The turbulent housing market and expert predictions thrown left, right, and centre got us thinking. What does it all mean for an average American? Is the cherished ideal of the American Dream dead, with house prices and mortgage rates changing like crazy? Which states and cities were the most and least affected?

We took matters into our own hands and analysed the data for the last decade.

And we have some pretty nifty findings to share—you can check them all out below.

Who said sifting through data can’t be fun?

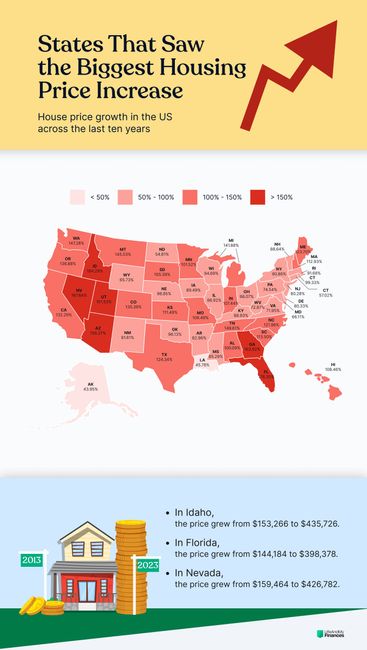

Mapped: Prices Soaring Across the Country (2013–2023)

We took a stroll down memory lane and analyzed the data for the last decade—crunching the numbers and putting things into perspective for you.

The map of house price growth across the last decade says it all—

In Idaho, prices have gone up by almost three times. In Utah or Arizona—by more than two and a half times.

Were you looking for the most modest states?

Alaska and Louisiana were somewhere below 45%.

Now, what does all that mean to you?

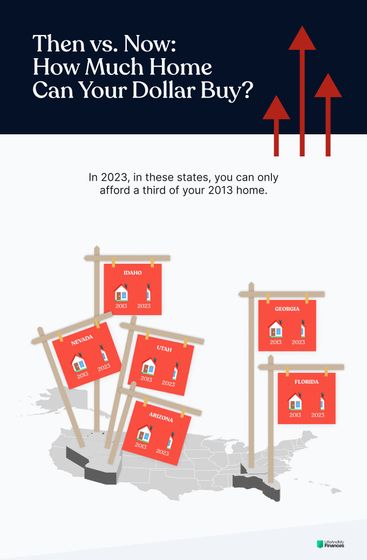

Did You Buy a House In These States In 2013? In 2023, You Could Afford One-Third of It

Idaho, Florida, and Nevada are just some of the states turning heads (big time).

Let’s look at the exact house prices in these states in 2013 and 2023:

STATE | 2013 | 2023 | INCREASE |

Idaho | $153,266 | $435,726 | 3x |

Florida | $144,184 | $398,378 | 3x |

Nevada | $159,464 | $426,782 | 3x |

Georgia | $116,612 | $307,758 | 3x |

Arizona | $163,345 | $418,605 | 2.5x |

Utah | $204,821 | $515,188 | 2.5x |

If you could afford a beautiful house in those states in 2013, now you’d only get one-third of it for the same money.

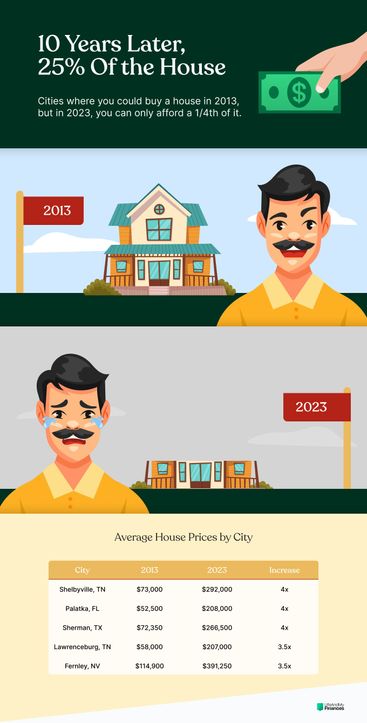

Looking to buy a house in these cities in 2023? Ten years ago you’d have gotten four for the price

Four-fold increase means 4x growth.

Take Shelbyville for example, where the housing market has seen an astonishing price surge—with property values soaring four times their original price.

Now you wish you’d gotten that house you dreamed of back then, don’t you?

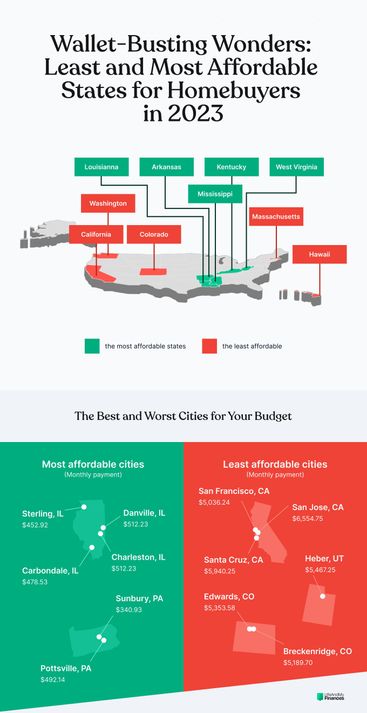

The Cheapest and Most Expensive States to Buy a House

Let’s have a look at the heroes and villains of the real estate world—

How much would you have to pay for a house in various states? What’s the 20% down payment and a monthly payment?

We used median prices to crunch numbers for a 30-year fixed mortgage.

The most affordable states in 2023

Here’s a list of the states with the smallest house prices:

STATE | PRICE | DOWN PAYMENT (20%) | MONTHLY PAYMENT |

West Virginia | $146,499 | $29,299.80 | $792.36 |

Mississippi | $161,582 | $32,316.40 | $883.22 |

Arkansas | $178,264 | $35,652.80 | $962.24 |

Louisiana | $183,113 | $36,622.60 | $993.27 |

Kentucky | $189,531 | $37,906.20 | $1,037.54 |

The least affordable states in 2023

Now let’s compare them to the states you wouldn’t definitely want to take out a mortgage in right now—

In 2023, the quest for reasonable housing opportunities might prove tricky in five notable states: Hawaii, California, Massachusetts, Washington, and Colorado.

High prices and stringent mortgage regulations in these states clash with potential buyers’ budgets.

To better grasp the affordability dilemma, compare down payments and monthly mortgage payments for each—

STATE | PRICE | DOWN PAYMENT (20%) | MONTHLY PAYMENT |

Hawaii | $966,277 | $193,255.40 | $5,247.18 |

California | $744,023 | $148,804.60 | $4,064.07 |

Massachusetts | $576,889 | $115,377.80 | $3,128.00 |

Washington | $576,090 | $115,218.00 | $3,155.22 |

Colorado | $551,616 | $110,323.20 | $3,013.39 |

The Cheapest and Most Expensive Cities to Buy a House

The cheapest cities in the US to buy a house in 2023

Let’s also see a few of the most affordable cities to buy a house right now—as you can see, Illinois and Pennsylvania are the places to be.

CITY | 2023 | DOWN PAYMENT (20%) | MONTHLY PAYMENT |

Sunbury, PA | $63,040 | $12,608.00 | $340.93 |

Sterling, IL | $84,000 | $16,800.00 | $452.92 |

Carbondale, IL | $88,750 | $17,750.00 | $478.53 |

Pottsville, PA | $91,000 | $18,200.00 | $492.14 |

Charleston, IL | $95,000 | $19,000.00 | $512.23 |

Danville, IL | $95,500 | $19,000.00 | $512.23 |

The most pricey cities in the US to buy a house in 2023

It comes as no surprise that California is leading the way in this category.

Picture a stack of dollar bills the height of the cities’ tallest skyscrapers—that’s what comes to mind when talking about buying property in the Golden State in 2023.

Next in line are the beautiful mountain-esque views in Heber, Utah—and similarly dreamy Edwards in Colorado.

CITY | PRICE | DOWN PAYMENT (20%) | MONTHLY PAYMENT |

San Jose, CA | $1,200,000 | $240,000.00 | $6,554.75 |

Santa Cruz, CA | $1,087,500 | $217,500.00 | $5,940.25 |

Heber, UT | $1,003,000 | $200,600.00 | $5,467.25 |

Edwards, CO | $980,000 | $196,000.00 | $5,353.58 |

Breckenridge, CO | $950,000 | $190,000.00 | $5,189.70 |

San Francisco, CA | $922,000 | $184,400.00 | $5,036.24 |

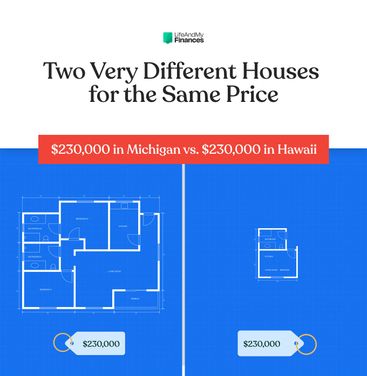

A Family Home in Michigan or a Hawaiian Shed?

We rummaged through Redfin to find an affordable house for a family willing to spend around $230,000 before mortgage (almost exactly the median listing price for a place in West Virginia, the most affordable state).

We found two interesting examples of just how much of a difference it makes to live in cheaper vs. more expensive states.

Check this out—

For a house of 400 square feet in Hawaii (one bedroom and one bathroom), you’d pay $230,000 (or around $1,400 a month).

The price tag for a much bigger house of 2,300 square feet in Michigan (with three bedrooms and three bathrooms) is $239,000 (or around $1,500 a month).

Yes, you read that right.

For obvious reasons, we can’t show you the actual pictures, but just to give you an idea—

Why Behind the House Market Crisis

In case you were living under a rock, we also compiled a list of reasons behind all these changes—

Should You Buy a House Now?

After all that, you’re probably left wondering—

Should I buy a house now or try to wait it out again?

June Jia, the owner of Canny Trading & Quantitative Researcher at GF Securities, predicts that house prices should be stable, at least for now:

In the short term, it’s highly improbable that housing prices in the United States will experience a significant increase. As the Federal Reserve persistently raises interest rates, housing demand will likely be suppressed due to the rising cost of borrowing. The current economic landscape in the United States remains relatively stable, making it doubtful that the Federal Reserve will reduce interest rates in the near future.

June Jia The owner of Canny Trading Quantitative Researcher at GF Securities

She adds

According to the CME FedWatch Tool, most people anticipate that the Federal Reserve will refrain from cutting interest rates until at least their meeting on September 20th. In an environment characterized by elevated interest rates, the likelihood of a substantial surge in housing prices is minimal.

June Jia The owner of Canny Trading Quantitative Researcher at GF Securities

The outcome of the most recent Federal Reserve meeting also contributes to the downward pressure on housing prices. Market participants were focused on the possibility of Chairman Powell announcing a pause in the ongoing tightening cycle. However, this announcement was not made, leading to disappointment in the market. The potential for the Federal Reserve to continue raising interest rates at the next meeting remains, further exerting downward pressure on housing prices.

June Jia The owner of Canny Trading Quantitative Researcher at GF Securities

Mark Fleming, Chief Economist at First American, agrees:

The main reason for the recent increase in prices is the dearth of supply. This doesn’t mean that prices will skyrocket, largely because that was fueled by significantly increased buying power of potential homeowners when rates were so low. That isn’t the case anymore.It was that level of buying power in combination with short inventory and the pandemic driving increased demand for “home” (a place to live, work, go to school, exercise….). We don’t expect the same confluence of events.

Mark Fleming Chief Economist at First American

Sasha Ramani, Corporate Strategy Lead at MPOWER Financing adds:

I expect more inventory will come to the market with fewer COVID-19 restrictions this year and for the foreseeable future. The rise of remote work will expand search areas and allow younger buyers to find their first homes sooner than they might have otherwise. About 4.6 million millennials will reach the age that millennials typically get married this year, so the seller’s market will be competitive and bountiful as first-time buyer demand outmatches the inventory recovery.

Sasha Ramani Corporate Strategy Lead at MPOWER Financing

I also asked Derek Sall, founder of Life and My Finances, for his thoughts:

If the inflation rate continues to fall, interest rates will plane out and begin to fall as well. Mortgage rates should follow suit. This will increase demand on an already-limited housing supply, which means house prices are set to jump yet again. You’re not going to save any money by waiting on mortgage rates. So, find the house that’s best for you, put a healthy down payment on it, and if you hate the interest rate, commit to paying it down faster. That’s what I did. No regrets.

Derek Sall financial expert and creator of Life and My Finances

Considering all that, we’d say buy that house now. There’s no telling what the future holds.

Just get financially ready, make a sound purchase, and enjoy it.

To paraphrase the classic saying—there’s no time like the present to plant a tree (next to your newly bought house).

.jpg)