Cryptocurrencies may not be as talked about as they used to be in the last few years, but data indicates that the cryptocurrency adoption rate in the UK is increasing. While there is still a great portion of the British population that still doesn’t know what cryptocurrencies are, some crypto owners spend thousands of pounds in crypto assets on a monthly basis.

Read on for a closer look into who owns crypto in the UK, how they got it, and why they did so in the first place.

Top 10 Statistics on the Cryptocurrency Adoption Rate in the UK

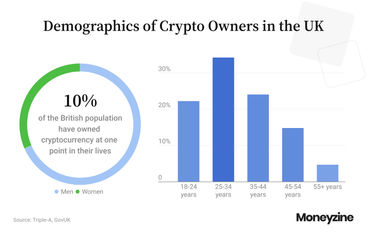

10% of the British population have owned cryptocurrency at one point in their lives.

34.26% of Brits who own crypto are aged between 25 and 34.

40% of British crypto owners have an annual income of over £200,000.

37.16% of British crypto owners own cryptocurrency with a value smaller than £1,000.

79% of crypto asset owners in the UK own cryptocurrencies.

25.58% of UK crypto users spend over £1,000 in cryptocurrency per month on average.

There are 495 crypto-friendly business locations in the UK.

65.35% of British crypto owners own Bitcoin.

68% of British crypto owners typically acquire their cryptocurrency from a centralised exchange.

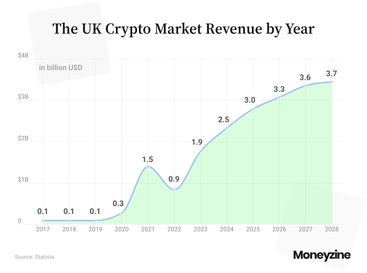

The UK crypto market revenue is expected to reach $1.9 billion in 2023.

Stats on the Crypto Adoption Rate in the UK

10% of the British population have owned cryptocurrency at one point in their lives.

In a recent survey, another 19% of respondents said they never even heard of cryptocurrency.

Other data revealed that 13% of all British men and only 6% of British women have held crypto at some point in their lives.

34.26% of Brits who own crypto are aged between 25 and 34.

Data on crypto ownership in the UK reveals that more than a third of Brits who own crypto are young Millennials, while the second-largest portion of 24.07% of British crypto owners fall into the 35 to 44 age group.

Young adults, between 18 and 24, account for 22.22% of all crypto owners in the UK and these three age groups collectively make for more than 80% of all people in the UK that hold some kind of crypto.

Crypto owners between 45 and 54 account for 14.81% of the total, while there are only 4.63% of all Brits who own crypto that are older than 55.

40% of British crypto owners have an annual income of over £200,000.

Cryptocurrency adoption statistics indicate that wealthier Brits are more likely to own crypto. According to the latest reports, around 71% of the British crypto owners have a yearly income north of £70,000.

More precisely, 40% of them earn more than £200,000 per year, 18% between £100,000 and £199.999, and 13% between £70,000 and £99,999.

Another 10% of the crypto owners in the UK earn an annual income of between £40,000 and £69,999, only 6% earn between £10,000 and £39,999, and interestingly enough, 7% of Brits who own crypto earn less than £10,000 per year.

37.16% of British crypto owners own cryptocurrency with a value smaller than £1,000.

While one in three Britons has less than £1,500 in savings, cryptocurrency adoption statistics show that most crypto owners in the UK also hold relatively small amounts of crypto.

More than a third of them have crypto assets worth up to £1,000, while another 24.45% have cryptocurrencies worth between £1,000 and £5,000.

Data further reveals that 19.32% of Brits who own cryptocurrencies, own crypto assets valued between £5,000 and £10,000, and the remaining 19.07% are crypto owners with cryptocurrency worth more than £10,000.

Stats on Cryptocurrency Usage in the UK

79% of crypto asset owners in the UK own cryptocurrencies.

Data on the crypto adoption rate and usage in the UK reveals that cryptocurrencies are by far the most popular crypto asset among British crypto asset owners.

In contrast, only 20% of the crypto asset owners in the UK own utility tokens, and just 11% own stablecoins. A small portion of 8% of the UK crypto asset owners own privacy tokens, 4% own a financial product where leverage is applied, and another 4% own other crypto assets that are none of the above.

52% of British crypto asset owners hold crypto because they believe it is a fun investment.

Interest in underlying technology is the second most common reason, as agreed by 36% of British crypto asset owners.

Data on the cryptocurrency adoption rate in the UK further reveals that only 19% of these Brits see crypto as a core part of their investment portfolios, 18% hold crypto assets so they can buy goods and services with it, and 8% hold crypto assets for gambling.

25.58% of UK crypto users spend an average of over £1,000 in cryptocurrency per month.

Another 33.49% of Brits who own crypto use it to make monthly purchases averaging between £100 and £1,000, while the largest portion of 40%, spend less than £100 in cryptocurrency, monthly.

There are 495 crypto-friendly business locations in the UK.

The latest findings on the global adoption rate of cryptocurrency among businesses that either accept crypto as an in-store payment or have a cryptocurrency ATM show that the largest number, or 44, of these businesses are consumer electronics stores, followed by 39 IT services, and 29 quick-service casual dining restaurants.

There are 12 countries in the world with more crypto-friendly business locations than the UK. The USA tops the list, with a whopping 5.968 businesses that accept crypto payments or have a crypto ATM.

Binance was the most downloaded crypto wallet in the UK in 2023

254,958 consumers in the UK downloaded Binance in Q2 2023, making it the most popular, and perhaps the best crypto app in the UK. This was followed by Trust with 137,889 and then Coinbase wallet with 109,454 downloads.

General Stats on Crypto Adoption in the UK

The raw transaction volume of the UK crypto market for 2023 is estimated at $252.1 billion.

The above figure places the UK in the number three spot globally in terms of raw transaction volume, while at the same time indicating that the UK is the biggest crypto economy in Europe.

On the other hand, the UK is in the 14th spot globally, in terms of crypto adoption, with Ukraine, Russia, and Turkey being the only three European countries ahead of it.

65.35% of British crypto owners own Bitcoin.

Statistics show that Bitcoin is the most used cryptocurrency in the UK, followed by Ethereum, held by 36.67% of them.

Cryptocurrency statistics reveal that Ripple and Tether are also among the most popular cryptos in the UK, owned by 24.21% and 20.54% of British cryptocurrency owners. Finally, 29.58% of Brits who own crypto own other cryptocurrencies, altcoins, stablecoins, CBDCs, NFTs, etc.

68% of British crypto owners typically acquire their cryptocurrency from a centralised exchange.

Conversely, only 11% of British who own cryptocurrency say they typically acquire it from peer-to-peer websites, and another 11% cite mining as their source.

Even a smaller portion of 9% say they received their cryptocurrency as a gift, only 8% got it from a decentralised exchange, and just 6% acquired them through an initial coin offering.

The UK crypto market revenue is expected to reach $1.9 billion in 2023.

Projections about the future of crypto in the UK predict that the market will continue growing at a CAGR of 14.03% between 2023 and 2028 and reach a figure of $3.7 billion in 2028.

Regarding the number of cryptocurrency users in the UK, forecasts predict that this will also increase and reach 22.43 million users in 2028.

Finally, the UK crypto penetration rate is also expected to grow, from 25.68% in 2023 to 32.04% in 2028.

The Bottom Line

While there is no significant cryptocurrency boom happening in the UK right now, digital assets are slowly finding their way into the lives of more and more Britons.

Granted, when we say crypto owners, we mainly talk about people who bought Bitcoin as they thought it was a fun investment. The percentage of people owning Web3 cryptocurrencies, using De Fi services, and participating in blockchain-based projects is still relatively low.

.jpg)

.jpg)

.jpg)

.jpg)