Our verdict

Chip is a UK-based automatic savings and investing app. It was founded in 2017, and since then, it has attracted over half a million registered users. The company saw its first profitable quarter in Q3 2023, when it doubled its active user count.

Its mission is to build a super app for savings and investing, and so far, its auto-savings aspect has been a hit among its users.

However, the platform also has some downsides. These include poor customer support experience and technical issues with its app. While it is easy to use and navigate, users sometimes encounter issues with logging in, linking bank accounts, or opening an account.

Who is it best for?

Chip is best suited for those who struggle to save regularly. It can help make this process automatic, and remove the need for planning and discipline. It develops good savings habits for you through the use of AI and advanced algorithms. Being user-friendly and easy to navigate, it is good for beginners and experts alike. But features beyond saving, such as the ability to invest in funds, are very limited.

Pros

- Offers auto-saving

- Features competitive rates and a free version

- Allows you to set up savings goals

- Offers a rich knowledge base

Cons

- Only allows you to connect one bank account

- Charges users for auto-saving

- Customer support is very slow to answer, often needing up to 24h

- Users report errors and technical issues during onboarding, connecting bank accounts, and more.

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 8.1 | Visitgetchip.uk |

Investment products

While it primarily operates as a savings app, Chip does offer investment products to its users. However, its offering is quite different from what you might expect to see from a regular broker. Specifically, Chip only offers access to funds, which can be a good thing for new investors, but not for experts who like to be in full control of their portfolios.

Pros

- It provides a diverse selection of funds for you to invest in

- It allows automated investing based on your spending analysis

- Offers a Stocks & Shares ISA with 0% platform fees

Cons

- Only lets you invest in funds, with no alternative assets

- The platform’s investment strategies lack transparency

- Automated investing limits your control over investment decisions

Assets Available

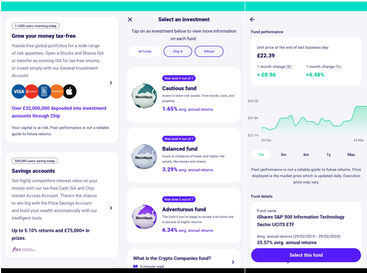

Chip allows its users to invest in a variety of funds that are split into five different categories, including:

Ethical — The first category offers access to ethical funds, such as the Clean Energy Fund or Ethical X Fund, which meets Environmental, Social, and Governance guidelines

Themed — Themed funds are simply funds that revolve around a common theme, such as healthcare, technology, or emerging markets.

Big Names — This investment fund contains companies and brands that most people are familiar with or tend to use their products or services in everyday life. These include FTSE 100 Index fund and the Global Companies fund.

Risk — Risk funds are six different funds comprising investments representing different levels of risk so that investors can pick the one they feel comfortable with. Some may be willing to take on low-risk funds, while others would be willing to take on big risks in exchange for big rewards. The funds include Cautious X, Cautious, Balanced X, Balanced, Adventurous X, and Adventurous. They are all managed by BlackRock’s experts.

Other — The Other category offers Physical Gold fund and Crypto Companies fund, which are different enough to not fall under any of the previous categories, as they include a fund based on a commodity and crypto firms.

Market Reach

Chip’s market reach is limited, given the fact that the company only operates in the UK and only offers 15 funds

It is also worth noting that Chip collaborates with multiple of the world’s largest fund managers, including BlackRock, Vanguard, Invesco, and iShares. Each of the offered funds comes from one of these companies, and is under their management.

As well as the UK market, users could gain exposure to the US market through the S&P 500 Tech fund, or markets such as South Korea, India, and Brazil through the Emerging Markets fund.

Account Types

When it comes to accounts, Chip features two types of General Investment Account (GIA):

Chip Free Account

As the name suggests, this is a free account that Chip lets you open by default. Not only is opening this account free but so is maintaining it. Autosaves are optional and come with some extra costs.

However, with this account, you gain access to a Cash ISA and Instant Access Account. Just keep in mind that you will be charged ₤0.45 for each autosave transaction and ₤0.25 for each recurring save transaction. Also, there is an investment platform fee that is collected monthly, which comes up to 0.50%, with ₤1 being a monthly minimum.

This account is good for beginners, as it offers access to simple options and fairly low fees. However, it also limits you to five investment funds. These funds were designed for long-term wealth building, but since there are only five available, you are limited in terms of how diverse your portfolio can be.

The available funds include S&P 500 Tech Fund, FTSE 100 Index Fund, Cautious Fund, Balanced Fund, and Adventurous Fund.

ChipX

ChipX is a premium account on Chip, which lets you access the full range of features and funds that Chip has to offer. However, it comes with a ₤5.99 subscription that is charged every 28 days, or you can pay ₤65.05 and have access to it for the entire year. In this scenario, the price you pay per 28 days is reduced to ₤4.99, so if you plan to use Chip in the long term, this might be a preferable option.

One advantage of this account is that you don’t pay the autosave fee, or the recurring savings fee, both of which are present for the free plan.

ChipX also provides you with the ability to engage in hands-off investing, and automatically top up your savings and investments with unlimited use of Al autosaving tools. As mentioned, all of the platform’s funds will be available regardless of their category.

Both Chip and ChipX give you access to a choice of savings and investment accounts. These include the Chip instant access account and the prize savings account, which has a monthly prize draw.

Stocks and Shares ISA

The Stocks & Shares ISA is a popular and tax-efficient account that comes with 0% platform fees, although it requires you to have a ChipX subscription. This account offers tax-free returns, allowing you to invest up to ₤20,000 per tax year. Any returns you gain will be free from Capital Gains and Income tax.

However, keep in mind that Chip does not provide tax advice, and that tax treatment depends on individual circumstances and might be subject to change in the future. With that being the case, this aspect of the ISA should be something that you must keep a close eye on at all times.

In the end, this type of account could be the right fit for those who aren’t looking for instant access to their invested money and are prepared to keep it invested for years to come.

Features

In terms of features, we are going to focus on three different types, including Chip’s trading tools, market research, and educational materials. These three are the most important types of features for traders and investors who might want to use Chip, so if you are among them, you should know what is available to you.

Pros

- Chip uses an AI saving tool for automatic saving

- The platform offers interest rates, savings, and other calculators

- A vast knowledge base with guides, videos, and a financial glossary

Cons

- The calculators’ results may be inaccurate as they assume the interest rates won’t change.

- No trading or market research tools.

- Automation means that users have very little control.

Tools

One thing to understand about Chip is that it primarily operates as a savings app. As such, it offers tools that allow users to save money automatically, rather than analyse financial markets or buy specific assets like stocks, bonds, or cryptocurrencies.

The platform’s customer support was kind enough to explain that they do not have trading tools. But instead, Chip offers an execution-only service, where trades are submitted by the customer directly through the app, and are executed as soon as possible by the custodian Seccl.

As for order types, Chip says that the only order type available is ‘at market’, which means executed as soon as the trade is accepted, providing the relevant market is open.

Apart from that, Chip lets you access funds managed by professional asset management firms like BlackRock, Invesco, or iShares.

However, the platform does have a different set of tools, such as calculators.

Calculators

There are three different calculators:

Interest Rates Calculator: The Interest Rates Calculator is a tool that allows users to calculate how much interest they could earn with their current interest rate.

Savings Goals Calculator: This calculator allows users to enter how much they can save per month, which gives them an idea of how long it will take for them to reach their savings goal.

Stocks & Shares ISA Calculator: This calculator allows users to calculate their potential returns with an initial lump sum deposit, regular monthly payments, or a combination of the two.

The platform points out that these calculators are for illustrative purposes only, as there are many things that could change and affect the final outcome. As a result, the figures that calculators provide might not be accurate.

Auto saving feature

The company’s primary feature is its auto-saving feature, which is used to run its savings accounts and provide savings plans. The feature is automatic, based on an advanced algorithm, meaning that it can help users automatically build up their savings without having to think about it or do anything personally.

With a combination of Auto-Saving technology and its Recurring Saves, users can build fully customised savings plans.

The feature allows users to set up their savings goals in only a few taps, and earn competitive savings rates. Entering your bank details enables Chip to automatically transfer money from your bank balance to your Chip savings where you can earn interest at a higher rate than a regular savings account.

Market Research

Unfortunately, the platform does not offer market research tools. There are no news or market research articles, neither by in-house experts or reputable third parties, nor does it offer asset-specific news. It also doesn’t display things like market winners and losers, or an integrated economic calendar.

Educational materials

Things are much better when it comes to educational materials. Chip offers plenty of guides on various subjects. It offers money savings tips, and it explains concepts like Cash ISAs, AER, Personal Savings Allowance, and more.

It also features a financial glossary that can explain some of the more industry-specific terms and phrases, and it offers videos involving savings and investments with Chip, and why they are beneficial.

However, there are no quizzes or other ways for users to test their knowledge after studying the platform’s materials. After reviewing them, we concluded that most of the available materials are meant for beginners and that their purpose is to ensure that beginner investors can understand the terminology and purpose of the offered features and accounts.

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 8.1 | Visitgetchip.uk |

Fees

Next, let’s talk about the app’s fees. Fortunately, Chip does not charge too many of them, and there are no additional charges for those who choose the platform’s premium plan. However, if you go ahead with the free plan, there are a few worth keeping in mind.

Cost | Chip Free Plan | ChipX |

|---|---|---|

Subscription | ₤0 | ₤5.99 per 28 days OR ₤65.05 per year |

Autosave fee | ₤0.45 per transaction | Free |

Recurring Savings fee | ₤0.25 per transaction | Free |

Investment Platform fee | 0.50% (₤1 monthly minimum) | N/A |

Chip Fees

When it comes to Chip’s free plan, also sometimes called Basic plan, it is free to use in the sense that you do not need to subscribe to it. However, if you use its auto-saving feature, each transaction will come with a small ₤0.45 fee.

Apart from that, there is also a ₤0.25 fee for each recurring save. Meanwhile, if you use its investment capabilities, you will have to pay 0.50% per investment. This is charged monthly, and it has a monthly minimum of ₤1.

Other than that, Chip does not charge trading fees or spreads since trading is not available, and there is also no inactivity fee that traders need to worry about.

If you choose the premium plan, however, the only thing you pay is a monthly or annual subscription. If you pay monthly, it will cost you ₤5.99, and it does not cover the entire month, but instead it gets renewed every 28 days. As for the annual subscription, it costs ₤65.05, and it covers the entire year. Broken down to monthly payments, this would cost ₤4.99 per month.

How does Chip make money?

Chip primarily makes money through subscriptions and small fees that come with its free account. Users are expected to pay these fees for savings and other transactions, as explained in the Fees section of this review.

According to Alex Latham, the company’s co-founder and Chief Marketing Officer, Chip saw its first profitable quarter in 2023. It started the year with £270 million, and by November of the same year, it managed to hit ₤3 billion. Latham says that this happened thanks to the fact that the app doubled its active user base during this period.

Usability

Moving on, let’s discuss Chip’s usability. This segment will touch upon the platform’s user-friendliness, design and navigation, portfolio management, and search functionality and notifications.

Pros

- It offers an app for both Android and iOS

- Chip’s interface is user-friendly, which makes navigation within the app easy

- Both investing and savings are simple to use and all it takes is a few taps

Cons

- Only has a mobile app: it doesn’t offer a desktop app or a web version

- Chip doesn’t offer portfolio management services, tools, or the ability to make investment decisions beyond picking a fund or funds

- Some users have reported technical difficulties when trying to register an account

Chip Web Trading Platform Review

Chip does not have a web version of its trading platform. Instead, it only offers a mobile app. While Chip does have a website, it is only informational in nature, allowing users to learn more about its service and what it has to offer. However, it does not offer the ability to invest, engage with its savings features, or even create an account.

Is Chip beginner-friendly?

Yes, both Chip’s website and its app are beginner-friendly, with different sections clearly marked to help users navigate and find the information they need. There is also live chat, a search function, and a bot that can help users find what they need faster.

Chip design and navigation

Chip has a user-friendly interface which makes navigation simple and intuitive. The entire experience is simplified so that users do not have to spend a lot of time “learning the ropes”. AI does most of the work when it comes to savings, and with investing, users only need to pick the funds and managers do the rest.

Search functionality and notifications

The search functionality is available on Chip’s website, and it can be found in the chat bubble. Once opened, the bubble presents users with the ability to ask questions and have a support team member answer them, or they can use the search function to enter keywords related to their search. The mobile app also features alerts and notifications that help users keep track of their savings activities, account status, and more.

Portfolio management

Unfortunately, Chip does not offer portfolio management that you might find with other more traditional brokers and investment services. Its main functionality revolves around analysing the spending habits of its users and figuring out ways for them to save money automatically on the user’s behalf.

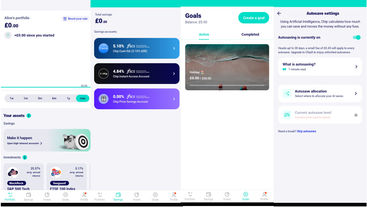

Chip App Review

The way the app works is that it analyses your spending by using AI, and looks at your past spending history by checking your transaction data, which it can access thanks to Open Banking. If you cannot grant it access to past transactions, it generates a suggested autosave amount using the transaction data it collected from other users.

It then autosaves money into your Chip account every 4 days. The app’s autosave and savings goals features may appeal to consumers who lack the time or patience to deal with the nuances of saving up their spare change and would rather leave it to AI and automation. The app will charge you for each transaction if you use a free plan, but not if you subscribe to the premium plan, ChipX.

App Sign-Up Process

It only took us a few minutes to download the app and create an account. We weren’t asked for any ID verification, just a few personal details. You can then choose to open a savings account and/or an investment account. If you opt for the latter, you can then pick funds to add to your portfolio.

App Navigation

The Chip app is very simple to navigate. The tabs at the bottom are clearly labelled so it’s easy to find what you’re looking for.

When you log in you’ll see your portfolio performance and assets. The second tab is where you can open and manage savings accounts. Next is the Invest tab, for seeing details about the funds and adding them to your portfolio.

After that, you have the Goals tab. This is for setting up your financial goals and tracking your progress towards saving for them. Last is your profile tab, where you can connect your bank account and change account settings. This is also where you can turn on the autosave feature and recurring saves.

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 8.1 | Visitgetchip.uk |

Customer Satisfaction & Reputation

Next, let’s review customer satisfaction and Chip’s general reputation among users and in the wider financial community. Specifically, things we will focus on here revolve around security and safety, regulations, and the company’s background. Following that, we will also check out reviews from Chip’s other users and what their experiences with the app have been like.

Pros

- Customer experience is overwhelmingly positive, with the majority of users giving it 5 stars in reviews

- Customer support is polite and willing to answer any questions

- The app has been around since 2017 with no major issues or controversies surrounding it

Cons

- Customer support sometimes takes a while to respond, with the response to the first message typically taking up to 24 hours.

- Existing customers had issues with the secure login where PIN or biometrics failed.

- Users have also complained about having issues with opening accounts due to their address line being too long.

Safety & Regulations

To start, let’s first consider Chip’s legal status in the UK, as well as its security and background. Chip is a licensed and safe service with advanced security features that protect both its clients’ funds and their private information.

Is Chip Regulated?

Yes, Chip is regulated in the UK by the Financial Conduct Authority (FCA), and its website specifies that it is a “Registered Company in England and Wales” under the name of Chip Financial Ltd.

However, Chip stresses that it is not a bank, meaning that it does not have physical branches, even though it does have a registered office in London. Also, given that it is not a bank, it cannot issue debit bank cards, and it can’t let users access their Chip money via ATMs. Finally, Chip stressed that it does not provide financial advice, and that its services are only available via the Chip app.

Is Chip Safe?

Chip has always been quite serious when it comes to securing clients’ money. As such, it provides high levels of protection for all the accounts available, whether the free version or premium.

All of the money deposited into a savings or investment account is eligible for cover by the Financial Services Compensation Scheme (FSCS). Chip even protects pending transactions. While they are pending, the money is held in a safeguarded client money account. It is also eligible for FSCS protection during this time, so there are no moments when your funds do not enjoy full protection, regardless of the account type or the status of the funds.

Chip further says that its accounts are powered by ClearBank, a UK-authorised bank partnered with Chip. Thanks to the FSCS, a total of ₤85,000 that the user may deposit is fully covered by the Scheme.

Chip also insists that the money will be protected by the FSCS even in the unlikely scenario that ClearBank fails. The same is true if Chip itself fails and goes out of business for whatever reason.

How am I protected with Chip?

As mentioned earlier, all of the funds held by Chip are protected and insured. Chip is also compliant with AML and KYC regulations.

Meanwhile, its application offers two-factor authentication to help keep your account more secure. This requires users to enter a unique code when logging into their account, ensuring that they are the only ones who can do it, even if someone else happens to learn their password.

Chip Background

Chip is a fintech firm founded in London, UK in 2017 with the mission of building wealth for its customers. According to its website, Chip can help its users build their long-term wealth. However, while many other solutions out there require users to invest in the latest meme coin or a hot new stock recommended on Reddit, Chip’s approach is to simply use artificial intelligence to provide savings and offer access to successful investment funds.

Chip was founded by Simon Rabin, who is also its acting CEO. Since it was founded, the company has grown and expanded. Today, in 2024, it has a team of 150 people and is supported by a community of over 27,000 individual shareholders and 500,000 registered users, according to its website.

Customer reviews

While we had first-hand experience with Chip’s app and service, in general, we were also interested in learning what other Chip users thought about the app. To determine the general impressions, we considered three sources — Trustpilot reviews, Google Play reviews, and App Store reviews.

Chip reviews from Trustpilot

On Trustpilot, Chip has almost 1593 reviews, with an overall score of 3.8 out of 5 stars. 65% of users gave it five stars, but 22% gave it only 1 star.

The positive reviews generally praise Chip’s service, describing it as fast, accurate, and easy to use. However, the biggest pain point seems to be customer support, as well as occasional technical issues with the app.

Chip Google Play reviews

The Google Play Store shows that Chip has over 100,000 downloads and that 4,148 users have reviewed it. The platform has an average score of 4 stars, with 5-star reviews dominating, but 1-star reviews still being the second-most numerous.

Users have described the app as “nice and slick and very fast for savings transfer.” They also said that the interest rate is decent. But customer support and technical issues once again dominated negative reviews, with one user complaining that they could not log in as PIN and biometrics did not work.

Chip App Store reviews

Finally, we looked into Chip reviews on Apple’s App Store, finding that it has over 27.2k ratings, with a total score of 4.6.

As such, Chip ranks as the 73rd most popular app in finance. The reviews themselves mostly praise the app, with the exception of customer support reportedly being quick to dismiss users who contact them for help, and technical problems. Specifically, users have complained about setting up minimal bank balances or failing to link the app to a bank account.

Customer Service

Chip’s customer service is overall not considered to be very good. However, this also depends on multiple factors. In our experience, customer service needed 24 hours to answer our initial inquiry, and the bot that Chip supposedly uses did not respond at all. Instead, a customer service agent responded the next day, answering the questions as best as they could.

There was even an unprompted follow-up where they provided additional information after consulting with colleagues, which improved the overall impression. However, while individual customer service agents did a good job, the slow responses, the lack of a phone number or an AI bot that is supposed to be there make it difficult to get answers quickly. When it is a general question, this is not too big of an issue, but in cases of emergencies, this kind of situation represents a problem for the customer.

Chip alternatives to consider

If the details you learned about Chip from this review make it seem like this is not what you are looking for, then consider these alternatives. While they offer similar services, their offerings might be a better fit for you.

Plum

Plum is an app that uses AI to keep track of users’ spending habits, similar to Chip. It also has its own app, and it lets you adjust your automatic saving amount. Plum’s greatest strength is a relatively new Plum Interest account, which supposedly “beats the banks” with a 5.15% return, compared to the 4.84% you get with Chip’s Instant Access savings account.

Moneybox

Another alternative is Moneybox, which also helps you save money automatically. However, this app goes a step further, as it invests the money it helped save for you. Simply put, it rounds up your spare change and uses it to make auto investments on your behalf. However, it comes with a ₤1 monthly fee, plus platform fees and investment costs.

App-only banks

Apart from the previous two services, you can also pick one of app-only banks, such as Starling, Monzo, or Chase, which also offer solutions that can help you save money. They also have features that save your spare change into dedicated savings pots.

Should you invest with Chip?

Finally, it is time to answer the big question — should you invest with Chip?

Chip has a lot going for it. It offers a free account, which does come with some service fees, but they are generally pretty low. It also has a very affordable premium account, whether you opt to pay on a monthly (28-day) or yearly basis. If you use it for auto-savings, it is a pretty decent option.

But, if you also want to use it for investments, you should know that the selection of funds is fairly limited, and that there are no other assets available. You cannot trade on this app, and it doesn’t offer market research tools or materials. Investing with Chip is just an additional thing that you can do, and trading is not among the available options. Plus, even with the existing investing options, your role in the process is extremely limited.

In short, Chip is a good savings app, although it has technical issues and its customer support needs work. But for other financial activities, you should likely look for a different solution.

| Name | Score | Visit | Disclaimer | |

|---|---|---|---|---|

| 8.1 | Visitgetchip.uk |