In recent years, the way we manage our finances has changed significantly. Gone are the days when we had to visit a bank branch to carry out basic transactions like checking account balances or transferring money.

The rise of online and mobile banking has made it possible for people to manage their finances from anywhere and at any time. With just a few clicks or taps, users can now transfer funds, pay bills, and monitor their accounts. In this article, we gathered a host of online banking statistics, facts, and data to give a clear picture of this aspect of the finance world.

The Top 10 Online Banking Statistics for 2026

78% of Americans prefer digital banking over regular banking.

Americans who prefer visiting a bank directly claim they receive better service live.

89% of Americans with bank accounts use mobile banking.

Users prefer to use their phones to check their account balance, but also prefer using a bank’s website to transfer money internationally.

Of those Americans who prefer banking online, 52% prefer mobile app banking, while 48% prefer a website.

Malware attacks on Android-based banking apps dropped by 55% between 2019 and 2020.

Mobile bank account usage increased by 62.8% between 2014 and 2021 in developing nations.

Mobile money accounts led to greater financial independence in Sub-Saharan Africa.

Transferring funds between accounts, as well as checking your bank balance, deposit, and statements, are considered as vital banking app features for consumers.

Norway uses internet banking the most.

General Internet Banking Statistics and Facts

In 2022, in the US, consumers are now 19% more likely to complete an online purchase through Venmo.

In fact, the number of people using Venmo in the US grew significantly in 2022, reaching 90 million accounts - almost a third of the US population.

Now, this is important because Venmo, and its ilk, serve as a form of mobile and online banking. You need to connect your bank account or debit (or credit) card with Venmo to send or receive money.

Note: Venmo's close competitor Cash App snaps a lot of users from the popular money transfer app - to understand which one is better, we compared the two industry giants in terms of speed, limits, convenience, and more. Read through before making a decision.

10% of HSBC banks cut, accelerated by a push toward digital banking.

The cuts done by HSBC are one of the clear signifiers of the development of online banking trends In 2022, HSBC shut down 69 of its 510 branches due to a significant decrease in foot traffic. Fewer than half of HSBC's customers actively use its physical branches, and foot traffic has dropped by an average of 50% since 2017.

New PayPal President and CEO chosen.

PayPal has announced the appointment of Alex Chriss as President and CEO, effective September 27, 2023, following a rigorous CEO search process aimed at finding a next-generation leader with global payments, product, and technology expertise.

Chriss, a highly accomplished business executive, currently serving as the Executive Vice President and General Manager of Intuit's Small Business and Self-Employed Group, has unanimous support from the Board and CEO search committee. His extensive experience positions him to drive growth across the PayPal platform and ensure its continued success for years to come.

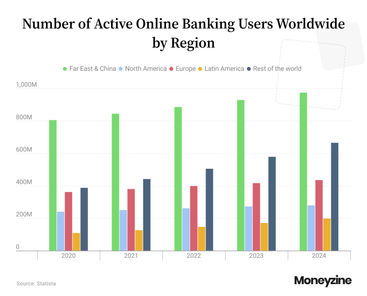

There will be an estimated 2.5 billion online banking users by 2024.

Online banking facts show that mobile banking usage is anticipated to grow consistently from 2021 to 2024, with the Asian market leading the way. In 2020, the Far East and China had more than 805 million active online banking users, and this number is projected to approach one billion by 2024.

While Asia held the top spot in terms of online banking users in 2020, the European countries had the highest online banking penetration rates. South Korea ranked sixth in penetration rate, at 74 percent.

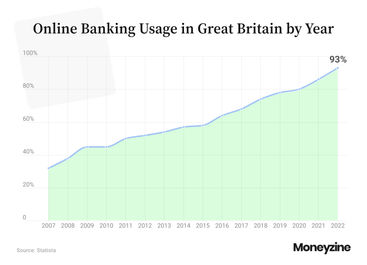

There is a significant surge in online banking in Great Britain.

In 2007, approximately one-third of the British population engaged in online banking, but this figure surged to over 90 percent by 2022.

With the widespread availability of secure internet systems for financial transactions, online access to bank accounts for payments, credit management, and savings investment emerged as one of the Internet's fastest-growing activities.

In Europe, Norway’s citizens use internet banking the most.

According to digital banking statistics gathered by Eurostat, 95.84% of Norway’s citizens, who have bank accounts, have used the internet for some sort of banking activity, including checking their account balance, making a financial transaction, etc…

Finland was in second place, with 94.68%, Denmark in third, with 94.35, the Netherlands in fourth with 90.72%, and Ireland in fifth with 86.29%.

Top five neobanks in the US see increase in average monthly active users, from 1.4 million in 2020 to 2.2 million in 2022

However, it's worth noting that traditional banks, within the same timeframe, maintained a significant lead with more than ten times the number of monthly active users compared to neobanks.

Following similar digital trends in banking, mobile banking apps in the US observed a rise in active users and average time spent from 2020 to 2021. Although the growth in time spent slowed in 2022 as the US gradually opened up, banking apps still continued to add new users.

29% of Americans prefer to visit a bank directly.

Even after the lockdowns and Pandemic measures, 29% of the US population prefers going to a bank. One reason is that consumers believe the service they get in person is simply better.

As one example, opening a bank account is still a very personal thing, and a properly trained bank teller can provide a consumer with personalized advice and guidance that not all, if any, mobile banking apps and websites can provide.

In 1994 Stanford Federal Credit Union was the first institution in North America to provide internet banking to the general public.

However, the history of online banking goes way back, to 1980. The United American Bank partnered with Radio Shack and had customer modems produced that let customers, who bought them, access their bank account info securely.

In 1983 the Bank of Scotland launched something similar, a service called Homelink which allowed users to pay their bills and transfer money online. However, the entire system was very unreliable, limited, and slow.

The “Digital Champion” bank category achieves better financial results.

The Deloitte Digital Banking Maturity Report defines “Digital Champions” as banks whose digital banking websites and apps offer “a wide range of functionalities” and provide users with a “compelling user experience”.

Indeed, digital banking trends are set by these banks, as they are usually at the forefront of new and advanced features.

Furthermore, these banks get better results. Digital champions have a 31% share of net fee income in total income, compared to 25% of non-champions, on average.

78% of Americans prefer digital banking over regular banking.

These banking statistics include both using mobile banking apps or going directly to a bank’s website. The main driving force in consumer behavior has, of course, been the Pandemic. People became much more reluctant to go to a bank in person, and in many places in the US they were not able to go at all.

For this reason, banks needed to adapt quickly, and fill in the gaps found within the banking app functionalities.

COVID-19 substantially catalyzed digital banking growth in developing economies.

As an example, only 18% of adults paid their bills through an online banking account in 2021, in developing economies.

However, for a third of these adults, the first time they actually did so was after the beginning of the Pandemic. Similarly, in China, 11% of adults made a digital merchant payment for the first time in 2021, after the start of the pandemic.

There are three vital new features Digital Champions implement.

Including these features represents the current leading trends in online banking. They include:

The complete digitalization of the banking process

Banking apps as a platform

Cross-platform solutions

The first one includes providing the consumer with a total overview of the entire banking process, from beginning to end. This includes things like opening an account online, closing an account, as well as applying for a personal loan.

Banking apps as a platform means they will take on a host of features, such as allowing users to, for example, buy tickets, schedule a doctor’s appointment, let them pay taxes directly, etc.

Finally, cross-platform solutions mean more seamless shopping between a bank account and a store, paying via QR codes, etc.

High-income economies use digital payments substantially more than developing economies.

In fact, the data on the mobile banking market shows that 95% of account holders in high-income economies, like the US, Germany, or Japan, have used their online bank accounts in some manner. In comparison, only 57% of people in developing economies have done the same.

Mobile Banking Statistics

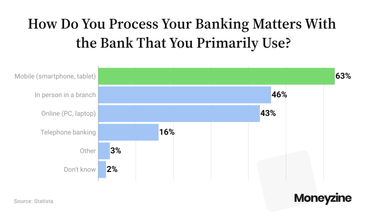

63% of Americans perform banking activities primarily via phone and tablet.

In the survey, participants were asked, "How do you process your banking matters with the bank that you primarily use (e.g., transactions)?" A substantial 63% of respondents reported that they primarily conduct their banking tasks using smartphones and tablets.

In contrast, 46% still opt for the traditional in-person approach, highlighting the enduring importance of physical bank branches. Additionally, 43% of respondents prefer personal computers as their primary banking platform, while a smaller 16% choose to engage with their banks via phone calls.

Only 26% of US citizens can imagine dealing with financial transactions exclusively via mobile phone in first half of 2023.

Covid banking stats show that in 2018, only 29% of US citizens could envision conducting their financial transactions solely through mobile phones. However, with the onset of the pandemic, this percentage increased to 32%, reflecting a shift in consumer behavior towards digital financial interactions.

As lockdown restrictions eased, this figure decreased to 28%, indicating a gradual return to traditional methods. Over time, despite fluctuations, the adoption of mobile-based financial transactions stabilized at 26%, highlighting the enduring impact of the pandemic on the way people manage their finances.

In the US, 89% of people with bank accounts use mobile banking.

According to a 2022 US survey conducted by Insider Intelligence, 89% of respondents claim they use mobile banking. However, as with all things digital, the numbers vary by age group. It's no secret that Gen Z prefers everything digital, mobile banking being no different, with an expected 45.4 million US users by 2025.

Around 97% of millennials state they use mobile banking, compared to 91% of Gen Xers and 79% of baby boomers.

Consumers use different features when using mobile apps and non-mobile online apps.

As an example, mobile banking statistics show that 56% of digital banking users use their mobile app to check their balance, while only 29% do so through non-mobile options. Respondents pretty much equally pay their bills either through their mobile app (41%) or directly online (44%).

However, when it comes to international money transfers, 53% prefer non-mobile digital banking, with 24% transferring money through the app. Finally, only 15% use their bank apps to inquire about a product, with 37% using other online means.

There are over 254.41 million mobile banking customers for the Bank of China, in 2022.

The Bank of China witnessed a notable surge in its mobile banking customer base over the years. In 2020, the bank served a substantial 210 million mobile banking customers, a number that continued to grow, reaching 235 million in 2021. Building on this trend, the customer base further expanded to a significant 254.41 million in the year 2022.

Checking account status and transferring funds between accounts are seen as the most important features of a mobile banking app.

According to US internet banking statistics from the 2022 Ipsos-Forbes Advisor U.S. Weekly Consumer Confidence Survey surveyed users on their top three most important features a mobile banking app needs to have.

30% of all consumers, as their top three, all picked:

Transferring funds between accounts

Mobile check deposits

Viewing accounts balance and statements

22% put paying bills at the top, while 5% believe cardless ATM withdrawal is vital.

(Forbes Advisor: 2022 Digital Banking Survey)

Mobile banking as a primary method of account access rose from 15.1% in 2017 to 43.5% in 2021.

Besides the prevalence in smartphone ownership and general advances in banking app development, the Covid Pandemic had a substantial influence as well. This is the best scene when we compare data to bank teller usage.

Namely, bank teller use was at 24.8% in 2017, dropped to 21% in 2019, and then dropped again to 14.9% in 2021. However, usage was higher in low-income and less-educated households, as well as older households.

Americans slightly prefer their online banking through mobile apps, than through a website.

When we look at the data studying online banking vs mobile banking, we see that 78% of Americans prefer to do their banking online. However, 52% like to use the bank’s dedicated mobile app, while 48% would rather use their bank’s website.

(Forbes Advisor: 2022 Digital Banking Survey)

Mobile bank account usage has substantially increased among developing countries since 2014.

In 2014, only 35% of bank account holders made digital payments in developing countries. By 2021, this number increased to 57%.

In comparison, 88% of account holders in high-income economies did the same. This number then increased to 95% by 2021.

Mobile money accounts improve the financial independence of women in Sub-Saharan Africa.

Due to a lack of access to brick-and-mortar banks, many people in developing regions of the world rely on mobile money accounts to build their savings and have more flexibility with their finances.

This is especially important for women in developing regions because of the inequality they face on a regular basis. Just as an example, in Sub-Saharan Africa, women face more stringent loan conditions compared to men.

Android banking malware attack rates are dropping.

Due to advances in both software protection, as well as a better understanding of digital safety, banking apps are becoming safer and safer. Current digital banking statistics and raw data is here to prove it.

Namely, Kaspersky Cybersecurity Solutions recorded 675,772 instances of malware attacks directed to Android banking malware in 2019. However, in just one year, these instances dropped by 55%, to 294,158 in 2020.

Conclusion

Online and mobile banking have revolutionized the way we handle our finances. As the online banking statistics in this article have shown, more and more people are choosing to bank online or through mobile apps.

The convenience and accessibility of these platforms have made them popular among consumers, and banks have responded by investing heavily in digital banking technologies. With the ongoing COVID-19 pandemic forcing more people to stay at home, online and mobile banking have become even more important in facilitating financial transactions.

.jpg)