There are many reasons you could benefit from having a USD account. Do you have family in the US? Or spend a lot of time there? Or do business with American people or organisations?

With a normal GBP account, your bank will automatically convert any incoming funds to pounds. The downside of this is that their exchange rates often aren’t great. If you deal with USD regularly, this can add up to a lot of money lost on unfavourable exchange rates.

Our research suggests that Wise is the best service for opening a USD account in the UK. It offers excellent features like a debit card and interest, while being cost-effective at the same time. This guide will dive into everything you need to know about USD accounts. Whether you’re a traveller, freelancer, expat, or something else—we’ll help you find your perfect USD account!

Best Dollar Accounts from UK Banks - Our Recommendation

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 1Wise | 9.2 | Visitwise.com | |

| 8.5 | Visitrevolut.com | ||

| 7.0 | Visitpayoneer.com | ||

| 4HSBC | 6.8 | Visitwww.hsbc.com/ | |

| 5OFX | 8.2 | Visitofx.com | |

| 7.0 | Visitbarclays.com |

Best UK Dollar Accounts Reviewed & Compared

Each of the following providers will allow you to open a USD account as a UK citizen. As for which one to choose — that depends on what you need an account for.

Best Dollar Accounts at a Glance

Best overall: Wise

Best for travelers and the self-employed: Revolut

Best for international students and expats: Monese

Best for freelancers: Payoneer

Best for low fees: HSBC Global Money

Best for International businesses: OFX

Best for multicurrency transfers: Barclays

Pros

- It lets you withdraw 200 GBP per month for free.

- It converts money at a mid-market rate.

- Wise card comes with no subscription fees, you only pay a one-time £7 issuance fee.

- Receiving money is completely free.

Cons

- While Wise might not charge ATM withdrawals, ATM networks might.

- Account funding transactions come with a 2% fee.

- Receiving wire payments comes at a fixed $4.14 fee.

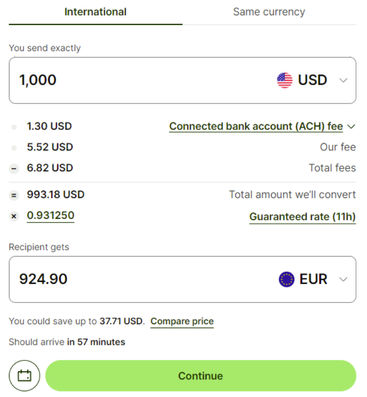

Wise is one of the best online payment services available to UK users. And its dollar account is no exception. The company allows you to receive money in US dollars for no fee, except for wire transfers. It converts funds at the mid-market rate with no hidden fees.

Apart from USD, it also lets you keep your money in over 40 other currencies. You can even receive money in 10 currencies with local account details. Wise is great for investors, freelancers, and businesses who want to send invoices to clients.

It is also a good option for international students, travelers, and anyone else who wants to send and receive money in USD. You can even earn up to 5.08% on your USD balance.

You also get to withdraw up to £200 from ATMs for free, although you must do it in 2 or fewer transactions. After that, withdrawals come at a £0.50 fee per withdrawal. Meanwhile, investing from your USD account comes with a 0.29% annual fee.

Conversion fees are usually low: swapping sterling for dollars costs just 0.44% plus a fixed fee of £0.26. This makes Wise the cheapest option for large transfers.

Pros

- Pays up to 4.75% AER/Gross interest on savings daily.

- Lets you earn up to 1.2% cashback if you pay with your Pro card.

- Apart from USD, it supports 35 other currencies.

- It offers both personal and business accounts that can hold USD.

Cons

- Advanced features usually come with additional fees

- 1% fee added if you exceed your monthly limit

- There are no physical branches that you can visit if you encounter issues

- Revolut adds a 1% markup to the exchange rate at the weekends

Revolut has been turning the heads of travellers and the self-employed in recent years. Online workers can open a free account and get a card made for their businesses. The service also lets them earn up to 1.2% cashback on every purchase.

Revolut lets you create a unique link for accepting payments quickly. However, it will charge a 2.5% fee on these transactions. You can also create a QR code, or invoice, or get in-person payments with its card reader. All of these methods come with a 2.5% fee, except for the last one. The card reader charges a 1.5% transaction fee.

However, these features are excellent for those accepting USD payments from abroad. Revolut also lets you open a Pro account which comes with a Pro debit card. Its Standard plan is free, letting you send money abroad, but it also has several paid plans. These include Plus, Premium, Metal, and Ultra.

If you are a digital nomad, you can also benefit from services like airport lounge access. The challenger bank even provides insurance for multiple circumstances, including trip cancellations and winter sports.

Pros

- Offers accounts in 9 different currencies.

- Transaction amount limits go from 0.37 GBP to 7,241 GBP and 0.50 USD to 10,000 USD.

- Fees are up to 70% lower than usual bank transfers

- Easily pay VAT and integrate accounting software

Cons

- Payoneer charges you an inactivity fee.

- Withdrawing money at ATMs comes with a fee.

- Customers have reported unexplained account freezes and terminations that led to the loss of funds

- Withdrawing the money to your local bank account comes with a fee as well.

Payoneer claims to be one of the best payment services for freelancers globally. That, of course, includes those living in the UK who use dollars. The service allows you to keep your funds in USD, as well as several other currencies. That way, you can avoid automatic conversions if your preference is to hold US dollars.

With Payoneer, users can bill their clients, make payments themselves, and manage finances. Payoneer is also connected to all leading freelance marketplaces, making it easy to withdraw your earnings. But, users should keep in mind that the service comes with many potential fees.

Paying someone who doesn't have a Payoneer account comes with a 3% fee, for example. Ordering your card via express delivery will come with a $40 fee, as opposed to free regular delivery.

Payoneer also claims to have expert customer service. But, some users have reported having their accounts frozen or terminated with no explanation. Customer service would say that they have broken the terms of service without specifying which ones.

Even so, Payoneer is a global and borderless service that many are quite satisfied with. It is great for freelancers as well as businesses.

Pros

- Its foreign currency account comes with no monthly account fee.

- You can hold money in up to 18 major currencies.

- Foreign currency accounts were designed to support an international lifestyle.

- You can apply for an HSBC currency account online in minutes.

Cons

- You must have an existing HSBC account to open a foreign currency account.

- You must use your GBP account to fund your HSBC currency account or withdraw money from it.

- The Global Money account doesn’t have overdraft facilities

- You can’t receive foreign currencies directly into your HSBC Global Money account.

HSBC Global Money is a great alternative for UK citizens who want a more traditional banking service. The bank allows you to hold USD, as well as 17 other major currencies.

The bank account comes with a few noteworthy features. The best one is that it doesn't charge an account fee, so you don't have to pay anything to keep it open. Apart from that, it converts money using live exchange rates, but it doesn't charge you for it. Finally, it lets you manage your payments and send money outside of the UK.

One of the limitations that it has is that you must fund it with money using your sterling HSBC account. This is also one of the requirements for opening the Global Money account — the need to have a regular account already. Other than that, the only requirement is that you must be 18 or older.

While you can manage the account online, transfers come with limits. You can only transfer £50,000 internationally or £250,000 between your own accounts. There are no such limits over the phone or in branches. The service charges very few fees and it is a good choice for those who wish to avoid them.

Pros

- You can set up exchange rate alerts

- ‘OFXpert’ phone support available 24/7

- Pay bills and invoices from the currency account directly.

- No setup, receiving, or account fees.

Cons

- Supports fewer currencies than Payoneer.

- It does not offer its own debit card.

- No options for cash pay-in or pay-out.

- Exchange rates come with a markup.

OFX is a simple self-serve platform that is the best fit for international businesses. It lets you hold up to 7 currencies, and even create separate accounts for them. It is also backed by phone support 24/7.

The platform helps you save on exchange rates when you transfer to over 50 countries. There are no fees for setting up or maintaining your account, or for receiving money. It does charge a margin on the exchange rate for FX transfers. OFX also says that for same-currency transfers, there is either a flat fee or a percentage of the value.

The platform is connected to many marketplaces, allowing you to use different currencies where you need them. Unfortunately, it does not offer interest on the money you store within its accounts.

Our research suggests that OFX is a transparent option for receiving and holding USD. Once the time is right, you can convert the funds back into GBP or another currency at fair rates. There are options to make this easier, such as limit orders and forward contracts. This makes it a good choice for businesses that operate on an international scale.

Pros

- Offers access to 17 different currencies, including USD.

- Receiving international payments under £100 comes free of charge.

- You can make international payments and transfer funds to and from your USD account.

- The account is accessible through online banking.

Cons

- You need to be an existing Barclays customer for 6 months or more to open a USD account.

- Cancelling an international payment comes with a £20 fee.

- Non-sterling card payments come with a 2.75% fee.

- You cannot pay more than £2,000 to a new payee.

Barclays is one of the leading traditional banks in the UK. The bank offers a wide range of services, including a foreign currency account. The account supports up to 17 currencies, including the US dollar and Euro.

You can open a foreign currency account if you are 18 or older and an existing customer. Note that Barclays requires you to be an existing customer for at least six months before you can open a foreign currency account. Assuming that you are a customer, you can open the account via phone or at the nearest branch.

Benefits of a foreign currency account include reduced exchange rate risk, and the ability to manage your own money. You can make and receive payments, and deposit or withdraw cash.

Barclays has certain transfer limits, such as £100,000 for international transfers. If you transfer money between your own accounts, the limit is £250,000 per day. Barclays has a separate savings account that will pay you interest, but not for your USD holdings. It is also worth noting that international drafts come with a £25 fee. However, there is no overdraft fee, which can be attractive to some users.

How We Rate & Review the Best US Dollar Bank Accounts

We considered many aspects while reviewing services with USD accounts for UK users. Most of them revolve around why you would want a USD account instead of immediate conversion. Some of the most important ones included:

Fees: Most services involving money come with some kind of fee. Whether conversion, card issuance, withdrawal, transactional, or otherwise, fees are always present. This is why we sought services that required you to pay as little as possible.

Account perks and features: Our main goal was to find affordable accounts for USD. But, we also wanted them to offer various features. We wanted to find services that had more to offer than the basics. This is why services with their own cards, cashback, interest, and more ranked higher.

Exchange rates: While receiving USD might be the goal, as a UK citizen, you will likely have to make conversions at some point. This is why we also sought services that offer affordable conversion rates. The idea is for you to lose as little money as possible by exchanging USD for GBP.

Can I Open a US Dollar Bank Account in the UK?

The short answer is yes. Pretty much anyone over 18 can open a USD account in the UK. But that doesn’t mean that everyone could open every USD account.

For example, to open an account with OFX or Payoneer, you’ll need to be a business or freelancer. For individuals, basically, anyone can open an account with challenger banks, like Wise and Revolut, in a matter of minutes. You just need to have a photo ID to verify your identity.

With high-street banks, there might be more limitations. For example, HSBC and Barclays both require you to have a current account with them before you can open a USD account.

What can you do with a US Dollar bank account?

As a foreign currency account, a USD account offers certain features and benefits. But, you should also keep in mind that it comes with limitations compared to a GBP account. For example, with a USD bank account, you can do the following:

Deposit/Withdraw money. You can easily deposit and withdraw money from your USD account. Of course, if you wish to withdraw cash, you might have to visit your bank's branch to do so.

Receive international payments. Receiving payments from abroad is one of the main reasons for opening a USD account in the first place. With it, you will be able to receive payments from most foreign businesses, including all US firms. Best of all, they will not be immediately converted into GBP at bad rates.

Manage your finances. Like with your GBP account, a USD account allows you to convert funds, make payments, and such. You can manage it like you would your local account.

Access customer service: Your bank can offer customer support for your USD account too, in case there are any issues. If payments are late or you have any kind of trouble, you can reach out and have it resolved.

But you can’t:

Use an overdraft: USD accounts in the UK don’t typically offer an overdraft. While HSBC and Barclays may offer you an overdraft on your GBP current account, they don’t offer one on the USD account itself.

Earn interest: USD accounts with banks will not pay you interest, making them a poor choice for savings. However, if you choose a service like Revolut, you could receive interest on USD.

Apply for credit: You will not be able to use your USD account to apply for credit in most cases. There may be a private bank or service that might allow it, but that depends on their personal policy.

What Are the Advantages of a US Account in the UK?

Holding a USD account in the UK can be beneficial for many reasons. For individuals who receive foreign payments, it can help them save money. If your bank conducts automated conversions, it can do it at high rates. It can even charge you for doing so without making such fees transparent.

If you receive funds in USD and they stay in USD, you can choose when and if you wish to convert them.

This can also be very beneficial for those who engage in forex trades without using brokers. Furthermore, you can make online payments with USD without having to convert your GBP.

Having a USD account makes it more convenient to manage transactions and maintain records. It can even allow you to pay with USD while traveling abroad. Depending on the service you use, this can save you from high fees and currency exchange rate fluctuations.

Businesses can use them to facilitate payments from their US-based customers. They can also pay suppliers and/or workers overseas.

Advantages such as these make it highly beneficial to open a USD account in the UK. Benefits exist for both individuals and businesses, as well as those in between, like freelancers.

Why use a USD account instead of exchanging when needed?

The main reason why you would want a USD account is to avoid converting money at expensive foreign exchange rates. That includes both the incoming and outgoing transfers. Often the rates are not favorable due to fluctuations. Add to that the fact that some banks and money transfer services use their own rates to make a profit. On top of all that, they might also charge you a fee for the service.

By the end of the process, you are sending a lot more money than the recipient is receiving. If you receive your money in USD, hold it in USD, and make a payment in USD, you know exactly how much you are sending. The process becomes much simpler and it is clear whether or not the service you are using is beneficial.

USD is also a preferred currency of countless online stores. Unless you are purchasing something from a local vendor, chances are that you will be paying in USD.

Common Charges of Dollar Accounts

Having and using your USD account may come with a variety of charges. These will mostly depend on the bank or service you are using. Some charges may exist with one of them while not being present at all with another.

For example:

Account management fees

Account management fees are fees you pay regularly — usually monthly or yearly — for your USD account. Most of the discussed services do not charge account management fees. If they do, that is typically in specific scenarios, such as if you use a higher tier of their premium plans.

One example of those that do is Payoneer with its annual fee, but you will only need to pay it if you have a card or are inactive for a year.

Many of these services will not charge you even for opening the account, although some might.

Transfer fees

Transfer fees are charged when you send and receive funds. Depending on the service, you might be charged the same amount when sending and receiving money. Or, you might have no transfer fee for one, while you still get charged for the other. Some services charge much higher transfer fees than others.

For example, HSBC will charge you £6 for receiving USD from abroad. Wise will charge you for sending money, although this varies depending on the transfer method. The type of fee and the amount charged vary from service to service. This is why you should research the fees thoroughly before selecting a service.

Conversion fee

Conversion fees are almost universally charged by banks and money transfer services. There are very few that might let you convert money without charging a fee for the service. Even then, they might have their own conversion rates, slightly more in their favour than the market rate. The fee can be flat (OFX), or it might depend on the amount you are converting.

One exception among the reviewed services seems to be HSBC Global Money. Our research suggests that it does not charge a conversion fee. However, it does mark up the exchange rate, so you might not get the best deal.

ATM withdrawal fee

While most services that allow you to withdraw money at ATMs will charge you a fee, they often won't do it right away. There is typically some small amount per month — up to $200 or so — that you can withdraw for free. Wise is a good example of this. However, after you have withdrawn $200, it will charge you 1.75% of any amount that exceeds this figure.

This is where comparing different withdrawal fees comes into place. Revolut, another highly popular service, will charge you a full 2% for USD withdrawals. Meanwhile, Payoneer will charge a flat fee of £1.95. This might be beneficial if you make few withdrawals of large amounts.

Card issuance fee

Then we have card issuance fee, charged by services that have their own debit card to offer. We mentioned that several of the reviewed services offer a debit card, but in most cases, they charge you for it. Payoneer will even charge you a hefty sum for delivering it, if you want it to arrive quickly.

HSBC, interestingly, offers a debit card for free, but services like Wise will charge a small fee. Wise, specifically, charges you £7 for issuing your debit card. While you don't have to have a debit card, it is useful to own it if you plan to spend money from your USD account.

Check Your Eligibility for a US Dollar Account

If you wish to open a USD account in the UK, you first need to ensure you are eligible to have one. The specific requirements may vary from one service/bank to the next. However, most have similar basic expectations from their clients.

You must be an adult

One of the biggest requirements is that you are an adult, meaning that you are 18 or older. This is quite understandable, especially when it comes to opening a foreign currency account.

You must be an existing client

This doesn’t apply to most of the options on our list. However, Barclays and HSBC Global Money have listed this in their requirements. This is not the case with all services, of course. Wise, Payoneer, and others, for example, let you choose which currencies you wish to hold.

You must provide identification

This is a regular rule at pretty much every regulated financial service in the UK. You must provide identification when registering. This is a must, as you need to complete the Know Your Customer (KYC) requirement. Usually, a government-issued ID will be enough. However, know that in some cases, you might also have to provide proof of residence as well.

Proof of income

Some banks might have an additional requirement such as regular, steady income. But, this is usually not the case with challenger banks such as Revolut, or services like Payoneer.

How To Sign Up to a Dollar Account?

If you decide to sign up for a USD account, note that the process may vary from service to service. For example, Barclays will require you to visit the nearest branch or sign up via a phone call. The same is the case when it comes to HSBC Global Money. However, in the interest of simplicity, we will provide steps for an easy-to-use service like Wise.

Step 1: Pick a service

Step 2: Sign up

Step 3: Identity verification

Step 4: Fund your account

Step 5: Convert the funds or make payments

How to Choose The Best Dollar Account In 2026

In order to choose the best dollar account in the UK, you need to consider multiple factors. Here are some of the most important ones.

Fees

Most financial institutions make money through fees. That means that they will charge for most of their services. You will likely have to pay fees for sending money, receiving it, converting it, maintaining your account, and more. Naturally, it is in your best interest to pay as little as possible.

This is why we recommend checking out all of these fees, whether they are charged, and if so, how big are they. You will want to choose a service that will charge as few fees as possible, and as little as possible.

Exchange rates

Given that you need a USD account in the UK, chances are that you will go through some currency conversions. Whether you will convert GBP into USD or vice versa, you want to keep an eye on exchange rates. Some services are not very transparent with their rates, because they use their own, instead of standard market rates. This is another way for them to make money.

Unfortunately, this is not beneficial for you. That is why you should pick the ones with the most favorable and fair rates. Look for services that are transparent about their rates. That way, you will always know what to expect to get from conversions.

Cards and other additional features

When picking a service for your USD account, consider what other features you want. Whether that is a card, the ability to use it for investing, or perhaps earning interest. Some services may offer one or more of such features, but this is not the norm that all of them follow.

Also consider your own situation, such as whether you are often traveling abroad, or offering freelance services. All of this may affect which service you might turn to in the end.

Security

Always remember to consider security factors when picking a service for your USD account. The first rule to follow is to always use a regulated entity. Thankfully, all the services reviewed in this guide are regulated by the FCA.

Apart from that, also remember to set up the two-factor authentication (2FA). Services that additionally protect your funds with insurance are also a great pick. Remember to check whether they offer spending notifications, fraud monitoring, and such, too.

USD Account Limitations

Lastly, before you open a USD account with a specific bank or money transfer service, consider the limitations. One example is HSBC, which doesn't allow you to receive USD payments. Instead, you have to fill your USD account by converting your GBP into USD from your existing account. Other services might not provide debit cards for you to spend your USD at terminals. And, of course, some may require you to be an existing customer for a certain period of time, like Barclays.

.jpg)

.jpg)