Our Verdict

Plus500 is a comprehensive CFD broker that will suit many traders. Its user-friendly interface and highly-ranked mobile app are among its best qualities. It also does well to provide a diverse range of CFDs across various markets, and its transparent fee structure will certainly be appreciated by cost-conscious traders.

On the other hand, Plus500 can do better to expand its research and analysis offerings. Its limited pool of financial instruments definitely has room for improvement, while its lack of portfolio management and tax-advantaged accounts leave much to be desired.

Overall, Plus500 is a solid choice for those new to CFD trading, though more experienced traders might seek platforms with broader capabilities and deeper market analysis tools.

Who is it best for?

Plus500 is best suited to traders who are interested in CFD trading on a variety of international markets, including stocks, forex, commodities, and options. The platform is particularly favourable for mobile traders, as it has a highly ranked trading app for both iOS and Android devices.

Its user-friendly interface and emphasis on ease of use make it a good choice for beginners, although it may lack some advanced capabilities desired by more experienced traders. Beginners are advised to use the demo account and the Trading academy to gain experience before trading with real capital due to the risks involved.

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 9.8 | Visitplus500 | CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. CFD Service. FCA (FRN 509909). |

Pros

- Trustworthy and reliable, constituent of the FTSE 250 index

- No commissions, minimum additional fees

- User-friendly interface, easy to use both on PC and mobile

- Access to trading insights

Cons

- Only offers CFDs, which are high risk

- Limited tools for advanced traders

- Not the best research and analysis offerings

- No portfolio management, automated, or copy trading

Investment Products

To kick things off, let’s see what you can trade on Plus500’s platform in terms of asset classes, derivatives, market limitations, trading instruments, etc.

Pros

- CFDs for almost every asset type

- Demo account available

- Leverage of up to 1:30

Cons

- CFD-only trading

- Not the widest range of CFDs out there

Assets Available

Plus500 is a CFD trading broker, which means that it allows traders to speculate on the price movements of a wide range of financial markets without actually owning the underlying asset.

Derivative Products

Plus500 users can access a total of around 2,800 instruments from multiple categories, including:

Index CFDs – Trade 30 of the most popular indices from different countries and sectors, including ESG indices, with leverage of up to 1:20

Forex CFDs – Over 60 currency pairs, with up to 1:30 leverage, and advanced trading tools such as stop loss, stop limit, and guaranteed stop orders.

Commodity CFDs – 20+ commodities including precious metals, energy, and agricultural commodities, with leverage of up to 1:20.

Share CFDs – Hundreds of shares from the most popular markets like the USA, the UK, and Germany, as well as dozens of other markets, with leverage of up to 1:5.

Option CFDs – Hundreds of calls and puts on exchange-traded options with leverage of up to 1:5.

ETF CFDs – More than 90 exchange-traded funds, with leverage of up to 1:5 and advanced trading tools such as stop loss, and stop limit orders.

All in all, there is enough variety of available CFDs for most traders. That said, as a broker that deals solely with CFDs, 2,800 instruments is simply not enough. Other brokers, like Saxo Markets, give their users access to more than 8,800 CFDs, in addition to other asset classes, which Plus500 doesn’t provide.

CFDs are high risk

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Market Reach

As a CFD platform, Plus500 does not provide access to stock exchanges. However, the instruments you can speculate on span a variety of markets and geographies.

Users can trade index and share CFDs from more than 20 different countries. However, these are mostly developed economies, with a very limited number of CFD instruments from emerging markets, namely the China A50 index and about 20 South African stocks.

You’ll also be able to trade CFDs on some minor and exotic forex pairs, although the selection is more limited than competitors such as Saxo Markets.

Account Types

As Plus500 only offers CFDs and not investment, it doesn’t provide tax-advantaged accounts such as ISAs or SIPPs. The available account types are explained below.

CFD Account

This is the standard account for UK residents. You’ll be able to trade CFDs on indices, forex, commodities, shares, options, and CFDs, with a maximum leverage of 1:30 on forex. There’s no commission and no stamp duty. Profits from CFD trading are subject to Capital Gains Tax.

Demo Account

You can test out the platform with a demo account without depositing any money. It’s also easy to switch from your real money account to your demo account if you want to test out a strategy or feature.

The demo account is one of Plus500’s greatest assets. It has all the same features, UI, and navigation as the real version, but it’s loaded with £40,000 of virtual funds. This is a great place to get familiar with the platform before risking any funds.

Professional Account

The Plus500 Professional account is a special account type that gives experienced traders access to higher leverage levels, up to 1:300. This account type provides access to all the same instruments as the regular account with the addition of crypto CFDs.

To be eligible for a professional account, a trader must meet two of the following three conditions:

Have a financial portfolio exceeding €500,000.

Have relevant trading experience in financial services.

Have made enough trades of a significant size in the past year.

Plus500 professional account users can use their access to higher leverage to amplify their positions and potentially make larger profits. However, trading with wider leverage levels is also much riskier and can lead to bigger losses, so the eligibility criteria are in place to ensure that these tools are only provided to professionals who know what they are doing.

Premium Service (VIP Account)

Like many other brokers, Plus500 also offers a VIP account, called the Premium Service Package. Premium Plus500 users get access to some exclusive perks, such as a dedicated client manager, access to exclusive expert analysis and trading webinars, premium customer support, etc.

What’s interesting is that Plus500 does not reveal the requirements a user has to meet to become a part of this VIP tier. Instead, their explanation is that the broker hand-picks the most valued clients and invites them to become premium customers.

In all honesty, the perks provided by Plus500’s VIP account are mainly for show, and don’t bring any significant additional value to the client. Users who don’t get invited don’t miss out on much.

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 9.8 | Visitplus500 | CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. CFD Service. FCA (FRN 509909). |

Features

The following section will dive deeper into Plus500’s trading tools and features, as well as the platform’s research and learning materials offerings.

Pros

- Great charting tools

- Multiple stop order types

- Unlimited demo account

Cons

- Scalping is not allowed

- Limited research offerings

- No real newsletter or trading recommendations

Trading Tools

Plus500 provides some useful trading tools to meet the needs of the average trader. Advanced traders may find the tools a bit lacking, as there is no social, copy, or algorithmic trading and no asset screeners.

The tools that are available are discussed below.

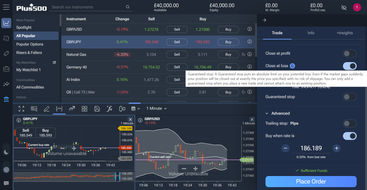

Charting

Plus500’s charting capabilities are a standout feature of the platform. Charts are available in a variety of time intervals from 1 week to 1 minute, as well as tick charts. You can personalise your charts with more than a dozen chart types and more than 20 drawing tools.

There are 110 different technical indicators available, which should meet the technical analysis needs of any trader. A really useful aspect is the multiple charts view, which lets you monitor up to 9 different charts on the same screen.

What’s more, you can save your chart layouts so you can easily return to them in your next trading session.

Order Types

Plus500 provides a decent array of order types. Their names and pop-up info should help newer traders understand what each is for (though the names could be a tad confusing for those who have traded elsewhere).

You can create a market order, or switch to a limit order by expanding the Advanced section and selecting ‘Buy (or Sell) when rate is’. You can add a stop loss to your order (called ‘Close at loss’) or a stop limit (‘Close at profit’), as well as a guaranteed stop. You’ll also find a trailing stop under Advanced.

Plus500 may be missing some more advanced order types, such as Once Cancels the Other (OCO) and multi-leg options orders, but what it does offer should suffice to meet the needs of most traders, except those with more complex and specific strategies.

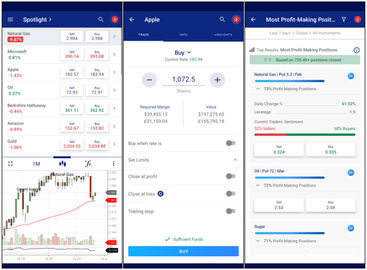

+Insights

This is a handy tool for traders who want to analyse trends and sentiment. If you head to the +Insights tab, you’ll be able to see real-time aggregate data on the activity of millions of Plus500 customers.

Choose a category, such as most traded, most viewed, highest sell ratio, or most profit-making positions. You’ll see the top instruments in that category, along with their buy/sell ratio, daily change, and leverage.

You can filter the results by time frame, trader location, and instrument type. There are also Buy and Sell buttons if you feel like opening a trade from that screen.

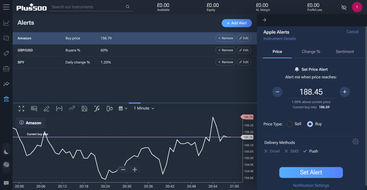

Watchlists and Alerts

If you want to keep an eye on certain instruments, Plus500 provides the tools you need. You can add your favourites to a watchlist so you’ll easily be able to view them as soon as you log in.

It’s simple to set up alerts as well—just click on the bell icon next to your chosen instrument. You can choose to be alerted when the instrument reaches a certain price, percentage change, or buyer sentiment.

If your alert is triggered, you’ll be notified by email, SMS, or push notification, depending on your settings.

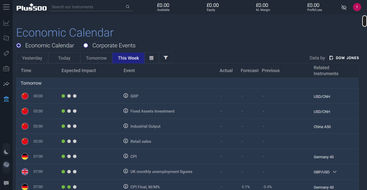

Market Research

When it comes to research, Plus500’s offerings are a far cry from the comprehensive resources that some larger brokers are able to provide.

While the platform provides some in-house market analysis, it doesn’t provide any fundamental analysis. Moreover, it doesn’t give its users access to third-party publications from reputable entities such as Morningstar, or the Wall Street Journal, which is the case with some other brokers.

What it does offer is the economic calendar, which is pretty neat and easy to use. There’s not a whole lot of detail about the events, but Plus500 does display their expected impact, related instruments, and any actual, forecast, or previous figures available.

Plus500 has a news and market insights section where some important market news is displayed reasonably regularly. These could be handy features for some traders, though others may be disappointed by the lack of deep analysis and asset screeners.

Educational Materials

Like most other online brokers, Plus500 also provides its users with learning materials and resources where they can learn more about trading with the platform, as well as trading in general. While they are not the most comprehensive educational offerings out there, they can definitely be of help, particularly for beginners.

On Plus500’s website, users can navigate to the Trading Academy, a page dedicated to learning trading, where they can find educational ebooks and videos. We were impressed by the videos as they were really well done – short, concise, and informative.

However, in our opinion, the best way to learn to trade on Plus500’s platform is to use the free demo account and practise. Unlike some other brokers, Plus500 doesn’t place limits on how long you can use the demo account, and beginners can try everything out before risking any capital.

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 9.8 | Visitplus500 | CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. CFD Service. FCA (FRN 509909). |

Fees

Now, let’s have a look at Plus500’s fee structure, what its users are expected to pay for when trading, and whether or not it is an affordable broker.

Pros

- No commissions

- No deposit or withdrawal fees

- No custody fees

Cons

- Overnight and guaranteed stop fees

- Currency conversion fees can get pricey

- Fee for inactivity

Plus500 Trading Fees

As a zero-commission broker, Plus500 does not charge any commissions for trading. The only fees Plus500 users are charged for their trading activities are the spreads and a few other trading fees, including:

Overnight funding fee

Currency conversion fee of up to 0.7% of the trade’s realized net profit and loss (subject to change in the future)

Guaranteed stop order fee

The amount of these fees depends on the chosen asset and can vary. However, Plus500 is very transparent with its fees and allows users to see exactly how much they will be charged if they decide to place a stop order or hold their position overnight.

Plus500 Spreads

Depending on the instrument, the spreads at Plus500 can be dynamic.

Dynamic spreads are constantly adjusted to match the market spread, even for the duration of an open position.

Given that Plus500’s spreads are continuously changing, it is best for you to check their current standings and not rely on our review to get the most accurate information.

As of right now, these are the minimum spreads you can expect to be charged at Plus500:

Asset | Minimum Markup |

|---|---|

Forex | 0.6 to 1.7 pips |

Equities | 0.50% to 1.00% |

Indices | 0.02% to 0.20% |

Commodities | 0.02% to 0.40% |

Plus500 Non-Trading Fees

Plus500 doesn’t charge any deposit or withdrawal fees. The platform, however, does charge an inactivity fee of up to $10 per month if you haven’t logged into your account for at least three months.

How Does Plus500 Make Money?

Plus500 does not charge its users any subscription or trading fees. Instead the company makes money from the bid/ask spread incorporated in the quoted rates. The only other fees Plus500 receives from users are for overnight funding, currency conversion, guaranteed stop orders, and inactivity.

As a listed company, Plus500 has also raised money from shareholders.

Usability

In the next section, we will discuss the functionality of the Plus500 platform, its ease of use, availability, and other important information regarding its usability.

Pros

- Easy to use

- Simplistic and straightforward design

- Available on Android and iOS

Cons

- Lacks advanced functionality and customization options

- No real portfolio management features

Plus500 Web Trading Platform Review

The Plus500 web trading platform is very straightforward. It’s easy to get started with and use for both experienced and less-experienced traders. It focuses on providing you with the most important information, but lacks advanced features.

Is Plus500 beginner friendly?

Plus500 is as beginner-friendly as a CFD trading platform can be. CFD trading is a complex and risky endeavour, but Plus500 tries to make things clear with its straightforward and simplistic interface and trading tools.

A nice thing about Plus500 is that the order types are named to make it clearer what each is for. You can even hover over the order type to see an explanation of what it does.

Additionally, the platform gives beginners access to its trading academy, where they can learn more about trading with Plus500. Anyone who is new to CFD trading should stick to using a demo account until they’ve built some knowledge and skills, but they will find Plus500 a welcoming place to do this.

Plus500 design and navigation

As soon as you launch the Plus500 web trading platform, you will notice that the people who designed it were going for simplicity rather than aesthetics. It is not convoluted, provides the most important information on the home screen, and navigating is easy from the first try.

The platform provides essential trading tools and allows users to monitor trades, analyze charts, and create watchlists. Compared to the popular Meta Trader 4, Plus500’s platform offers significantly less functionality and customisation options, making it much easier to use.

Login and security features

Logging into your Plus500 account supports both two-factor authentication and biometric authentication on mobile devices. You can enable login through Facebook or Apple as well as with your email, if you prefer. You can also enable notifications of logins.

Search functionality

The Plus500 platform provides users with quick and easy access to any instrument they might be looking for through its search bar, located on the upper left side of the platform. Alternatively, you can select a watchlist, asset type, or category on the left to see a list of relevant instruments.

The +Insights tool can also be used to help you find instruments in other categories, such as the most viewed or those with the highest sell ratio.

Alerts and notifications

Plus500 offers a free notifications service that sends alerts and notifications when a user opens or closes a position, or when an instrument reaches a certain rate. Plus500 also provides real-time market event notifications on prices, percentage change, and traders' sentiments.

Portfolio management

While Plus500 offers basic information in real time about the user’s account, transactions, balances, and profit/loss breakdowns, it doesn’t provide any noteworthy portfolio management tools or features.

Earning reports & fees breakdowns

Users can use the Plus500 platform to generate reports of their profits, losses, closed positions, and other account activity for the current year, or any other particular time frames, and receive them via email.

Plus500 App Review

The Plus500 platform is available on both Android and iOS devices through its native apps for both operating systems. Just like the web platform, the apps focus on making things easy and clear rather than providing tons of functionality.

That said, the apps do a great job. They can be used to open and close positions, set orders, monitor and analyze charts, set alerts, send notifications, explore +Insights, and do essentially all the things that mobile traders need.

You’ll get pretty much all the same features in the app as you do on the web platform, so Plus500 is a good choice for users who want to trade on the move without sacrificing functionality.

Mobile Charts

This is an area where Plus500 excels. Many trading platforms don’t provide advanced charting tools to mobile users—you’re often lucky to get just a simple real-time line graph.

The Plus500 app, however, provides all the same chart styles, time intervals, drawing tools, and 110 indicators that you’ll find on the web platform. The only way in which the mobile charts fall short of the web charts is that the app doesn’t have a multi-charts view for looking at instruments side-by-side—which is understandable on a small mobile screen.

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 9.8 | Visitplus500 | CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. CFD Service. FCA (FRN 509909). |

Customer Satisfaction & Reputation

In this section, we will discuss the overall reputation of Plus500 as well as how happy its users are with the broker’s platforms on PC and on mobile.

Pros

- Trusted constituent of the FTSE 250 index

- Overwhelmingly positive reputation online

- Negative balance protection and FSCS coverage

Cons

- No customer support by phone

- Limited security settings

Regulations

Plus500 is a well-established and trusted broker, regulated by the proper authorities in every country it operates. It provides its users with a quality trading environment and takes the necessary precautions to protect their funds in unfortunate scenarios.

Is Plus500 regulated?

Yes, Plus500’s UK subsidiary, Plus500UK Ltd, is regulated by the Financial Conduct Authority (FCA) in the UK (FRN 509909).

The broker’s subsidiaries are also authorised and regulated by many other regulatory authorities around the world. These include:

CySEC (Cyprus)

ASIC (Australia)

FMA (New Zealand)

FSCA (South Africa)

FSA (Seyshelles)

EFSA

MAS (Singapore)

FSA (Dubai)

The company holds client funds in segregated accounts and follows Anti-Money Laundering regulations. The broker also provides users with a range of risk management tools to help them protect themselves.

The company publishes its financial statements, annual reports, and transactions in its own shares. It is also committed to a range of ESG initiatives.

Plus500 may not offer as much in the way of security features as some competitors—for example, there’s no 2FA for opening/closing positions. But it does provide notifications and 2FA for logins, including fingerprint login for the app.

Plus500 Background

Plus500 is an international online trading platform, founded by six alumni of the Technion - Israel Institute of Technology in 2008. Today, it has subsidiaries in the USA, the UK, Japan, Australia, Israel, Singapore, Seychelles, Estonia, Cyprus, and Bulgaria.

The company went public on the London Stock Exchange in 2013, and it is currently a constituent of the FTSE 250 Index. Plus500’s current chairman is Jacob Frenkel, while David Zuria is the company’s CEO.

How Am I Protected With Plus500?

Plus500 doesn’t use its users' funds for investment purposes like hedging or any other business objectives. Instead, it segregates it into trust accounts and administers it in accordance with the FCA’s rules.

Plus500 is covered by the Financial Services Compensation Scheme. This means that in the event of the broker going bankrupt, users could claim up to £85,000 in compensation.

Finally, Plus500 also protects users from having negative balances through its margin call feature.

Customer Reviews

The online reputation of Plus500 is generally positive, with an overwhelming majority of users reporting they are happy with how the platform works on computer and mobile devices.

Plus500 reviews from Trustpilot

Plus500 has a great 4.1-star rating on Trustpilot. More than half, or 58%, of all 12,495 user reviews rate the broker as excellent, with five stars. However, we can’t overlook the large 15% portion of users who only give it one star.

Reviewers praised Plus500’s intuitive platform, prompt customer support, and demo account. However, some felt the platform could improve by providing more educational content and additional features such as Good Till Cancelled orders.

Plus500 Google Play reviews

Among Android users, Plus500 has an even more positive reputation, with a 4.3-star rating out of more than 106k reviews. There is tons of praise for the app’s interface and user experience, and its usability overall.

There are some negative reviews as well, though most of them have nothing to do with the app and its functions. It is mainly users who lost money while trading, blaming the app for their unsuccessful endeavours.

Plus500 App Store reviews

On Apple’s App Store, Plus500 has only 478 reviews. However, Apple users gave it an average of 4.1 out of 5. They praised the simple deposit and withdrawal process but criticised the limited range of instruments.

Customer Service

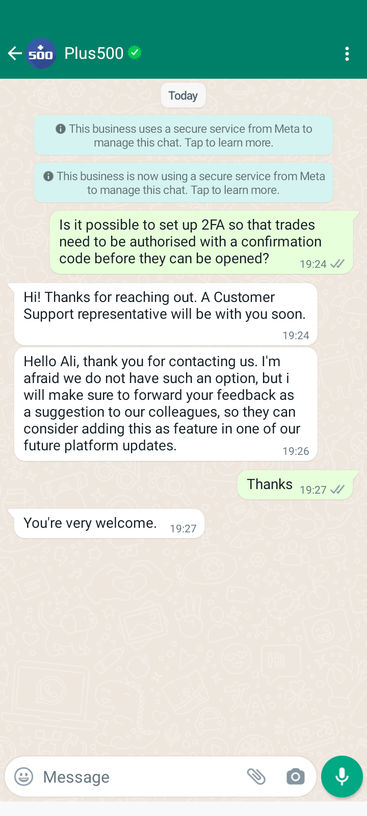

The only way users can contact the Plus500 customer support and receive any sort of assistance is in writing. They can either use the live chat, WhatsApp, or the contact form available on the Plus500 website’s Contact page, to contact the support team by email.

The lack of phone support is disappointing and means Plus500 lags behind full-service brokerages such as Hargreaves Lansdown or Saxo Markets in this respect.

However, the WhatsApp support is a nice touch and easy to use. When we tested this feature, a human customer support rep answered our query in a couple of minutes.

Support channel | Details |

|---|---|

Contact form | |

Live chat | In the platform or from the contact page |

+44 7780 007138 |

Plus500 Alternatives to Consider

If you are not happy with a certain aspect of the Plus500 platform, some of the best alternatives to consider include:

IG – Excellent platform with superior trading tools and educational materials. Also provides access to a wider range of available assets to invest in. For more information, read our IG Markets review.

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 8.9 | Visitig.com | Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. |

eToro – For social trading and copy trading, eToro is not only better than Plus500 but easily the best platform for this particular purpose worldwide. For more information, read our eToro review.

Interactive Brokers – If you are looking for market variety, IBKR provides access to 135 markets in 33 different countries, making it the better alternative.

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 9.1 | Visitinteractivebrokers.com |

Depending on your trading style and personal preferences, there is always the possibility that Plus500 may not be the ideal broker for you, and you should always research thoroughly before making a decision.

Should You Trade With Plus500?

Whether or not you should invest with Plus500 largely depends on your individual trading preferences and experience.

If you are new to trading, particularly CFDs, and seek a straightforward, user-friendly platform with robust mobile support, Plus500 could be an excellent fit. Its simplicity, combined with a diverse range of CFD options across various markets, appeals to beginners or those who prefer a no-frills trading experience. (Beginners are advised to start with a demo account)

However, seasoned traders or those looking for extensive research tools and a broad spectrum of tradable assets beyond CFDs, might find Plus500 somewhat limiting. Weigh these aspects against your trading goals and conduct thorough comparisons with other platforms to find the best match for your investment needs.

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 9.8 | Visitplus500 | CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. CFD Service. FCA (FRN 509909). |