You’re looking at houses. (Exciting!) But there’s a problem—all the houses on the market suck.

The asking prices are insane.

They’re old, dark, and dungy.

The layouts make no sense.

People are bidding before you even know the home exists.

And they’re often in some obscure location that’s going to annoy you for life (like, next to the fire station, on a busy road—or right underneath a major fly zone).

Screw it. Why not just find a plot of land you like and build something you’ll love for decades (vs. never)? If you’re going to spend a whack load of money, you may as well do it on your forever home, right? So now the big question—how much does it cost to build a house?

Well, it’s not cheap—but you knew that already. The real question at this point is, “Is building a home worth it?” Let’s lay out the details—so you can make the most informed decision possible.

First up, if you're building a house, you need a solid tracker in place. We've created one just for that 👇

Perfect spreadsheet for any home renovation project 🏠

This template is:

Easily customizable for any project

It comes with examples and ready to use

It can be used in Excel or Google Sheets

Average Cost Per Square Foot to Build a House

The price per square foot to build a house is currently $202. If you wish to build a 1,000-square-foot house, it’ll cost you roughly $202,000. (If you want a 2,000-square-foot home, the cost will be around $404,000.)

Average Size of New Home Construction

In 2022, the average single-family house was 2,561 square feet. (The median size of a single-family home was 2,338 square feet.) (To help you relive your high-school years of math here (yay!)—the average is when you add up the total square feet built in the US and divide it by the number of houses.

The median is when you line up all the house build sizes from smallest to largest and pick the middle one. The average is usually higher because of people like Tiger Woods and Ellen DeGeneres building crazy-expensive $70 million houses.)

Average Cost to Build a House

The average house costs $517,700 to build. This assumes a size of 2,561 square feet at a cost per square foot of $202. If you want to build the median-sized home of 2,338 square feet, this will cost you around $470,600. (These facts and figures are for September 2022, and come from the NAHB—National Association of Home Builders.)

As a comparison, existing homes (those crappy ones thatdon’t meet your criteria) of the same size are $390,000. (Much less, but certainly not as new and shiny.)

That’s a quick snapshot—but as with anything, we should dive deeper to understand the costs of whatyou want (based on the number of bedrooms, location, and perhaps even the type of house).

Related questions and answers:

Cost to Build a House by Size

The average price to build a house is $517,700. Yeah, that’s pretty steep—very few people can afford that. After seeing that eye-popping figure, you might start asking yourself questions like:

“How much does it cost to build a small house?”

“What’s the average cost to build a 1,500 sq ft house?”

“What about the cost of a 1,000 square foot house?”

Or, maybe you’re filthy rich, and wondering about something bigger—like the cost of a 2,500 square foot home (or perhaps even a larger, 3,000-square-foot house). Check out the table below to see the approximate cost of building a house for these various sizes—

NEW HOME BUILD SIZE | AVERAGE TOTAL BUILD COST (BASED ON SQUARE FOOTAGE) |

1,000 sq ft | $202,000 |

1,500 sq ft | $303,000 |

2,000 sq ft | $404,000 |

2,500 sq ft | $505,000 |

3,000 sq ft | $606,000 |

Is It Cheaper to Build a House?

It’s not cheaper to build a new construction home. (Ouch.) New builds are usually about 25% more expensive than existing homes on the market. So—if a house in your desired neighborhood is $400,000—it’ll likely cost you $500,000 to build a similar-style home in that same location. (Sorry to burst your bubble.)

There are plenty of advantages to a new home, though—including brand new appliances and HVAC units—which means your maintenance costs should be non-existent for the first few years. (Pro tip here: If you’re looking to sell your spouse on a new build, lead with this—not the 25% higher costs of the new home construction.)

NEW HOME BUILD SIZE | AVERAGE TOTAL BUILD COST | AVERAGE COST TO BUY AN EXISTING HOME |

1,000 sq ft | $202,000 | $161,600 |

1,500 sq ft | $303,000 | $242,400 |

2,000 sq ft | $404,000 | $323,200 |

2,500 sq ft | $505,000 | $404,000 |

3,000 sq ft | $606,000 | $484,800 |

Average Cost to Build a House by the Number of Bedrooms

If you’re not an architect or builder, it’s probably difficult for you to think in terms of square footage. Instead, you’d probably pose the question like this:

“What is the average cost to build a 4-bedroom house?”

(Or—depending on the size of your family—the cost to build a 2-bedroom, 3-bedroom, or maybe even a 5-bedroom house.) See below for the average cost to build a home based on the number of bedrooms—

HOUSE SIZE (NUMBER OF BEDROOMS) | NEW HOME BUILD COST |

2 bedrooms (800-1,500 sq ft) | $161,200-$303,000 |

3 bedrooms (1,500-2,200 sq ft) | $303,000-$444,400 |

4 bedrooms (2,000-3,000 sq ft) | $404,000-$606,000 |

5 bedrooms (2,800-5,000 sq ft) | $565,600-$1,000,000 |

How Much Is It to Build a House in Your State?

Every state has a different cost of living—including the cost of home construction. The cost of building a house in California will almost certainly be higher than the cost of constructing a home in Iowa.

So, what’s the average price to build a house in California, Hawaii, or Colorado? (Heads up here—If you live in these states, have a seat before you scroll down.) Look at your state for the likely damages of building a home vs. the overall average—

STATE | AVERAGE NEW HOME COST |

Alabama | $282,346 |

Alaska | $464,816 |

Arizona | $586,167 |

Arkansas | $246,991 |

California | $1,041,649 |

Colorado | $784,751 |

Connecticut | $508,212 |

Delaware | $476,604 |

Florida | $563,824 |

Georgia | $431,437 |

Hawaii | $1,390,628 |

Idaho | $625,216 |

Illinois | $358,732 |

Indiana | $301,447 |

Iowa | $267,247 |

Kansas | $285,601 |

Kentucky | $272,911 |

Louisiana | $290,074 |

Maine | $487,317 |

Maryland | $551,675 |

Massachusetts | $799,461 |

Michigan | $311,217 |

Minnesota | $449,327 |

Mississippi | $226,431 |

Missouri | $312,888 |

Montana | $615,356 |

Nebraska | $329,705 |

Nevada | $623,148 |

New Hampshire | $603,185 |

New Jersey | $642,241 |

New Mexico | $399,071 |

New York | $503,796 |

North Carolina | $437,720 |

North Dakota | $384,639 |

Ohio | $289,924 |

Oklahoma | $250,086 |

Oregon | $691,838 |

Pennsylvania | $358,472 |

Rhode Island | $591,453 |

South Carolina | $398,520 |

South Dakota | $405,628 |

Tennessee | $407,834 |

Texas | $420,150 |

Utah | $760,025 |

Vermont | $498,245 |

Virginia | $516,478 |

Washington | $830,183 |

West Virginia | $191,438 |

Wisconsin | $360,061 |

Wyoming | $448,586 |

(The above table shows Zillow’s recent home sales data modified to reflect the premium cost of new construction.)

How to Build Your Own House—Step-by-Step Breakdown

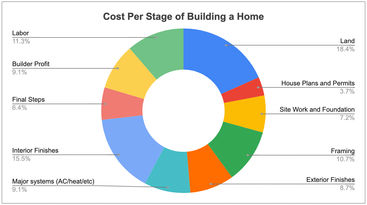

Curious about the cost breakdown of building a house? Based on data from the NAHB, my personal build project, and various other web resources—we were able to put together a breakdown of construction costs for each stage of the home build.

Numbers can vary (based on your location and the amount of land you buy), but this should give you a solid estimate of the cost breakdown for building a house—

BUILDING STAGE | AVERAGE COST | % OF TOTAL |

Land | $95,000 | 18.4% |

House plans and permits | $19,000 | 3.7% |

Site work and foundation | $37,500 | 7.2% |

Framing | $55,500 | 10.7% |

Exterior finishes | $45,000 | 8.7% |

Major systems (AC/heat/etc.) | $47,000 | 9.1% |

Interior finishes | $80,000 | 15.5% |

Final steps | $33,000 | 6.4% |

Builder profit | $47,000 | 9.1% |

Labor | $58,700 | 11.3% |

Total | $517,700 | 100.0% |

Financing Construction—How Do You Do It?

Let’s say you’re ready to pull the trigger. You’ve reviewed the cost of building a house—and you decide it’s the best option for you and your family.

But now what? How do you finance a land purchase? And what’s the process for financing construction?

How do you get a loan for the land?

The process of getting a loan for land is similar to getting a loan for a house:

You’ll work with the bank for the loan.

A loan officer will walk you through the process.

You’ll need good credit to secure the loan.

There will be an appraisal of the land.

You’ll need to put a down payment on the property.

Believe it or not, getting a loan for land is more difficult than getting a loan for a house. Fewer lenders specialize in land loans—you’ll need better credit, and you’ll likely need a larger down payment (upwards of 35% down for raw land).

How to get a construction loan

A home construction loan is a short-term, higher-interest loan that will give you the funds you need to build a residential property. (A construction loan term is typically one year.) How does the new construction process work?

The borrower applies for a construction loan from the bank. (To get it, the borrower must supply financials, plans, and project timelines.)

If the bank approves the loan, the borrower starts drawing funds for each phase of the project. (Throughout construction, an appraiser or inspector assesses the build to authorize the next stage of funds.)

Once the build is complete, the borrower usually converts the construction loan to a permanent mortgage.

What about a home equity line of credit (HELOC)?

A land loan and construction loan sound complex and pretty involved. Wondering if a home equity loan might be easier?

If you already own a house (that you’re going to sell after building the new home), and have a bunch of equity—you could pull money from that equity to start the new build process. It’s a pretty good idea.

With a HELOC, you can pull up to 90% of the value from your home—and the closing costs are often cheaper than if you went through the construction loan process. The only issue you may run into is if you have enough equity in your current home to buy the land and construct your new home. If you do—this is certainly an option worth exploring.

And if you don't—consider funding only the land with a HELOC. (It’ll save you the hassle of getting a land loan, and could save you some cash.) Get all the details and implications from your local bank before acting on this idea.

Perfect spreadsheet for any home renovation project 🏠

This template is:

Easily customizable for any project

It comes with examples and ready to use

It can be used in Excel or Google Sheets

Tips to Save Money on Building a House

Are you still coughing at the cost of building a home? (I mean, $500,000? Most of us don’t have this amount of cash floating around.) Can we maybe reduce these costs somehow? Below are a few ideas to avoid carrying a massive mortgage into retirement—

Project manage the build yourself

Want to save $50,000? Put your builder hat on, and project manage the home build yourself. That’s right—maybe you can get your house built without a contractor.

It’s a risky move, since the contractor coordinates everything and problem-solves all the issues that may arise—but, if you have some experience in construction and project management (and have some extra time on your hands), this could turn into huge savings.

It won’t be easy—but earning a quick $50,000 never is! (Want a project build estimator? You can use this one from my recent remodel estimate.)

Reduce square footage

The average cost to build a 2,000-square-foot house is $404,000. Maybe that’s way out of your budget. (And honestly, it may be way more size than you need—especially if it’s just you and your spouse.)

Instead—how much does it cost to build a 1,200 sq ft house? It’s a significant price difference. Like that, your build cost goes from $404,000 to $242,400. Get creative—ask yourself those tough questions:

Do you really need three bedrooms?

What if you got rid of the den? Would you really miss it?

That master suite—maybe it can be just a standard bedroom instead.

Keep some space unfinished

Maybe you don’t want to limit your space permanently, but you might postpone it if necessary. (And perhaps even finish it yourself down the road—double savings. Cha-ching!).

Perhaps you could get the basement studded in—but don’t have it drywalled, mudded, or painted. You could do the same thing with one of those bonus rooms or even the garage. If the builders don’t need to do all the work, they’ll give you a break on the overall build price.

Choose a stock design

If you design your own house, you’ll have additional costs with the architect and the builder. (With special requests, build times take longer—which means more money out of your pocket.)

If you want to save money, meet with the builder first—see what designs they’re familiar with. This approach will probably save you money.

Make it modest

If you’re serious about saving money on your new home, cut back on the luxurious materials. Look into the materials list for building a house, review the most expensive components—and dial it back a notch.

Do you need marble countertops throughout the house? (And those top-of-the-line appliances—are they going to improve your life that much?) Look at it this way—if you’re on a budget, would you rather have more square feet or a shinier refrigerator? (I’d take the space for me—but it’s obviously up to you!)

Other Build Options and Costs

It’s time to think outside the box a bit— Maybe you don’t want to make any of the above concessions on your house build. Is there a way to build a house, have all the nice stuff in it—but still save a bunch of money in the process?

Yup. It all boils down to the terminology of the word "house". What does that really mean to you? What if you changed the style of your house? Might it suit your life better? (It could even save you money.) Let’s look at the different house styles and the typical costs for each—

Cost to build an A-frame house

The cost per square foot to build an A-frame house is between $400 and $600. Compared to a standard new construction cost of $202 per square foot, there are no savings here. Here’s where the savings come in, though—

Since the A-frame is a straightforward structure, you could do much of the work yourself. Reduce the labor to nearly nothing—and your per-square-foot cost plummets to between $100 and $200.

If you could get the cost down to $100 per sq ft, a 2,000-square-foot home is no longer $404,000—it’s $200,000. (That’s a huge difference!)

Cost to build a pole barn house

The cost to build a 2,400 square foot pole barn house with all the finishes is typically $300,000. That’s significantly cheaper than the traditional home—which would cost $484,800. Why is it so much cheaper?

The biggest price difference is in the foundation. Pole barns require just a concrete slab (with all the living space on one level)—standard homes have a foundation with full basements that need to be constructed.

Average cost to build a tiny house

The national average cost of a tiny home is $45,000—much cheaper than a standard home that will cost more than $400,000. The home itself is much smaller, though—so what’s the cost per square foot?

The average size of a tiny home is 225 feet, which means the cost to build a tiny house is roughly the same as a traditional home—$200 per square foot. But, if you want to save money (and don’t mind living in a much smaller footprint), this would save you a bunch of cash.

How much does it cost to build a container house?

The average cost of a shipping container home is $35,000. (The container itself costs only $2,000. Add the land, foundation, all the amenities—and you’re roughly at $35,000.) And in case you’re asking yourself, “What’s the square footage of a shipping container?”

Shipping containers are 40 feet by 8 feet—which equates to 320 square feet. This means the cost per square foot of a container house is $109. (Very reasonable. But just like the tiny home—is this just too small for your desired lifestyle?)

How much does it cost to build a prefab home?

Modular homes cost between $80 and $160 per square foot. For a 2,000-square-foot home, the average build cost is $240,000—much less than the standard home build of $400,000. Why is a manufactured home so much cheaper to build?

There are two main reasons— First, the prefab home is built by the same manufacturer, and in one controlled location—there’s much less downtime and more efficiencies with this process.

Second, modular homes come with standardized designs—with just a few build options that are repeated again and again by the manufacturer, costs are naturally less. (The modular home estimates likely do not include the cost of land. Even with this factor, though, the modular home is still much cheaper than the standard build.)

Owners ofSparkRental.com had this to add, “Today’s manufactured homes exceed the quality of stick-built homes in many ways, including energy efficiency and cost efficiency, without sacrificing build quality. Quite the opposite—modular homes often exceed the build quality of stick-built homes since every component is standardized and doesn’t require custom work by often underskilled laborers.”

Key Takeaways

Building a house today isn’t cheap—but if you’re tired of getting outbid on mediocre homes and have always dreamed of constructing a house on your own, then it still might make sense for you.

First, understand that the average home size is roughly 2,500 square feet, and the average cost is just over $500,000. Second, where you live might affect the price.

Finally, if you want to save money on a home build, consider taking some tasks on yourself, leaving some of the house unfinished, or building a non-conventional home (like a modular house or even a shipping container). Just be sure to weigh all the options, work with someone with experience, and build the best space for your present and future.

.jpg)