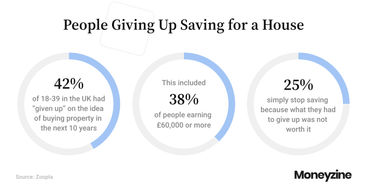

- 42% of adults aged 18-39 who don't own a home say they've given up on the idea of buying one in the next ten years - including 38% of people earning £60,000 or more.

- 1 in 10 young home owners had to give up dating or a relationship in order to afford their property.

- This has led to a large increase (more than 700,000!) in the number of adults living with their parents.

This has been a common refrain amongst critics of the ‘entitled’ millennial generation. But new research illustrates just how difficult buying a home has become.

Moneyzine.com has analysed findings that reveal the lengths even those earning nearly three times the national average income must go to in order to get on the property ladder.

High Earnings Are Not Enough

A recent study found that 42% of 18-39 in the UK had “given up” on the idea of buying property in the next 10 years. Strikingly, this included 38% of people earning £60,000 or more. With house price increases, growing mortgage rates and a cost of living crisis, even relatively affluent young people find the idea of owning their own home unrealistic. This had led 25% to simply stop saving - because what they had to give up was not worth it.

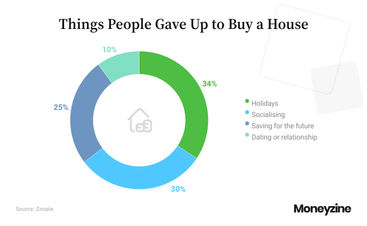

To illustrate the point, researchers asked those that had bought their own property in recent years how they had achieved it. They found that 34% had given up on holidays, which might seem reasonable. But 30% had given up socialising and 10% had given up dating or being in a relationship.

The conclusion is simple: owning a home requires most Millennials and Gen-Z to give up on the things most people find make life worthwhile.

Have we got “failure to launch” wrong?

Earlier this year, the ONS released data showing a large increase in the number of adults living with their parents. The total number of adult children living with their parents increased 14.7% in the same period from around 4.2 million in the 2011 Census to around 4.9 million in Census 2021. More than 1 in 10 (11.6%) of those aged 30 to 34 years live with their parents, and there are more than a third more men living at home than women ((60.8% and 39.2%, respectively.)

Upon publication, these findings were taken as evidence of an out of control housing market. And this reading is true: the average British property price has almost doubled since 2000, and the average age of first-time buyers is now 32. But while the growing phenomenon of adults living at home - sometimes called ”failure to launch” - is bemoaned by the media, might we ask: why is it such a bad thing?

As more people live with their parents, the stigma attached to this situation is also likely to diminish. Italy is a clear example where such a cultural shift has happened, with two-thirds of young Italian adults currently living at home. And when even those earning nearly 3x the national average salary have no hope of buying a home, fewer people are likely to frame their own lack of property as a “failure”.

“The big question raised by this research is: how does living at home impact quality of life? While almost 1 in 4 families with adult children in London is overcrowded, the same is true of just 1 in 15 homes in north-east England.”Jonathan Merry, Personal Finance expert at Moneyzine.com

Contributors

.jpg)