Zing is a brand-new app for sending and spending money abroad. It represents HSBC’s endeavour to compete with the likes of Wise and Revolut in the hugely valuable market of international payments. As a brand new entrant to the market, it’s yet to be seen how Zing will fare against the big guns. Though there is limited information about the newly launched app, this review will tell you everything we do know and why Zing could soon be a household name.

About Zing

Zing’s history is a brief one as things stand: the app was launched on the 3rd of January, 2024, initially in the UK with plans to expand globally later. It is part of the HSBC Group, an attempt by the high street bank to move with the times and take on challenger fintechs such as Revolut and Wise.

These fintechs have achieved dominance in the lucrative remittance industry with user-friendly apps and low fees. Now, however, HSBC is taking a leaf out of their book with the user-friendly Zing app and multi-currency card.

Zing enables both customers and non-customers of HSBC to hold 10 currencies in their account, send money in over 30 currencies (including free transfers to other Zing users), and spend in more than 200 countries.

Zing Review at a Glance

💳 Pay-in Options | Debit card, quick bank transfer, traditional bank transfer |

|---|---|

💶 Min. Transfer Amount | £0 |

💷 Max. Transfer Amount | £40,000 |

💱 Currencies Supported | 30+ |

🌍 Available in | UK (will launch worldwide) |

💬 Languages Supported | English (more to be added later) |

📍 Headquarters | London, UK |

📃 Established | 2024 |

🌏 Offices | London (HQ) |

🏆 Award(s) | None yet |

👮 Regulators | FCA |

How Zing Works

Zing is an e-money institution that combines the experience and security of HSBC with the flexibility of a fintech. You can use the Zing app to hold e-money in a virtual account in multiple currency wallets. This money can then be transferred to Zing users or external payment accounts, or used to make purchases with a physical or digital Zing card.

Top Zing Features

Zing combines useful and innovative features. Here are the best ones.

International Payments

.png)

It’s simple to send money to anyone, anywhere with Zing. There are transparent fees with no markups, and Zing-to-Zing transfers are free. You’ll also be able to track any payments you make and benefit from money-back guarantees.

Multi-Currency Card

The Zing card lets you spend like a local, with no fees when paying with local currency. If you don’t have enough local currency, other currencies you hold will be automatically converted. The card is accepted worldwide and can easily be frozen and managed from the app.

Real-Time Exchange Rates

You can monitor exchange rates for your favourite currency pairs from the Zing homepage. It’s easy to convert your money between your different currency wallets—the charges are transparent and there’s no mark-up.

What We Like and Dislike About Zing

Why should you use Zing? | Why shouldn't you use the Zing? |

|---|---|

No hidden fees — Zing displays fees transparently and doesn’t apply any exchange mark-ups | Limited availability — So far, Zing is only available to UK residents over 18 |

Excellent customer service — Zing offers human customer support around the clock | No FSCS protection — Unlike HSBC bank accounts, any money held in the Zing app isn’t insured by the FSCS |

Accessible multi-currency card — Start using your virtual card as soon as you sign up, and get a physical card delivered for free | Limited information — As a brand new app, Zing is yet to garner customer feedback, and hasn’t released detailed information about its payment and conversion fees |

Transparent, user-friendly app — The app lets you manage your data and track payments while showing you real-time rates and detailed fee breakdowns | |

Access to rewards — Early sign-ups can choose which rewards they want, with the potential for more rewards for all users in future. |

What are Zing’s Exchange Rates, Fees & Costs

Exchange mark-up | 0% |

|---|---|

Transfers to Zing users | Free |

Domestic payments | Free |

International payments | Free |

Currency conversion | 0.2% |

Card issuance | Free |

Exchange Rate Mark-up

This refers to the percentage that providers add to the mid-market rate for currency exchanges, which is how many money transfer providers make a profit. However, Zing (like rival Wise) doesn’t add any markup to the mid-market exchange rate. This is the case for all currencies, and you can view the current exchange rates in the app at any time.

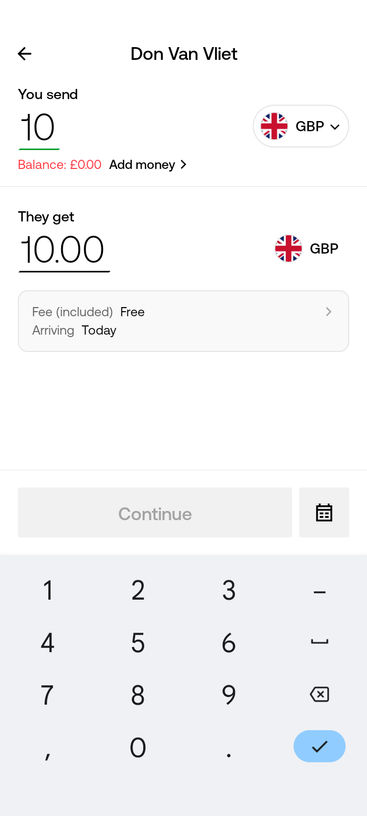

Transfer Fees

If the recipient is a Zing user, you can transfer money to their account in the same currency for free (Zing is comparable to Wise in this respect). Making domestic transfers is also free, though a 0.2% conversion fee will apply if currency exchange is involved.

If you want to transfer money internationally, there's no transfer fee, but you'll still pay the 0.2% currency conversion fee.

Zing provides a detailed breakdown of fees before you confirm your transfer. You’ll also be able to view fees using the app’s Currency Calculator, once this feature goes live.

Additional Costs

Zing doesn’t charge anything for opening, maintaining, or funding your account. Card issuance and the first card replacement are also free, though subsequent card replacements before renewal cost £5. This is one area where Zing beats Wise, which charges £7 for initial card issuance.

ATM withdrawals within the UK are free, while international ATM withdrawals are free for the first withdrawal each month and £2 subsequently. It’s free to pay with your Zing card as long as you hold the required currency, but card transactions in other currencies incur a 0.2% currency conversion fee on top of the Visa exchange rate.

Zing Fee Transparency

Zing aims to be transparent about its fees, as evidenced by its promise of no exchange mark-ups and no hidden fees. You can easily view current exchange rates in the app, as well as detailed breakdowns of fees for transactions before you make them.

Top Currencies and Destinations for Sending Money with Zing

You can hold money with Zing in 10 currencies, namely: GBP, USD, EUR, CAD, AUD, AED, HKD, JPY, NZD, and SGD.

However, you can transfer money in over 30 currencies, which also include: NOK, DKK, SEK, PLN, HUF, CZK, INR, IDR, MYR, RON, PHP, BHD, CHF, CZK, HUF, ILS, KES, KWD, MYR, OMR, PLN, QAR, RON, SAR, THB, TRY, UGX, and ZAR.

You’ll be able to send money anywhere in the world with Zing, with some of the top destinations including:

UK

USA

EU

Canada

Australia

New Zealand

Japan

Hong Kong

Singapore

UAE

What Types of Transfers Can You Make with Zing?

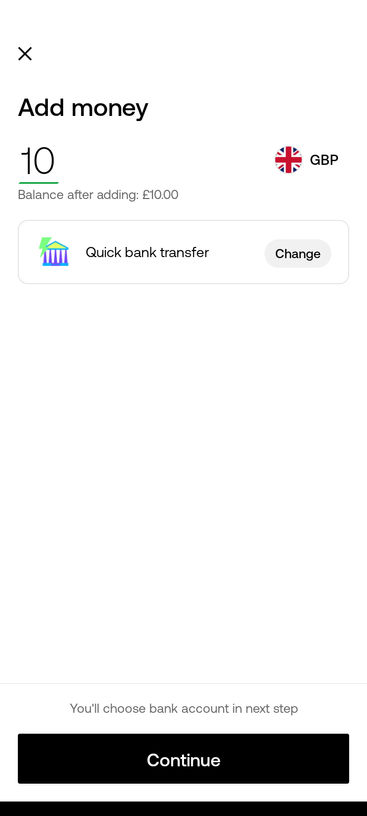

You can only make e-money transfers with Zing using funds in one of your Zing wallets. This means you will need to top up your Zing wallet with a debit card or bank transfer before you can transfer money to someone else through Zing. Once you do this, you will have the following options.

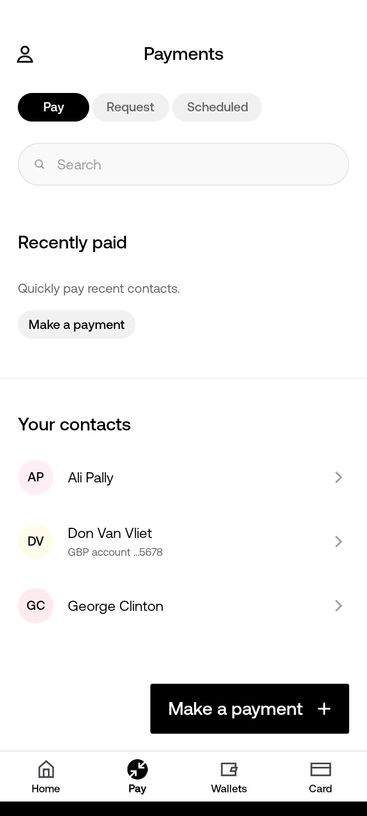

Transfers to Zing users — This is easy to do with just the recipient’s phone number. It’s also free as long as there’s no currency conversion.

Transfers to domestic bank accounts — You just need the recipient’s bank account details, and there’s no fee if there’s no currency conversion.

Transfers to international bank accounts — You can make this transfer like you would a domestic one, but you’ll be charged a 0.2% fee.

What Are Zing’s Payment and Withdrawal Options?

Zing’s payment options are a bit more limited than competitors such as Wise, but they should still serve the purposes of most users.

Zing deposit options | Zing withdrawal options |

|---|---|

Debit card | Transfer to a bank account |

Quick bank transfer | ATM cash withdrawal |

Traditional bank transfer |

How Long Will It Take to Receive Money Using Zing?

Zing doesn’t provide much information on its website on the processing times for transfers, only that they’ll vary depending on the currencies and intermediary banks involved. When sending money to the UK or EEA in GBP or EUR, you can expect it to arrive the same day or the next working day, but payments that involve other currency conversions could take up to 5 working days.

Is Zing Safe to Use?

Although Zing has only just launched, its status as part of the HSBC Group already grants it a level of legitimacy and trustworthiness. As for how reliable the app is, this remains to be seen until it has gained more users and customer feedback.

The app supports secure payment methods and transfers are trackable and come with money-back guarantees. It also offers biometric authentication to better protect your account, although there are no other 2FA options available.

Zing is regulated by the FCA. One thing to note, however, is that Zing is not a bank, so unlike with an HSBC bank account, any funds you hold with Zing won’t be protected by the Financial Services Compensation Scheme.

Instead, Zing safeguards customer funds according to regulatory guidelines by holding them in a bank account in cash or liquid assets separate from company funds. Zing is also subject to an annual independent audit.

Zing Support Options

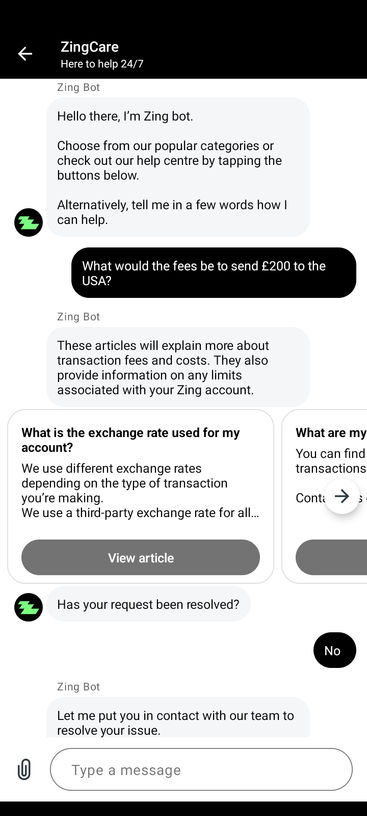

Zing has human customer support available 24/7 through in-app messaging, backed by HSBC’s many years of customer service experience. However, in terms of its lack of phone support and limited support languages, Zing does lag behind some competitors such as Wise.

When we tested the in-app messaging, the chatbot put us through to a human agent very promptly. However, that agent took over half an hour to provide an answer to our query that wasn't wholly satisfactory. This could just be a case of teething problems though, while the support team gets up and running.

Zing contact number | None |

|---|---|

Zing support email | |

Live chat support | In-app messaging (customers only) |

Support languages | English |

Other support options | FAQs, contact form |

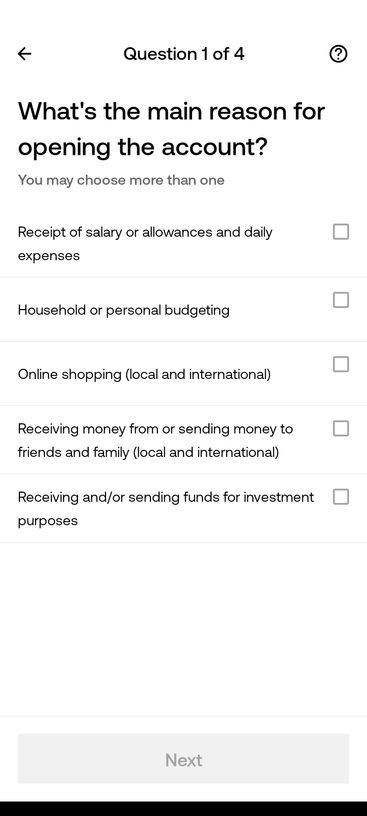

How To Get Started with Zing to Send and Receive Money

Zing excels when it comes to accessibility and ease of use. Creating your account and setting up a transfer can easily be done in a matter of minutes if there are no delays.

How To Send Money with Zing?

The process is pretty smooth and straightforward, and you’ll be able to do it all from your mobile.

Step 1: Create an account

Step 2: Finish setting up your account

Step 3: Add money to your account

Step 4: Choose or add a contact

Step 5: Send money

Does Zing Have a Mobile App?

Absolutely—in fact, the mobile app is the only way to access Zing’s features. It’s easy to download the app from the Apple or Google Play store, and totally free. Everything—from setting up your account to sending money, converting between currencies, and managing your multi-currency card—is done through your mobile. As a brand-new app, however, Zing is yet to garner feedback from app users.

Zing Alternatives

Zing certainly looks set to be a major player on the international payments stage, but it’s not perfect. So if it doesn’t meet your specific needs, here are some of your other options.

Revolut: It offers the same services as Zing with added features for saving, budgeting, and investing. What’s more, Revolut offers free ATM withdrawals and accounts for under 18s.

Wise: It supports more currencies and payment methods than Zing. Wise also allows for larger transfers and offers interest on the money you hold in your account.

TorFX: As a well-established provider, TorFX has a high credit rating and awards under its belt. It’s a better option for large or business transfers as TorFX supplies a personal account manager.