Discover whether saving, investing, or a combination of the two will earn you more money. In this article, you’ll learn about the difference between saving and investing, the pros and cons of each, and how to start investing.

Saving vs Investing: A Summary

Saving | Investing | |

|---|---|---|

Risk | Low | Low - high |

Potential returns | Low | Highly variable, historically higher than savings |

Time horizon | Less than 5 years | 5+ years |

Liquidity | Immediate access | Variable |

Saving

Saving money is essentially the opposite of spending. People save for a variety of reasons, usually for specific things like holidays, large purchases like a car or a house, or for smaller things like specific items of clothing or a household gadget.

Others save more generally for their future, keeping money back for emergencies in case large expenses crop up unexpectedly, or saving for retirement through a pension or lifetime ISA.

Usually, saving refers to putting money aside into a cash product held separately from your everyday current account, such as a savings account, an ISA, or a credit union account.

Saving Pros and Cons

There are positives and negatives to growing wealth through savings.

Pros

- Minimal risk of loss with deposits protected by the FSCS and returns promised through interest rates

- Money is easily accessible in an emergency

- Good funding for short-term goals like small purchases or holidays

- Interest compounds, so you earn interest on your interest

Cons

- Lower long-term yields

- Variable interest rates

- Unlikely to beat inflation, meaning the spending power of your savings will decrease over time

While saving is a crucial part of developing a healthy budget, there are some cases when a savings account won’t be the best option for your needs. While interest rates will give you a guaranteed positive return on your deposit, the longer you keep your money saved, the less spending power it will have in the real world due to the impact of inflation.

Easy withdrawals make it possible to move your money if you decide you’d like to deposit it elsewhere in the longer term. This makes savings accounts ideal for short-term cash building or temporary saving.

Compound Interest

Interest compounds when your savings accounts include interest you’ve already earned when making your next interest payment. Basically - your interest earns interest.

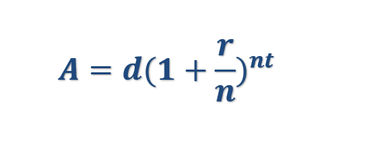

Compound interest can be calculated using the following formula:

A = Final amount (including compound interest)

d = Deposit amount

r = Interest rate in decimals

n = Number of times interest is compounded per time period

t = Total number of time periods you’re calculating for, usually in years

For example:

You deposit £1,000 into a savings account. The interest rate is 5% and it compounds monthly. You aim to keep the money in your account for a year.

d = 1,000

r = 0.05

n = 12 (12 months in a year)

t = 1

1,000 x (1 + 0.05/12)(12 x 1) = £1,051.16 (rounded down)

Therefore, at the end of the year, you would have £1,051.16 in your account.

With compounding, you have earned £51.16 in interest. Without compounding, you would have earned only £50.

This does not look like much, but the amounts grow as your deposits increase, and the longer you leave your money in the account, the longer it will earn compound interest.

How To Pick a Good Savings Account

Defining a ‘good’ savings account is tricky, as different savings accounts offer different things that may be more beneficial to some people than others. A common mistake people make when looking for a good savings account is to only consider the interest rate, but there are many other factors that can impact the suitability of a savings account, including:

Account term length

Maximum deposit limit

Minimum deposit required

Withdrawal restrictions

Frequency of interest payments

Tax implications

Introductory bonuses and offers

Is Saving the Best Use of Your Money?

This depends on how much you’d like to save, the returns you’d expect, how accessible you’d like your money to be, and your attitude to risk. Saving is essential to healthy budgeting, but it’s not the only way you can make your spare cash work for you.

Traditionally, interest rates have frequently been outperformed by investment returns. One of the key flaws of savings accounts is that interest rates will almost always be outpaced by inflation, but clever investing could help you keep up with it.

How much would saving and investing have earned you in 2021?

Interactive Investor researched the annual returns you would have received if you’d invested in 2021. The results are below.

Money deposited in | Annual return from December 2020 - December 2021 | Real return after UK CPI inflation |

|---|---|---|

Easy access cash savings accounts (interest)* | 0.17% | -5.23% |

1-yr fixed rate bond (interest)* | 0.59% | -4.81% |

Global equities (MSCI World Index)** | 22.9% | 17.5% |

UK equities (FTSE All Share)** | 18.32% | 12.92% |

Residential property – capital growth*** | 10.4% | 5% |

Residential property – rental yield, gross (November 21)**** | 4.98% | -0.42% |

Gold** | -2.87% | -8.27% |

Global corporate bonds** | -2.06% | -7.46% |

ii ISA investor performance - average (capital growth and income) | 13.7% | 8.3% |

ii Sipp investor performance – average (capital growth and income) | 12.2% | 6.8% |

Sources:

*Moneyfacts Treasury report

**Morningstar Direct

***Nationwide

****Zoopla

Investing

Investing is the process of purchasing assets in the hope that they will increase in value over time, at which point you can sell them and make a profit. Common investments include stocks and shares, property, bonds, and commodities.

Investing Pros and Cons

Investment returns traditionally outperform interest rates, but there are some drawbacks, including the risk that your investments lose value.

Pros

- Traditionally provide higher returns than savings

- Useful for long-term goals like retirement

- Diversification of your investments can reduce the risk of high losses

Cons

- Risk of loss, particularly in the short term

- Takes longer to provide decent returns

- Funds can be impacted heavily by external events like financial crises, political uncertainty, and business losses

There are a few key takeaways from this. Investing has the potential for higher returns than saving, but the added risk of loss and long time frame can seem off-putting.

However, the ability to grow your wealth over time through compounding and reinvestment gives you a much greater chance of reaching your long-term financial goals, like buying a house or saving for retirement.

Diversifying your investment portfolio helps to spread the risk of loss across different types of investment, with each having different characteristics and volatility levels. Investing in one company is great if the company performs well, but if anything impacts the company’s performance or the company goes bankrupt, your investment goes with it.

A diversified portfolio may include company shares, government bonds, commodities, and cash, which will all react differently to market conditions. This should allow you to ride out problematic times for some of your investments, as these troubles may not impact, and may even benefit some of your others.

Types of Investment

When people think of investment, they naturally think of the stock market, but there are lots of different ways you can invest money, and a diversified investment will usually involve at least three of the below:

Stocks and shares

Bonds - Gilts, government bonds, and corporate bonds

Cash

Commodities

Funds and unit trusts

Cryptocurrency

Company/Individual

When To Save and When To Invest

I want enough money for… | Should I save or invest? |

|---|---|

An annual holiday | Save |

My retirement | Invest |

My first house | Save or invest |

Higher long-term wealth | Invest |

A new phone | Save |

An emergency fund | Save |

Investing is more of a long-term process than saving, and you have to be prepared to take at least a small degree of risk. Saving is a good way to keep small amounts of money back for emergencies or more immediate payments. But to really increase your wealth, you’ll need to look at investing in the right places to make a greater return in the long term.

This is a key reason why most pensions are based on investments. As the longest-term saving goal you’ll have in your lifetime, pensions are best suited to diversified investment portfolios that can truly take advantage of market fluctuations and price increases.

Due to the impact of inflation, money held in savings accounts for a long period will have less spending power than it did when you first deposited it, so while there will be more money in your account, it won’t go as far as it used to.

Which Is Riskier, Saving or Investing?

Investing is the riskier way of increasing your wealth, but there are risks to saving as well. Typically, the best returns on investments come from more volatile assets, which have a high chance of increasing in value, but also a high chance of decreasing.

Savings on the other hand are almost always reducing in value against inflation, so keeping all your money in savings is unlikely to grow your wealth as much as the right investments would.

You can directly compare your expected returns on interest rates and investments by looking at two figures; the gross interest rate and the average rate of return on investments. Typically, investments will have a higher average rate of return over long periods than interest rates, but you always run the risk of getting back less than your original stake.

Compare these results with the base rate of inflation to check how much spending power your money is likely to have in the longer term. If the interest rate on your savings account is 5%, but the base rate of inflation is 7%, your money will be worth 2% less than it was at the beginning of the year.

Is It Better To Save or Invest?

Savings are often preferred because investments carry a more obvious risk of losing money. It’s easy to see the value of an investment decrease when your account total is lower than it was yesterday, but savings accounts have a lower spending power over time as well.

The key to success is diversification. Diversification within investments helps shield your investment from the more volatile price changes, and likewise, diversification away from just savings accounts into the realms of investment can help increase your capital over a longer time period.

Investment also takes courage. Education around investment is rarely prioritised, so potential investors tend to lack the self-confidence to open an investment in case they make a poor decision and lose out. Diversification can help mitigate this, or you could invest in a managed fund or a stocks and shares ISA to allow a fund manager to make investment decisions on your behalf.

How Much of Your Income Should You Save or Invest?

This all depends on your financial situation, investment confidence, and saving priorities. Saving should start with short-term necessities such as an emergency fund and easily accessible savings for unexpected expenditures or occasional treats. As money-saving expert Martin Lewis says: “It’s generally worth having three to six months’ worth of expenses put aside in savings in case of an emergency”.

But when it comes to building wealth, the right investments are crucial to long-term financial success. Additional savings after emergency buffers and easier spending can work harder if they’re in the right investment.

What is the 50/15/5 rule?

This budgeting rule suggests that you aim to allocate no more than 50% of your income to essential expenses, invest 15% for retirement, and use 5% for short-term savings. This leaves you with 30% to do what you like with, such as eating out or more saving.

Are You Ready To Invest?

To find out if you’re ready to invest, ask yourself the following questions.

1. Do you have any outstanding debts or overdrafts?

2. Do you have an emergency fund?

3. Have you made a budget?

4. Have you got an investment plan?

5. Have you done your research?

6. Have you had any financial advice?

When you’ve completed the steps above, you’re ready to start investing.

Where Should I Invest To Begin With?

If you’re considering starting an investment but you’re a little nervous, try investing a small, expendable amount each month in a managed, diversified portfolio and reviewing its progress over the next few years.

Managed funds employ specialist fund managers to make investment decisions on your behalf via the pooled fund, so this limits your personal responsibility for your investment decisions and can be a good way to start if you’re not sure where to invest.

Tip:

It usually takes at least five years to see a real benefit from investment growth, so keep in mind that you’re unlikely to see the results immediately.

.jpg)