Dutch-style mortgages landed in the UK in February 2024 with the launch of April Mortgages. These new mortgages could save you money on interest, along with a host of other benefits.

Find out whether going Dutch is the right move for your mortgage and what your options are for getting a Dutch-style mortgage.

Dutch Mortgage Model Explained

Okay, let’s get down to business. So, what exactly is a Dutch-style mortgage? And no, it’s not just a mortgage for a windmill.

There are a couple of things that mortgage lenders do differently in the Netherlands. To start with, fixed-rate periods for Dutch mortgages often last longer than in the UK. Many Dutch homebuyers opt to fix their interest rates for as long as 20 or 30 years.

This may sound unusual to Brits, but many other Europeans who are just setting down roots like the stability of knowing what their monthly payments will be for the long term.

Of course, the other key difference with Dutch-style mortgages is that the interest rate automatically decreases as you pay off your debt. Below, we'll dive into the nitty-gritty of how these mortgages actually work.

Key differences between Dutch-style mortgages and regular UK mortgages:

Dutch-style mortgages are often fixed for 20 years or more, while in the UK, 2-5 years is more common

The interest rates automatically decreases as you pay off your mortgage

As mortgage expert and founder of Lease Extensions, Ashley Connell, told us:

For many people, these mortgages could save them real money the longer they pay. The rates going down over the years mean interest costs decrease, and building equity speeds up too. Not having penalties for early payments gives flexibility if needing to sell or pay extra.Lease Extensions founderAshley Connell

How Do The Interest Rates Work With the Dutch Mortgage Model?

Interest rates that get lower over time? This may sound too good to be true, but it’s pretty standard over in the Netherlands.

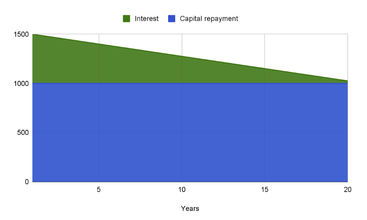

The logic is that as you reduce the size of your loan, the risk to the lender reduces. This means they don’t need to charge you as much to compensate for their risk.

Mortgages with a lower loan-to-value (LTV) ratio typically have lower interest rates. So, once you’ve reduced your LTV through repayments, you’ll automatically be moved to the interest rate for your lower LTV.

It’s easiest to see how this works by looking at an example.

Example:

Imagine you buy a £200,000 house by borrowing £190,000 with a Dutch-style mortgage. At the outset, your LTV is 95%. You opt for a 20-year fixed-rate mortgage, and your lender offers an interest rate of 5% for 95% mortgages.

You’ll start out by paying this 5% interest rate. But after a year, you’ve repaid £10,000 of your mortgage. This means your LTV has reduced to 90%. Seeing as your lender offers 90% mortgages with a 4.7% interest rate, they automatically move you onto this lower rate.

Another year later and you’ve reduced your LTV to 85%. Your interest rate drops to 4.4% as that’s the available rate for 85% mortgages. This process continues until you’ve paid off your mortgage.

With these loans, the rate adjusts based on your home's worth compared to what's still owed. The lower that ratio gets, the lower your rate goes too. This happens without having to refinance like with a normal fixed-rate loan. April offers terms up to 15 years with rates potentially dropping across several equity tiers.Lease Extensions founderAshley Connell

The upshot of this model is that you could pay less interest overall compared to other fixed-rate UK mortgages. Seeing as interest accounts for a huge amount of what borrowers pay, a Dutch-style mortgage could save them thousands.

What’s the Catch?

There’s a noteworthy downside to Dutch-style mortgages: you’ll be very limited in your choice. April Mortgages is currently the only lender offering Dutch-style mortgages in the UK.

What’s more, they’re only offering loans to remortgage customers at the time of writing. However, they plan to expand their offering to home buyers in the future.

Of course, locking into one of these longer-term deals means you're sort of stuck if rates drop significantly later on. And April's upfront fees may stop some from going this route.Lease Extensions founderAshley Connell

How Do Dutch-Style Mortgages Compare to Existing Deals?

Wondering whether a Dutch-style mortgage is best for you? Well, to answer that we’ll need to look at how they compare to other types of mortgages.

Dutch-Style Mortgages vs Fixed-Rate Mortgages

A Dutch-style mortgage is a type of fixed-rate mortgage, but it differs from other fixed-rate mortgages offered in the UK. This is because Dutch-style mortgages let you fix the rate for longer, and the rate will automatically reduce as your LTV reduces.

Compared to the standard 2-5 year fixes most get here, these Dutch loans offer locking in a rate for a longer stretch. But they also see that the rate adjusts over time which provides stability and predictability when planning long-term.Lease Extensions founderAshley Connell

With regular fixed-rate mortgages, you’ll usually be able to fix the rate for 2, 3, or 5 years. Your interest rate will stay the same during this period, even though your LTV will decrease. You won’t have the opportunity to look for a lower rate until the end of your fixed-rate period.

Whether you get a lower rate at the end of the fixed-rate period is at the discretion of your lender. And if you don’t sort out a new deal before the end of your previous one, your mortgage will automatically switch onto the standard variable rate (SVR), which will probably be higher.

Pros and Cons of Fixed-Rate Mortgages

Pros

- You’ll have plenty of choice of lenders and deals

- The short fixed-rate periods mean you don’t have to commit to anything long term

- If rates drop, you can shop around for a better deal at the end of your fixed period

Cons

- If rates drop during your fixed period, you can’t take advantage until your deal ends

- No option for a longer fix for long-term stability

- If you don’t sort out a new deal in advance you’ll end up on the (probably higher) SVR

Dutch-Style Mortgages vs Tracker Mortgages

Tracker mortgages are totally different. Their interest rate changes in line with the Bank of England base rate. This means your monthly payment amount could go up or down.

Tracker rate mortgage deals last a set number of years. After that, you can choose another tracker-rate deal or a fixed-rate deal. If you don’t, you’ll end up on the SVR, which will likely be more.

A Dutch-style mortgage is a better choice if you want the stability and consistency of knowing how much you’ll pay each month. You could end up paying less than a tracker rate if base interest rates rise.

On the flip side, a tracker mortgage could see you paying less if the base interest rate drops. On top of this, they usually have no or lower early repayment charges than fixed-rate mortgages. This could make it easier to move home or remortgage.

Pros and Cons of Tracker Mortgages

Pros

- You could pay lower interest rates when the base rate drops

- You can shop around as there are lots of available options

- You don’t need to make a long-term commitment as the deals last a few years at most

Cons

- A rise in the base rate could see you paying a higher interest rate than fixed-rate deals

- A lack of stability as interest rates could change at any time

- You’ll end up on the SVR if you don’t secure a new deal in time

April Mortgages: Your One and Only Shop for Dutch Mortgages in the UK

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 0.0 | Visit |

Types of mortgages offered | Remortgages (home purchases to be available in April) |

|---|---|

Term length | 5, 7, 10, 12, or 15 years |

Maximum LTV | 85% (increasing to 95% later in 2024) |

Allows overpayments | Yes |

Regulated by | FCA |

April may have only launched in the UK in February 2024, but it’s backed by DMFCO. This Dutch asset manager also launched its mortgage lending arm, Munt, which has been offering mortgages in the Netherlands since 2014.

As the only Dutch-style mortgage lender in the UK, April is unique in the UK, given its longer terms and decreasing rate. It aims to provide borrowers with flexibility, long-term stability in repayments, and no obligation to remortgage for as long as they want. There’s also no high variable rate.

April funding their loans overseas rather than with UK pensions is a novel move for the market, which the large banks have traditionally dominated. Whether this catches on locally may depend on how consumers receive it and if the property market holds up over the long haul.Lease Extensions founderAshley Connell

You won’t be able to apply for a mortgage directly with April. Instead, you’ll need to contact one of their associated mortgage brokers: moneyQuest or HL Partnership.

Perks and Future Prospects

The decreasing interest rates aren’t the only boon of April Mortgages. They facilitate further borrowing with the same conditions as your original loan, so there’s no need to start a new mortgage application.

What’s more, April doesn’t impose an Early Repayment Charge, and your first valuation is free.

Although April’s current offering is only remortgages up to 85%, it will be expanding to offer higher loan-to-value mortgages for home purchases later in 2024.

Additional Costs Involved

There are a variety of fees associated with getting a mortgage. Here are the costs you should be aware of.

Application Fees

Cost: £195

This is a non-refundable fee charged for assessing and processing your application. The amount is on par with other UK lenders, which typically charge £100 to £200.

Valuation Fees

Although the first valuation is free (for properties up to £750,000 in Greater London or up to £500,000 in the rest of England and Wales), any subsequent valuations will be charged according to the property’s value as follows.

Property Value | Fee |

|---|---|

Up to £100,000 | £260 |

£100,001 to £200,000 | £295 |

£200,001 to £250,000 | £328 |

£250,001 to £300,000 | £361 |

£300,001 to £350,000 | £394 |

£350,001 to £400,000 | £427 |

£400,001 to £450,000 | £460 |

£450,001 to £500,000 | £493 |

£500,001 to £600,000 | £525 |

£600,001 to £700,000 | £620 |

£700,001 to £800,000 | £715 |

£800,001 to £900,000 | £810 |

£900,001 to £1,000,000 | £905 |

£1,000,001 to £1,250,000 | £1000 |

£1,250,001 to £1,500,000 | £1,220 |

£1,500,001 to £1,750,000 | £1,430 |

£1,750,001 to £2,000,000 | £1,640 |

£2,000,001 to £2,500,000 | £1,850 |

These fees are a bit higher than those charged by Lloyds, and significantly higher than Barclays.

Completion Fee

Cost: £995

This is the equivalent of the product fee and can be paid upfront. If you opt to add it to the total mortgage amount instead, you’ll pay interest on it. April charges a similar amount to other UK lenders: Barclays and Santander both charge a £999 product fee for many of their mortgage products, though they also offer some mortgages without a product fee.

Legal Fees

Cost: £150

This cost is only charged by April if you make a change to your mortgage such as adding a party or altering the term.

For a house purchase, the legal fees will be charged by your conveyancer and can vary. In the case of a remortgage, April will pay the conveyancer, but you may need to pay some additional legal fees.

Early Repayment Charge

Cost: None or variable

April won’t charge an ERC if you make overpayments or pay off your mortgage during the product term. But if you decide to remortgage to another lender or refinance to another April product during the term, you could be charged.

What stands out with April's offerings is the lack of bailout charges and rates reducing automatically as equity rises. This could appeal more to first-timers or those short on starting capital since it offers a fairer lending model with the flexibility to move. Just note charges may apply if refinancing mid-deal rather than moving homes.Lease Extensions founderAshley Connell

Our Final Verdict on Dutch-Style Mortgages: Are They What They’re Cracked Up to Be?

Dutch-style mortgages certainly provide some benefits. The automatically reducing interest rates could see you pay less overall. And the longer terms could give you the peace of mind of knowing what your repayments will be well into the future.

That doesn’t mean Dutch-style mortgages are for everyone, though. If you prefer shorter terms or a wide choice of lenders, you’ll be better off with other types of mortgages.

April Mortgages is currently your only choice for Dutch-style mortgages. It’s a brand new player in the UK mortgage market, though it brings plenty of experience from the Netherlands. Time will tell whether April’s unique offering proves popular with Brits.