Planning to send money to South Africa but dreading the fees and slow service? Our guide cuts through the clutter, comparing top international money transfer services just for you.

Dive into an analysis that doesn't just scratch the surface; we dig into the all-important details like fees, exchange rates, and service speeds.

Discover the most cost-effective and rapid ways to transfer your funds to South Africa in 2026.

We lay out the pros and cons of each option, from industry titans to innovative newcomers, ensuring you have the full spectrum of choices. And the best part? We aim to find you a service that's not only budget-friendly but also delivers your money in record time.

Top Money Transfer Providers to Send Money to South Africa

Data and user opinions point to Wise as the standout choice to send money to South Africa

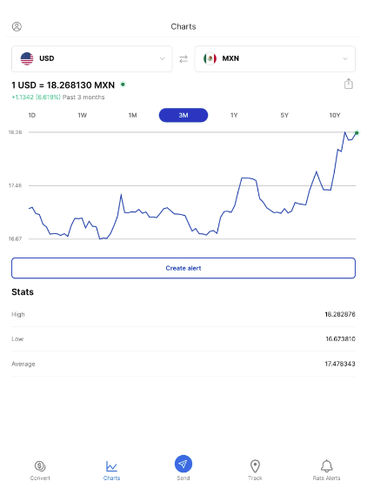

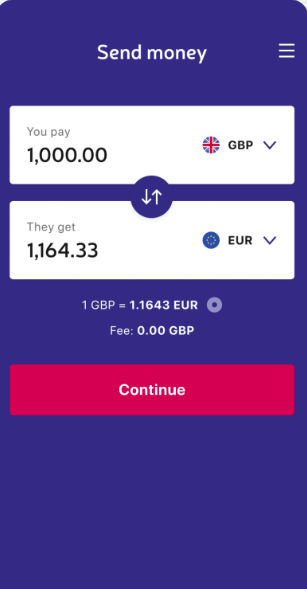

The Pound-to-Rand rates are competitive. You won't lose your hard-earned money when you send it across continents. This is a big deal. Let's face it, no one likes to see their money eaten up by bad rates and hidden charges.

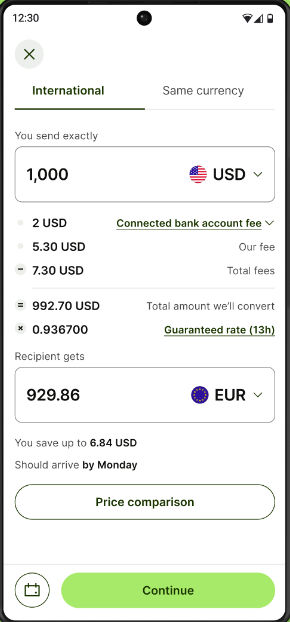

Speaking of charges, Wise prides itself on transparency and gives you all fees upfront. The low fees with no hidden surprises are something users genuinely appreciate.

It's refreshing to see exactly what you're paying for upfront, without having to worry about extra costs creeping in. And when it comes to using Wise, simplicity is the name of the game.

Their interface is intuitive. It makes sending money easy. This is true both on the web and in their app.

Wise doesn't skimp on security either. This service employs top-notch encryption and security measures to keep your money safe from start to finish. Plus, the real-time exchange rates ensure you're always in the know. You can make informed decisions with up-to-the-minute information.

Our data show that Wise delivers in speed too. It has quick delivery options that can get your money to South Africa in mere minutes. With Wise, you get also to choose from a large number of payment services, so it’s not limited to a bank transfer from high street banks.

Users are very satisfied. Wise has a great reputation on customer feedback platforms. Their high rating is a testament to the reliable, cheap, and easy service they provide.

Pros

- No markup to the mid-market rate

- Very transparent about fees

- Strong security and encryption

Cons

- Larger transfers require additional verification

- No live chat support

When speed is of the essence, and you need to send money to South Africa, Xe is the rapid-fire option you need.

What makes Xe the go-to for swift transactions? It's simple: once they receive your funds, the money is typically in the recipient's South African bank account within five minutes. Yes, you read that right – minutes.

But speed isn't the only thing Xe has going for it. They also offer competitive exchange rates. This means not only does your money get there fast, but you also get a good deal in the process. Everyone loves a win-win.

Xe streamlines the process with direct bank-to-bank transfers. This cuts out unnecessary middlemen and speeds up the transaction. And through their partnership with Sikhona Money Transfers, the process is even quicker.

Once the transfer is made, Sikhona gets in touch with the recipient to verify details, ensuring the money is deposited pronto.

Worried about how to pay for the transfer? Don't be. Xe offers many payment options. These include bank transfers and debit/credit cards. This flexibility ensures that, no matter your situation, you can find a convenient way to send money.

Transparency and security are also top priorities for Xe. They're upfront about any fees, and follow strict security and rules to protect your data and money.

So, if getting money to South Africa quickly is your goal, Xe delivers. Fast, competitive, and secure – it's the trifecta of international money transfer.

Pros

- Send money to South Africa in minutes

- Benefit from competitive exchange rates

- A variety of payment options available

Cons

- It's not as Cheap as Wise or Atlantic Money

- Refunds could take a while if you cancel the transaction

Want to save as much as possible on your transfer, even if your money may take a bit longer to get to South Africa?

TorFX is a low cost alternative that offers the best value for money. Their exchange rates can outdo what you'd find at the banks when you need to transfer money to South Africa, helping your money go further.

But the real cherry on top? TorFX doesn't tack on transfer fees. This is a game changer for anyone looking to maximize savings while sending money abroad. It's like sending money without the sting of extra costs—everyone's dream.

This award-winning service has won awards many times. They were recognized for their great customer service. They are also a top international money transfer provider.

Customers say this too. Many praise TorFX for their professionalism, low rates, and great service. It's one thing to claim you're the best; it's another when your customers sing your praises.

Lastly, TorFX has regulatory compliance from the Financial Conduct Authority (FCA) and a top rating from Dun & Bradstreet. It is not just the cheapest, but also a trustworthy option to send money online to South Africa.

Pros

- No fees for transfers

- Stellar customer service with personal account management

- Award-winning and trustworthy

Cons

- You need to provide your email to get a quote

- Identity verification can be cumbersome

How to Send Money to South Africa Using a Money Transfer Provider

Sending money to South Africa online from overseas can be easy. If you are about to start your first money transfer, use a specialized online money transfer service. Here's how to navigate the process in three simple steps:

Step 1: Compare Providers

Step 2: Sign Up

Step 3: Transfer Money

Fastest Way to Send Money to South Africa

Xe stands out as our top pick to send money to South Africa fast.

Why Xe? For starters, the speed is unbeatable. Once Xe receives your funds, they can get to the recipient in South Africa within a mere five minutes.

This fast service is thanks to their direct bank-to-bank transfers. It's also thanks to a strategic partnership with Sikhona Money Transfers. That partnership ensures your money lands swiftly and securely.

Plus, Xe's transparency on fees and competitive rates means you're not sacrificing cost for speed.

Cheapest Way to Send Money to South Africa

On Moneyzine, we've looked at all options, and TorFX is the cheapest way to send money to South Africa - especially if you are looking for a British pound to South African rand transfer.

There are no hidden fees and their exchange rates are hard to beat, always surpassing what banks can offer. This means more money in your recipient's pocket. Then, there's the appeal of fee-free transfers, making it a no-brainer for anyone looking to save on costs.

Add to this their many awards for great service and glowing customer reviews. You've got a service that's about saving money as much as it is about reliability and trust.

What Are the Best Apps to Send Money to South Africa Online

When it comes to sending money to South Africa, the apps from Wise, Xe, and TorFX stand out. They are great ways to complete your transfer from a mobile device.

Here's the scoop. Wise impresses with its user-friendly design, ensuring you can send money quickly and track it in real time. It's about simplicity and efficiency.

Xe is all about speed; their app gets your money where it needs to go, fast, and keeps you informed every step of the way.

Then there's TorFX. It offers low rates and applies a no transfer fee policy. They are wrapped up in a sleek app. The app makes managing international transfers easy.

Each of these apps brings something unique to the table, ensuring that, no matter your needs, there's an app that's just right for you.

Online Money Transfers and Safety

Sending money to South Africa requires a keen eye on safety and security. The golden rule? Use secure online money transfers when you send money online. Why? They follow strict guidelines to protect your money.

Unregulated platforms might not offer the same level of security, making them a riskier choice.

Bank transfers with strangers? Tread carefully. It's safer to use recognized money transfer services, as they offer more robust protection against scams.

Yes, even bank and PayPal transfers can be compromised. Always double-check details before you send money online and stay alert to phishing scams. The right provider doesn't just move your money; they safeguard it every step of the way.

Things to Consider when Sending Money to South Africa

If you want to ensure your money arrives quickly and with no issues, you should spend 10 to 15 minutes preparing the transfer. These are the most important factors elements to consider:

Regulations and Guidelines

In South Africa, several entities regulate money transfers. These include the South African Reserve Bank (SARB), the Financial Intelligence Centre (FIC), and the Financial Sector Conduct Authority (FSCA).

They make sure banks follow the country’s laws on stopping money laundering and terrorism financing.

The Financial Intelligence Centre analyzes financial transactions. It does this to find potential money laundering or terrorist financing.

Banks in South Africa may ask about the source of your funds. This is a standard part of due diligence.

A legitimate source of income, like salary, business revenue, or an inheritance, is usually considered a good reason. Inquiries can happen at any stage. They are common when making big transactions or opening new accounts.

How Much You Are Sending Abroad

Big sums might need to be reported to financial authorities to keep things above board. If you plan to send more than £10,000 to South Africa, expect to do some paperwork.

Banks can cancel or reject big international transfers. They do this due to security or regulatory reasons. The key to avoiding this is transparency. You must provide all needed documents and answer any questions about the transfer's purpose.

How Much Does It Cost to Send Money?

Costs can vary widely. They are based on factors like the amount you’re sending, how you fund the transfer, and the service provider.

Costs Involved

1. Transfer Fees: These are upfront charges by the service provider. Some platforms might offer fee-free transfers up to a certain limit or for the first transfer.

2. Exchange Rate Margins: The difference between the market rate and the rate you're given. It's how most services make a profit.

3. Additional Fees: Depending on the method of transfer (bank, online, app, cash pickup), there might be extra costs. Funding transfers with a credit card, for instance, often incurs higher fees.

To dodge these pesky fees, comparing providers is key. Look for services with low or no transfer fees and competitive exchange rates like TorFX or Wise.

Some providers offer fee waivers on your first transfer or when you send above a certain amount. Using bank transfers for funding, rather than credit cards, can also lower costs.

Domestic vs. International Fees

Domestic transfers are generally cheaper and faster, lacking the international component that hikes up costs.

The exchange rate doesn't apply to domestic transfers, which can significantly lower the overall cost.

In short, a transfer to South Africa from the United Kingdom (i.e. if you need to send GBP to South African Rand) costs more than a domestic one. However, using reliable services for your money transfers to South Africa you will be able to cut down on costs and often pay only a flat fee.

Sending Money to South Africa for Business

Fees range from 0.55% (minimum R275, maximum R550) when sending online. Money can be sent for business purposes like paying overseas suppliers. Amounts over $10,000 must be reported to tax authorities.

Payment Type: Gifts

Gifts over R100,000 per year must pay 20% tax. The donor must report gifts over R100,000 by submitting an IT144 form to SARS and paying the tax by the end of the next month.

What Do You Need to Send Money to South Africa

Sending money to South Africa is straightforward once you know what's needed. Here’s what to keep on your checklist:

- Recipient's Full Name: It’s crucial this matches their ID perfectly to avoid any hiccups.

- Recipient's Bank Details: For bank transfers, you'll need their account number and branch code. South Africa doesn't use IBANs but relies on these details instead. For non-bank transfers, gather the necessary information for your chosen service.

- Amount and Currency: Decide how much you’re sending and in which currency. South Africa’s currency is the Rand (ZAR).

- Your Identification: Some transactions require a form of ID from you, especially for online or bank transfers.

- Purpose of the Transfer: Be prepared to explain why you're sending the money, though keeping it straightforward is best.

For larger transactions:

- Declaration Forms: Moving a lot of money? You might need to fill out forms for tax or legal reasons, aligning with both South African and your country's regulations.

Safety first: If you don’t personally know the receiver, double-check their details. This step is vital for preventing fraud and ensuring your money lands in the right hands.

What Do You Need to Receive Money in South Africa

Having a local bank account can streamline receiving international funds. For bank transfers, the sender will need:

- Your Bank Account Number and Branch Code: Unlike some countries, South Africa doesn’t use IBANs. These details are sufficient for receiving money from abroad.

- Possibly Your BIC/SWIFT Code: Some international transfers require this code to identify your bank.

For smaller amounts or if using services like Western Union or PayPal:

- Service-Specific Account: You might need an account with the respective service.

- Confirmation Codes or Transaction IDs: Keep these handy for tracking your money or picking it up.

And don’t forget:

- Your ID: Essential for verifying your identity, whether you’re picking up cash or receiving funds through an online service.