $3 bill?) You could find a better job—or work a side hustle to supplement your income. Side hustles are lucrative. Sceptical? Well, picking up trash can fetch you over $50,000 a year so— Pull your socks up and get to it. And don’t worry—you don’t have to get lost in an internet rabbit hole looking for side gigs—here you’ll find the swankiest side gigs:

5. Automate savings

If you’re like me—impulse shopping is a part of your personality. None of us is proud of it, and we usually can’t help it unless we automate our savings. Decide how much you want to save towards your down payment each month. Next, contact your bank and simply authorize an automatic withdrawal from your primary account into a separate savings account. Easy peasy. Take it from me (a recovering over spender)—these house saving tips work wonders.

Key FAQs on Saving For a House

Alrighty, let’s answer some more common questions about saving money for house payments:

1. How can you budget for a new home?

The only tough nut to crack is figuring out how much down payment you want to pay. With that number in mind—you can put together a clear-cut monthly budget plan. Let’s say you’re buying a $200,000 house, and want to make a $40,000 down payment (or 20% of the house price)— To save up $40,000 in two years, you’d need to set aside $1,700 each month ($40,000 / 2 years / 12 months = $1,700).

2. Where to save money for a house?

Your savings fund isn’t your investment fund. (Read that again.) If you prioritize making interest money off of your savings, you’ll end up parking your savings in an investment pathway that offers low liquidity. There’s nothing worse than saving up for a financial goal—and not being able to access your funds when you need them. Make sure your house-buying fund is parked in simple money market accounts, high-yield savings accounts, and CDs.

3. When Should I Start Saving for a House?

Start as soon as you think you’re ready. But how do you know if you’re ready? If you’re debt-free and have an emergency fund covering your living expenses for 3–6 months—we reckon you’re good to go. (Not debt free? Check out our Debt Snowball Spreadsheet to help get you started.)

Key Takeaways

You’ll need to save at least 25% of the house price if you’re opting for a mortgage—this includes a 20% down payment, 4% closing costs, and 1% moving expenses.

A 20% down payment can help you avoid paying for private mortgage insurance (PMI).

Closing costs can total up to 2%–5% of your mortgage loan principal. (For reference, borrowers paid an average of $6,387 in closing costs and taxes in 2021.)

Get the best mortgage rate by researching lenders and comparing costs, such as loan origination fees, closing costs, pre-payment penalties, and points between lenders.

Consider tactics like downsizing, working a side hustle, and automating savings, to quickly build a home-buying fund.

.jpg)